Top Star Entertainment shareholder says thousands of investors ‘praying’ for survival

Bruce Mathieson Jr, the son of a billionaire pokies magnate, says he sympathises with the fears of myriad mum and dad shareholders who may lose their life savings if the casino group falls into administration.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

The largest shareholder in Star Entertainment believes there are thousands of investors “praying” for a lifeline as the embattled casino group struggles for survival.

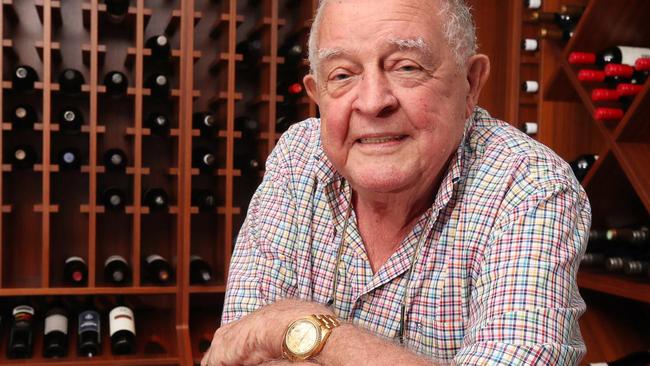

Bruce Mathieson Jr, the son of billionaire pokies magnate Bruce Mathieson whose company Investment Holdings has 9.59 per cent of Star, says he can understand the fears of myriad mum and dad shareholders who may lose their life savings if the operator falls into administration.

The Mathiesons themselves are poised to haemorrhage hundreds of millions of dollars after purchasing around 200 million shares in the casino group since early 2023 - a buying spree which lifted them to substantial shareholder status.

“The situation is finely balanced,” Mathieson Jr said of the tightrope The Star is walking to remain financially viable.

“There are a lot of shareholders whose fault this isn’t – we are all praying for a way through.

“There is a lot going on. Let’s see what happens. I don’t want to say anything at the moment that could influence things.”

His comments come as a mystery Macau-based investor emerged as a substantial Star shareholder.

Wang Xingchun now holds 5.52 per cent of Star after spending about $30m amassing more than 158.3 million shares since September 2024.

Mr Wang’s most recent purchase was on Friday, when he picked up 15.58 million shares at just over 11c each, according to a disclosure to the Australian Securities Exchange.

The Star has around 75,000 shareholders on its register, many based in NSW where the Sydney property at Pyrmont has long been the flagship of the group’s three casinos.

The Gold Coast and Brisbane are home to the other two casinos, with The Star Brisbane a multibillion-dollar development that opened late last year.

Chair Anne Ward outlined the issues facing The Star at its annual general meeting in November when she told shareholders: “The company has experienced very significant leadership changes, challenging operating conditions, declining revenues, another public Inquiry, further asset writedowns and serious financial and ongoing liquidity challenges.

“All these pressures have contributed to a material decline in share price and the value of the Company.”

The Star’s situation has continued to decline with the company announcing last Wednesday its available cash had shrunk from $149 million to $79 million for the three months to the end of December 2024.

Shares in Star plummeted 33 per cent to a then record low of 13 cents on Thursday following the announcement.

The Star’s share price has continued to falter and closed on Monday at 12.5 cents.

Analysts have warned the gaming group could collapse by February.

The Star revealed it has already used the first half of a $200m lifeline provided last year by a consortium of banks.

The casino group can gain access to the second tranche only if it raises an extra $150m and meets additional conditions.

Analysts warned Star would be lucky to last until the end of February with its existing cash reserves, amid increased warnings regulatory fines will trigger a final downfall.

Star has set aside $150m for an anticipated fine from AUSTRAC, Australia’s anti-money laundering and counter-terrorism financing regulator.

On Sunday NSW Premier Chris Minns said there was no further support for The Star, after deferring poker machine duty rates and delaying limiting bets to $1000 per day last year.

The NSW Independent Casino Commission (NICC), the casino regulator, is also monitoring the Star.

The NICC has remained in direct contact with The Star’s group chief executive Steve McCann on the ability of the company to continue operating as a viable concern.

A tense relationship between the regulator, Mr McCann’s predecessor Robbie Cooke, and The Star’s former chair David Foster was highlighted in a second inquiry into the casino group, run by Adam Bell SC last year.

If you are a shareholder of The Star, tell us your story, Email: danielle.gusmaroli@news.com.au

Originally published as Top Star Entertainment shareholder says thousands of investors ‘praying’ for survival