Lunch Wrap: ASX up as Trump tariffs tossed by court, Nvidia fuels data centre rally

Wall Street’s AI charge and a court blow to Trump’s tariffs lit a fire under global markets, but the ASX held steady.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX data centre stocks surge after Nvidia’s earnings

Trump tariffs blocked by court

Oil jumps on tariff call

The ASX spent most of Thursday morning stuck in neutral gear, despite a roaring start from US futures.

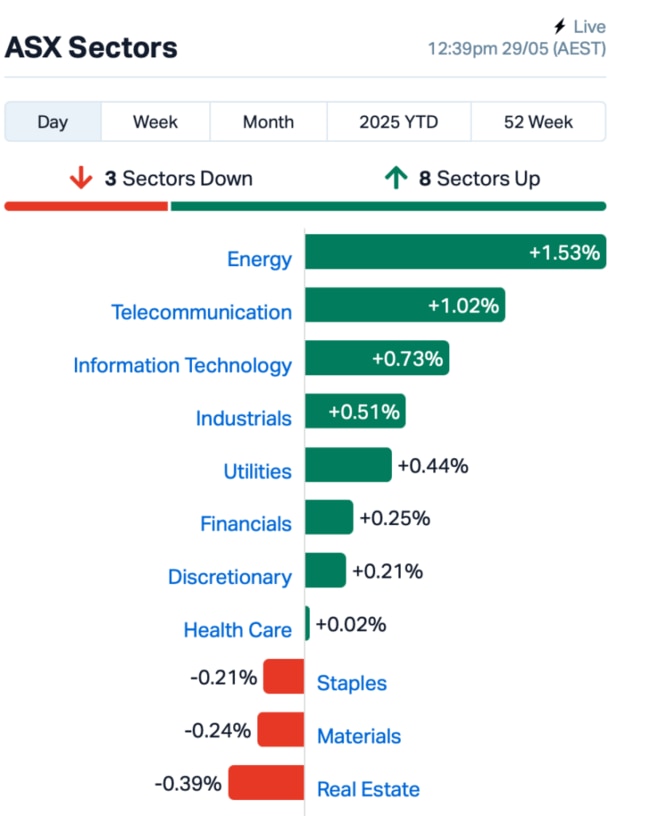

The ASX 200 swung back and forth before settling higher by midday, up by 0.2%.

Overnight on Wall Street, the vibe was very different.

Nvidia fired up the after-hours circuit, jumping over 5% thanks to a blockbuster earnings print: a 69% surge in Q1 sales as it ramps up production of its next-gen Blackwell chips.

CEO Jensen Huang turned up the volume too, talking up exponential AI demand, fresh investment flowing in from the Middle East, and a thaw in US-China trade tensions.

That was more than enough to jolt Nasdaq futures 1.7% higher this morning.

Market sentiment also turned positive after Federal judges in Oregon ruled Trump's sweeping global tariffs were illegally imposed.

Turns out you can’t just call a trade deficit a national emergency and start slapping on levies.

The judges rejected it outright and Trump is now appealing the decision. But for now, markets are breathing a sigh of relief.

Oil prices got a boost from the ruling. WTI immediately climbed past US$62 a barrel, Brent crude also cruised above US$65.

That mix of bullish tech and tariff relief also spilled over to ASX data centre stocks this morning.

Megaport (ASX:MP1) and DigiCo Infrastructure REIT (ASX:DGT) climbed 2%, and NextDC (ASX:NXT) followed suit, up 1%.

In large cap news, Champion Iron (ASX:CIA) flexed its muscle, rising 2.1% after posting a 44% jump in quarterly earnings. The EBITDA print of C$127.4m was 50% higher YoY and backed a 10 Canadian cents per share semi-annual dividend.

Woodside Energy Group (ASX:WDS) kept climbing, up another 3% after the Albanese government signed off on extending the life of its North West Shelf gas project to 2070. Two strong sessions in a row for the energy giant.

On the downside, Elders (ASX:ELD) slipped 1% after the ACCC flagged its $475 million play for Delta Agribusiness could crimp competition in rural supply chains.

And ... Resolute Mining (ASX:RSG) got smacked 2% after it said it was chasing clarification from the Guinean government amid reports that some of its permits might be in jeopardy.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 29 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.003 | 150% | 80,138,982 | $4,109,881 |

| TM1 | Terra Metals Limited | 0.037 | 42% | 8,643,506 | $10,793,512 |

| IVX | Invion Ltd | 0.115 | 35% | 963,243 | $7,201,936 |

| MTB | Mount Burgess Mining | 0.004 | 33% | 1,000,000 | $1,055,108 |

| OB1 | Orbminco Limited | 0.002 | 33% | 5,000,000 | $3,596,352 |

| TEM | Tempest Minerals | 0.004 | 33% | 228,000 | $2,203,590 |

| RMI | Resource Mining Corp | 0.030 | 30% | 6,006,280 | $15,304,332 |

| EDU | EDU Holdings Limited | 0.260 | 30% | 1,017,540 | $30,110,682 |

| TMG | Trigg Minerals Ltd | 0.088 | 28% | 41,222,053 | $63,747,023 |

| RCL | Readcloud | 0.140 | 27% | 112,860 | $16,898,174 |

| ENL | Enlitic Inc. | 0.030 | 25% | 268,231 | $17,313,813 |

| BP8 | Bph Global Ltd | 0.003 | 25% | 336,421 | $2,101,969 |

| RDS | Redstone Resources | 0.005 | 25% | 2,118,012 | $3,701,514 |

| ROG | Red Sky Energy. | 0.005 | 25% | 6,167,424 | $21,688,909 |

| COB | Cobalt Blue Ltd | 0.068 | 23% | 2,240,911 | $24,688,556 |

| VPRDB | Voltgroupltd | 0.120 | 20% | 15,266 | $16,074,312 |

| EM2 | Eagle Mountain | 0.006 | 20% | 19,843 | $5,675,186 |

| TEG | Triangle Energy Ltd | 0.003 | 20% | 2,465,660 | $5,223,085 |

| AKN | Auking Mining Ltd | 0.007 | 17% | 2,370,782 | $3,448,673 |

| AX8 | Accelerate Resources | 0.007 | 17% | 1,559,649 | $4,783,132 |

| LSR | Lodestar Minerals | 0.007 | 17% | 357,142 | $1,910,543 |

| TMS | Tennant Minerals Ltd | 0.007 | 17% | 200,000 | $5,735,342 |

| PLC | Premier1 Lithium Ltd | 0.011 | 16% | 228,638 | $3,496,576 |

| RPG | Raptis Group Limited | 0.030 | 15% | 250,000 | $4,558,903 |

| PTR | Petratherm Ltd | 0.310 | 15% | 1,339,332 | $93,315,988 |

Eden Innovations (ASX:EDE) has captured momentum with its EdenCrete Pz7 concrete additive, a product that makes standard concrete mixes stronger. Over the past three months, sales topped US$567k. In April and May alone, sales were 86% higher than the same quarter last year. Holcim US also ordered US$91k worth of Pz7 for a 22-storey high-rise in Denver, Eden’s first major commercial project.

Invion (ASX:IVX) just got the thumbs-up from the safety committee after treating the first six patients in its skin cancer trial. There are early signs the drug is shrinking tumours after one dose. INV043 also makes cancer cells glow under violet light, hinting it could double as a diagnostic tool. Invion is now gearing up for a second study with Peter Mac, combining the treatment with immunotherapy.

Trigg Minerals (ASX:TMG) has kicked off its first exploration campaign at Antimony Canyon in Utah, a site with a rich mining history but no modern exploration. The team is targeting old antimony mines and scouting spots for a potential smelter as part of its push to become a US-based supplier of critical minerals. Trigg said it’s in talks with US agencies about federal funding.

Almond grower Select Harvests (ASX:SHV) is back in profit territory, swinging from a $2.4 million loss to a $28.7 million net profit in the half. Earnings more than tripled to $60.7 million. Debt came down, cash flow turned positive, and the company reckons demand’s still strong. No interim dividend this time, but the crop’s clearly ripening.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 29 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MOM | Moab Minerals Ltd | 0.001 | -33% | 500,000 | $2,600,499 |

| RLL | Rapid Lithium Ltd | 0.002 | -33% | 147,966 | $3,734,834 |

| CTQ | Careteq Limited | 0.009 | -31% | 1,344,453 | $3,082,543 |

| GMN | Gold Mountain Ltd | 0.002 | -25% | 239,339 | $10,267,776 |

| MGU | Magnum Mining & Exp | 0.007 | -22% | 100,000 | $10,094,858 |

| NPM | Newpeak Metals | 0.011 | -21% | 317,020 | $4,509,004 |

| TGH | Terragen | 0.024 | -20% | 415,001 | $15,150,515 |

| AAU | Antilles Gold Ltd | 0.004 | -20% | 177,945 | $10,631,838 |

| AQX | Alice Queen Ltd | 0.004 | -20% | 12,800,280 | $5,734,450 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 598,062 | $4,349,768 |

| CR9 | Corellares | 0.002 | -20% | 1,500 | $2,514,016 |

| ERA | Energy Resources | 0.002 | -20% | 1,273,540 | $1,013,490,602 |

| JAV | Javelin Minerals Ltd | 0.002 | -20% | 97,024,174 | $15,115,373 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 13,334 | $7,937,639 |

| SHP | South Harz Potash | 0.004 | -20% | 41,501 | $5,513,644 |

| OLL | Openlearning | 0.015 | -17% | 99,553 | $8,688,144 |

| EPM | Eclipse Metals | 0.005 | -17% | 1,100,000 | $17,194,914 |

| GLL | Galilee Energy Ltd | 0.005 | -17% | 7,500 | $4,243,157 |

| LU7 | Lithium Universe Ltd | 0.005 | -17% | 302,360 | $4,715,878 |

| NES | Nelson Resources. | 0.003 | -17% | 80,000 | $6,515,783 |

| OVT | Ovanti Limited | 0.003 | -17% | 1,956,528 | $8,380,545 |

| RC1 | Redcastle Resources | 0.005 | -17% | 2,856,728 | $4,461,401 |

| CDE | Codeifai Limited | 0.006 | -14% | 262,000 | $2,282,222 |

| EMT | Emetals Limited | 0.003 | -14% | 1,849,999 | $2,975,000 |

| FGH | Foresta Group | 0.006 | -14% | 6,741,238 | $18,570,345 |

IN CASE YOU MISSED IT

An independent study comparing Altech Batteries (ASX:ATC) CERENERGY technology to alternatives including lithium-ion, sodium-sulphur and vanadium flow batteries has revealed several areas of superior performance. The sodium chloride solid state batteries developed by ATC offer comparative energy efficiencies to lithium-ion batteries, exceeding the other two chemistries, and matches or exceeds its rivals in overall lifetime, cycle life, safety, temperature range, and discharge duration.

At Stockhead, we tell it like it is. While Altech Batteries is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX up as Trump tariffs tossed by court, Nvidia fuels data centre rally