Nasdaq Wrap: History signals rally ahead after Fed cut; and is Intel ready for an epic merger?

Some weeks are game changers for the market, and last week was one of them for Wall Street and the Nasdaq.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Nasdaq Wrap is our weekly look at the highly influential, tech-heavy Nasdaq 100 index – movers and shakers over the past seven days or so, talking points and a brief look at what’s ahead.

- US stock market soars following 50 bp Fed rate cut

- Positive outlook as history shows rate cuts often lead to gains

- Nasdaq highlights include Intel's takeover talks and Apple's iPhone 16 demand

The week that was

Some weeks are game changers for the market, and last week was definitely one of them.

The Fed Reserve finally gave the nod that everyone’s been waiting for – cutting interest rates by a jumbo 50 basis points.

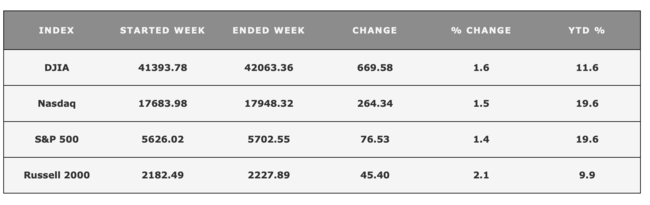

As a result, US stocks (as well as the ASX) hit new highs, with the S&P 500 index touching an all-time high of 5,733 points and notching its 39th record this year.

The Nasdaq was also up by 1.5% during the week, while the Dow Jones finished above 42,000 for the first time in history.

The occasion was certainly momentous – it was the Fed’s most aggressive tightening campaign in 40 years following the second-longest pause in history.

But it was hardly a surprise, given that Fed Chair Powell had given hints during last month's Jackson Hole meeting.

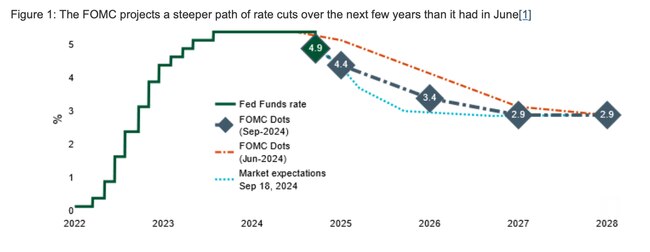

Investors quickly shifted their focus to the FOMC's projections, known as the ‘dot plot,’ which indicates a steeper pace of rate cuts ahead.

According to the dot plot, we can expect an additional 50 basis points of cuts by the end of the year, suggesting two more 25-point cuts by December, along with another 100 points in 2025.

At the post-meeting press conference, Chair Powell was pretty upbeat, saying, "The US economy is in a good place and our decision today is designed to keep it there."

However, he also clarified that the 50 basis point cut shouldn’t be seen as the start of a big rate-cutting spree.

“I do not think that anyone should look at this and say, ‘Oh, this is the new pace," Powell said.

He added that US consumer spending is strong, jobless claims are low, household net worth is hitting record highs, and wages are outpacing inflation.

All these signs suggest a soft landing is not just possible, but very likely.

There’s indeed reason for optimism

Historically, data shows that when the Fed cuts rates outside of a recession, stocks tend to rally afterwards.

Since 1982, in the 11 previous rate-cutting cycles, the S&P 500 has risen by an average of 9.1% within six months of the first cut.

However, exceptions occurred in 2001 and 2007, when the Fed's cuts weren't enough to avoid a recession, leading to declines in S&P 500.

Economists also tend to feel a bit more relaxed after a cut, with Goldman Sachs recently lowering its recession forecast to just 20%.

Defensive sectors like healthcare and utilities often shine in the months following a Fed rate cut.

Small-cap stocks, measured by the Russell 2000 Index, also typically react strongly to rate cuts. The Russell has seen a solid 10% rally this year.

However, not all analysts are convinced that a stock market rally is guaranteed, and there’s always a chance of disappointment.

The S&P 500 has already jumped 30% in the past 12 months, its best performance leading up to a rate cut on record. This could mean some potential gains are already priced in.

“It’s crucial to remember that while rate cuts are generally implemented to stimulate the economy, they are not without potential downsides,” said a note from Stringer Asset Management.

“Prolonged periods of low interest rates can lead to asset bubbles, and encourage excessive risk-taking...”

Last week’s Nasdaq stock highlights

Intel (NASDAQ:INTC)

Intel was up 3% on Friday and 9% for the week after Qualcomm reportedly made informal overtures to Intel about a potential takeover, which could become the largest tech merger in history.

Intel is market capped at over US$90 billion, while Qualcomm is valued at approximately US$190 billion.

Reading between the lines, the move highlights Intel's steep decline. Once the world's largest chipmaker, the company has struggled in recent years; over the past year, Intel's stock has dropped by 36%.

The largest tech merger to date was Microsoft's acquisition of Activision Blizzard for US$69 billion, and there was a $117 billion bid from Broadcom for Qualcomm in 2017, which was blocked by former President Trump.

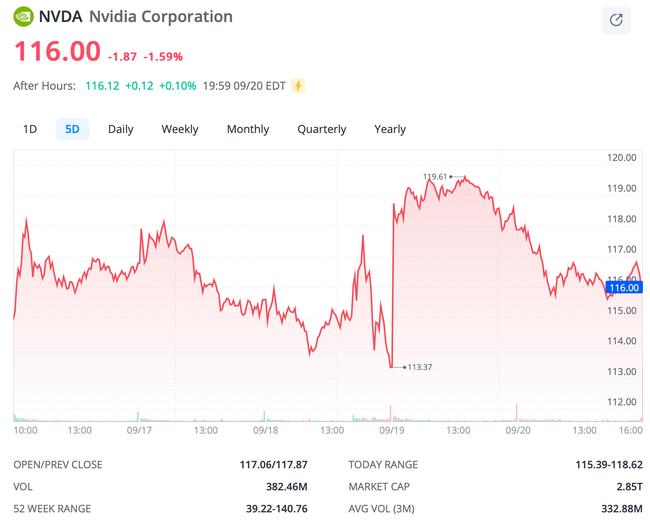

Intel's troubles predate the rise of generative AI, but the company essentially failed to adapt to the rapidly changing market, especially as competitors like Nvidia have gained prominence and now boast a market cap of US$2.85 trillion.

Qualcomm, based in San Diego, has yet to make an official offer, nor has it detailed how it would finance such a massive acquisition.

Meanwhile, news just in last night, private equity powerhouse Apollo Asset Management has committed to a US$5 billion investment in the ailing Silicon Valley icon, presumably to thwart any potential moves by Qualcomm.

Apple (NASDAQ:AAPL)

Apple saw a nice bump of around 5% for the week after T-Mobile US CEO Mike Sievert shared some encouraging news about the early demand for the iPhone 16.

In a CNBC interview, Sievert mentioned that T-Mobile is experiencing higher sales of the new iPhone compared to last year's models. Sales officially kicked off on Friday, following a week of preorders.

The new models include the standard iPhone 16, as well as the more advanced iPhone 16 Pro and Pro Max.

“The first week was better than last year,” Sievert said, adding that customers are opting for the higher-end models.

However, he pointed out that the rollout of some AI features, which Apple is calling Apple Intelligence, could extend the buying cycle for the iPhone 16. These features are set to be available in a software update next month.

Needham analyst Laura Martin has reaffirmed her buy rating on Apple with a price target of US$260, versus current price of US$228.

Nvidia (NASDAQ:NVDA)

There was no specific news from the market darling last week, but the stock saw a small jump right after the Fed cut announcement.

The previous week, Nvidia's shares fell heavily after the company reported its fiscal Q2 earnings. The stock dropped further when the Department of Justice issued subpoenas as part of an antitrust investigation.

However, Nvidia bounced back after CEO Jensen Huang made a compelling case for AI investments at a Goldman Sachs conference last week, with industry leaders like Larry Ellison and Elon Musk showing strong interest in Nvidia's AI chips.

The semiconductor sector is facing uncertainties ahead, however, particularly with the upcoming US presidential election.

Both candidates have taken a hard stance on China, which could pose challenges for American chipmakers like Nvidia. Nvidia is already developing a custom chip for Chinese customers that adheres to these trade regulations.

One other thing of concern for this darling stock is that Nvidia insiders have sold significantly more shares than they purchased, including Huang, who sold nearly 6 million shares recently.

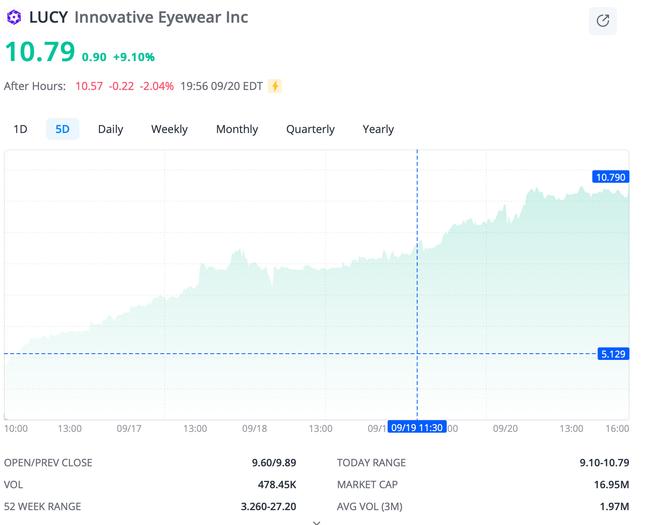

Innovative Eyewear (NASDAQ:LUCY)

Here’s one Nasdaq-listed stock you’ve probably never heard of.

LUCY surged by 120% last week after launching its first American National Standards Institute (ANSI)-certified smart safety eyewear at Vision Expo West in Las Vegas.

This new product, called Armor, is part of the company’s ChatGPT-enabled smart eyewear range.

Armor represents a breakthrough in safety and technology, offering wearers advanced eye protection as well as hands-free connectivity and features.

LUCY says the Armor line is expected to open new markets, including logistics, healthcare, and hardware retail.

It’s also the company's first wrap-style sunglass, featuring light-reactive, auto-tinting lenses suitable for both indoor and outdoor use.

The company has pending patents for the design and utility of this product.

Read more: Wall Street notches best week in 2024 as Nvidia rebounds; but will the Fed spoil it all?

Join a community of dedicated traders who demand an advanced investing app – and get it. Sign up today and claim your welcome rewards, start investing in the US market with $0 brokerage*, tap into the convenience of 24-hour trading, harness the power of real-time data, and test your strategies risk-free with our Paper Trading.

Things to watch for this week

This week kicks off with flash PMI data from major developed economies, which will be key for understanding central bank policies.

PMI, or Purchasing Managers' Index, is a key economic indicator that measures the health of the manufacturing and services sectors.

While US inflation seems under control, economies are showing signs of vulnerability, making the flash PMI surveys crucial for clues about future rate moves.

Weakness in the PMIs could lead to more aggressive rate cuts, while resilience may lead to a more cautious approach.

Fed watchers will also pay close attention to Jerome Powell's upcoming speech and the core PCE inflation data this week.

Meanwhile, the European Central Bank will be looking out for eurozone inflation figures, and the RBA's meeting will also draw interest here at home.

Originally published as Nasdaq Wrap: History signals rally ahead after Fed cut; and is Intel ready for an epic merger?