RBA interest rate decision: 0.25% hike to 2.85% locked in as inflation forecast raised to 8%

In a seventh-straight monthly lift, the RBA cash rate has been raised by 0.25% to 2.85%. Worryingly, the central bank has also increased its inflation and unemployment forecasts.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

Seven interest rate rises in a row might not be enough as economists predict an eighth straight jump in December and a greater chance of another hike in February after the Reserve Bank lifted its inflation forecast yet again.

The RBA tightened monetary policy for a seventh consecutive month yesterday, increasing the benchmark cash rate by 0.25 percentage points to 2.85 per cent, as was expected. That is set to add about $70 to monthly repayments of a $500,000 mortgage.

A household with such a loan will be paying $750 more per instalment than they were before the RBA began its crusade against inflation in May.

Treasurer Jim Chalmers said it was “another difficult day for Australians who are already under the pump.

“Inflation is the number one challenge in our economy,” Mr Chalmers said.

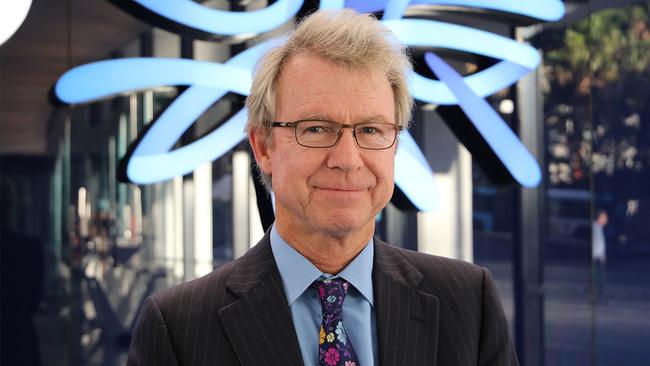

In announcing the latest rate increase, RBA Governor Philip Lowe also revealed the central bank now expects inflation to peak at about 8 per cent by year’s end, compared to its August forecast of 7.75 per cent.

Mr Lowe said “medium-term inflation expectations remain well anchored and it is important that this remains the case.”

However, in the next sentence of his statement came an increase to these expectations.

Inflation is now tipped to remain higher for longer, with the consumer price index likely to be average 4.75 per cent next year, versus a prior projection of 4.3 per cent. It is also expected to stay above the RBA’s target range of 2-3 per cent through 2024.

With the RBA ultra-keen to get inflation back into its comfort zone, RBC Capital Markets macro rates strategist Robert Thompson said “you could argue that opens the door to needing to hike in February.”

Economists at ANZ said there was now a risk that medium-term inflation expectations become “unanchored”. Even before the RBA’s upward revision on inflation, ANZ was anticipating rate increases in February and March.

Both RBC and ANZ tip a hike next month, as does AMP chief economist Shane Oliver, although he thinks that will be the last one for a while.

“By February there will be enough evidence that things are slowing,” Mr Oliver said. “But it’s a close call and the momentum is up on rates.”

Mr Thompson said the RBA was trying to strike a balance between getting inflation down quickly “without hitting growth too hard” or pushing unemployment too high.

Mr Lowe said economic growth is anticipated to be slower than previously thought – 1.5 per cent in 2023 and 2024, down from a prior expectation of 1.8 per cent next year and 1.7 per cent the year after.

As a consequence, unemployment is now forecast to rise above 4 per cent.

NAB was the first major bank to increase home loan rates, doing so by 25 basis points from November 11.

The 25bp increase on Tuesday means mortgage repayments have risen by a third compared to before the string of rate hikes began.

In April, when a typical variable mortgage rate was 2.5 per cent, monthly repayments on $1,000,000 were $4500.

Now, with home loan rates going to at least 5.25 per cent, that will be the instalment on a $750,000 loan.

A 0.25 per cent increase on a loan such as that adds $110 a month to repayments.

Meanwhile, a record number of homeowners are taking action to lower their borrowing costs, with refinancing to a new lender at an all-time high nationally and double the level of 2019.

The RBA board meeting in Hobart took place amid expectations that the US Federal Open Market Committee will this week lift American rates by 75 basis points, which would be its fourth consecutive rise of that size.

Inflation in the US is outstripping Australia.

More Coverage

Originally published as RBA interest rate decision: 0.25% hike to 2.85% locked in as inflation forecast raised to 8%