Monthly inflation ticks down to 2.7 per cent, within rate cut range

Inflation is coming down but experts are warning it isn’t yet time for Aussies to pop the champagne bottles to celebrate a rate cut.

Breaking News

Don't miss out on the headlines from Breaking News. Followed categories will be added to My News.

Inflation is coming down in Australia, but experts warn it is still too soon to pop the champagne bottles as price pressures remain volatile and RBA governor Michele Bullock commits to a hawkish approach on interest rates.

Annual headline inflation for the month of August dropped from 3.5 per cent to 2.7 per cent, the Australian Bureau of Statistics reported on Wednesday, and underlying inflation also fell from 3.8 per cent to 3.4 per cent.

Canstar data insights director Sally Tindall said while the August CPI print showed inflation was “moving in the right direction”, it was not “nearly enough” for the RBA to bring forward rate cuts into 2024.

“At 3.4 per cent in the monthly indicator, annual trimmed mean inflation is still too high,” she said.

The Reserve Bank want inflations to fall within 2-3 per cent, before the central bank will cut rates.

RateCity.com.au money editor Laine Gordon also warned temporary measures such as electricity rebates were slowing inflation.

“While August’s headline inflation figure of 2.7 per cent will raise a few eyebrows, the RBA needs to be absolutely sure inflation is going to return to target before cash rate cuts are on the agenda in future board meetings,” she said.

“The board has made it clear the slowing in inflation is due to temporary measures, such as electricity rebates and cost-of-living relief, and that the job is far from done.

“All four big bank economic teams believe the next move from the RBA will be down, but there are five months between CBA’s first forecasted cut in December this year, and NAB’s which is May next year.

“If you have a big mortgage, the difference between the two is huge.

“No one knows for certain, not even the RBA, when the cash rate will go down, so don’t daydream about when that day will come.”

RBA governor Michele Bullock, meanwhile, made clear on Tuesday the board was adamant about returning inflation to its 2-3 per cent target band and would look for “sustainable” moves downward before cutting rates.

“The board needs to be confident that inflation is moving sustainably towards the target before any decisions are made about a reduction in interest rates, so we really need to see progress on underlying inflation coming back down toward the target,” she said.

“Progress in getting underlying inflation down has slowed, and it’s likely to have remained slow in the September quarter,” she said.

Bendigo Bank chief economist David Robertson while Wednesday’s numbers were only a subset of the third quarter data, “the numbers are very encouraging for rate cuts in 2025, and certainly brings a February rate cut back into play”.

“Today’s data certainly helps the case for a February cut, however upcoming data and events will keep markets guessing between now and then, including the US Presidential election in November. We continue to expect at least three rate cuts next year,” he said.

‘Encouraging’: Government welcomes CPI

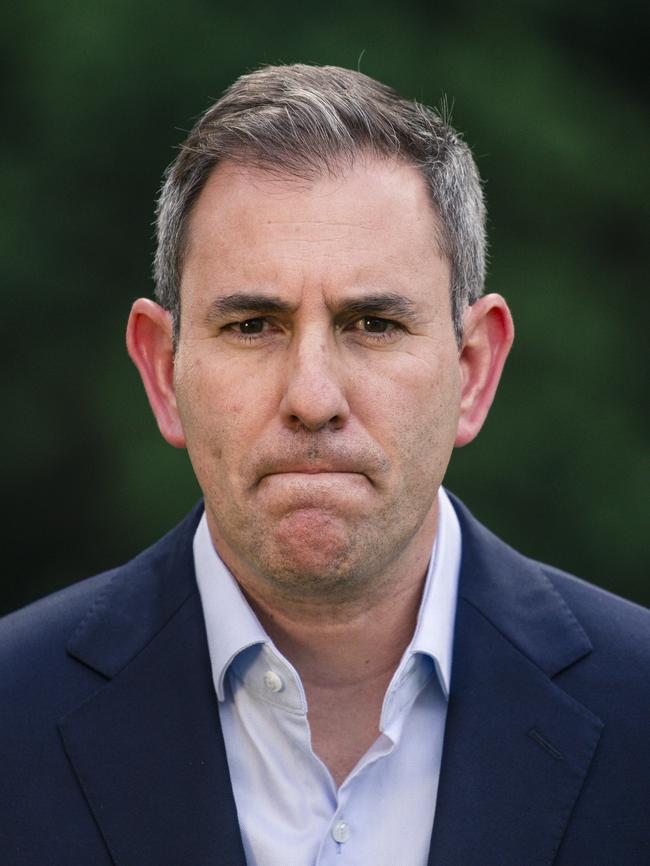

Federal Treasurer Jim Chalmers welcomed Wednesday’s figures, saying headline and underlying inflation went down “substantially”.

“These are very welcome, very encouraging and heartening numbers,” he said.

“They show our policies are helping in the fight against inflation, but we’re not complacent because we know people are still under pressure.

“It’s now less than half the (headline CPI of) 6.1 per cent we inherited and less than a third of its peak.”

Shadow treasurer Angus Taylor said “trimmed mean is still well ahead or above the target range”.

“Services inflation is still running at three times good inflation. Services inflation is proving to be sticky and causing great pain for Australian households right now,” he said.

The shadow treasurer reiterated that Australia has recorded six consecutive quarters of negative GDP per capita.

“Our core inflation is higher than every other advanced country, peer country, in the world other than the UK and that is not one I would be wanting to compare myself with just now,” he said.

At the end of October a more comprehensive quarterly inflation figure will be released before the RBA’s next board meeting on Melbourne Cup day on November 5.

The Reserve Bank places more weight in trimmed inflation, which removes outlying and volatile price measures.

Housing up, energy bills down in August

Trimmed inflation also ticked down in August, in annual terms, from 3.8 per cent to 3.4 per cent.

The latest ABS data shows that in annual terms the biggest price rises were in housing (up 2.6 per cent), food and non-alcoholic drinks (3.4 per cent), and alcohol and tobacco (6.6 per cent).

Alcohol itself went up 3 per cent, while tobacco rose 13.4 per cent.

Transport costs fell 1.1 per cent.

Petrol and diesel also fell 7.6 per cent, as part of those overall transport cost reductions.

Electricity costs also fell dramatically, as government subsidies washed through the economy. On the whole, electricity fell 17.9 per cent. This is because of rebates from the federal, Queensland, Western Australian and Tasmanian governments. Services inflation is running at three times goods inflation.

Plenty of key household items are still keeping inflation elevated.

The price of fruit and vegetables spiked hard in August, lifting to a 9.6 per cent rise on this time last year. That eclipses the previous monthly markers of 3.6 and then 7.5 per cent rises.

Rents ticked down slightly, easing from 7.1 per cent, to 6.9 per cent, and now 6.8 per cent in August.

New dwelling purchases by owner-occupiers rose 0.1 per cent to 5.1. Insurance similarly ticked down, from 6.4 to 6.2 per cent.

Looking at grocery prices on a month-to-month basis, bread, cheese, fruit, and snacks and confectionery have come down.

From July to August, the cost of breakfast cereals, lamb and goat, vegetables, eggs, jams, honey and spreads, and wine, have gone up the most.

Originally published as Monthly inflation ticks down to 2.7 per cent, within rate cut range