MoneyTalks: Antipa prime gold M&A target, says Euroz analyst Michael Scantlebury

Euroz’ Michael Scantlebury says Newmont’s exit at Telfer will lead to more Paterson Province M&A, with Antipa in the box seat.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Newmont's exit from Telfer and Havieron has kicked off M&A action

Antipa Minerals already benefiting from sale of 32% stake in Citadel gold project JV to Rio Tinto

Scantlebury says money is coming down the curve from majors to mid-tiers, Greatland Gold a case in point

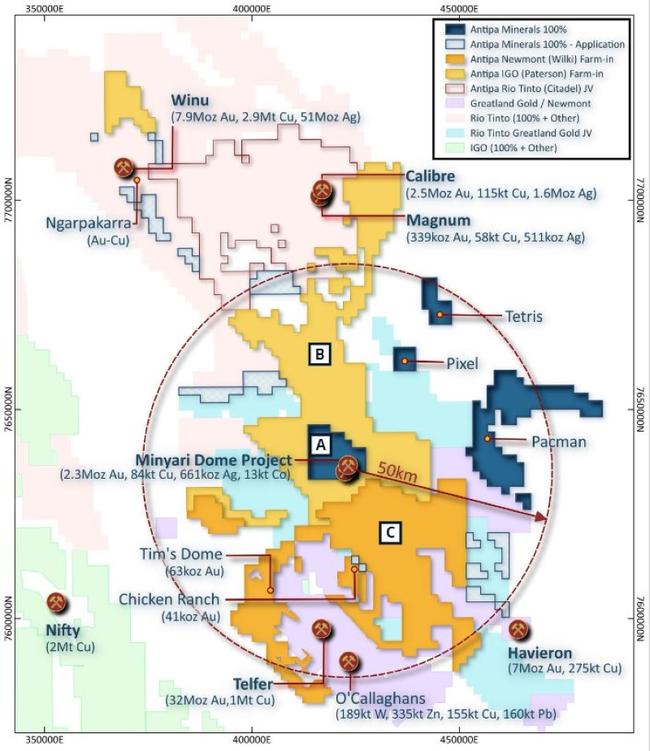

WA's Paterson Province has been under the microscope since gold major Newmont (ASX:NEM) placed the legendary Telfer mine on the auction block in the wake of its US$15 billion merger with the WA gold mine's owner Newcrest Mining.

Twiggy Forrest-backed Greatland Gold has picked up the mantle, purchasing Telfer and the remaining 70% stake of the Havieron JV from Newmont for US$475m in cash and scrip.

Speaking to Stockhead, Euroz Hartleys resources analyst Michael Scantlebury says the $17m sale of Antipa Minerals' (ASX:AZY) 32% interest in the 2.84Moz gold Citadel project to Rio Tinto (ASX:RIO) could be just the start of moves and shakes for the explorer in the Paterson on the back of bonkers, all-time high gold prices.

READ MORE: Gold Digger: Analysts must be busy, as they’re re-rating gold upwards every week

Gold bull nothing to be ashamed about

Scantlebury says Euroz are unashamed gold bulls and underlying short-term fundamentals couldn't look any stronger, driven by the rate cut cycle kicking off in the US and ongoing conflict in Europe and the Middle East.

"Investors always seem laser-focused on short-term gold price movements, driven by daily headlines of gold ETF movements, US dollar movements, inflation data, interest rate decisions and the relationship to inverse real interest rates," Scantlebury says.

"However, often what investors fail to appreciate is the longer-term picture, and who is actually driving the gold price.

"Physical buying is largely undertaken by Reserve Bank buying from emerging markets and individuals, which is no real surprise given the weaponisation of the US dollar in recent years due to Russian sanctions.

"It would be crazy for emerging market Reserve Banks and individuals to at least consider diversifying their reserves away from the US dollar with physical gold bullion. We expect this trend to continue for the foreseeable future and beyond."

Money in gold

We asked Scantlebury where he sees the money coming from and the Euroz analyst reckons that the market is starting to shift from the majors down the curve to mid-tiers. Case in point: Greatland Gold's Paterson purchases.

"There's a real focus on gold producers that show legitimate organic growth in production over the coming years and that are well placed to internally fund this growth through cashflow," Scantlebury says.

"Some capital has even started flowing into some successful explorers, although we could argue that exciting gold discoveries never struggle to attract capital no matter gold sentiment.

"We (Euroz) would expect money continue to continue to flow towards the smaller end, as investors seek value and growth.

"We have also noticed money positioning in a number of takeover targets as the market appreciates that a lot of producers lack organic growth and have no other choice but to acquire."

Ripe for the taking

With the biggest player in the region (Newmont) recently packing its bags, the Paterson Province is in the midst of an M&A frenzy.

Scantlebury reckons the elephant in the room is the processing hub of Telfer, which has a very hungry plant capable of treating +20Mtpa and is in the process of changing hands.

"This has fundamentally changed the game in the Paterson Province and the investment thesis for Antipa Minerals is, as for the first time in decades, you have a company running Telfer who is incentivised to grow and improve the asset," he says.

"But importantly, the mill is hungry for ore feed. As part of the Telfer transaction Greatland will own ~8.6% of AZY as Newmont is selling their position to Greatland."

AZY still has a sizeable landholding, with multiple JVs on the cards on top of its flagship 2.3Moz Minyari Dome gold asset.

Missed by the market

"Antipa is now cashed up with $23m of cash (pro-forma) and looks unlikely to come back to the market any time soon and its 100%-owned Minyari Dome is just 35km from Telfer, and, in our view, is being completely missed by the market," Scantlebury said.

"With a strong cash balance, it leaves them in a position of power to negotiate with Greatland Gold to sell or partner on the Minyari Dome gold project.

"We simply do not see how AIM listed Greatland Gold do not buy the company. Greatland are looking to list on the ASX by June 2025, which we speculate would be the most logical time to launch a takeover of Antipa."

AZY is due to release an updated scoping study on a standalone operation at Minyari Dome gold project in the coming weeks, which Scantlebury says should really highlight value of the asset to the market and institutional investors.

"It's important to remember that whatever the NPV is of the updated scoping study is, it will be a lot higher if you remove the capital expenditure required for the processing facility, as this is what the value will be to Greatland Gold, as they would simply process the ore through the spare capacity at Telfer," Scantlebury says.

Shares in Antipa are up >100% in the past month already, with the $128m market-capped junior trading at 2.7c.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Euroz Hartleys declares that it has provided corporate advice during the last year and has received a fee for these services from Antipa Minerals and has acted as underwriter to, and/or arranged an equity issue in, and/or been engaged in a capital raising during the last year. Euroz Hartleys has received a fee for these services from Antipa Minerals.

At Stockhead, we tell it like it is. While Antipa Minerals is a Stockhead advertiser it did not sponsor this article.

Originally published as MoneyTalks: Antipa prime gold M&A target, says Euroz analyst Michael Scantlebury