Wittner’s $3m tax debt revealed as administrators cobble together a sale

The multi million-dollar tax debt of century-old shoe brand Wittner has been revealed, with the deadline looming for final offers from prospective buyers of the now collapsed company.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The multi million-dollar tax debt of century-old shoe brand Wittner has been revealed, as the administrators of the now collapsed company urgently try to lock in a buyer.

Deloitte insolvency experts David Orr and Sal Algeri, who were appointed administrators last month when the iconic footwear retailer went bust, told creditors that final offers from interested buyers were due later this month.

The Melbourne-based company, which specialises in fashion-forward, high-quality shoes and accessories for women, has a workforce of over 250 employees operating across Australia and New Zealand.

The well known brand’s mountain of tax debt – totalling over $3m – has been exposed in new documents lodged with the corporate regulator.

Other creditors listed included builder Southern Cross Shopfitting Operations ($65,206), marketing agency Chain Social ($13,200), eCommerce consultant Jcommerce ($3,300), supply chain consulting firm tgroup.co ($8,076) and companies Silverleaf Investments ($26,360) and Flow Software Au Trading ($7,162).

Another creditor, the name redacted due to “commercial sensitivity” was also listed as being owed $318,227.

Other companies owed money included eCommerce agency Matter Design & Digital, Monash University Foundation, property group GPT Property Management and builder Twenty Three Projects.

Deloitte partner Daniel Demir told creditors that the administrators had published advertisements in The Australian and Australian Financial Review in an attempt to attract buyers, and had contacted potential parties that would have an interest in acquiring the business.

“He advised that the administrators had received an encouraging level of interest generated from the sale campaign,” the minutes from the first creditor meeting lodged with the Australian Securities and Investments Commission read.

Mr Demir said several parties had signed confidentiality agreements allowing the administrators to share marketing materials with prospective purchasers.

Initial offers were due on the 1st of this month, with interest parties to be short-listed and final offers submitted in “mid-to-late” May.

Mr Orr told creditors that he hoped a prospective buyer would acquire all Wittner stores.

The company has over 20 branded stores in Australia and New Zealand, over 25 concession stores across David Jones and Myer, and a multi-store e-commerce platform that trades across its own branded website, Myer, David Jones, and The Iconic.

“It was further noted that the acquisition of only a limited number of stores would not be viewed favourably, and the appointees would be encouraging purchasers to consider a whole-of-business acquisition approach,” the minutes read.

Mr Orr said the business would continue to operate as usual to preserve the brand and asset value and maximise the opportunity for employees to retain employment through sale and/or recapitalisation.

Administrators have been appointed to three businesses that trade under the Wittner brand – Wittner Group Holdings, Wittner Retail Australia and Wittner Retail New Zealand.

Wittner Retail Australia is the primary trading entity, employing all Australian staff, contracting with suppliers and creditors, holding leases and carrying out the majority of the business’s operations.

Wittner Retail New Zealand controls all New Zealand operations, while Wittner Group Holdings is a holding company with no trading activities or operational functions.

A statement from Wittner management at the time of its collapse said while the company had achieved strong growth over the last twelve months, margins were eroded by cost pressures from rising wages and occupancy costs, and challenging trading conditions and supply-chain disruptions.

It’s understood Wittner – which has its head office in Cremorne in inner-city Melbourne – previously put itself up for sale in mid July 2023, amid a flurry of businesses hitting the market.

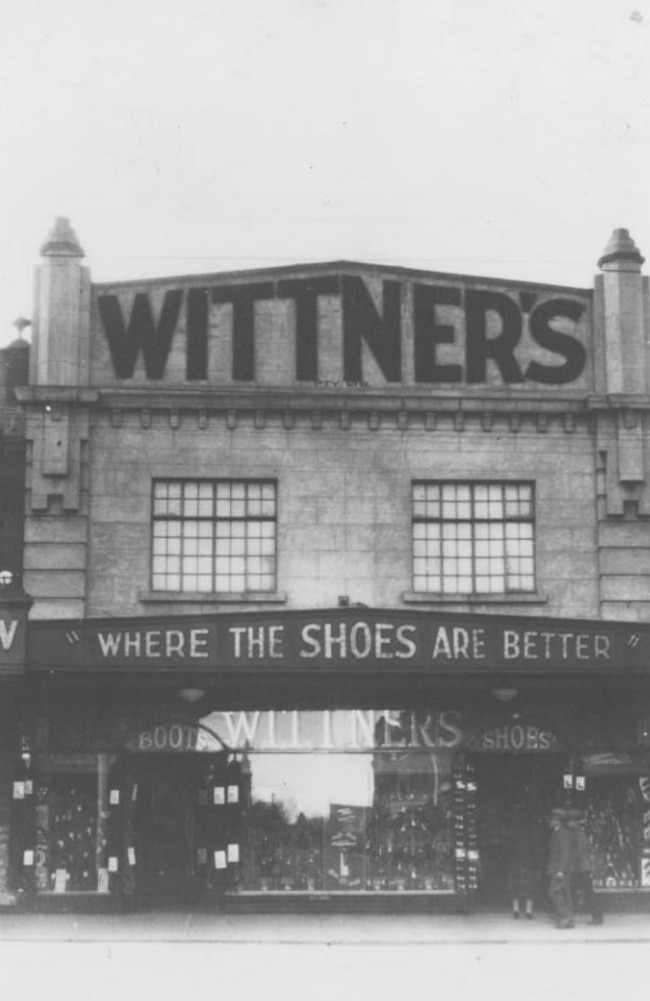

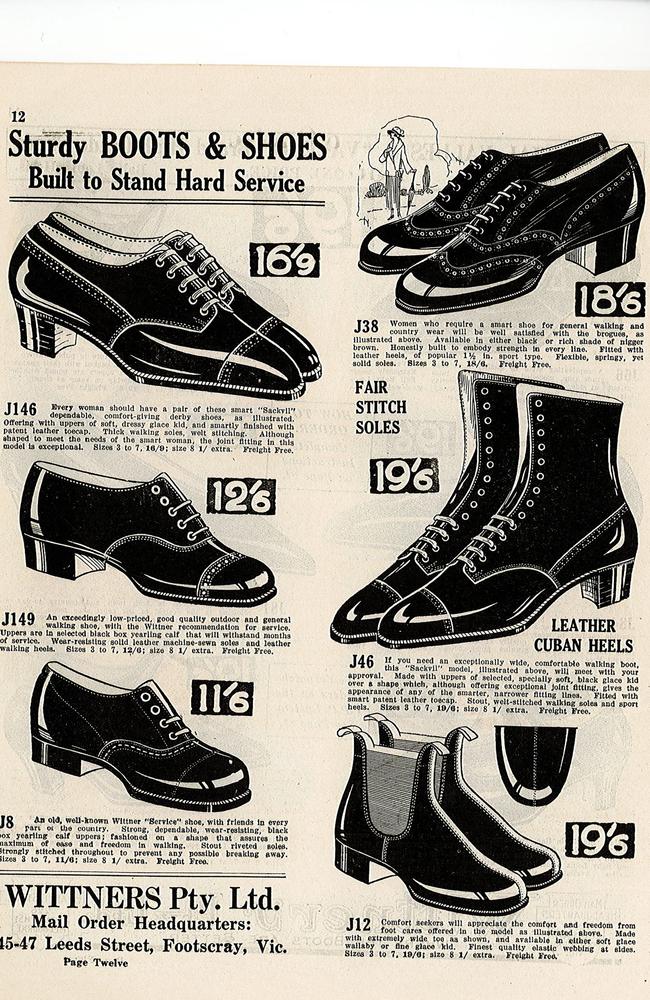

The company was established in 1912 by HJ Wittner.

He initially opened a store in Footscray, Victoria, and soon launched the first mail-order footwear business in the country.

The Wittner family has mostly been sold out of the business. It is now owned by British special situations investor Hilco Capital.

The collapse follows fashion retailer Jeanswest calling in the administrators in March – its second collapse in five years.

Nearly 90 Jeanswest stores will close in coming weeks, resulting in the loss of jobs for 600 retail staff.

Originally published as Wittner’s $3m tax debt revealed as administrators cobble together a sale