Nasdaq Wrap: Nvidia, Netflix, Coinbase keep Wall Street abuzz as earnings season ramps up this week

Wall Street closed the week on a high note, with the S&P 500 and Dow Jones hitting record levels, driven by positive earnings reports.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Nasdaq Wrap is our weekly look at the highly influential, tech-heavy Nasdaq 100 index – movers and shakers over the past seven days or so, talking points and a brief look at what’s ahead.

- Wall Street rose to record highs last week, driven by strong earnings

- The semiconductor sector struggles as ASML lowers its outlook

- Upcoming earnings reports from stocks like Tesla this week

The week that was

Wall Street closed last week on a high note, with both the S&P 500 and Dow Jones reaching record highs. The Russell 2000 index also shone, reflecting strong investor interest in smaller-cap stocks.

These gains were primarily driven by solid earnings reports, especially from major tech and financial firms.

Morgan Stanley exceeded expectations with a surge in dealmaking, driving its shares to new heights, while Citigroup and Bank of America also outperformed previous dismal forecasts.

However, the semiconductor sector struggled, mainly due to ASML's disappointing outlook, which sparked a tech sell-off on the Nasdaq on Tuesday. The Dutch chipmaker warned of a slow recovery in the semiconductor market, downgrading its guidance and projecting a significant drop in sales to China.

Investor sentiment was further dampened by regulatory concerns, as reports emerged of the Biden administration considering restrictions on advanced AI chip sales to certain countries.

Despite those challenges, there was some recovery later in the week after Taiwan Semiconductor Manufacturing Company (NYSE:TSM) reported strong third-quarter results and positive guidance for the fourth quarter.

Additional economic data contributed to the upbeat sentiment, with stronger-than-expected retail sales and initial jobless claims suggesting resilience in US consumer spending.

The upbeat reports fuelled speculation that the Federal Reserve may adopt a less aggressive stance on interest rate hikes, further boosting investor confidence later in the week.

New to the US earnings season?

The US earnings season will continue to ramp up this week.

Earnings season should be an exciting time for investors, especially for newbies, as it's when companies report their financial results for the past quarter.

In the US, this happens four times a year right after each financial quarter ends, kicking off in January/February, April/May, July/August, and October/November.

For new investors, it's crucial to watch for "bellwether" stocks, such as Apple or FedEx, as their performance can signal trends in the broader economy.

Also, if a company experiences profit declines for two consecutive quarters, it may indicate a struggle, though this doesn't necessarily mean the overall economy is in recession.

Paying attention to a company's guidance, meanwhile, can offer insights into future performance and management’s outlook.

Also watch for surprises like acquisitions, management changes, stock buybacks, or restructuring plans that can affect the stock price.

Lastly, with stocks often rising in anticipation of earnings, even good news might not boost a stock on the day if the news is already highly baked into the price.

Last week’s Nasdaq stock highlights

Netflix (NASDAQ:NFLX)

Netflix’s shares jumped 11 per cent on Friday after its results eased concerns about Big Tech facing challenges in the third quarter.

The streaming giant's profit shot up, smashing Wall Street estimates, and both revenue as the company gained 35 million paid subscribers year over year.

Netflix reported earnings of $US5.40 per share and $US9.82 billion in revenue for the third quarter of 2024, surpassing analyst expectations.

Revenue increased over 15 per cent from $US8.5 billion last year. After strong subscriber growth from its new ad tier and password-sharing changes, shares touched a record high of $US766.

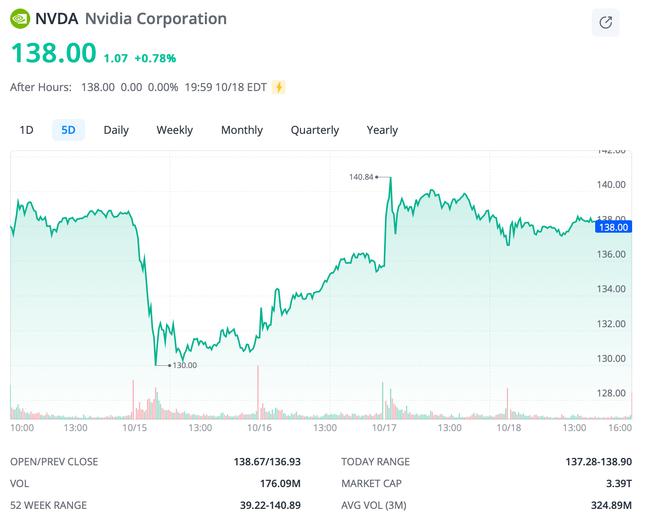

Nvidia (NASDAQ:NVDA)

Bank of America analysts believe Nvidia's stock still has significant growth potential, raising their price target from $US165 to $US190 (versus current price of $US138).

BofA said there was a "generational opportunity" in AI accelerators, where Nvidia holds an 80per cent market share, as major clients like Alphabet and Meta invest heavily in its GPUs for AI applications.

The analysts project the total market for this technology will expand dramatically, with Nvidia expected to capture a large portion of it, potentially generating $US272 billion in AI revenue by 2030.

In addition, BofA said Nvidia boasted higher profit margins compared to its peers and has lucrative partnerships that add to its revenue streams.

Coinbase (NASDAQ:COIN)

The cryptocurrency industry’s flagship company was on a roll last week, benefitting from the price of Bitcoin, which has been inching closer to its all-time high level.

Although at just under $US74k, that level is still a pump or two away at the time of writing, which has BTC simmering at about $US68,500.

As the 2024 US election approaches, cryptocurrency has become a talking point, with nearly half of all corporate campaign contributions coming from crypto supporters.

Investors are paying close attention to how presidential candidates Donald Trump and Kamala Harris position themselves on this topic.

Trump has shifted from previously criticising crypto when he was president, to now fully embracing it.

He wants the US to become the leading global hub for cryptocurrency and even launched a campaign that accepts Bitcoin donations and is also connected to a crypto project called World Liberty Financial.

On the other hand, Kamala Harris has been more cautious. She hasn't taken a clear stance on crypto, reflecting the Democratic Party's struggle to connect with the crypto community.

Harris has, however, recently begun mentioning support for innovative technologies, including digital assets, although she hasn’t detailed any specific plans.

Coinbase, meanwhile, is scheduled to release its quarterly report on October 30.

Zacks analysts project the company could report earnings of $0.34 per share this quarter, an impressive 3,500 per cent increase from the same time last year.

Tevogen Bio (NASDAQ:TVGN)

Here’s one Nasdaq-listed stock you may never have heard of: Tevogen Bio.

The biotech company specialises in advanced immune therapies using its unique ExacTcell technology.

As the company explains, the ExacTcell technology focuses on developing T cell therapies that use CD8+ cytotoxic T lymphocytes to target and eliminate specific diseases, including cancers and infections.

This platform creates "personalised treatments" that can be readily available. The aim is to enhance the immune response for patients with significant medical needs.

Tevogen’s shares popped last week after the company announced it expected to generate $US1 billion in revenue from its oncology pipeline in its first year, with projections of $US10 billion to $US14 billion within five years.

The New Jersey-based biotech firm estimated that over 2 million patients in the US would be eligible for its treatments.

Key products in Tevogen's pipeline include TVGN 489 for SARS-CoV-2 infection, TVGN 920 for cervical cancer prevention, and TVGN 960 for mouth and throat cancer.

What to expect this week

This week on Wall Street, investors will be paying close attention to earnings reports from big companies, with names including Tesla, Boeing, Verizon, and industrial leaders like GE Aerospace and Honeywell.

Many other US companies are also set to report Q3 earnings this week, including:

Logitech, GE, Philip Morris, Verizon, Texas Instruments, Lockheed Martin, General Motors, 3M, Coca-Cola, T-Mobile, IBM, AT&T, UPS, American Airlines, Northrop Grumman, Southwest Airlines, Dow, and Colgate-Palmolive.

In addition to earnings, investors will also be listening for insights from several Federal Reserve officials.

There will be important economic data released this week. This includes flash PMI numbers for the manufacturing and services sectors, durable goods orders, and some housing market statistics.

The Federal Reserve's Beige Book, which details regional economic activity, will also be released.

Now read: US bull market hits two years, will it keep charging ahead?

*Trade US and Australian ETFs with $0 brokerage. Additional brokerage discounts may apply during promotional campaigns. Regulatory and FX fees may apply.

The views, information, or opinions expressed by the experts quoted in this article are solely those of the experts and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Originally published as Nasdaq Wrap: Nvidia, Netflix, Coinbase keep Wall Street abuzz as earnings season ramps up this week