Gold Coasters putting ‘lots and lots of cash’ into cryto ATM

Crypto ATMs are completely legitimate but police warn they’re the machine of choice for scammers and organised criminals around the world … with the city’s residents at risk.

Gold Coast

Don't miss out on the headlines from Gold Coast. Followed categories will be added to My News.

It looks like an average ATM.

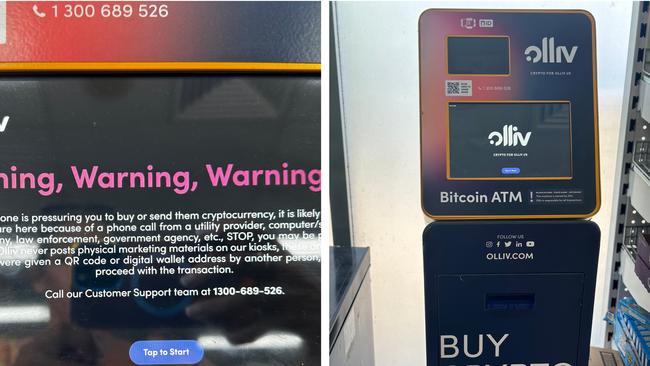

But tucked away at the back of a Gold Coast convenience store, this machine has the words “buy crypto with cash” emblazoned on its body.

And it’s just one of a wave of cryptocurrency automatic teller machines flooding Gold Coast suburbs.

It might seem like a novelty, or even an ubiquitous way to simply advertise crypto coins, but the man behind the counter at this local shop assured me otherwise.

“The crypto ATM? People use it all the time … all the time,” he said.

When I asked why someone wouldn’t just purchase crypto online from the comfort of their own home, a method which carried far fewer fees than this ATM, he said these machines had a particular benefit.

“They use this machine because they can use cash. They use lots and lots of cash.”

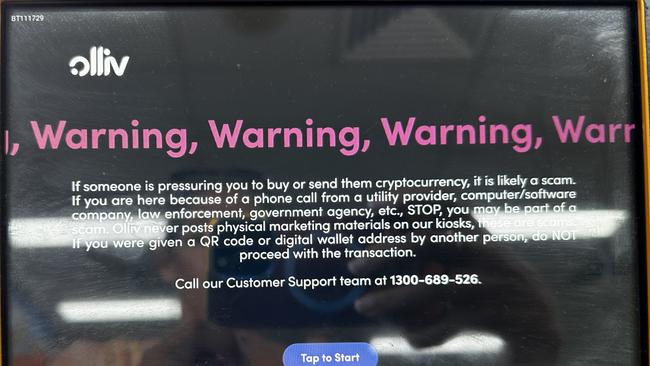

While this crypto ATM was not a scam, even if it did charge exorbitantly high fees, its ilk has become the machine of choice for scammers and organised criminals around the world … meaning Gold Coast residents were at risk.

That’s precisely why the Australian Federal Police recently unleashed the highly-skilled, multi-agency Taskforce Avarus to target criminals laundering tens of millions of dollars in Australia every day.

“Crypto ATMs, prepaid debit cards loaded with cryptocurrency or online gaming sites that accept cryptocurrency are some of the ways crypto is used to hide illicit funds (and launder money),” said the AFP.

“This dirty money that is laundered through our economy is not only bankrolling lavish lifestyles but also funding future crime, such as more illicit drug importations and weapons trafficking.”

Both the Federal Bureau of Investigations in the US and the AFP have issued warnings about how crypto ATMs were being used … or rather, abused.

The FBI recently warned that crypto ATMs were emerging as a popular method that ‘pig butcher’ scammers used to receive funds from defrauded victims, after posing as romantic partners or long-lost friends.

The AFP said Australians should be on high alert for these organised criminals around Valentine’s Day this week, as statistics showed residents lost up to $4500 every hour to romance scammers in 2022 and up to $3800 every hour in 2023.

It’s certainly cause for growing concern given that a quick count on Google maps showed at least 20 of these machines in our city, owned by multiple operators and located everywhere from supermarkets, newsagencies and convenience stores.

Industry figures from Coin ATM Radar recently suggested Australia now has 383 machines nationwide, more than all of Asia, after a rapid expansion in 2023.

The machines work by allowing customers to feed cash in to buy various cryptocurrencies at the exchange rate shown on the screen. The crypto is then available in the customer’s digital wallet where it can be stored in the hope the value will increase, or used to pay for items from sellers who accept the currency.

Some of the machines also allow withdrawals, for customers who want to sell cryptocurrency and receive the value in cash.

A single company, Olliv, the local entity for the US-based CoinFlip, owns more than 300 machines in Australia, including the majority on the Gold Coast.

CoinFlip told the Sydney Morning Herald in May that it was “betting big on Australia” and would need to double the network just to meet current demand.

Certainly it’s an attractive prospect for newsagencies and convenience stores, with businesses typically receiving between $250 and $400 a month in rent for hosting the ATMs.

While the crypto machines were completely legitimate, and there’s no suggestion of any wrongdoing by the stores or Olliv, everything crypto touches can quickly turn to fools gold given the lack of regulations and high degree of anonymity for users.

Despite multiple controversies and conspiracies, cryptocurrencies have been widely accepted in the mainstream … but it also can’t be denied they were the preferred currency for some dodgy operators.

An ASIC spokesman said that while crypto remained largely unregulated or at best a grey-zone, it was the ‘Wild West’.

Indeed, a study by advisory firm Statis Group showed that an estimated US$4.9 billion was invested in crypto start-ups in 2017 – and up to 78 per cent of those were scams.

Yikes.

Between conspiracies advocating that cash remain king to groups pressuring for the wholesale uptake of cryptocurrencies, how we pay has become just as important as how much we pay.

Perhaps the best way to protect your bank balance these days is practising exactly that … balance.