The electricity price bubble is slowly bursting

Global forces are still playing a bigger role in Australia’s east coast power market than the rise of green energy.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

There are promising early signs that Australian electricity prices could be in for a period of relief after surging to painful highs – eventually.

It’s likely to be of little comfort as households start to receive the first of their winter bills and will feel the financial sting of two extraordinary years of national electricity pricing.

And in the slow-moving drama of Australia’s energy market, lower average prices on wholesale markets today won’t be felt for another year or two.

Regardless of the noise of the influence of green energy, or claims of political intervention, Australia’s power market is heavily impacted by global forces.

And the prices of the two biggest inputs into generation – coal and gas – have surged through the Covid-19 years. The bubble for both has now deflated, with the two commodities trading closer – the emphasis on closer – to recent longer-term averages.

And Australia’s east coast has this year avoided the dramatic winter pricing shock from last year, when a gas crisis and outages at some power plants caused a temporary shutdown of the nation’s traded electricity market and a dramatic action by regulators.

Origin Energy, one of the nation’s biggest electricity generators, on Monday highlighted both electricity and gas spot prices “reduced materially” during the three months to end June, compared to the same quarter last year.

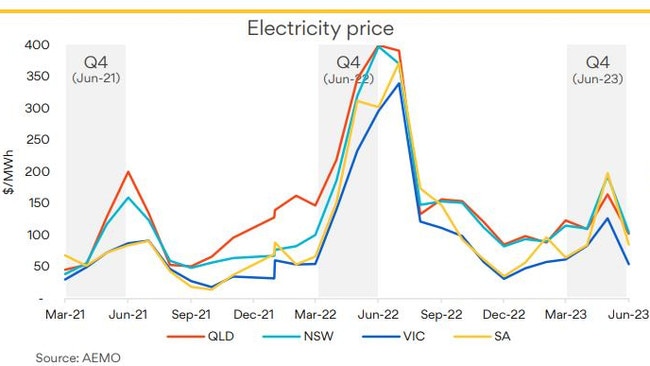

The average national spot electricity price is down 57 per cent to $118/MWh, while average domestic spot gas prices have halved to $14/GJ. In ordinary markets that’s the sound of a bubble bursting.

Winter demand means power prices are still elevated, but Origin said in its quarterly update spot prices have softened recently back to the pre-winter levels of April. This means the tail of high winter prices is so far showing it is unlikely to be as long as recent years.

Victoria, which is more reliant on brown coal to fuel its generators, is leading the way on lower prices, while NSW is inching towards pre-winter pricing.

Reliability of coal generation is an important factor in keeping prices down because outages usually see more expensive gas peaking plants turned on for longer.

Origin pointed to continued increase in solar uptake as trimming demand through winter, but there is still a long way to go before it really moves the dial. At the same time warmer weather, particularly in NSW and Queensland, has eased pressure on demand.

The comments from Origin are consistent with the Australian Energy Market Operator June quarter review, which too noted heavy falls in spot prices in the June quarter.

High average spot prices through May of $154/MWh fell to half of that level in the month of June and have stayed below $100/MWh.

Remember, electricity prices are closely watched by policymakers such as the Reserve Bank, given they are a key input into the tracking of inflation.

Global forces

As always, it’s the invisible force of international markets that really count. And quarterly updates from US energy giants ExxonMobil and Chevron in recent days have highlighted the extent of the pullback in commodity prices, with Europe now having time to adjust to a long war between Russia and Ukraine.

ExxonMobil executives told investors the pullback over the past 12 months has been dramatic, with oil and gas now trading at the top half of a 10-year range. In the northern hemisphere, natural gas was experiencing higher supply, reduced demand and milder weather, all pushing prices lower, ExxonMobil chief executive Darren Woods said.

Chevron, which operates one of the world’s biggest LNG projects, the Gorgon field in Australia’s North West Shelf, has forecast crude oil prices between $US85 a barrel for the next five years as a bull case and averaging $US50 a barrel as a bear case.

“The upside case is a case that’s not too different from what we’re seeing now,” Chevron’s vice-president Pierre Breber said. LNG is generally sold under long-term contracts, and prices are typically linked to oil price. The US benchmark WTI crude last traded at $US80.27 a barrel.

Globally traded black coal for power stations is trading at $US130 a tonne ex-Newcastle, levels last seen in May 2021 before prices really started surging. It was in the September quarter last year that coal had spiked to unseen levels of more than $US430 a tonne.

As always the big uncertainty for Australia’s power market is the medium-term performance of its creaky east coast grid that is slowly being retrofitted for a flood of renewable energy.

The costs to business and households in doing this are taken upfront, and there is a real risk of another supply squeeze as ageing coal-fired plants are pulled out of commission before a full green energy solution is found.

RBA doves

Brian Redican, the chief economist of NSW’s funding arm TCorp, is among those in the evenly split camp expecting the Reserve Bank will sit on its hands at Tuesday’s board meeting and keep the cash rate on hold for the second consecutive month.

Redican, a former head of research at Macquarie Group and a one-time RBA staffer, said last week’s cooler inflation number has given the central bank some breathing space on interest rates.

“No doubt inflation was still higher than the RBA would be comfortable with. So if they were in a mind to keep on pressing the brakes and keep on raising rates, they could still go ahead and do it,” Redican tells The Australian.

“But what we’ve seen in the last few months is their commentary that they can see inflation getting back to RBA’s target band in 2025 and they’re prepared to wait that long, but not any longer,” he says.

Underlying inflation is running at an annual rate of 5.9 per cent, according to June quarter figures released by the ABS. This is down from 6.6 per cent in the March quarter and a peak in the December 2022 quarter of 6.9 per cent.

Last week’s numbers surprised on the downside, Redican says.

“That just means they can afford to keep sitting and watching rather than just deliver the next rate hike.”

The cycle might not be over just yet, particularly if the jobs market remains hot and spending picks up again. That would give the central bank enough ammunition to return with more hikes if it thought it was necessary.

Redican points out in the arena of global interest rate markets, they are firmly behind the RBA. Current interest rates futures are pricing less than 10 per cent chance of an interest rate hike at Tuesday’s meeting and starting to factor in rate cuts from November next year.

“The market does seem really confident that the RBA is going to win this fight quite decisively, get inflation back to two and a half per cent. It’s going to take sort of another 18 months or so. But it will get back there and then it will keep it there for the rest of the decade,” Redican says.

He is tipping “resilient” earnings numbers in the upcoming August reporting season. Retailers are starting to feel higher cash rates more acutely, although the impact will be felt more broadly by corporate Australia in the September and December quarters.

“Australia still has this opportunity to avoid a recession. And that’s partly because the wages growth has been slower to leap up as we’ve seen in the US or the UK. But more importantly, it has been the overseas migration story and the speed with which that has returned.

“That means there’s going to be a lot more people in Australia spending money and I think that provides another cushion to ensure that the overall economy doesn’t shrink.”

johnstone@theaustralian.com.au

More Coverage

Originally published as The electricity price bubble is slowly bursting