Research reveals huge salary needed just to afford to rent a home as housing crisis deepens

A six-figure salary used to guarantee a sense of financial certainty, but no more. It’s barely enough to comfortably cover the rent of a standard home.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

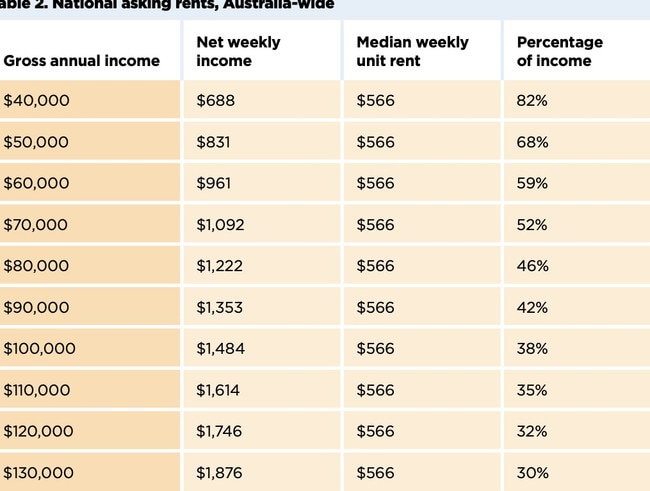

Startling new research has revealed Australians now need an income of $130,000 per year to afford the typical rental property.

Campaign group Everybody’s Home released its Priced Out report today. It paints a stark picture of the worsening housing crisis, with even those on six figures struggling.

“Rental stress is no longer confined to those on lower incomes – it’s affecting professionals, essential workers, and middle-income families who simply can’t keep up with soaring rents,” Everybody’s Home spokesperson Maiy Azize said.

“A $100,000 salary used to be considered a secure income, but our research shows people on this wage are struggling in both cities and regional areas because rents are so staggeringly high.”

Few affordable homes on offer

A person forking out 30 per cent or more of their income on accommodation is deemed to be in housing stress.

For Aussies on $100,000 per year, rent costs are above that threshold in about half of the country, the Everybody’s Home report revealed.

MORE: Half of renters experiencing financial difficulties

That kind of financial strain leaves little room for other essential costs, including food, healthcare and transport, the research noted.

“The situation is even more dire for those on lower incomes, with people earning $40,000 per year facing extreme rental stress nationwide,” Ms Maiy said.

For those tenants, they must spend between 41 per cent and 119 per cent of their net income on rent, depending on the location.

MORE: Man moves into DIY tiny house to avoid paying rent

Even people with an annual income of $60,000 need to spend between 30 per cent and 85 per cent of their wages on rent.

“This report exposes the stark reality facing Australian renters every day,” Ms Maiy said.

Urgent action needed

Without urgent intervention, Ms Maiy said more and more people will be priced out of safe, affordable and decent homes.

“With an election coming up, the next government needs to urgently boost social housing. These are low-cost rentals for people in the most severe housing stress – people who are being smashed by the private rental market,” she said.

“We are also calling on parties and candidates to scrap investor tax handouts, like negative gearing and the capital gains tax discount.

“It is unfair to spend billions of dollars propping up investors and pushing up costs while people on low and middle incomes are left behind.”

One of Anthony Albanese’s major focuses in Labor’s first term in government has been housing, with tens of billions of dollars committed to drastically boosting housing supply.

The Prime Minister has set an ambitious target of building 1.2 million new homes across the country by mid-2029.

But the Property Council of Australia projects a shortfall of almost 500,000 dwellings.

The group’s chief executive Mike Zorbas said missing the target would “set off a housing affordability time bomb”.

“Boosting housing supply is the only long-term, sustainable way in which we can boost affordability of homes to buy and to rent,” Mr Zorbas said.

He called on governments to “redouble our housing supply efforts with the urgency and commitment the crisis demands” and said doing so would drive huge savings to renters.

Big incentive to double down

Modelling by the Property Council found if the housing target shortfall can be bridged in the next four years, renters would save a considerable amount.

Research conducted by Mandala Partners found hitting the magic number of 1.2 million new homes would deliver a weekly saving of $90, or $4680 per year.

Across the country, seven million renters would collectively save an estimated $253 million every week if the target is reached.

Based on the modelling, New South Wales is set to see the largest gap of 185,000 new homes.

But if that shortfall can be addressed, tenants will be about $130 per week better off, the research found.

In Queensland, filling a projected shortfall of 96,000 homes would save renters $80 per week, while closing Victoria’s gap of 71,000 homes would reduce rents by $50 per week.

Those renting in Western Australia would save up to $100 per week if the 56,000 shortfall is met, while in South Australia, meeting the 32,000 deficit could deliver a saving of $70 per week.

“Ideally, hitting the targets will make housing more accessible and more affordable for millions of Australians,” Mr Zorbas said.

Ahead of next week’s federal budget, the Property Council is calling on the government to double its New Homes Bonus – a perk for states that exceed their housing targets – to $6 billion.

“That increase would be just 0.1 per cent of the government’s 2024-25 budget,” Mr Zorbas said.

The group also called for the scheme to be extended to seven years and deliver upfront payments that support long-term reforms.

“We also need to improve the scheme’s transparency through public reporting and highlighting best practice to ensure accountability.”

As well as delivering rental price savings, bridging the new housing target shortfall would moderate home price growth by 0.2 per cent each year, the modelling found.

And the construction of 462,000 additional homes would inject $128 billion into the economy and support some 368,000 jobs.

Originally published as Research reveals huge salary needed just to afford to rent a home as housing crisis deepens