Gold Coast Council rates: Surprise cut for thousands of ratepayers

Council have quietly delivered a surprising change to thousands of ratepayers on the Gold Coast. Here’s how to find out if you’re affected.

Council

Don't miss out on the headlines from Council. Followed categories will be added to My News.

Council quietly delivered a surprise cut in the rates bill of about 1000 homeowners on the Gold Coast after complaints some had been paying way over the odds for years.

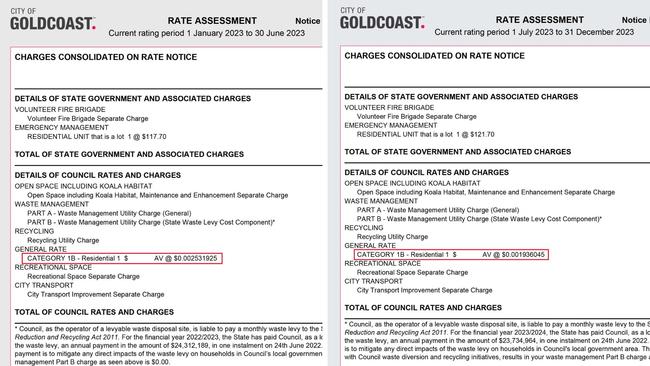

The saving, which appeared in bills issued in July, came after the dollar rate used to calculate charges for approximately 13,600 properties which are part of community titles schemes was reduced by 23 and a half per cent.

Council calculates rates by applying a small percentage – the dollar rate – to land value set each year by the state government’s Department of Resources.

It sometimes adjusts the rate downwards to prevent bills spiking when land valuations jump, as happened this year.

However such changes do not normally deliver reduced bills and the cut to the Category 1B rate covering the properties was unusually large. In contrast, the cut in the 1A category which covers most houses on the Gold Coast was just 4.4 per cent.

Benowa resident Andrew McDonald, who saw the rates council charge him drop by more than $350 between January and July bills, said he was stunned by the development.

Mr McDonald’s property is part of a small community titles scheme (CTS) containing just his house and his neighbour next door.

Although there are only two properties involved, they come under Category 1B, just as properties in far larger schemes would, where rates charges are diluted by the splitting of the assessed land value between many properties.

He has been campaigning for change for some time, noting that he was paying rates at an almost 70 per cent higher rate than neighbours in almost identical properties which did not happen to be part of a scheme, and thus came under the 1A category.

But he said he was stunned by the manner in which the change was finally delivered.

“I challenged them last year, I said, this is ridiculous, you’ve been overcharging us, this group of two lot community titles, for years,” Mr McDonald said.

“CTS covers a lot, it covers little ones like ours and it covers ones with 30, 40, 50, 150 properties. That’s quite a variation.

“By using the same rate, it ends up with a totally distorted result. The two-lot ones get absolutely hammered, while the larger ones get away (with comparatively low bills).

“Last year I was paying 58 per cent more than my neighbour who is on a block of land with exactly the same valuation in a single dwelling.

“That was the start of my beef. I said, look this is wrong.”

Mr McDonald said he wanted council to introduce a reform to rates charged to community titles schemes that differentiated between large schemes and two-lot schemes such as his.

Such a measure, called the ‘Community Title Scheme parity factor’, is used by Brisbane City Council to ensure more equitable bills. Under this measure, the dollar rate used to calculate rates is higher for larger schemes.

He said his concerns were taken on board by council, who arranged a meeting with officers who gave him a sympathetic hearing.

However he said he was then surprised to learn that all properties in Category 1B had received a substantial cut to the dollar rate, including those in larger schemes.

“The bottom line is they reduced ours by 25 per cent. Lovely, terrific, we’re paying less than last year on the general rates,” he said.

“But then if you did the extension and you said, hang on, within 1B they reduced it for everyone.

“What they’ve done is ones (in larger schemes) that were already getting the benefit of paying marginal rates have now had a reduction.”

A council spokesperson told the Bulletin that of the 13,600 properties in the 1B rating category, only about 1000 had seen an actual drop in their rates bills. Rising property values would have masked the change for the remainder.

The spokesperson declined to say how much revenue had been foregone by the city had the change to the 1B dollar rate not being made, saying “overall revenue” was not impacted.

“Every year as part of the budget process a routine review of all rating categories is undertaken to ensure the rating structure remains equitable and fit for purpose,” the spokesperson said.

“A total of 73 out of the City’s 165 differential general rating categories saw a reduced rate in the dollar in 2023-24 compared to 2022-23. This includes Category 1B where it was found that valuation base and composition of the community titles scheme properties included in this category had changed in recent years and a reduction in the rate in the dollar only for this category was warranted.

“Property valuation increases are also a key factor in determining the rate in the dollar that is set for rates – as the valuation base increases, the rate in the dollar doesn’t need to increase by as much, or in some cases is reduced. This was the case in the 2023-24 financial year as the effects of increased valuations received in 2022 continue to be progressively phased-in. The changes to the rate in the dollar does not impact overall revenue and given the routine nature of the changes, no specific communication was provided or required for ratepayers.

“The 1B differential general rating category contains approximately 13,600 properties. We estimate approximately 1000 properties depending on changes to their individual valuation, may have received a small decrease in general rates in 2023-24.”

An internal council review last year recommended a simpler ratings system be introduced after a Bulletin investigation showed some residents had been overcharged about 40 per cent on their bills for many years.

About $300,000 was provided for the review of the rating structure with the aim to complete it in the 2023/24 financial year for the 2024/25 rating period.

The recommendation stemmed from an investigation ordered by Mayor Tom Tate in the wake of the Bulletin’s reports. A number of immediate changes were also made following that investigation.