2024 Year in Review property report reveals strong commercial property sale results

A new property report has revealed strong demand for vacant land and rising prices for Townsville’s industrial and commercial properties. See what’s driving up prices.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

Despite its supply constraints, Townsville is experiencing significant price growth and robust demand for commercial properties and vacant land, according to a new report.

Compiled on behalf of Colliers Townsville by Townsville economist Callum Kippin, Townsville Market Snapshot 2024 Year in Review report paints an optimistic picture of how the local property market has been tracking.

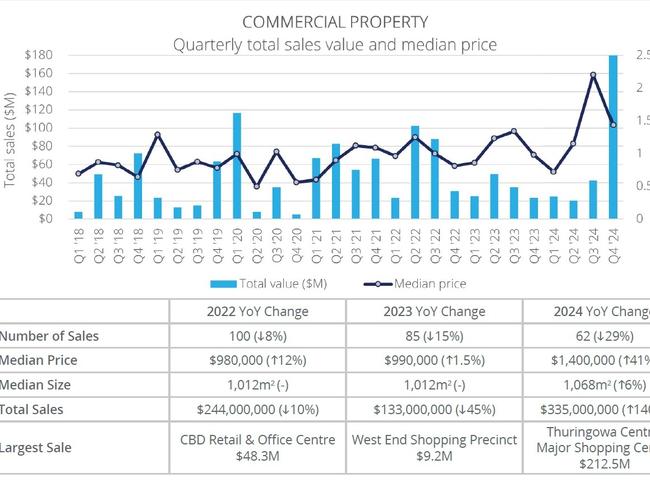

The city’s ongoing supply shortage continues to act like a hand brake on buyer opportunities, leading to a drop in the non-industrial property transactions and an upward trend on prices.

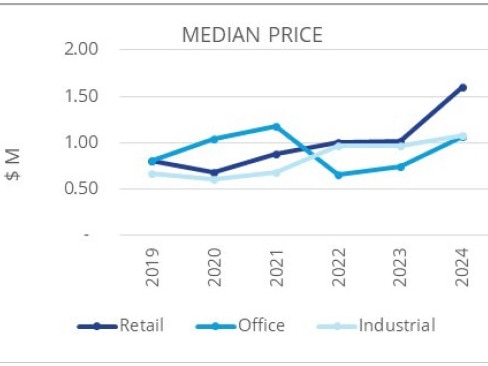

Retail and office properties have led the charge, recording the city’s highest price growth, in a strong recovery following the disruption created by the pandemic.

Faced with a challenging operating environment driven by increases to the cost of living and elevated interest rates, the retail sector has struggled, recording half the number of transactions compared to 2023.

However, the retail median price still rose more than 50 per cent to $1.6 million, propelled upwards by the $212 million sale Willows Shopping Centre, in Queensland’s most expensive retail sale for the year.

The hospitality sector also recorded its best result in six years, with four restaurant sales contributing to a total of $8 million, led by a $5.25 million transaction on The Strand.

Office property transactions were more consistent in 2024 with the median price rising 42 per cent to $1.06 million – the first time prices had exceeded $1 million since 2021.

In the CBD, there were fewer sales yet a 38 per cent rise in sale prices to $1.24 million.

After one service station sale in 2023, sales surged in 2024 with six transactions totalling $27 million – the best result in recent history.

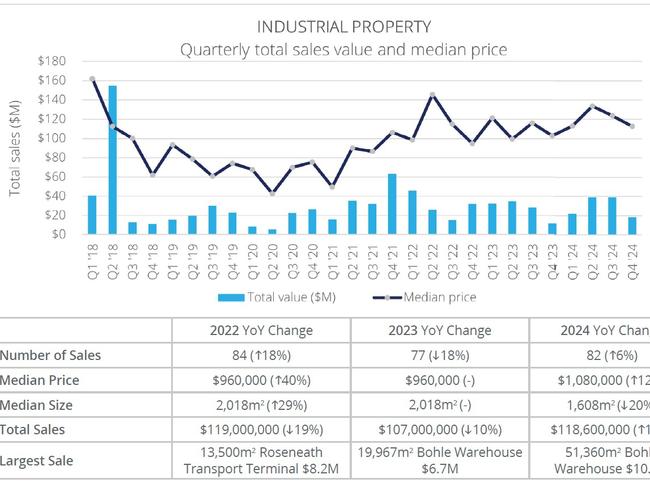

Meanwhile, there was a more modest price rise for industrial properties, with a 12 cent increase to reach a median price of $1.08 million.

Leasing activity continues to be patchy, but high quality office space performed well thanks to corporate interest in large tenancies, while smaller sized tenancies (100-200sqm) were also in demand.

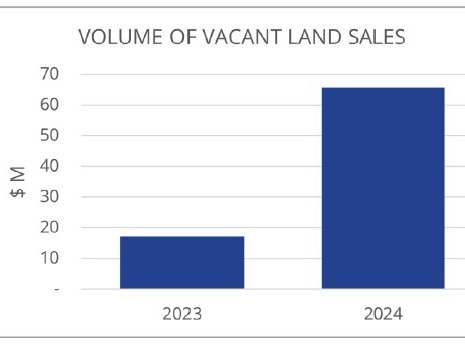

The report also noted a sharp rise in land sales, suggesting that the appetite for new property construction might be returning – relieving pressure on supply constraints.

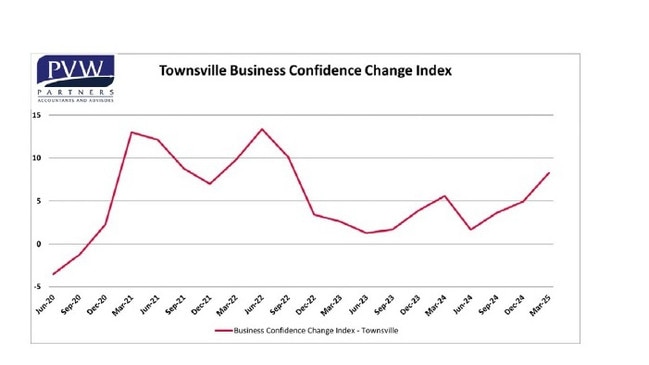

With potential interest rate cuts on the horizon, improving business confidence, and a positive outlook for the regional economy, Colliers Townsville Managing Director Peter Wheeler was optimistic that the market had further room to grow.

“North Queensland continues to attract the attention of both owner-occupiers and national investors. There’s not a lot of stock available, but the significant sales across the year demonstrates the interest that exists when properties become available,” Mr Wheeler said.

“For the last few years, construction costs have been too high for buyers to consider new builds (but) the market for existing properties is so tight now that more businesses are deciding they just have to bite the bullet if they want to expand.

“It’s an uncertain time for the global economy, but there is still a lot of commercial activity planned for North Queensland. With the new Queensland Government committed to rolling out Copperstring and potential for further interest rate rises, we’re optimistic about what the future holds for local property.”

More Coverage

Originally published as 2024 Year in Review property report reveals strong commercial property sale results