Zip, Sezzle unveil merger amid increasing competition

The latest merger in the fiercely competitive buy now, pay later space has been signed as Zip and Sezzle search for profits.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The burgeoning buy now, pay later landscape will soon be a little slimmer after Zip Co signed a takeover of US-based rival Sezzle, signalling the future of the two in North America.

The deal – valuing Sezzle at $491m – marks a key moment of consolidation in the sector after a land grab by BNPL operators crashed into the rising tide of inflation and interest rates.

Both Zip and Sezzle have been sold off by investors in recent months, so rapidly it almost scuttled talks between the two.

The all-scrip agreement will see 222 million new Zip shares issued in a deal first flagged by The Australia’s DataRoom column.

Zip will also undertake a fully underwritten placement in a bid to raise up to $198.7m. The money is set to bankroll Zip as it lines up for the integration, before it expects cost cutting to turn the loss maker into a profit spinner.

Zip co-founder Larry Diamond said conversations between Zip and Sezzle kicked off in August when “share prices were at very different stages”. Since then the market has turned on Zip, selling it down 67.9 per cent from its September start from $4.26 to just $2.21 on Monday.

“The unique thing about it being a script for script deal means we could both have retained the ownership of the business,” Mr Diamond said. “We’ve been watching the market with great concern over the past weeks and months and hoping we wouldn‘t have to walk away from this.”

Mr Diamond said the concern was whether the two businesses would be sufficiently capitalised to last through to 2024, when growth and synergies from the deal are expected to kick in.

Ord Minnett equities analyst Phillip Chippindale said the Zip-Sezzle deal was a “natural transaction” given both companies were focused on the same market.

“The price of a 22 per cent premium for Sezzle shares does not appear to be overpaying, … this lifts Zip to the 8.8m customer level in the North American market which puts them at ~4th place,” Mr Chippindale wrote in a note to clients. “The capital raising is also timely, and will assist bedding down the transaction and strengthening their overall capital position.”

The deal comes less than two months after Latitude Financial said it would purchase the credit card and BNPL business owned by Humm to create an operation with around 5 million customers.

Latitude in January made a $330m bid for Humm’s consumer business. Humm was previously known as FlexiGroup.

It also comes amid the integration of Afterpay into the platforms operated by US giant Block, where shares surged almost 33 per cent to $154.20 on Friday after an investor briefing from chief executive Jack Dorsey.

“We intend to integrate buy now, pay later more deeply in our ecosystem over time and believe Afterpay will accelerate the connections between our Square and Cash App ecosystems,” he said.

Block shares rose another 1 per cent on Monday to close at $155.30.

As part of its US plans, Zip will lodge American Depositary Receipts, opening the way to local investors and Sezzle’s former US holders to trade in the company’s shares. Under a long term plan, the Sezzle brand will join the Zip operation, in a similar manner as US acquisition Quadpay.

Sezzle chief executive Charlie Youakim will become the company’s Americas president, covering the US, Canada, and Mexico.

The deal is expected cost $60m over two years, but forecast to bring in between $60m and $80m in synergies from cutting headcount and employee costs and bringing the operations under one platform. Another $40m to $50m is expected to be delivered in revenue and net transaction margin synergies as Zip gains access to Sezzle’s large customer base and merchant deals.

Zip also flagged it would review its capital allocation to the 13 markets it operates in, with the company moving to write down its UK operations by $44.7m, fulling impairing goodwill attributed to the Zip brand in the country.

Mr Diamond said Zip failed to “to deliver more product” to make its UK plans successful.

Zip ploughed millions into the UK, targeting 10m customers within three years of its launch in 2020. However, Zip currently only boasts 1.2m customers across Europe and the Middle East.

The tie-up comes as Zip reported its results for the six months to December 31, with the rising toll of chasing new business mounting on the balance sheet.

Zip reported an 89 per cent jump in revenue to $302.2m for the six months to December 31 following its acquisition of Spotii and Twisto. Consumer numbers were up 74 per cent to 9.9 million. Transaction volumes across the platform surged 92 per cent to $4.44bn from $2.32bn a year.

Asia Pacific remained Zip’s strongest market, but the company’s American operations soared with total transaction volumes reaching $2.12bn.

Operating income across the business was up nearly 89 per cent to $301.3m. However, Zip booked an interim loss of $172.8m, down from $455.9m a year earlier. Cost of sales more than doubled to $242.2m from $82.8m.

Zip has been making inroads into American markets in recent months, but the cost of chasing new customers has seen a two per cent lift in bad debts.

Bad debts and expected credit losses surged across the business, topping $148.3m over the six months to December from $29.5m a year earlier. The takeover deal, subject to shareholder and regulatory approval, must be wrapped up by November 28.

Zip’s latest results, in February, were below market expectations given higher costs and bad debts.

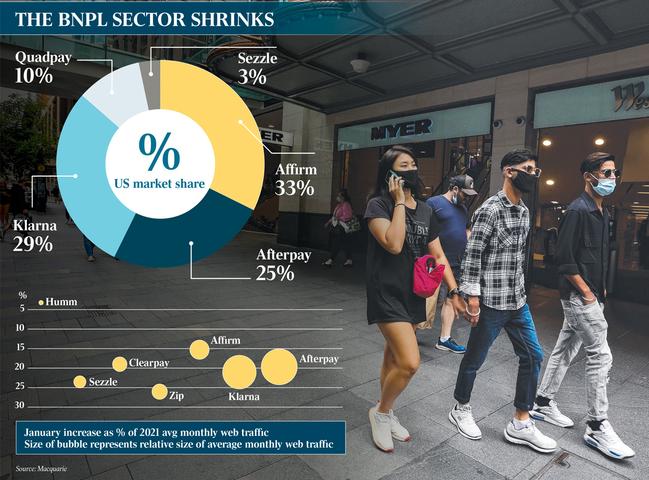

The most recent analysis of the BNPL sector by Macquarie analysts found there was a sector downturn across the board, with traffic to major providers down 15.4 per cent.

“We maintain our view that larger players are solidifying their position in the BNPL space and consider them to be beneficiaries in a volatile market, Afterpay being one of them,” they told clients in a note on February 10.

“That said, with tightening global regulation we see BNPL more as a complimentary customer acquisition tool rather than a revenue generator going forward,” they wrote, adding consumer spending would recover as Covid-19 restrictions eased.

Originally published as Zip, Sezzle unveil merger amid increasing competition