Annabel West helps pull off $150m takeover deal between Sage Group and Tetra Tech

From humble beginnings in Seacliff Park, pioneering engineering firm Sage Group has secured a bumper deal with a US giant – with the help of the premier’s wife. Find out how.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

From humble beginnings working out of a backyard shed at Seacliff Park, pioneering engineering company Sage Group has landed a bumper payday after securing a huge $150m-plus takeover deal with a US consulting giant.

California-based Tetra Tech, listed on the Nasdaq stock exchange with a market capitalisation of $US8.4bn ($13.1bn), has agreed to acquire Sage Group, which employs more than 800 staff across Australia and India, including 260 at its head office at Tonsley.

It’s understood a $150m price tag has been agreed, with an additional earn out component – contingent on Sage Group hitting certain performance targets – lifting the total price to potentially more than $200m.

A group of 27 Sage Group shareholders will share in the proceeds, including founder Andrew Downs, who established the company in 1994.

After leaving school at the age of 16 to become an apprentice electrician, Mr Downs later landed a job as a maintenance supervisor at Bridgestone in 1989, before playing around with programming and CAD (computer-aided design) as a side hustle and later formally establishing Sage Group in 1994.

The company has gone on to become one of the state’s biggest business success stories, with the company generating $216.5m in revenue last financial year, up from $186.4m in the previous year, and underpinning a $4.7m profit.

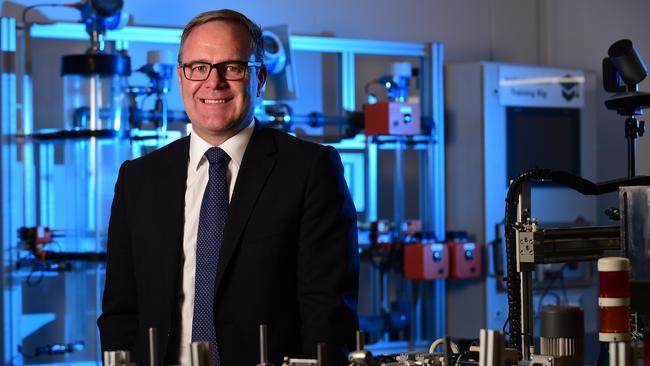

Sage Group managing director Adrian Fahey – who took over the position in 2020 following Mr Downs’ decision to spend more time on philanthropy, mentoring and other board roles – said a global expansion would be fast-tracked under the new owners following the company’s long-held aspirations to expand into the lucrative US market.

“We’ve always had aspirations of getting into the US – it’s a huge market, a big opportunity for industrial digitalisation businesses such as ourselves,” he said.

“We have been working in the US, but really we’ve been taken there by customers. We don’t have an office in the US and really to be in a location you need to have an office, so that was key for us.

“Certainly that global focus that we’ve had – to have a really strong business like Tetra Tech behind us will just accelerate that.”

During its early days focused on the automotive industry, Sage Group outgrew the backyard shed after just 12 months, with the company setting up shop in Melrose Park before moving to the hi-tech Tonsley Innovation District in 2017.

The company has diversified over the years and through its four businesses – Sage Automation, Nukon, Embedded Expertise and Skills Lab – now provides industrial automation and digital transformation services to the water, defence, energy, manufacturing, resources and transport sectors, as well as training and resource management services.

The sale to Tetra Tech, which was advised by a team of lawyers led by Thomson Geer partner Annabel West – wife of Premier Peter Malinauskas – comes a decade after the US company snapped up local engineering group Coffey International, and seven years after its acquisition of infrastructure and engineering design group Norman Disney & Young.

Tetra Tech employs 30,000 staff across 550 offices around the world.

Mr Fahey said Sage Group was experiencing strong demand for services across its three key industries of transport, manufacturing and water infrastructure, while there were also other emerging areas of growth.

“We continue to see very strong growth in the energy space, and certainly in the smart energy space, and as we look to grow our defence capability here in Australia … there are still very strong opportunities there as well,” he said.

“We’ve doubled in the last five years, our workforce here in Australia, and we expect that will continue to be the trend as more companies lean into industrial digitalisation and data enablement.”

Sage Group’s local management team will continue in their roles as part of the deal with Tetra Tech, with Mr Fahey reporting to head office in the US rather than Sage Group’s local board which has been chaired by Adelaide businessman Bruce Carter since 2020.

The company is currently redeveloping and doubling the size of its 3000sq m head office within the Main Assembly Building at Tonsley.

The deal with Tetra Tech is subject to conditions including Foreign Investment Review Board approval.

More Coverage

Originally published as Annabel West helps pull off $150m takeover deal between Sage Group and Tetra Tech