What’s so scary about new Gold Coast flooding maps is the cost of your home insurance

NEW flooding maps council has been forced to publish reveal the terrifying truth of what our city would look like in a major flooding event. And the news gets even worse for ratepayers.

Council

Don't miss out on the headlines from Council. Followed categories will be added to My News.

THE release of new flood maps which show most of the Glitter Strip covered in water in a major disaster event is creating an insurance nightmare for residents.

The Bulletin understands the council — under the instruction of the State Government — had to prepare the maps but their release on a planning page has caused outrage.

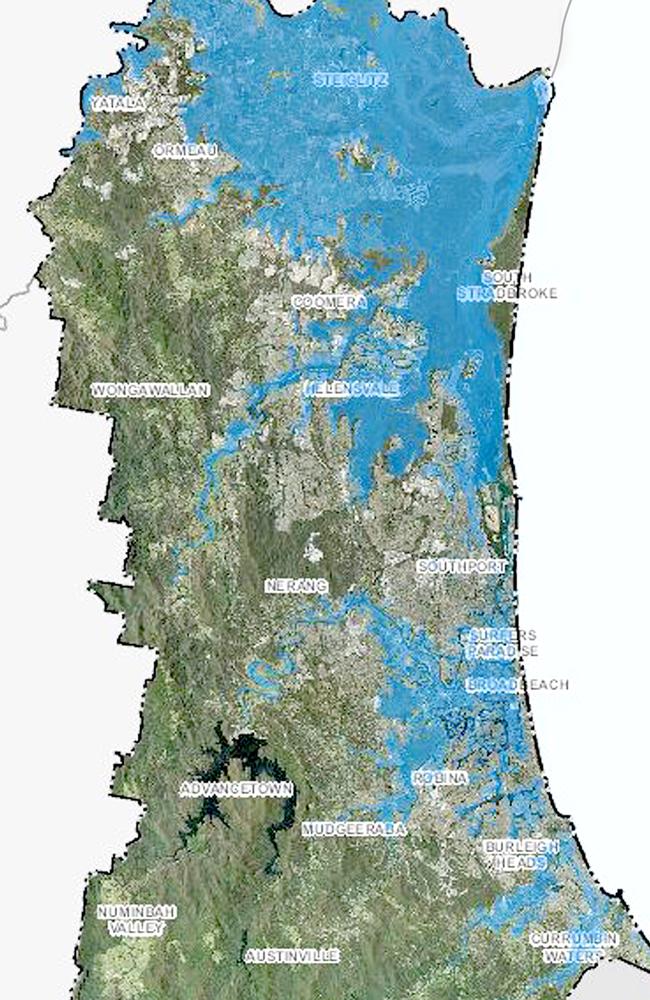

Residents who access the council website and go to flood map overlay will find most of the Coast, from Yatala to Helensvale east of the M1 and Surfers Paradise south to Coolangatta is under water in a major flooding event.

Coast LNP MPs Mark Boothman and Michael Hart have received numerous complaints from concerned residents in Helensvale and Burleigh either unable to get property insurance or facing massive premium hikes.

HEAVY RAINS CAUSE FLOOD WATCH FOR COAST

Mr Boothman told the Bulletin: “My office has been contacted by residents dismayed that their properties have been included in the new inundation flood mapping, with most never suffering any inundation previously.

“These changes to the planning scheme, at the request of the State Government, are now starting to affect residents.

“This policy will affect huge tracks of the Gold Coast, not just canal properties, but areas some distance from waterways that have never been previously inundated”.

Mr Boothman, in a question on notice in State Parliament, has asked State Development Minister Cameron Dick of the impact on residential properties of the Government’s planning policy.

The mapping reflects the Government’s preparations for a 0.8m rise in sea level by 2100.

Mr Boothman asked if the Department had reported on the effect of this outcome for home and contents insurance policy premiums, and would it commit to an investigation.

Many Coast residents who had a home and contents insurance policy of $4000 have witnessed a doubling in fees.

Documents produced by the MP show one constituent at Helensvale was given a quote for $29,928.

COAST’S ROAD FLOOD AFTER HIGH TIDE

“Some could not believe insurance companies were not interested in covering their properties. They’ve looked at the new flood maps and said the water has gone nowhere near us before,” Mr Boothman said.

Mr Hart fears the consequences of the public release of the new mapping on development applications, particularly in low lying coastal areas like Palm Beach.

“It will put the majority of Palm Beach under water if there is a one in 100-year flood. It will stop development,” Mr Hart said.

Mr Dick is required to answer the question next week and the Bulletin understands he will advise Mr Boothman that the Australian Prudential Regulation Authority supervises insurance institutions and not the Government.

“I am advised by the Insurance Council of Australia that insurers do not provide cover for gradual sea-level rise attributable to climate change, and as a result insurance premiums do not include any costs for this exposure,” a spokesperson for Mr Dick said yesterday.

“Therefore I am further advised by the ICA that the release of a sea-level rise prediction or map, for 2050 or 2100, will have no impact on an insurance premium.

GET FULL DIGITAL ACCESS FOR 50C A DAY

“I am also advised by the ICA that insurance premiums on the Gold Coast are determined using today’s climate and reflect the current risk.”

Council planning committee chairman Cameron Caldwell said the flood maps ensured future development was built to a certain standard and resilient to potential future floods.

“Insurance companies use various means to determine flood risk for individual properties. Some companies may have developed their own flood information while others may seek information from the results of a council flood search,” he said.