Federal budget 2023: potential tax changes that may affect you

The budget is just a fortnight away and Australians may see more tweaks to their taxes. Experts reveal who’s most likely to be targeted.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

High-income earners, business owners, investors and the family home are potential tax targets in next month’s federal budget, finance specialists say.

A fortnight before Treasurer Jim Chalmers unveils his second budget, there are varying views among accountants and tax experts about how hard he will go following his tax hit on high super balances announced in February.

BDO tax partner Mark Molesworth said “the top end of town should be on notice if the recently proposed superannuation changes are anything to go by”.

He said Treasury figures showed the capital gains tax exemption on people’s main residence would cost the budget $48 billion this financial year and was the largest tax concession provided.

“Some trimming of it could be on the agenda, if the government thinks that the increased tax revenue is worth the political pain,” Mr Molesworth said.

However, other tax specialists say the family home is safe, but warn CGT thresholds and business tax breaks may be changed.

Mr Molesworth said any prospective changes in taxing main residences “might be palatable” if they only applied to increases in value after budget night and on property sales above $2 million.

He said the 50 per cent CGT discount for other investments held more than a year could be on the chopping block for some people. “It’s possible to imagine a reduction in the discount for gains over a certain threshold – say $3 million – limiting the impacts to a smaller, wealthier cohort.”

Mr Molesworth said large legislated stage three tax cuts from July 2024 for high income earners could be altered to reduce their generosity without troubling the vast majority of the population.

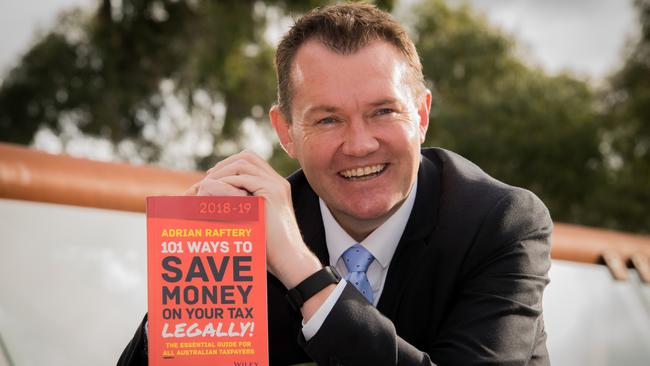

Chartered accountant and Mr Taxman founder Adrian Raftery said the stage three tax cuts “won’t change”.

“They have said it often enough that it’s going to go through as is, so that’s not going to shift,” he said.

“But after that goes through, don’t expect any future tax cuts for many years to come.”

Dr Raftery does not expect tax changes for family homes or negative gearing.

“They definitely won’t touch the home at all … I would bet my house on that,” he said.

Dr Raftery said there might be changes to the 50 per cent CGT discount, while the Low and Middle Income Tax Offset (LMITO) – scrapped last year – might make a return in some form.

“Reinstating that offset could be on the agenda – I would not be surprised if it’s relabelled as something else,” he said.

Dr Raftery said he was confident there would be no negative budget surprises.

“Generally they leak out stuff. If there’s no leak by now there’s a good chance there’s no bad news,” he said.

H&R Block director of tax communications Mark Chapman said the government was unlikely to tinker too much with the tax system until it worked out what to do about the stage three tax cuts, which he described as “the most unloved tax cuts in the world”.

“Pundits are mostly united in believing that the Liberal-era tax cuts, which heavily favour the highest income earners, are unaffordable and unfair, and opinion polls suggest that most voters agree,” he said.

“It may well be that these tax cuts never see the light of the day – at least in their current form – but the government has time on its side and will probably make an announcement when it becomes clear which way the economy is going, later this year or early next year.”

Mr Chapman said the LMITO appeared to be “gone for good”, but might be replaced by something else such as more support for energy bills or low income earners.

Business owners could lose the temporary full expensing tax break that was introduced in 2020 and provides a 100 per cent deduction for spending on most capital assets, without limits.

“It’s due to expire on 30 June 2023 and there are no indications that the Treasurer plans to extend it, let alone make it permanent, as many business groups have called for,” Mr Chapman said.

“From 1 July 2023 TFE will be replaced by the far less generous instant asset write-off,” he said.

More Coverage

Originally published as Federal budget 2023: potential tax changes that may affect you