How Matthew Perrin went from the Gold Coast high life to as low as it gets in just 10 years

MATTHEW Perrin fell faster and harder than any other young Gold Coast tycoon, from a $150 million fortune to bankrupt drink-driver and fraudster. His corporate crash was driven by ego.

Crime and Court

Don't miss out on the headlines from Crime and Court. Followed categories will be added to My News.

MATTHEW Perrin fell faster and harder than any other young Gold Coast tycoon — from a $150 million fortune to bankrupt drink-driver and fraudster.

His corporate crash was driven by ego.

His prediction of facing a jail term proving to be his only truth after a Brisbane District Court jury found him to be a liar.

He has now been released from jail despite not being eligible for parole until next year.

The jurors judged it was Perrin and not his ex-wife who signed documents for a bank loan in a desperate bid to save his fortune. His forgeries were the last act in a 10-year drama where all the money and marriage was lost.

Those on the Coast closest to Perrin at work and around the racetracks blamed his gambling streak and an arrogance which grew with the wealth he accumulated.

YOUNG HIGH ROLLER

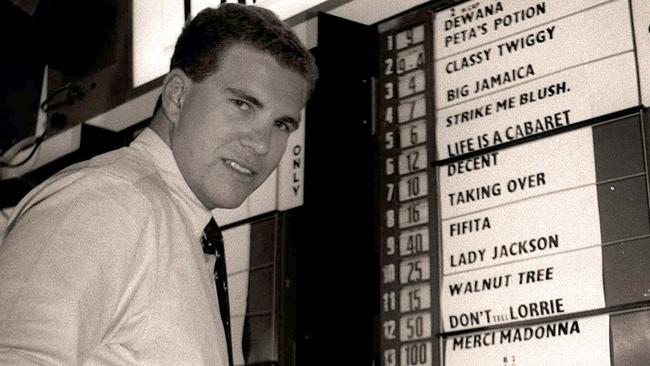

Perrin stumbled into horse racing in 1982 when one of his teachers at The Southport School posted a notice on the board aimed at aspiring mathematicians, saying they could get out-of-school work by enrolling as a bookmaker’s clerk.

After graduating as a top student from the elite school, Perrin paid for his law degree by working as a clerk for leading Australian bookmaker Laurie Bricknell.

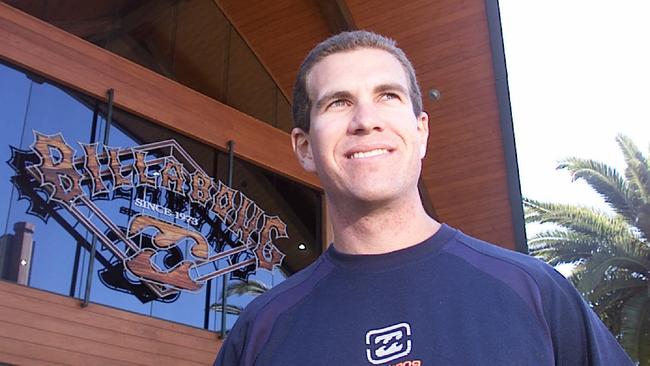

Short cropped hair, lean and tall, Perrin had a beaming smile and looked the winner when photographed at his bookkeeping stand at Magic Millions. Laurie’s daughter Nicole was just 16.

A family friend tells the Gold Coast Bulletin: “Laurie was the Gold Coast’s biggest bookmaker. He’s a good fella. His three girls are lovely. Nicole is a local St Hilda’s girl.

“They were a low key, great family. Matthew was the head boy at TSS. He should have known better.”

The reference is to Perrin’s affair and later his signing of his wife’s signature to defraud the Commonwealth Bank of $13.5 million in bank loans to keep his finances afloat.

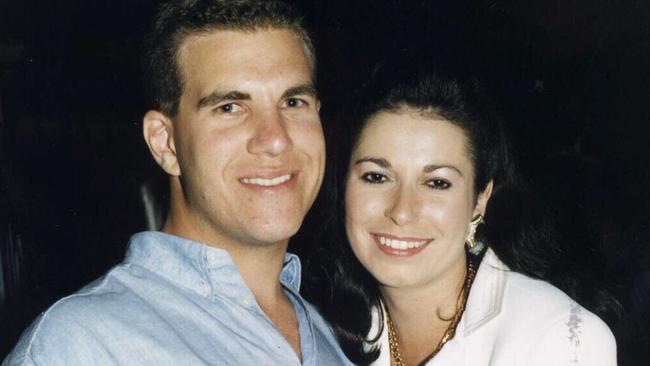

In the beginning, the couple had a golden, innocent glow about them.

BETTING ON BILLABONG

After graduating Perrin began a Coast legal practice with his brother Scott and married Nicole in September 1996. Within a year she had sold her beauty therapist business and had the first of their three children.

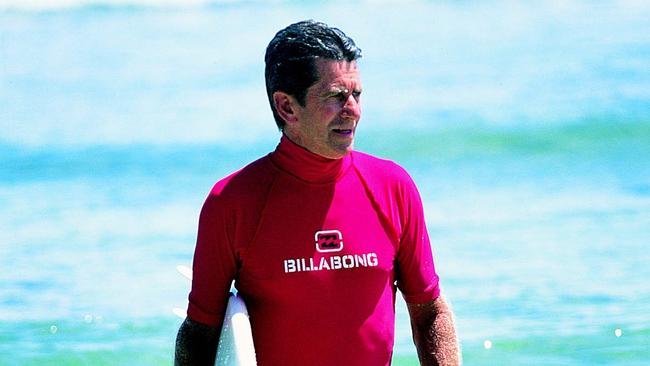

A split in another corporate Coast marriage and business creates a rare investment opportunity. Gordon and Rena Merchant, after building the family surf fashion company Billabong, are negotiating a divorce.

Perrin and another Coast business colleague, Qantas chief executive Gary Pemberton, buy Rena’s 49 per cent stake in the then-unlisted company. Perrin within two years is the company’s chief executive.

Gordon was a board shaper and Rena created the braided board shorts, starting from struggle street in Sydney’s west.

Perrin’s arrival and new board changed the company’s laidback fabric.

A former work colleague recalled Perrin as a destabilising force who put many people offside.

“He was the head honcho and that was part of the restructure of the company as they made it public,” the former worker said.

“Gordon had tried to keep it surf and family, and fairly tight. We embraced that.

“When Perrin came along, and this happened with the new board, they tried to corporatise it.

“There was no loyalty to anyone who was there.

“Then he did the dirty on the board and sold off his shares.”

In August 2002 the corporate world was stunned when Perrin offloaded more than half of his portfolio, selling $66 million worth without telling his board. Two months later he quit.

LIVING LIKE A BILLIONAIRE

The 30-year-old is driving a $130,000 Mercedes, the couple own a beachfront unit at Mermaid Beach’s Albatross Avenue and start demolishing an existing property to build their Cronin Island dream home.

Friends recall the extravagance, being invited on a plane to Hamilton Island for a birthday party. “He made good money but he was living life like a billionaire,” a friend said.

But two years later Perrin makes his first flawed business call. He is approached by Ben and Nathan Thynne to invest $10 million into Global Mart and buy up several supermarkets in provincial China.

The Coast brothers are big names in the private health sector. Their consortium in Southport creates the Gold Coast Surgery Centre and buys Allamanda private hospital.

Nicole cautions him against the business deal. As sole owner of their $15 million home, she is concerned about their assets but he ignores her warning.

The former work colleague believes Perrin’s ego causes him to underestimate the Chinese.

“The Chinese always get the best deal. Here’s a bloke who for five minutes for Billabong was buying stuff for Rena and thought he could get into the system.

“The guy was dreaming. He wasn’t that smart. That was where his arrogance comes through.”

LOSING THE MARRIAGE AND THE LOT

Perrin’s personal life begins to plummet like his business portfolio. On Boxing Day 2007, Nicole discovers text messages on his phone.

She hires private detectives after finding a diamond bracelet and Gucci dress two sizes too small for her in his suitcase. A woman is texting him about not phoning for her birthday.

“It’s my birthday you (expletive) bastard, you won’t take my calls, I bet you are with her,” she texts. “Let me guess, won’t do surf club but Zen (at Conrad Jupiters) with all the trimmings.”

By Easter the next year the Chinese investment with Global Mark Limited is in free-fall. Perrin is the largest single investor, his 33 per cent stake worth $US16.8 million.

The Coast young business gun focuses on Global Mart’s retail side, wanting to reshape it under Western management, bring in fresh food. But other investors are needed to buy up the supermarket properties.

Perrin is tipping in all the money. In an email to a fellow investor, he writes: “I am furious and have let my feelings fully known to the Thynnes. This will be the last transaction I will ever contemplate with them. Fortunately I didn’t resort to physical violence.”

He puts everything on the line. The couple’s home is used as security against a $13.5 million loan from the Commonwealth Bank. He provides the paperwork and guarantees.

Nicole’s signatures are never sighted by the bank. The signature of Perrins’s brother Fraser, a prominent lawyer, is used to witness the documents.

Yet hope still remains on Nicole’s horizon. On Christmas Eve she gives him a card titled Love Conquers All Things.

“I can’t believe this is our 11th Christmas with the children. We are so lucky to have three beautiful kids to share such a happy and fun day with,” she writes.

“It has been a very hard year full of bad times but we have done and shared many good times with the kids. Our kids have excelled this year and we must be very proud of them. Smile, relax and enjoy and be happy.”

THE GUT-WRENCHING CONFESSION

But early in the New Year, on the way to breakfast at the exclusive Grand Golf Club, Nicole senses something is very wrong when he pulls the car to the side of the road and vomits.

Two days later he gathers Nicole, her father, his two brothers and a business partner at their home and he tells them, “I’ve done a lot of bad things”.

He is on the floor crying, cradling his head in his hands. She is at breaking point but assures him, “It’s OK, you are having an affair again”. They all suspect this.

Instead, he tells her, “I’m going to jail. I’ve lost everything. I forged Nicole’s signature.” He had also signed his brother Fraser’s.

Talks for the restructuring of Global Mart continue during the next few weeks but Perrin at the final minute fails to sign. A year later he walks into a Brisbane office and files for bankruptcy.

His assets are a $100 laptop, a $200 watch, $1400 in shares, $3000 in clothes, about $16,000 in superannuation and $30,000 cash.

His personal debt totals more than $25 million and two failed private companies owe at least $100 million. Financial analysts ask how he could lose so much and speculate on his gambling.

The couple separate and he moves out. Perrin returns to the mansion regularly, often with the kids, sometimes carrying legal documents, never smiling. Genuine concerns are held about his mental health.

THE BANK BEGINS CIRCLING

His ex-wife begins rebuilding her life as Nicole Bricknell. She drives the kids to their private schools, meets an inner circle of friends for coffee. In the background, the bank is closing in.

After being sued for the loan, Nicole fronts the civil court and drops the bombshell that she did not consent to the mortgages or sign the loan guarantee.

Justice Philip McCurdo considers the testimony of handwriting experts. In September 2011 he finds Nicole had not given authority to her husband to sign on her behalf, that both she and Fraser Perrin had their signatures forged.

The mansion sells for an estimated $6.1 million four months later and Nicole finds herself a job, launching a real estate career.

After legal bills and debts, she estimates “not a lot is left”. She is taking medication for a health condition, remains confident another stress-related illness is under control.

On the desk in front of her is a small frame with a photograph of three young children.

Why continue with the marriage for so long after the bankruptcy and affairs? “It was for my children,” she replies.

THE TOUGHEST TESTIMONY

It is unspoken but she knows her husband will be charged with fraud, that as a key witness her testimony determines whether the father of her children goes to jail.

They are working through the custody arrangements. His recent drink-driving charges remain a concern.

A friend tells the Bulletin: “It’s a fractured relationship. She was still very angry with him but trying to be nice to him because of the kids.

“I don’t think she wants the family dragged through the mud. She finds the whole situation highly embarrassing. But there is no doubt in her mind he’s done the wrong thing.”

Her friends remain close, some of his older corporate mates disappear and refuse to talk. A Sydney-based bookmaker estimates he is owed $830,000 in losing bets.

“He was a nice chap. He enjoyed a bet. He would win some, I would win some,” he says, as bankruptcy documents reveal $1.62 million was owed to bookies.

THE FINAL STRAIGHT

The dark cloud finally arrives and remains for days, all of last week until yesterday.

She holds her head high on arrival in Brisbane for court, like her father always encouraged her to do. But on the witness stand, the memory of the marriage breakdown leaves her sobbing in front of the jury.

A former Perrin friend, close to the track, knows Perrin’s biggest loss is not in the corporate world but closer to home.

“He was a horse gambler. He was a pretty young guy and he had this Billabong money. He was rooting this other sheila. Nicole ended up getting kicked in the guts,” he says.

He pauses after thinking about how much of the good life, the extended Bricknell family, the Coast’s highest flying youngest tycoon had blown away.

“Matthew is a just boofhead,” he says.

The betting among he former corporate rivals is Matthew Perrin will serve three of six years in jail.