Tick, Tick … Boom!: Why Lion Selection Group’s Hedley Widdup thinks mining’s latest bust is almost over

Rising institutional interest in developers, a surge in gold and cash takeovers show the mining cycle may be ticking back towards a boom.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

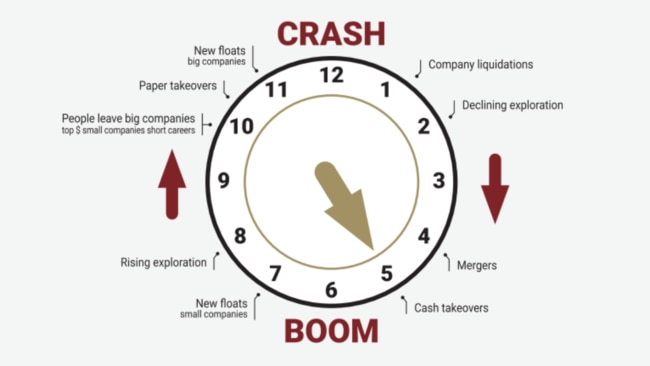

Lion Selection Group has moved its Mining Clock to 5 O'Clock, suggests the next resources boom could be within sight

Cash takeovers could be harbinger of new cycle and surge in liquidity across the sector

Institutions starting to pile into gold developers like Medallion Metals

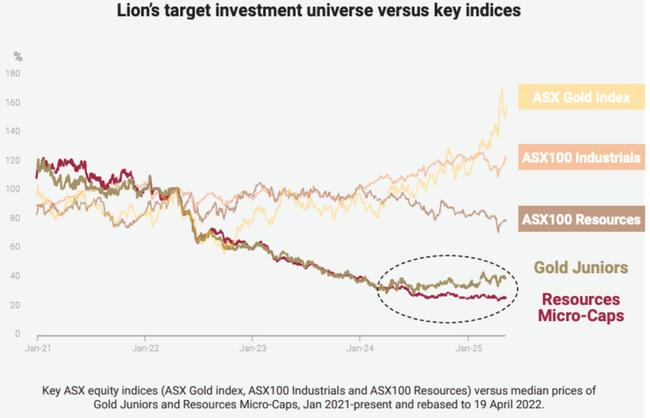

Mining stocks have never looked too undervalued, with capital flowing to the US tech giants who dominate the media landscape and a host of commodities well off their post-Covid highs.

For the past four years we've seen majors like BHP (ASX:BHP), Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG) trade downwards as prices of iron ore, lithium, oil, coal, gas, nickel and more have tumbled from record levels.

But there's light at the end of the tunnel for resources investors says Lion Selection Group's (ASX:LSX) Hedley Widdup.

His listed fund uses its patent Mining Clock to guide its capital management decisions, deploying millions into junior gold stocks in recent years in a counter-cyclical ploy to catch tailwinds before they fully emerge.

In its simplest terms the Lion Mining Clock has two poles. When the clock strikes midnight silly season has come and gone, IPOs have gone wild, capital flows freely and majors are overpaying in pro-cyclical M&A that only makes sense if the good times roll on forever.

At 6 O'Clock, by contrast, valuations have been pounded into the dirt, majors have tightened the belt and all the money that can the leave the sector has exited stage left – the next boom beckons.

Lion this week updated its time to 5 O'Clock, a period often signified by early moves into gold (prices of the yellow metal are an eye-watering US$3300/oz), cash takeovers as sold off juniors are swallowed into growth hungry blue chips and rising secular interest in the undervalued mining sector.

"We've watched as the bust unfolded from 2021 and 2022 onwards. And as that's happened, we've seen money move away from the resources sector," Widdup told Stockhead.

"We've seen liquidity diminish, commodities start to weaken and there have been some significant falls in terms of the prices of major miners.

"BHP and Rio on our exchange, not so significant. Fortescue a bit more so. Anglo-American and Glencore in London, far more significant, down about 50% from their highs.

"We've kind of been watching as each of the different things happens where exploration just stops, capital expenditure falls, et cetera. We've gone a long way into that now and I think we've ticked off most of the worst of it."

Symptomatic

One of those key symptoms, cash takeovers, came into full view this week.

On Wednesday, silver miner Adriatic Metals (ASX:ADT) confirmed an approach from Dundee Precious Metals, which Sky News in the UK suggested could value the dual London and ASX listed Bosnian miner at more than £700 million ($1.46bn).

Also on Wednesday US copper developer New World Resources (ASX:NWC) revealed a $185m takeover from London-listed copper and zinc producer Central Asia Metals. And on Monday Xanadu Mines (ASX:XAM) unveiled a takeover deal worth $160m from Singapore's Boroo – owner of the Lagunas Norte gold mine in Peru – and XAM director Ganbayar Lkhagvasuren to procure its Kharmagtai copper project in Mongolia.

All are being covered with cash, as opposed to the scrip heavy deals we saw at the end of the last cycle.

"That liquidity could be starting to tickle up a bit now. Symptomatically, what we weren't forecasting was cash takeovers of companies in the space, but we are seeing that, I would say, a little bit more frequently than what we've seen through the last few years. We've seen some M&A, but we're now starting to see companies pay up with cash," Widdup said.

"At any time you go through this part of the cycle you can talk about what the symptoms might be but it doesn't mean that they'll occur.

"In this case we're fortunate, particularly having moved the clock a couple of days ago that all of a sudden you do see confirmatory symptoms playing out and that's nice.

"We don't know about New World yet, we'll see what's announced, but in the case of Adriatic and Dundee it's the mentality of the bidders which is really what I think is interesting."

Scrip takeovers tend to happen when miners think their equity could be overpriced, giving them leverage over competitors.

Cash takeovers happen when those same miners see brighter days on the horizon – they don't want to dilute their shareholders by offering scrip or running an equity raise because they want to capture the full upside of the acquisition when commodity prices rise.

For small companies, busts can cloud any future earnings outlook as capital becomes harder to find.

"If the future looks bleak to you, a cash takeover I imagine could be quite attractive. So when those circumstances overlap, that's when we see 5 O'Clock," Widdup said.

A key uncertainty is the prospect of recession in the United States and falling growth rates in China, pending the outcome of a market-shaking trade war that has broken out in earnest since the election of President Donald Trump.

Smart money

Gold is often the canary in the coal mine, so to speak, when it comes to seeing the light at the end of the tunnel.

Central banks, trying to diversify their reserve holdings away from the US Dollar and Treasuries, have been behind a dramatic run in gold prices, with net demand eclipsing 1000t for three straight years.

This year retail investment demand, largely from China and latterly from the West, has also seen gold prices scale new heights.

Now at US$3300/oz, or more than $5100/oz Aussie, gold producers are pulling in big bucks.

Widdup said it was hard to see that the BRICS nations (Brazil, China, Egypt, Ethiopia, India, Indonesia, Iran, Russian Federation, South Africa and United Arab Emirates) would be done with gold purchasing if their intention was to reduce their reliance on the USD.

Other non-BRICS nations have also been avid purchasers, with Poland and Czechia in the former Soviet Bloc among the most prolific bullion accumulators.

"If BRICS nations' central banks continue to accumulate gold, I think that probably provides the outlook for, at worst, a really well-supported gold price, and at best multi-years with upside in the price from here," Widdup said.

The slow reversal of the mining bust and rising tide of the gold price has seen big investors shift their eyes from large and mid-tier producers down to WA gold developers who missed the early part of the boom.

Case in point is Medallion Metals (ASX:MM8), which is aiming to reach FID this year on its 1.6Moz gold equivalent Ravensthorpe gold and copper project.

Since raising $6.5m at 10c per share in February, MM8's shares have run 150% higher to 25c, valuing the junior at $120m.

Its plan is to acquire IGO's (ASX:IGO) disused Forrestania nickel concentrator and retool it to produce a gold and copper concentrate, at a capital cost estimated in a scoping study last year of just $73m, producing 336,000oz gold and 13,000t copper over an initial 5.5 year mine life.

Those numbers are likely to improve with a bankable feasibility study underway against the backdrop of a much higher gold price environment.

A $27.5m raising last week was notable not just for the scale of the placement but also the names buying in.

Alongside Lion, which picked up another $2m in the placement, Stockhead understands fellow instos Konwave out of Switzerland, IFM Investors, Franklin Templeton, 1832 Asset Management – an arm of the Bank of Nova Scotia – and Sydney's Paradice Investment Management also picked up stakes.

Widdup said the addition of names like those to the register signified gold developers were no longer outside the risk radar for large institutions, a good signal for a sector rerate.

"I think it speaks to the risk appetite evolution that we've seen for some of those bigger investors," Widdup said.

"My understanding of exactly what those specific groups invest in is not great. Some of them I'd say are reasonably resource bent, some of them it might be a time to time thing.

"There's nothing to say that they need to hold gold companies all the time. So to see them appearing suggests that, for a lot of them, now has become the time where they're prepared to deploy money into that space."

The fact they're looking further down the food chain at a developer speaks volumes for the comfort institutions have moving into the more speculative end of the market.

"Given that we've seen similar institutional groups pop up on the registers of similar companies I'd say that you know, they're broadly feeling pretty comfortable with picking off a couple of developers for the upside that they have," Widdup said.

"I think seeing (MM8) as a near-term producer, which has just become a lot more near term, a lot lower risk in terms of the amount money they needed to raise, has probably appealed to those instos and Medallion's been quite strong since it raised that money."

Is now the time for resources?

So should investors be cycling into resources at the moment.

It depends on circumstances, goals and risk appetite.

It could be months or longer, but Widdup thinks the next stage of the mining cycle is "not too far away".

"If you're investing in small cap resources stocks ... the most significant event in your investing experience is going to be a mining boom," he said.

"There's all sorts of stock-specific catalysts, but the rising tide is what you're really after and we think that that's now not too far away.

"It's not impossible to say when but ... around the corner might be a reasonable expression to use.

"If we start to see continued improvement of liquidity, which is money coming into the space, particularly if it starts to enable IPOs of explorers onto the market, then I think we're at the point where we start feel like we'd be thinking about calling the turning point."

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

At Stockhead, we tell it like it is. While New World Resources and Medallion Metals are Stockhead advertisers, they did not sponsor this article.

Originally published as Tick, Tick … Boom!: Why Lion Selection Group’s Hedley Widdup thinks mining’s latest bust is almost over