The City has defended its view tax saying it was not to raise revenue but help other ratepayers

Council has strongly rejected that it introduced a “view tax” as a revenue earner, saying the previous rates system was unfair to residents living on lower floors of apartments.

Gold Coast

Don't miss out on the headlines from Gold Coast. Followed categories will be added to My News.

Council has strongly rejected that it introduced a “view tax” as a revenue earner, saying the previous rates system was unfair to residents living on lower floors of apartments.

High rise residents attending a town hall meeting organised Southport councillor Brooke Patterson had asked if their increase in their rates was raising up to $40 million in revenue.

A Gold Coast City Council spokesperson, when asked by The Bulletin replied: “No, this is not correct.”

When asked if the system was introduced to level out rate increases for all Coast property owners, the spokesperson said “yes”.

“This includes 31,962 or 71 per cent of all Vertical Community Title Scheme Primary Place of Residence properties – apartments located on the first five floors.”

Councillor Darren Taylor, based in Surfers Paradise, Main Beach and Broadbeach, this week began meeting with body corporates and writing to protesting residents.

Pintari apartments residents in Main Beach told him they were concerned at the increase with no prior discussion.

“This increase was brought in by council in 2014 – our councillor was Suzie Douglas at the time – following outrage it was promptly withdrawn,” a resident told the councillor.

Mr Taylor in a response said approximately 70 per cent of the city’s rateable primary place of residence properties would receive a rate increase of 4.24 per cent or less.

“The increase in rates and charges is necessary to maintain the services, facilities and activities expected by the community, and is based on property valuations determined by the state government,” he said.

To ease sharp increases, council had averaged out property valuations across three years. “This approach spreads out the impact of the recent property market activities, which have driven many valuations higher than anticipated,” Mr Taylor said.

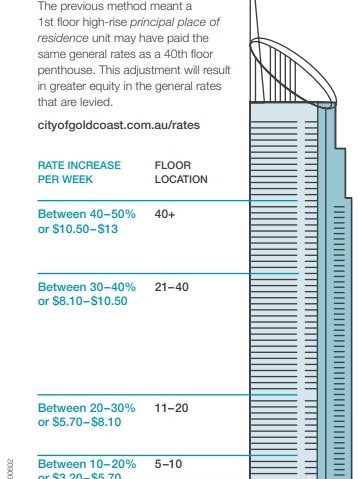

“Regarding high-rise units, the council identified that the previous method of rating was not equitable. Previously, a first-floor unit could pay the same general rates as a 40th-floor unit.

“The new method takes into account both the size and floor level of the apartment to ensure fairness and equity. This adjustment restores a fairer system similar to the one used before 2013.”

Changes under the new differential rating categories are as follows:

* 10 per cent increase (or $3.20 per week) for floor levels of 5 to 10.

* up to a maximum 50 per cent increase (or $13 per week) for floor level 40 and above.

* about 12,000 properties impacted – which equates to around 4.3 per cent of all rateable properties in the city.

Mr Taylor said the decision to adjust the rates was made as part of the City Budget process.

“We understand that this change comes at a challenging time given the current cost of living pressures,” he said.

“The City offers payment arrangements for ratepayers who may have difficulty paying their rates by the due date. By entering into a payment plan, you can avoid penalty interest charges.”