Key council-owned companies miss out on watchdog scrutiny

The state’s public sector watchdog has not given opinions on 19 entities from Brisbane, Logan, Redland, Moreton and Ipswich councils in its latest local government audit. Here’s why

Logan

Don't miss out on the headlines from Logan. Followed categories will be added to My News.

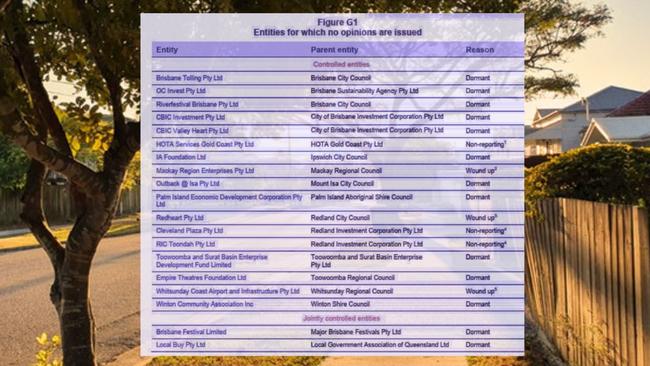

Nineteen Queensland local government-controlled entities, including high-profile subsidiaries of Redland, Logan, Brisbane, and Moreton Bay councils, did not receive audit opinions for the 2023–24 financial year.

The Queensland Audit Office’s Local Government 2024 report, published this week, revealed the entities were excluded from audit opinions because they either did not produce financial statements or were deemed dormant or non-reporting.

Among the most notable omissions are entities tied to Redland City Council.

Redheart Pty Ltd, a wholly-owned council entity established in 1990 to quarry and sell mineral materials for brickmaking and road surfaces, was deregistered on 2 October 2024 and did not prepare financial statements for the 2023–24 year. As a result, no audit opinion was issued.

The company had previously surrendered its environmental authority in October 2023 and ceased all quarrying activities. Despite the deregistration, the site at German Church Road in Mount Cotton remains protected under the state’s Key Resource Area designation, preserving it for potential future quarrying if economically viable.

The council stated that deregistering Redheart Pty Ltd was not expected to impact future quarrying operations and would reduce compliance and auditing costs.

Other Redland entities listed as non-reporting in the QAO report include Cleveland Plaza Pty Ltd and RIC Toondah Pty Ltd, both subsidiaries of the Redland Investment Corporation (RIC). Their transactions were consolidated into RIC’s financial statements, and therefore no separate audit opinions were issued for those entities.

Brisbane City Council also had five dormant subsidiaries excluded from the QAO’s audit, including Brisbane Tolling Pty Ltd, OC Invest Pty Ltd, Riverfestival Brisbane Pty Ltd, CBIC

Investment Pty Ltd, and CBIC Valley Heart Pty Ltd. These entities did not engage in any material financial activity during the period.

CBIC reported a comprehensive loss of $17.1 million in its 2024 annual report, attributed largely to a reduction in the fair value of its property portfolio. Nevertheless, it declared an $11.8 million dividend to Brisbane City Council. In 2023, CBIC also sold a $35.25 million Yeerongpilly asset as part of a broader strategy to reduce risk and diversify its investment portfolio.

Councillor Jared Cassidy publicly questioned CBIC’s financial structure and the use of ratepayer funds in 2023, prompting further scrutiny. In response, the QAO noted that financial sustainability is considered in annual audits, and no going concern issues were identified at the time. A 2019 PwC report had previously raised concerns about the board’s lack of property expertise and potential risks to council funds.

Logan City Council’s development arm, InvestLogan, was also not subject to a full audit in the QAO report, which confirmed the company did not submit a financial report for 2023–24.

Logan had resolved to voluntarily deregister InvestLogan in 2023, after using it to deliver several multimillion-dollar development projects.

These included The York in Beenleigh, a seven-storey mixed-use complex sold in 2022 for $33.52 million, along with community housing in Marsden, mixed business units in Berrinba, and an urban renewal precinct in Rochedale South.

The council has indicated future projects will be delivered directly by council, with a renewed focus on transparency, community benefit, and alignment with citywide planning objectives.

The QAO issued Moreton Bay City Council a clean audit opinion for both its financial statements and sustainability statement.

However, its wholly-owned company Millovate Pty Ltd received an “emphasis of matter” paragraph in its audit report.

The QAO noted that Millovate’s financial statements were prepared on a basis other than a going concern, as the company had ceased trading. All assets and operational responsibilities were returned to the council, and Millovate was formally deregistered on 18 December 2024.

Ipswich City Council also received an unmodified audit opinion for its 2023–24 financial statements. Its sustainability statement carried an “emphasis of matter,” which is typical for special purpose financial reports.

However, the Ipswich Arts Foundation Trust, a dormant entity wholly owned by the council, did not prepare financial statements for the 2023–24 period. Consequently, the QAO did not issue an audit opinion for the trust. The Ipswich Arts Foundation Trust remains listed as a council-controlled entity, although council records from 2017 indicate efforts to streamline governance structures related to arts funding.

More Coverage

Originally published as Key council-owned companies miss out on watchdog scrutiny