Who topped ASX resources stocks for September? Hint: GOLDIES

Gold stocks ripped up the ASX small caps scene for September as bullion kept punching through all-time highs.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

As bullion kept punching through all-time highs…

… gold stocks ripped up the ASX small caps scene for September

Also catching the eye: a Chinese coal deal, Spanish rutile purchase and antimony hunters

It was the yellow metal's time to shine, and that's exactly what explorer Mithril Silver and Gold (ASX:MTH) did, taking first place among September's ASX ressie performers through an insane 363% gain. This came on the back of an impressive exploration run at its Copalquin gold and silver project in Mexico.

Interest in the junior really started to kick off on August 19 when it struck up to 5.16g/t gold and 78g/t silver over 17.95m from its first six drill holes at the El Refugio area of the tenure.

Ongoing exploration drilling is looking at expanding Copalquin's current 2.41Mt at 4.8g/t gold, 141g/t silver for 373,000oz gold plus 10.9Moz silver (total 529,000oz gold equivalent) endowment, with an aim to double the resource by Q1 2025.

The Copalquin mining district is home to five of the world’s 10 largest silver mines and supplies 25% of the world’s silver. MTH has also just commenced trading on Canada's TSX Venture Exchange (TSX-V) to expand investor reach.

Hot on the goldies' heels in second spot was Osmond Resources (ASX:OSM), rising 294% after announcing the acquisition of an 80% stake in Iberian Critical Minerals and its Orion EU project in Spain, where it's sampled some seriously high grades of rutile, zircon and REEs.

The junior raised $700k during the month and has now been backed by renowned resources entrepreneur Tolga Kumova as an investor and strategic advisor.

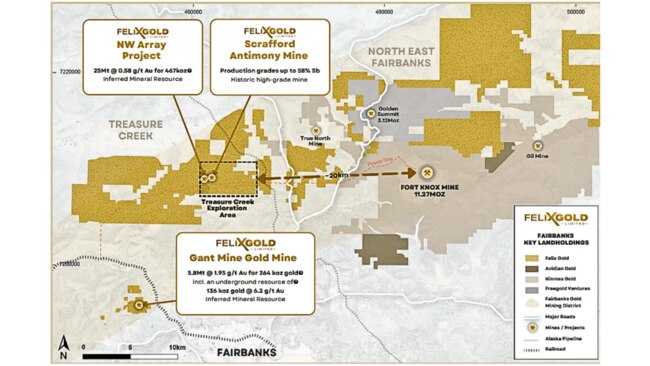

Also high on our September ressie winners list, with a 130% monthly gain, was Felix Gold (ASX:FXG), which has been exploring its historical Treasure Creek landholding in Alaska’s prolific Fairbanks gold district.

Historical gold production in the region exceeds some 16Moz, with FXG's leases sandwiched between Kinross’ 11.8Moz Fort Knox mine and Freegold Ventures’ 19.7Moz Golden Summit project (18km away).

From March into April, FXG shares had risen from 3c to 8c when the company revealed the NW Array target within Treasure Creek was an open-at-surface, oxide and flat-lying 2km by 600m gold system – with the ability to be fast-tracked into production due to its proximity to the mill at Fort Knox.

By June, Felix had proved up a global resource of 831,000oz gold at its Fairbanks assets (with the addition of NW Array) and despite a drop in share price, there was forward momentum towards the development of the gold assets.

Focus remained on adding ounces during July, with augur sampling commencing to build upon the resource near Kinross’ Fort Knox.

Then, in August, China put export restrictions on antimony, a commodity commonly found within certain types of gold mineralisation that’s heavily used in military tech, battery technologies, semiconductors and to strengthen alloys.

That’s when shares in FXG started to go gangbusters, as within the junior’s Treasure Creek tenure lies the historical Scrafford antimony mine – which, back in the day, saw some of the highest grades of antimony ever produced – between 38-56% Sb.

FXG immediately diverted its attention and showcased Scrafford’s potential – and the market reacted in step, with investors pouring in to rocket the stock price up last month.

During the month the junior implemented a fast-tracked antimony strategy – recently raising an additional $4.8m to recommence mining at Scrafford by next year and churn out the critical mineral at a run rate of 5000tpa.

It’s now being seen as more than just a side hustle for gold miners, as demand for ex-China sources has hiked prices up to around the US$25,000/t mark.

Meanwhile the month's third-highest gainer was MC Mining (ASX:MCM) (+292%) which almost tripled last month on a US$90m Chinese buyout of the company which sees Kinetic Development Group take a 51% via a two tranche subscription agreement which will back the development of its Makhado steelmaking coal project.

And Trigg Minerals (ASX:TMG) was another head turner with a 167% rise on the back of picking up a string of antimony mines that include some of the highest grades ever recorded in Australia, including its 100%-owned Taylors Arm project which has Australia's highest ever antimony grade of 63%.

The latest acquisition, its Achilles project, includes a huge 14.24% Sb grade at the project's Wild Cattle Creek deposit – the second largest antimony deposit in NSW behind Larvotto Resources' (ASX:LRV) nearby Hillgrove.

| Code | Description | Last | %Mth | MktCap |

|---|---|---|---|---|

| MTH | Mithril Silver Gold | 0.625 | 363% | $62,361,114 |

| OSM | Osmond Resources | 0.28 | 294% | $22,742,439 |

| MCM | Mc Mining Ltd | 0.145 | 292% | $76,178,456 |

| TMG | Trigg Minerals Ltd | 0.032 | 167% | $15,920,421 |

| ESR | Estrella Resources | 0.01 | 150% | $25,447,873 |

| FXG | Felix Gold Limited | 0.115 | 130% | $31,758,700 |

| OCT | Octava Minerals | 0.096 | 113% | $4,644,777 |

| AZY | Antipa Minerals Ltd | 0.024 | 100% | $119,217,486 |

| MGA | Metals Grove Mining | 0.098 | 100% | $10,331,160 |

| BPM | BPM Minerals | 0.105 | 91% | $7,047,832 |

| EMP | Emperor Energy Ltd | 0.017 | 89% | $7,404,580 |

| MHK | Metalhawk | 0.17 | 87% | $17,113,900 |

| AGD | Austral Gold | 0.028 | 87% | $17,757,029 |

| PLG | Pearl Gull Iron | 0.02 | 82% | $3,681,752 |

| HYT | Hyterra Ltd | 0.054 | 74% | $47,519,887 |

| E25 | Element 25 Ltd | 0.335 | 72% | $72,571,092 |

| AZ9 | Asian Battery Metals PLC | 0.029 | 71% | $9,368,664 |

| SMS | Star Minerals | 0.056 | 70% | $4,736,140 |

| C1X | Cosmos Exploration | 0.055 | 67% | $4,241,251 |

| INR | Ioneer Ltd | 0.23 | 64% | $537,608,050 |

| MAY | Melbana Energy Ltd | 0.039 | 63% | $111,216,735 |

| SNX | Sierra Nevada Gold | 0.071 | 61% | $8,607,644 |

| LRL | Labyrinth Resources | 0.017 | 61% | $62,614,033 |

| CR9 | Corellares | 0.008 | 60% | $3,255,647 |

| CTN | Catalina Resources | 0.004 | 60% | $4,953,948 |

| ODE | Odessa Minerals Ltd | 0.004 | 60% | $2,086,565 |

| SAN | Sagalio Energy Ltd | 0.008 | 60% | $1,637,281 |

| CVR | Cavalier Resources | 0.15 | 59% | $6,507,250 |

| IMI | Infinity Mining | 0.035 | 59% | $3,122,115 |

| AQI | Alicanto Minerals Ltd | 0.027 | 59% | $20,199,860 |

| TRE | Toubani Resources Ltd | 0.3 | 58% | $66,542,344 |

| RDN | Raiden Resources Ltd | 0.044 | 57% | $128,264,636 |

| PNN | Power Minerals Ltd | 0.125 | 56% | $15,965,231 |

| TAT | Tartana Minerals Ltd | 0.039 | 56% | $6,392,606 |

| OMA | Omega Oil & Gas Ltd | 0.335 | 56% | $93,095,261 |

| MOH | Moho Resources | 0.007 | 56% | $3,774,247 |

| SRR | Sarama Resources Ltd | 0.034 | 55% | $5,838,776 |

| WIN | WIN Metals | 0.046 | 53% | $14,517,343 |

| AGR | Aguia Resources Ltd | 0.041 | 52% | $51,592,167 |

| QML | Qmines Limited | 0.1 | 52% | $31,367,124 |

| STN | Saturn Metals | 0.28 | 51% | $98,843,163 |

| DMG | Dragon Mountain Gold | 0.006 | 50% | $2,368,030 |

| LPD | Lepidico Ltd | 0.003 | 50% | $25,767,375 |

| MXR | Maximus Resources | 0.045 | 50% | $17,117,108 |

| NAE | New Age Exploration | 0.006 | 50% | $10,763,393 |

| PRM | Prominence Energy | 0.006 | 50% | $1,945,882 |

| TMX | Terrain Minerals | 0.0045 | 50% | $7,200,115 |

| VML | Vital Metals Limited | 0.003 | 50% | $11,790,134 |

| AL8 | Alderan Resource Ltd | 0.004 | 50% | $3,818,584 |

| KFM | Kingfisher Mining | 0.086 | 48% | $4,297,200 |

Other small cap standouts

Paterson Province explorer Antipa Minerals (ASX:AZY) made a 100% gain through September as it took advantage of its widespread landholding and JV's in WA's gold-laden Paterson Province, which is currently subject to a flurry of M&A since Newmont divested its Telfer and Havieron projects stakes.

During September, AZY agreed to sell its 32% non-controlling interest in the 2.84Moz Citadel gold project in Paterson to JV partner Rio Tinto (ASX:RIO) for $17m, cashing up the junior to accelerate exploration at its nearby Minyari Dome gold project.

Octava Minerals (ASX:OCT) dined out on finding historical high-grade antimony hits of up to 13.6% Sb at the Discovery project in WA with and climbed 113% for the month, while fifth-placed Estrella Resources (ASX:ESR) pivoted from lithium to finalise an acquisition of a highly prospective manganese project in Timor-Leste and rose 150%.

At Stockhead, we tell it like it is. While Felix Gold, Mithril Silver and Gold and are Stockhead clients at the time of writing, they did not sponsor this article.

Originally published as Who topped ASX resources stocks for September? Hint: GOLDIES