‘Cash grab’ bank closures to continue in 2025 starting in Logan

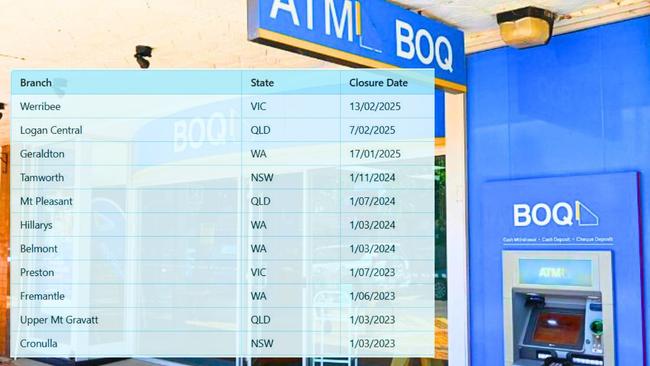

Bank branch closures will continue to sweep Australia in 2025, with the Bank of Queensland starting the year by announcing 14 closures next month, seven of which are in Queensland.

Logan

Don't miss out on the headlines from Logan. Followed categories will be added to My News.

Unprecedented bank closures which defined 2024 will continue this year, according to finance sector experts, with the latest bank preparing to shut 14 branches across the country including seven in Queensland.

On Monday it announced that between February 7 and 27, one branch would close in Western Australia, three in NSW, five in Victoria and seven in Queensland.

“We are focused on supporting our people throughout this process and are pleased that most team members will transition to new roles across our network,” a spokesman said.

The Courier-Mail last week reported the Logan Central closure would be one of 47 branches across all Queensland banks to close in the past year and follows last month’s surprise closure of a BOQ branch at Browns Plains, which forced two long-term branch managers to hand back their franchise. The Logan Central branch closure would be the bank’s 11th branch closure in the past 12 months and its third in Queensland.

The BOQ Wembley Rd branch at Logan Central will shut on February 7, with financial sector representatives claiming it heralded another blow to customers seeking personal access to local banking services.

BOQ has promised to relocate the branch’s four employees to nearby outlets at Springfield, Daisy Hill, and Browns Plains.

However, Finance Sector Union national assistant secretary Jason Hall said the move failed to address the broader impact on Logan Central residents who rely on face-to-face banking services.

Mr Hall said the Logan Central branch, in the busy Logan Central Plaza, was the only bank branch in the area, making its closure a significant loss for the local community.

“Banks are prioritising profits over people, with no mandatory requirements to keep branches open,” he said.

“Automated services and ATMs cannot replace the human touch in banking.

“BOQ must clarify its intentions: does it aim to support communities or maximise profits at their expense?

“Queenslanders have already copped 47 bank closures in the 12 months thanks to the greed of banks who have no requirements to keep branches open.”

BOQ’s decision is part of its aggressive cost-cutting strategy, first announced in 2023 with the union claiming next month’s Logan closure highlighted the worrying trend in banking services.

The union said it feared the buyback of franchises branches and the subsequent consolidation closures would continue, wording community access to essential banking services.

The bank has been “consolidating” its operations, including a $125 million initiative to buy back 114 franchises branches over the past 12 months which triggered concerns the bank was laying the groundwork for widespread closures.

BOQ revealed plans to cut 400 staff in September, following 220 job cuts in October 2023.

The popular bank raised the ire of banking sector analysts last month, when it swooped in and took back the franchise of the Browns Plains branch in a move that surprised owners Natasha Hobson and Kerry Menck.

The pair bought the franchise in 2022 as a long-term prospect but were forced out after the bank announced plans in August to bring all owner-managed branches under corporate control by March.

That closure prompted the Finance sector Union to call for the introduction of minimum standards to ensure access to basic banking services nationwide.

The FSU has also urged BOQ to reconsider its strategy and prioritise customer needs over short-term profits to curb further closures and staff reductions.

Bank of Queensland Logan Central manager Kelly Reed was contacted for comment.

■ BOQ shares were trading at $6.72 on Thursday afternoon, down from $6.90 in December when the franchise buybacks started.

More Coverage

Originally published as ‘Cash grab’ bank closures to continue in 2025 starting in Logan