Resources Top 5: GreenTech more than a one hit Whundo

Copper hits from GreenTech have the explorer on the up and up, while WA gas stocks have rare good government news.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

GreenTech runs higher on copper hits at Whundo

Serbian antimony buy stokes fire under Bindi

Strike Energy up as WA Government bends on Perth Basin international gas sales

Here are the biggest small cap resources winners in morning trade, Thursday, September 19. Prices accurate at time of writing.

GREENTECH METALS (ASX:GRE)

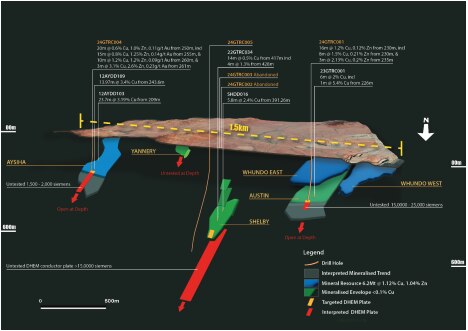

Up and about this morning, Pilbara copper explorer GreenTech is eyeing a significant expansion of its Whundo copper project in the Pilbara on the back of assays from a 1710m reverse circulation drill program looking for copper below six known mineralised shoots.

And in credit to GRE, today's move is on the back of actual drill results, not just the rock chips that get investors high on grades every few days.

Over at Austin drilling confirmed the continuity of mineralisation with 16m at 1.2% copperr, 0.12% zinc and 0.035g/t gold from 230m, including 8m at 1.5% Cu, 0.21% Zn and 0.039g/t Au from the start of the hole.

That's deeper than a previous hit of 6m at 2% Cu from 226m.

And over at the Ayshia zone, the drill struck 10m at 1.2% Cu, 1.2% Zn and 0.09g/t Au from 260m, with 3m at 3.1% Cu and 2.6% Zn from 261m, deeper than older strikes of 23.7m at 3.2% Cu and 13.97m at 3.4% Cu.

Down-hole EM has confirmed those Cu-Zn shoots at Austin and Ayshia continue beyond 230m, with more drilling and copper resource expansion planned off the results.

There's currently 6.2Mt at 1.12% Cu and 1.04% Zn sitting in the VMS deposit, with ample processing options nearby.

“We’re thrilled with the stage one drill results, which show real potential to significantly grow Whundo’s current 6.2Mt copper-zinc resource by targeting down-dip extensions to our known shoots," GRE exec director Tom Reddicliffe said.

"Based on our exploration results to date we firmly believe that we can continue to expand the Whundo copper resource to potentially underpin a copper project.

"Furthermore, with Whundo situated on a granted mining lease and with processing options potentially being available either through our Alliance with ANAX or Artemis Resources’ Radio Hill processing plant we are well positioned to take advantage of exploration success.

"With this strong start, we’re very eager to get back out on the ground for our next stage of drilling to push further."

GRE shares were up 28% at last check.

BINDI METALS (ASX:BIM)

Today's antimony dispatch takes us to Serbia, where explorer Bindi Metals says it's on the trail of two targets in the 'world class' Tethyan Magmatic belt.

Throwing the word's world class aside for a second, a phrase we'd rather reserve for the majesty of a Steve Smith pull shot, Bindi says the Mutnica antimony and copper prospect collected as part of the acquisition contains rock assays of up to 4.5% and 2.7% antimony and base metals soil results, which have never been followed up.

The Lisa antimony and gold project could be even more exciting, given 60,000t of ore was extracted from shallow pits between 1932 and 1951 at the site.

Grades ranged from 5% to 20% antimony.

Along with the acquisition, a $2m placement to sophisticated and professional investors has restocked the coffers for drilling and exploration.

Antimony prices have doubled this year, with the commodity the latest trend in resources market after dominant miner and processor China announced export controls.

“We are excited to confirm the historical high-grade antimony mining within the Lisa permit and also high grades of antimony present at Mutnica," Bindi chairman Eddie King said.

"These historical antimony-rich regions, with evidence of shallow past production, is ideally situated to assist Europe as it faces growing supply chain vulnerabilities for critical metals. With antimony playing a critical role in both defence and renewable energy technologies, the acquisitions of these projects aligns with our focus to secure essential mineral resources.”

Small-scale antimony mining at Lisa continued between 1964 and 1982, and while Serbia's mining sector has been overshadowed by protests against the establishment of Rio Tinto's (ASX:RIO) Jadar mine, there are plenty of large deposits being worked over in the Balkans.

Bindi will pay $200,000 in cash, issue 1 million shares and grant a 1% net smelter royalty on copper, silver, gold and other associated metals for Mutnica to Edelweiss Mineral Exploration, a subsidiary of ASX listed Apollo Minerals (ASX:AON).

For Lisa, Bindi will pay $200,000 cash and issue 2.5m fully paid shares, subject to shareholder approval.

MIRAMAR RESOURCES (ASX:M2R)

(Up on no news)

There are no market details behind the 42% rise in M2R's shares this morning, with the last bite from the WA explorer being the issue of a touch over 2 million shares to Topdrill in exchange for services provided by the Kalgoorlie driller.

Eyes are closely trained on assays due from its maiden campaign at Bangemall where M2R and its boss, former WMC and Doray mineral hunter Allan Kelly, are looking for Norilsk style magmatic nickel, copper and PGE targets.

Located in the Capricorn Orogen, the project includes the Mount Vernon prospect where RC drilling is testing geological and geophysical targets and where the WA Government co-funded drilling through its exploration incentive scheme.

While nickel prices have put pressure on Aussie producers, magmatic discoveries like Norilsk or IGO's Nova mine are typically at the lowest end of the cost curve, well below Indonesian laterites and Australia's narrow-vein or disseminated nickel sulphides.

Exploration work is also ongoing at the Chain Pool and Gidji projects, the latter a gold opportunity over the fence from Northern Star Resources' Kalgoorlie ops.

COPPER SEARCH (ASX:CUS)

(Up on no news)

Also on a run this morning, Copper Search delivered the results from its first drill hole at the Douglas Creek IOCG copper prospect in South Australia last week.

Nothing super in there, with some non-copper explanations for a co-incident gravity magnetics anomaly.

Assays for a second 820m deep hole were still pending as of September 13, though MD Duncan Chessell was quick to point out neither Rome nor Olympic Dam was built (or drilled) in a day.

"We have always known that Copper Search’s mission to find the next large-scale copper deposit was a high-risk, high-reward endeavour," he said at the time.

"Over the past two years, we’ve seen indications of IOCG-style mineral systems in multiple drill holes, but pinpointing the core mineralised zone in these systems is often very challenging.

"Olympic Dam, for example, wasn’t ‘discovered’ until the 10th drill hole (RD10).

"While the latest results are not what we wanted, we’re looking forward to seeing the results of the second drill hole, 24PK14-B, at the Douglas Creek IOCG Prospect and Professor Schaefer’s review of the Peake Project."

Douglas Creek is close to an interpreted "near miss" drill hole that found a maximum 0.45% Cu and 5.35g/t Au in 2023 drilling.

STRIKE ENERGY (ASX:STX)

A rare non miner in this column, but the update in WA's domestic gas reservation strategy bears mention here.

Strike shares were up almost 10% after the export ban for onshore gas producers was lifted.

All pre-FID projects can now bank on being able to ship 20% of their output overseas until the end of 2030, opening them up to higher prices in the international and east coast markets.

That's got strong benefits for Strike and its partner Warrego, owned by Gina Rinehart's Hancock, but also Mineral Resources (ASX:MIN), which has opened up a process for a partner to develop its own Perth Basin gas assets after a reported lowball offer from Mitsui (part owner of the Waitsia project), per The Australian's Dataroom.

Its boss Chris Ellison had campaigned for an exemption to export gas to cover the construction costs of the project, intended to ultimately supply cheap energy for its lithium and iron ore mines.

"This evolution in the WA Domestic Gas policy is a strong positive for Strike where export markets provide premium pricing and a deeper market," $630 million capped STX said in a release this morning.

"Strike stands to benefit through its substantial uncontracted gas Reserves and Resources position across its suite of pre-FID projects.

"Strike also has some of the most prospective exploration acreage in the Basin, which was recently demonstrated by the Erregulla Deep gas discovery, and this policy may increase the rate of Strike’s exploration activities and investment."

As our senior energy reporter Bevis Yeo noted in his Got Gas column last week, recent exploration by Strike identified gas with low CO2 levels at depths never encountered in the Perth Basin before. The new rules will only strengthen the development case.

At Stockhead, we tell it like it is. While GreenTech Metals and Miramar Resourcs were Stockhead advertisers at the time of writing, they did not sponsor this article.

Originally published as Resources Top 5: GreenTech more than a one hit Whundo