Cairns real estate: How national house price decline will affect Far North

Researchers have made the call the country was beginning to suspect – house prices will soon fall, but what do experts forecast for the FNQ market?

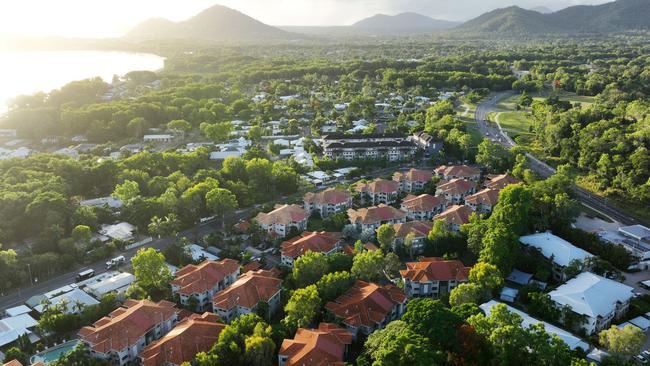

Cairns

Don't miss out on the headlines from Cairns. Followed categories will be added to My News.

RESEARCHERS have forecast a national drop in house prices, but say the “shift in the cycle” could be slow to reach certain markets, including Cairns.

For those desperately seeking rental properties in the midst of the region’s housing crisis, the wait might be extended, with the region’s property prices set to again defy national trends.

Industry research firm IBISWorld noted that while the country had experienced a 5.2 per cent rise over the past five years, some housing markets were “already displaying signs of price declines.”

Senior analyst Matthew Reeves said a reduced migration cap of 160,000, increased national supply through the HomeBuilder scheme and an expected rise in interest rates would lead to a “5.2 per cent fall in housing prices in (the) 2022-23” financial year.

“Greater global economic uncertainty and the damage to investor confidence caused by the Russia-Ukraine conflict is expected to constrain demand, weakening housing prices,” Mr Reeves said.

“IBISWorld expects the cash rate to rise at an average annual rate of 0.27 percentage points to 1.45 per cent in 2026-27.

“Prices are expected to slightly recover from 2024-25, but not return to the heights of 2021-22. This translates to an average annual fall in residential housing prices of 1.1 per cent over the five years through 2026-27.”

In the Far North skyrocketing demand for property amplified by a southern migration due to the pandemic has led to an 18.7 per cent median price increase for houses and 8.2 per cent over the last five years.

While the impressive capital growth figures hadn’t stunted rent yields overall, just a drop of 0.2 per cent in five years, it certainly slowed rental availability, with vacancy rates below one per cent creating a long-lasting housing crisis in the city.

For renters in Cairns relying on new investors to show interest in the city, there might be little relief, with Far North house prices set to again buck national trends.

“While weaker investor confidence and rising interest rates are expected to have a broad negative impact on housing prices, the extent of the impact will differ from region to region,” Mr Reeves said.

“House prices in Cairns have risen strongly on the back of a surge in demand from southern state residents looking for a sea-change or travellers locked out from overseas holiday destinations. The easing of international border restrictions is likely to slow this demand.

“However, ongoing hesitancy regarding travelling overseas, particularly among retirees, may encourage greater demand for holiday homes in Far North Queensland. This may then result in weaker price falls in Cairns compared to other parts of the country such as Sydney and Melbourne.”

The latest CoreLogic data showed in the past 12 months, the number of houses sold in Cairns each month peaked in May 2021, with 345. Since then, sales had gradually declined to 204 sold in January this year.

However CoreLogic head of research Eliza Owen said momentum was still “fairly strong” across Cairns.

“Quarterly growth across dwelling values was 4.6 per cent, up from 3.5 per cent over the three months to December,” Ms Owen said.

She said the Far North market would eventually follow the capital cities, but stopped short of declaring property prices would fall.

“Other parts of the Australian housing market are seeing a shift in the cycle; it looks increasingly as if boom times are over in Sydney and Melbourne, and even Brisbane has seen a slowdown in quarterly growth rates, from a high of 8.5 per cent in the December quarter to 6.4 per cent in the three months to March.

“This suggests that even before a rise in the cash rate target, housing markets can be subject to slowdowns off the back of affordability constraints, more vendors deciding to sell, or a change in prudential standards in the credit space.

“It is likely that we will, eventually, see the (Far North) market follow this trend of softer growth rates.”

More Coverage

Originally published as Cairns real estate: How national house price decline will affect Far North