Lunch Wrap: Energy stocks crumble, but XPON lights up the boards with a 300pc surge

Westpac dragged the banks lower, oil giants slipped, but Qantas soared on cheaper fuel and XPON was up 300pc on acquisition news.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Banks slump as Westpac disappoints

Strong US jobs fuel Wall Street run

Qantas lifts, XPON up 300pc on acquisition news

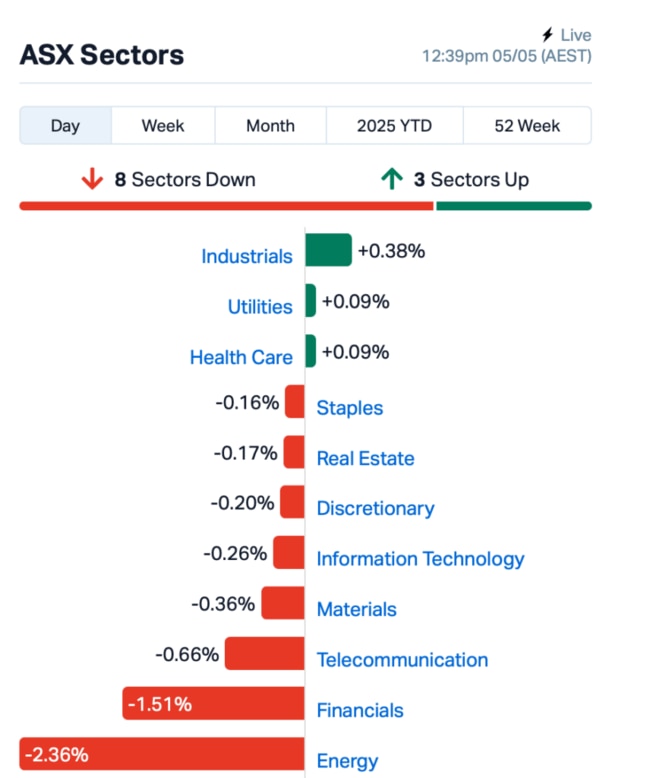

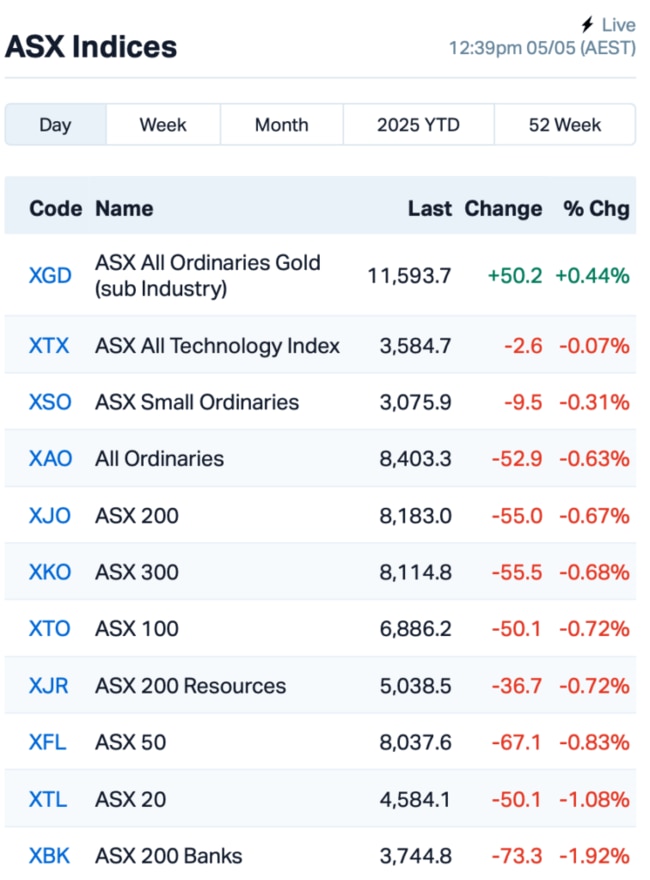

The ASX has limped into the week, down by 0.5%, dragged by the banks and energy sectors.

Traders are still digesting the federal election results after Anthony Albanese secured back-to-back wins, the first PM in over two decades to do it.

With the politicking done, markets are now expected to refocus on fundamentals.

And just in case there wasn’t already enough on the geopolitical menu, Trump also announced a 100% tariff on all non-US-made films, calling it a matter of “national security”.

But he turned down the heat a notch after saying over the weekend that tariffs on China might “come down at some point,” because, in his words, the two economic giants have “essentially stopped doing business”.

That little olive branch, or at least the hint of one, was enough to lift market spirits on Wall Street.

The S&P 500 gained 1.47% on Friday, while the tech-heavy Nasdaq rallied by 1.51%.

Solid US jobs data, where 177,000 new jobs were added in April, also helped soothe recession fears.

Back on home turf, eight of the 11 ASX sectors were flashing red this morning.

Leading the fall were energy stocks, which took a spill after oil prices were knocked down nearly 4%. Brent crude fell below $US60 a barrel after OPEC+ surprised markets by cranking up supply.

But Qantas (ASX:QAN) got a solid tailwind from that same oil news, jumping 2.5% in early trade.

Westpac (ASX:WBC)was down 2.65% after its $3.5 billion half-year profit missed expectations, along with little improvement in its net interest margin. That was enough to send the whole banking sector into reverse this morning.

In other large caps news, Gold Road Resources (ASX:GOR) rallied 9% after finally agreeing to a $3.7 billion takeover offer from South Africa’s Gold Fields. It was a sweetened deal, up from the original $3.3b bid, which will hand full control of the Gruyère mine to Gold Fields.

Endeavour Group (ASX:EDV), the owner of Dan Murphy's and BWS, also edged higher, up 1%, after telling the market it expects “flat to modest” retail sales growth in the fourth quarter. Not a blockbuster, but investors seemed okay with that given how cautious consumers are still feeling.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 5 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| XPN | Xpon Technologies | 0.024 | 300% | 56,682,254 | $2,174,649 |

| ANX | Anax Metals Ltd | 0.012 | 140% | 38,028,485 | $4,414,038 |

| SPX | Spenda Limited | 0.008 | 60% | 29,733,868 | $23,076,077 |

| AXP | AXP Energy Ltd | 0.002 | 50% | 258,191 | $6,574,681 |

| RLL | Rapid Lithium Ltd | 0.003 | 50% | 5,051,636 | $2,489,889 |

| CT1 | Constellation Tech | 0.002 | 33% | 53,114 | $2,212,101 |

| NWM | Norwest Minerals | 0.017 | 31% | 9,261,767 | $6,306,554 |

| VR8 | Vanadium Resources | 0.017 | 31% | 187,603 | $7,335,794 |

| KGD | Kula Gold Limited | 0.009 | 29% | 474,189 | $6,448,776 |

| EQX | Equatorial Res Ltd | 0.115 | 28% | 118,000 | $11,830,082 |

| CTN | Catalina Resources | 0.003 | 25% | 213,317 | $3,327,519 |

| EVR | Ev Resources Ltd | 0.005 | 25% | 81,824 | $7,943,347 |

| PCL | Pancontinental Energ | 0.010 | 25% | 7,075,381 | $65,092,687 |

| WTM | Waratah Minerals Ltd | 0.245 | 23% | 1,816,126 | $40,610,833 |

| PUA | Peak Minerals Ltd | 0.011 | 22% | 3,899,791 | $25,265,892 |

| SMP | Smartpay Holdings | 0.925 | 22% | 435,022 | $183,877,033 |

| SRR | Saramaresourcesltd | 0.034 | 21% | 143,164 | $7,620,232 |

| MXO | Motio Ltd | 0.041 | 21% | 324,530 | $9,469,116 |

| CCO | The Calmer Co Int | 0.003 | 20% | 737,094 | $6,694,362 |

| EAT | Entertainment | 0.006 | 20% | 100,000 | $6,543,930 |

| KPO | Kalina Power Limited | 0.006 | 20% | 1,524,366 | $14,471,099 |

| SHP | South Harz Potash | 0.006 | 20% | 113,300 | $5,412,894 |

| TMK | TMK Energy Limited | 0.003 | 20% | 5,593,366 | $25,555,958 |

| KNB | Koonenberrygold | 0.091 | 20% | 20,651,467 | $71,512,515 |

XPON Technologies (ASX:XPN) skyrocketed by 300% after snapping up Alpha Digital, a well-known Aussie digital marketing outfit and long-time partner of the business, in a deal set to wrap up in early May. The buyout is worth $1.72 million upfront, with a bit extra on the table if Alpha hits future earnings targets.

Alpha pulled in $4.6 million in revenue last year and comes with around a million bucks in cash. The plan now is to plug in XPON’s AI smarts to supercharge Alpha’s offering, and roll out more tools to big-name clients like Target, Kmart and QUT. XPON reckons this could be the first of many in a repeatable “acquire, AI-enable, cross-sell” strategy.

SmartPay (ASX:SMP) shares jumped after it entered exclusive talks with a mystery buyer offering $NZ1.20 a share. It had been weighing up offers from that bidder and Tyro, but went with the first after a sweetened proposal landed in late April. Tyro’s now out of the race, and Smartpay’s got until June 9 to lock in a deal.

Anax Metals (ASX:ANX) has just locked in a $3.3 million funding deal from a global player called Mineral Development Partners (MDP). MDP has agreed to tip in up to $103 million all up, backing Anax’s push to bring the Whim Creek copper project in WA back to life, and turn it into a major base metals hub for the Pilbara. Anax says the backing is needed to fire up Whim Creek and grow into a serious copper and base metals contender.

Waratah Minerals (ASX:WTM) has hit a solid patch of porphyry copper-gold at its Breccia West target in NSW, just a few kilometres west of Newmont’s Cadia mine. Its first drill hole returned some chunky intercepts, including 196 metres at 0.54% copper equivalent, pointing to a promising magmatic-hydrothermal breccia system. A second hole revealed a separate zone tied to magnetite-rich rock, and that’s now shaping up as a high-priority target.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 5 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.001 | -33% | 4,528,817 | $43,400,718 |

| BIT | Biotron Limited | 0.002 | -33% | 126,478 | $3,981,738 |

| VML | Vital Metals Limited | 0.002 | -33% | 6,890,477 | $17,685,201 |

| AOA | Ausmon Resorces | 0.002 | -25% | 717,407 | $2,622,427 |

| AON | Apollo Minerals Ltd | 0.012 | -25% | 11,117,462 | $14,855,310 |

| CAV | Carnavale Resources | 0.004 | -20% | 444,119 | $20,451,092 |

| LNR | Lanthanein Resources | 0.002 | -20% | 145,000 | $6,109,090 |

| NC6 | Nanollose Limited | 0.035 | -19% | 467,027 | $10,749,239 |

| NGS | NGS Ltd | 0.022 | -19% | 264,247 | $3,658,036 |

| PLY | Playside Studios | 0.135 | -18% | 1,633,696 | $67,521,652 |

| HCF | Hghighconviction | 0.037 | -18% | 87,864 | $873,292 |

| EQS | Equitystorygroupltd | 0.025 | -17% | 420,003 | $5,004,612 |

| HIQ | Hitiq Limited | 0.025 | -17% | 110,034 | $11,026,874 |

| RXL | Rox Resources | 0.300 | -17% | 4,920,955 | $219,429,280 |

| 1AD | Adalta Limited | 0.005 | -17% | 1,227,809 | $3,859,337 |

| BPP | Babylon Pump & Power | 0.005 | -17% | 910,000 | $14,997,294 |

| ENL | Enlitic Inc. | 0.040 | -17% | 639,891 | $27,629,578 |

| RDS | Redstone Resources | 0.005 | -17% | 3,871,722 | $5,552,271 |

| TMX | Terrain Minerals | 0.003 | -17% | 256,666 | $6,010,670 |

| TON | Triton Min Ltd | 0.005 | -17% | 50,450 | $9,410,332 |

| BPH | BPH Energy Ltd | 0.009 | -15% | 480,286 | $12,182,328 |

| DTR | Dateline Resources | 0.023 | -15% | 75,120,302 | $74,670,353 |

| JAN | Janison Edu Group | 0.150 | -14% | 217,575 | $45,480,444 |

| PPG | Pro-Pac Packaging | 0.018 | -14% | 25,704 | $3,815,442 |

IN CASE YOU MISSED IT

Decidr Ai Industries (ASX:DAI) has expanded its board in preparation for the next phase of commercial scaling and global expansion of its Agentic AI platform, selecting Gordon Starkey as chief revenue officer and Kael Hudson as head of partnerships. The two brings extensive sofrware-as-a-service and partner-led commercial strategy experience, with the appointments intended to “reinforce Decidr’s momentum following major wins across Australia and the US in healthcare, media, finance, education and energy”.

Arovella Therapeutics (ASX:ALA) is moving to obtain two new licenses for novel chimeric antigen receptors (CARs) targeting solid tumours, including neuroblastoma and hepatocellular carcinoma. Both CARS have been studied in clinical trials, reducing the need for preclinical testing.

A US$175,122 research rebate from the Canadian Government has bolstered Recce Pharmaceuticals (ASX:RCE) funds, as the company works to develop a new class of synthetic anti-infectives to address the growing problem of antibiotic-resistant superbugs.

At Stockhead, we tell it like it is. While DecidrAI, Arovella Therapeutics and Recce Pharmaceuticals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: Energy stocks crumble, but XPON lights up the boards with a 300pc surge