Australian households say losing $100 a week in income would push them to the brink

Australian households have had to reassess their finances during the pandemic and many are looking at new ways to cut their costs. SEE HOW YOU CAN WIN A SHARE OF $50,000.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

Household budgets are being pushed to the brink as two in three people concede losing $100 in weekly income would put them on the breadline.

Millions of Australians are feeling the financial toll from the coronavirus pandemic and Australia remains in recession after 28 years of economic growth.

A new Dynata survey commissioned by News Corp quizzed 1000 respondents found one in three believe a windfall of just $50 per week could make a big difference to their household budget.

Free childcare is due to end next month and in the coming months other support measures including JobKeeper payments and mortgage payment holidays will also stop.

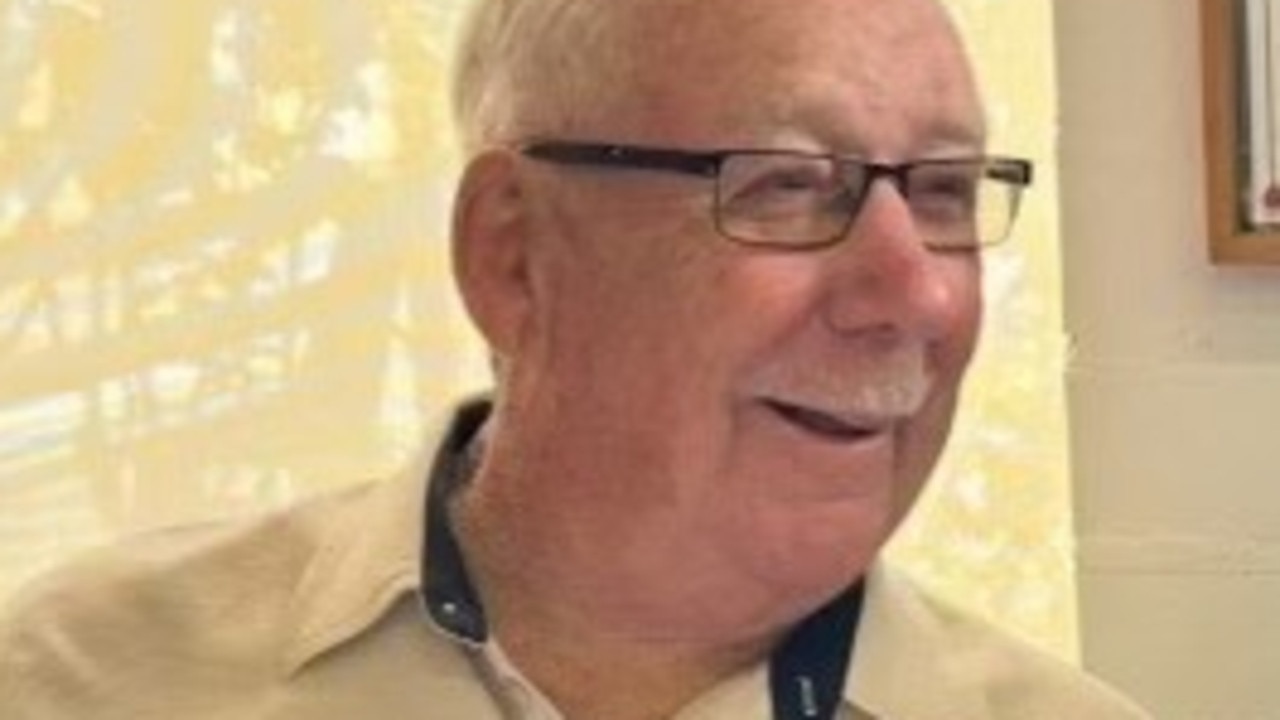

Crown Money Management chief executive officer Scott Parry said “too many people are just spending everything they earn”.

“People who have a decrease to their weekly income of $50 or $100 feel like they are living on the brink,” he said.

“What they all suffer from is lifestyle creep, we think if $50 a week is going to make a huge difference it doesn’t, your lifestyle often just increases by $50 a week in expenditure.”

He urged people to reassess their discretionary spending on items such as clothes, dining out and entertainment.

From Wednesday the Federal Government’s early access to superannuation scheme will reopen, allowing eligible applicants who have suffered a severe hit to their income to access up to $10,000 from their retirement kittys.

But despite more than two million people already accessing $18.5 billion, the research showed a majority of the population (72 per cent) take little or no interest in their super.

‘WE’VE LOOKED FOR A BETTER DEAL’

Primary schoolteacher, Tamara Riddell, 47, from Niddrie in Melbourne’s northwest said she had reassessed her family’s finances since COVID-19 and had booked to see her financial adviser.

“We’ve also looked into our superannuation to see what impact COVID-19 has had on it, and discussed looking at our current home loan to see if we can get a better deal,” she said.

Ms Riddell said her husband Scott, 48, who is an electrician has taken a financial hit during the COVID-19 period.

“Although his job is secure, there have been some weeks where there has been little to no work,” she said.

“Like many families this has impacted our ability to pay the mortgage, bills and other expenses.”

HSBC chief economist Paul Bloxham said were there concerns about a financial “cliff” coming when wage subsidy programs end but what remained uncertain was the jobs market.

“As the economy is reopened it will be important how quickly those jobs return,” he said.

“Our expectation is that we have already seen a pick up in May in the weekly numbers and we expect to see a rising trend in the lift of employment”.

The nation’s unemployment rate is 7.1 per cent.

Mr Bloxham also expects there to be sharp rise to households saving cash.

‘WE TRY NOT TO WASTE TOO MUCH’

Dave Franks and his partner, Libby Littleyuile, have been saving cash naturally during the coronavirus pandemic by “not having an opportunity to spend money on going out”.

COVID-19 had highlighted the money they were spending previously that they probably did not need to, said Mr Franks, 25, of Bondi.

“We have tried to do more socialising at home, or at a mate’s place,” he said.

“Most of our friends are in a similar situation so cooking for each other and paying take away prices for booze has been a big help.

“We also try not waste food and cook with what’s in our pantry, rather than picking a recipe and going out to buy those items.”

Ms Littleyuile, 26, said the couple had been tracking their spending to gain an understanding of where their money went.

“There’s lots of apps now to help, or even a simple spreadsheet can do wonders,” she said.

Win a share of $50,000. Enter at bankbalanceboost.com.au, T&C’s apply.

Originally published as Australian households say losing $100 a week in income would push them to the brink