RBA holds rates as CME economist highlights key differences in Aussie economy

With interest rates holding firm in Australia as they drop in the US, CME Group’s chief economist has explained why our economy stands out from its global peers.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Investors should remember Australia's economy is different to many of its peers, according to CME Group

Australia’s short‐term interest rate markets price far fewer rate cuts from the RBA than other central banks

Australia’s inflation rate has remained somewhat more persistent than in other countries

With the RBA keeping Australia's current cash rate on hold at a 12-year high of 4.35% on Wednesday, CME Group chief economist and managing director Erik Norland has warned investors to keep in mind that several factors differentiate the Australian economy from that of peers such as Canada, Europe and the US.

Headquartered in the US, CME operates financial derivatives exchanges including the Chicago Board of Trade, Chicago Mercantile Exchange, New York Mercantile Exchange and The Commodity Exchange. The company is also a partial owner of S&P Dow Jones Indices.

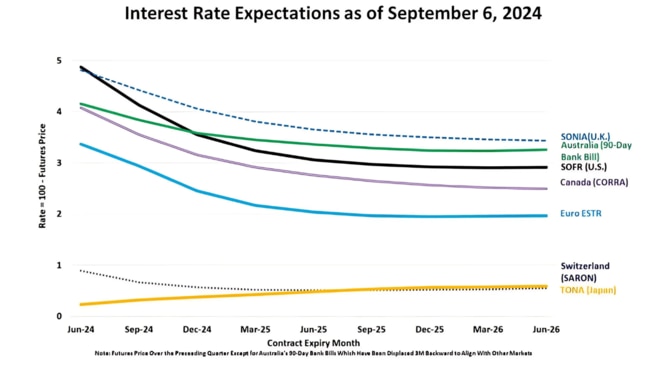

"Australia’s short‐term interest rate markets price far fewer rate cuts from the Reserve Bank of Australia (RBA) than other central banks, as priced by their respective interest rate markets," Norland wrote in a research paper.

He said that, for example, as of September 6, traders’ pricing of secured overnight financing rate (SOFR) and Euro short-term rate (ESTR) futures suggested the US Federal Reserve (Fed) and European Central Bank (ECB) would cut rates by 225 basis points (bps) and 175 bps, respectively, between now and the summer of 2026.

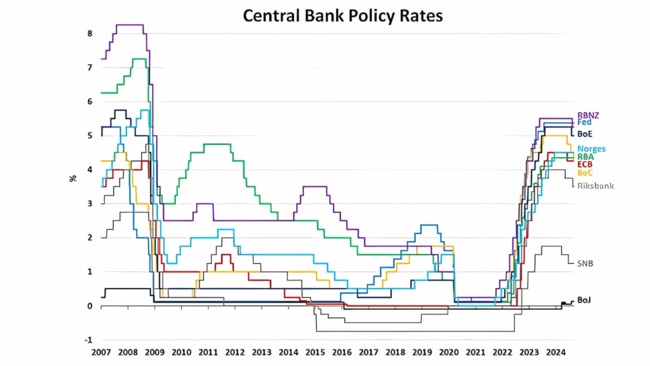

He also noted that many central banks including the ECB, the Bank of England, Bank of Canada, Riksbank and the Swiss National Bank had already eased policy.

The Fed made a 50bps on September 18, lowering the federal funds rate to a range between 4.75%-5%.

"By contrast, the RBA has thus far left policy on hold, and 90‐Day Bank Bill futures price only about 75bps of easing over the next two years," Norland said.

Two reasons rates will take time to fall

Norland said there appeared to be two reasons investors priced fewer rate cuts in Australia than elsewhere.

1. RBA didn't raise rates as much as peers

"First, the RBA didn’t tighten policy as much as many of its peers," he said.

"In 2022‐23, it raised rates by 425 bps compared to over 500 bps in the US or the UK, and 475 bps in Canada."

2. Inflation in Australia remains sticky

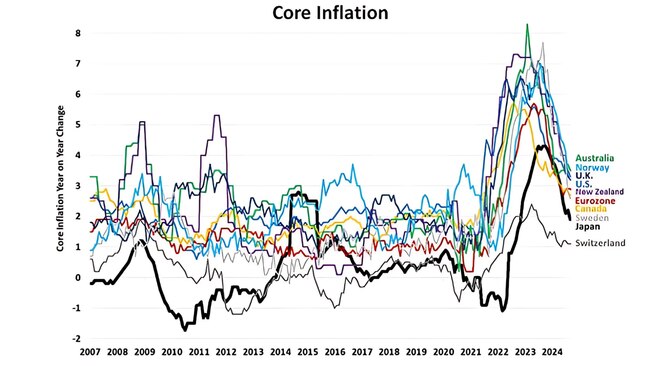

Norland said the second reason was that Australia’s inflation rate had remained somewhat more persistent than in other countries. The RBA board on Tuesday noted inflation was still some way above the midpoint of its 2 - 3% target range.

"Inflation, excluding volatile items, stood at 3.5% YoY at the end of July, slightly higher than core inflation in the US (3.2%), UK (3.3%) or the Eurozone (2.8%)," he said.

Norland said housing markets and the structure of the mortgage market explained why the RBA hadn’t raise rates as much as in Europe or North America, adding:

"In the US, Canada and parts of the Eurozone (notably France and Germany), people tend to use 15 to 30‐year fixed rate mortgages.

"In Australia, mortgages typically reset after just three years.

"Moreover, many homeowners borrowed during the pandemic when three-year mortgage rates were exceptionally low due to the RBA’s near zero short‐term rates and yield curve control, which depressed bond yields further up the curve."

The CME Group chief economist said the RBA's policies had worked to reduce pressure on Australia’s high level of household debt, much of which was connected to the mortgage market.

"While Australia’s overall level of debt is lower than most of its peers thanks to modest levels of public sector and non‐financial corporate debt, household debt is rather high at 109.7% of GDP," he said.

"By not tightening as much as its peers, the RBA avoided excessively straining household balance sheets."

Rate hikes slow Australian economy

Norland said the RBA’s rate hikes had visibly slowed the Australian economy, with the pace of GDP growth dwindling to 1% YoY by Q2 2024, and unemployment beginning to modestly rise.

"If inflation continues to recede and if signs of economic weakness persists, investors might come to expect the RBA to deliver more and faster rate cuts than they price currently," he said.

"What is remarkable is that except for the exogenous shock of Covid, Australia has not experienced a recession as defined by negative GDP growth since the early 1990s."

This was impressive, he noted, given Australia’s dependence on commodity exports.

"Over the past three and a half decades there have been extended periods of depressed commodity prices including during the 1990s and the second half of the 2010s," he said.

"Commodity prices have once again fallen sharply since peaking around Q2 2022."

Flexible exchange rate adds protection

According to the expert economist, part of the reason why Australia avoided a boom‐bust cycle was that it had been protected by a flexible exchange rate regime.

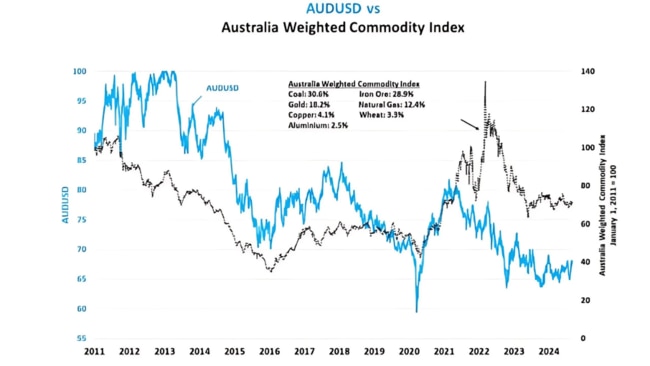

He said when commodity prices were low during the 1990s and early 2000s, the AUD-USD fell as low as 48 cents.

"When commodity prices peaked in 2011, an Australian dollar bought 1.11 USD," he said.

"Over time, AUD-USD has roughly tracked an Australia‐weighted commodity price index."

Norland added that the current level of AUD-USD at ~67 cents reflected depressed prices for many key exports, including coal, iron ore and petroleum gas, as well as other, smaller, exports such as wheat, aluminium and copper.

"These prices are depressed mainly because of weak growth in China, which buys nearly 30% of Australia’s exports," he said.

"Overall, exports amounted to 24.4% of Australian GDP, meaning that exports to China account for 7% of Australian GDP."

READ: Why the Aussie dollar matters, and which ASX stocks are exposed to its movements

Slowing China economy

Norland said that over the northern summer, the world's second largest economy, China, appeared to have slowed considerably more.

Meanwhile Pan Gongsheng, governor of China's central bank, The People's Bank of China (PBOC), this week announced support to stimulate the economy including cutting the amount of cash banks must hold as reserves, known as the reserve requirement ratios (RRR), by 50bps.

Gongsheng said the the PBOC would also reduce the seven-day repo rate by 0.2 percentage point to 1.5%, while deposit and other interest rates would fall along as well. Interest rates on existing mortgages were also set to be cut by 0.5 percentage point on average.

Past CME Group research has suggested that the prices of many commodities lag the growth in China by roughly one year.

"As such, even If China’s economy begins to grow at a faster pace, commodity prices might not recover immediately and could fall further in the meantime," said Norland, adding:

"The low level of AUD-USD might also explain some of the relative persistence of Australia’s inflation.

"On the one hand, weaker commodity prices lower inflation rates globally.

"On the other hand, lower commodity prices also mean a weaker AUD, which leads Australian consumers to pay higher prices for imports, offsetting some of the benefits for lower costs for raw materials prices."

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Originally published as RBA holds rates as CME economist highlights key differences in Aussie economy