Resources Top 5: Many Peaks scales new heights on Côte d’lvoire gold results

Many Peaks Minerals has received broad high-grade results from Ouarigue South prospect of the Ferké gold project in Côte d’lvoire.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Many Peaks has hit a new record on the back of strong gold news from its projects in Côte d’lvoire

Kingston Resources is selling its Misima gold project in PNG to Ok Tedi Mining in a deal worth up to $95m

The potential of EUR’s Tanbreez project has grown with assays from historical drilling revealing high REE concentrations

Your standout resources stocks for Tuesday, May 20, 2025

Many Peaks Minerals (ASX:MPK)

A new record high of 60c has been set by Many Peaks Minerals, a lift of 22.45% on the previous close, on the back of strong news from its gold projects in Côte d’lvoire.

The release of broad high-grade results from Ouarigue South prospect of the Ferké gold project in the country’s north follows Monday’s start of a 3500-metre RC drilling campaign at its Odienné gold project in the northwest.

A second diamond drilling campaign at Ferké extended Ouarigue South mineralisation and produced results of up to 201m at 1.12g/t gold from surface, including 12m at 1.04g/t from surface, 34m at 1.92g/t from 26m and 19m at 3.72g/t from 72m.

The 34m intercept included 3m at 9.05g/t and the 19m intercept included 6m at 10g/t.

Another hole returned 72.21m at 2.11g/t gold from 233.85m, including 30.8m at 3.95g/t from 233.85m, and another produced 78.75m at 1.33g/t from 278.65m, including 4m at 7.17g/t.

Ferké is on the eastern margin of the Daloa greenstone belt at the intersection of major regional scale shear zones and is host to the >16km Leraba gold trend.

Many Peaks Minerals (ASX:MPK) is leveraging data from more than US$4m of previous exploration expenditure with follow-up activity focused on extending confirmed gold mineralisation.

Exploration success in the second phase has prompted the company to progress an additional 4000m of diamond drilling and mobilise a second diamond rig to site.

A 6000m RC drill campaign at Ferké is also expected to begin within the next 10 days while assays from a further 172 aircore drill holes for 5477m are expected this month.

“The Ferké project continues to deliver increasing volume potential at the Ouarigue South prospect, where downplunge extensions of the mineralised felsic intrusion return increasing widths and gold grades with depth,” MPK managing director Travis Schwertfeger said.

“Our 8-hole diamond core program just completed included several ‘scissor’ holes drilling down the mineralised lithology at Ouarigue with the intention to define fault and vein orientations within the mineralised intrusion to underpin increasing confidence in mineral resource estimation work.

“This drilling has also delivered substantial extensions to gold mineralisation from drilling in multiple orientations, with drill hole FNDC032 visually extending the favourable Felsic intrusion body an additional 188m down-dip of the deepest hole drilled to date.

“That deepest hole, also drilled in this program, has demonstrated increasing width and high gold grades.

“The increasing gold grades and volume with depth continues to expand the scope of work at Ouarigue, with conceptual pit depths and bulk tonnage potential increasing as exploration progresses.”

Kingston Resources (ASX:KSN)

Moving ahead 45.17% to 13.5c, a new high of almost three years, was Kingston Resources after agreeing to sell its 3.8Moz Misima gold project in PNG to Ok Tedi Mining Ltd in a deal worth up to $95m.

This injection of funds will put KSN in a strong position to grow its Mineral Hill copper-gold operations in the prolific Cobar Basin of NSW, Australia, by wiping out debt, funding new gold and copper projects and unlocking millions in future value.

The deal includes $50m payable at completion, $10m after 12 months and another $10m upon a final investment decision.

It also includes a 0.5% gross revenue royalty on production beyond 500,000oz with a $25m royalty buy-back option for PNG-owned Ok Tedi.

The transaction aligns with Kingston’s strategic objective to unlock shareholder value and strengthen its balance sheet while retaining upside exposure to Misima.

It negates the $4m a year annual interest and upkeep costs at Misima and locks in a two times return on investment for Kingston.

Sale proceeds will allow Kingston to fully repay a $15m debt facility… and support the expansion and exploration of the Mineral Hill copper-gold operations.

Kingston is focused on building value by growing production at Mineral Hill, targeting the start of underground operations by next year. The company is also progressing a second underground ore source, near-mine surface exploration and greenfields exploration at the site.

“The sale of Misima concludes a comprehensive global strategic process that commenced in November 2024,” Kingston’s managing director Andrew Corbett said.

“This deal will deliver Kingston up to $70 million in cash plus ongoing exposure to the future large-scale production profile of Misima through a gross revenue royalty, unlocking significant value for our shareholders.

”The total consideration is greater than Kingston’s current market capitalisation whilst we retain 100% of the Mineral Hill gold and copper operation.

“Kingston is delighted to complete this transaction with PNG’s largest mining company Ok Tedi. Ok Tedi is the natural owner and operator of Misima and we are excited by their vision to fast track towards FID for project construction.

“We look forward to Ok Tedi returning Misima to a leading Asia-Pacific gold mine for the benefit of the Papua New Guinea economy and local Misima community.”

Ok Tedi operates the Ok Tedi Mine, the longest running open-pit copper, gold and silver mine in PNG.

The company is 100% PNG owned with a 67% direct shareholding by the Independent State of PNG through Kumul Minerals (Ok Tedi) Limited and a 33% interest held by the people of the Western Province.

Ok Tedi is the single largest employer in the Western Province and one of the largest in PNG.

“The company is now ideally placed to consider accretive Australian based copper and/or gold growth initiatives that match with our vision of being a leading multi mine producer with significant scale and long-term returns,” Corbett added.

Midas Minerals (ASX:MM1)

Investors have welcomed positive news from Midas Minerals, driving shares up as much as 65.63% to 26.5c, a new 12-month high.

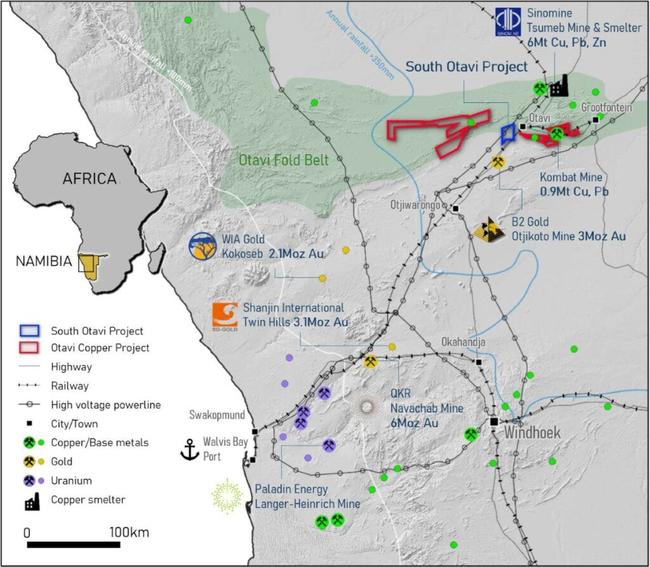

After acquiring an option on Monday over a 195km2 Exclusive Prospecting Licence in proximity to its Otavi copper project in Namibia, the company has received firm commitments for a $6.5 placement.

Funds from the placement at 15c per share, which was strongly supported by existing shareholders, will be put towards the acquisition of the Otavi and new South Otavi projects and for exploration programs in Namibia as well as at MM1’s Newington lithium-gold and Challa gold-copper-PGE projects in Western Australia.

Demonstrating their confidence in the company, directors will participate for a total of $185,000, subject to shareholder approval.

The issue price represents a 6.25% discount to the last traded price of 16c on Thursday, May 15, 2025, and a 4.76% discount to the 15-day volume weighted average price of 15.75c.

South Otavi hosts a large bedrock gold anomaly defined by geochemical drilling in 1997 to 1999 while a copper anomaly was delineated in the 1970s in a setting analogous to the Deblin deposit on Midas’ Otavi project.

Due diligence soil sampling has confirmed copper anomalism and with trenching, mapping and sampling underway, MM1 plans to drill-test prioritised gold and copper targets once defined.

“We are already active on the ground, having located insitu near-surface copper mineralisation, and have plans to test the separate gold target zone with drilling,” Midas MD Mark Calderwood said.

European Lithium (ASX:EUR)

European Lithium has reinforced the critical minerals potential of the Tanbreez project in Greenland with initial assays from historical deep drilling revealing high rare earth concentrations and securities have been up 10.2% to a daily high of 5.4c.

All deep drill holes delivered consistently well-mineralised total rare earth oxide (TREO) levels, grading between 0.39% to 0.47%.

The assays also revealed around 27% heavy rare earth oxides (HREO) accompanied by minimal uranium and thorium content.

EUR sees these results as a strong opportunity to expand the 45Mt maiden resource through further drilling, pending approval from the Greenland government.

European Lithium holds a 7.5% interest in Tanbreez in southern Greenland as well as around 68% of Critical Metals Corp which holds 42% of the project and the right to earn 92.5%.

Held under a 30-year exploitation licence, the project is primed to provide reliable, long-term rare earth output to meet growing demand in Europe and North America.

Tanbreez hosts elevated concentrations of high-value magnet rare earth oxides — including neodymium, praseodymium, dysprosium and terbium — which are significantly more valuable than light rare earths.

The company is planning to mobilise exploration and in-country field crews to Tanbreez for the upcoming field season to prepare for resource drilling in mid to late June.

Axel REE (ASX:AXL)

Auger drilling by Axel REE at the Caldas project in Brazil continues to return high-grade rare earth elements including high-value neodymium and praseodymium (NdPr), and dysprosium and terbium (DyTb).

Caldas is within a proven rare earths rich intrusive in the southwest of mining-friendly Minas Gerais with neighbours Meteoric Resources (ASX:MEI) and Viridis Mining and Minerals (ASX:VMM) boasting high end discoveries.

The shallow auger drilling was conducted inside and around the northern extents of the Poços de Caldas alkaline complex, highlighting a large prospect along the weathered zone at the northern contact point of the Caldera which returned encouraging REE mineralisation.

Best results include:

- 8.8m at 5309ppm TREO (26% MREO) from surface including 1m at 8100ppm TREO (29% MREO) from 4m ending with 0.8m at 6289ppm TREO (27% MREO) from 8m; and

- 10.8m at 3683ppm TREO (32% MREO) from surface including 1m at 6726ppm TREO (38% MREO) from 6m ending with 0.8m at 3452ppm TREO (32% MREO) from 10m.

“The consistent flow of high-grade TREO results continues from our shallow auger drilling program inside the Poços de Caldas alkaline complex,” AXL’s board said.

“The grades reported are consistent with major discoveries made by neighbours including Meteoric Resources and Viridis Mining and Minerals.

“Importantly, the high-grade TREO mineralisation is increasing at the end of auger holes, demonstrating the mineralisation is open at depth and amenable to deeper drilling.”

Shares reached 7.5c, an increase of 15.5% on the previous close.

While Many Peaks Minerals, European Lithium and Axel REE are Stockhead advertisers, they did not sponsor this article.

Originally published as Resources Top 5: Many Peaks scales new heights on Côte d’lvoire gold results