Gold Coast could get rates cut after city’s credit rating upgraded by Queensland treasury

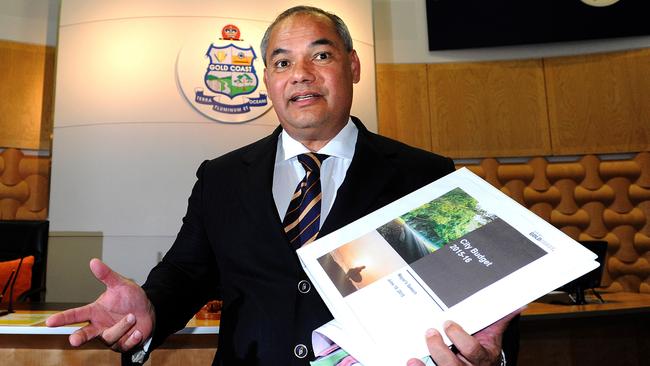

MAYOR Tom Tate has flagged the potential for a rates cut following a positive review of the city’s financial position by the state treasury body.

Council

Don't miss out on the headlines from Council. Followed categories will be added to My News.

MAYOR Tom Tate has flagged the potential for a rates cut following a positive review of the city’s financial position by the state treasury body.

The Gold Coast’s credit rating has been increase from moderate to sound by the Queensland Treasury Corporation as a result of its improving financial status and reduction of debt on the back of a strong local economy.

Sound is the third-highest rating behind strong and very strong and comes as the city’s budget jumped from $1.15 billion to $1.19 billion.

But the report warns that city hall is expected to run a deficit in 2018 because of increased costs associated with the 2018 Commonwealth Games.

When asked if the rating improvement could lead to a rates cut, Cr Tate said it was “possible”.

“It possibly can (lead to a rate cut) ... and the rates on the gold Coast will be CPI or lower,” he said.

“The main thing is we have two major projects we need to bring home — the final payment for light rail stage two and, depending on the commencement, stage three.

“We will continue to invest in traffic congestion and I am quietly happy that the QTC have said we are so sound.”

The report, issued by the QTC notes that the council has improved its operating result over the past two financial years and reported and operating surplus in the 2015-16 financial year.

In 2016 the council had a surplus of 1.1 per cent following deficits of 1.6 per cent in 2015 and 5.4 per cent in 2014.

Its financial leverage has also “improved substantially” to a “modest” 15.5 per cent.

This situation was attributed to improved recurrent revenues, higher unrestricted bash balanced and repayment of debt.

The council’s debt was at $735.9 million and is expected to drop to $535.5 million by 2021.

The report notes that operating surpluses are expected through across four-year forward estimates to at least 2021, with the exception of the 2018 financial year because of the increased Commonwealth Games expenses.

Council finance boss William Owen-Jones said city hall’s fiduciary position was improving.

“This is a result of the improvement of the city’s balance sheet and shows improving confidence on the Gold Coast,” he said.

“It is great to see the QTC has acknowledged this by changing.”

The report reveals the council’s total debt has decreased in the past two years and was forecast to continue falling as scheduled repayments exceed new borrowings.

Other reasons for the better rating, according to the QTC. were the city's improved capacity to service debt, strong liquidity supported by robust cash management and demonstrated a capacity to deliver core services and capital programs as well as improved economic conditions.

City leaders have also attributed the improved confidence to the record high number of development applications filed with the council in 2016.