Lunch Wrap: ASX seesaws as Wisetech, uranium stocks reel in gains

Trump’s tariff delay gave markets a breather, WiseTech popped on a record deal, and uranium names lit up as the US backed nuclear.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Trump delays EU tariffs, markets breathe

WiseTech pops 5pc on $3.25b acquisition

Uranium stocks surge again on US nuclear push

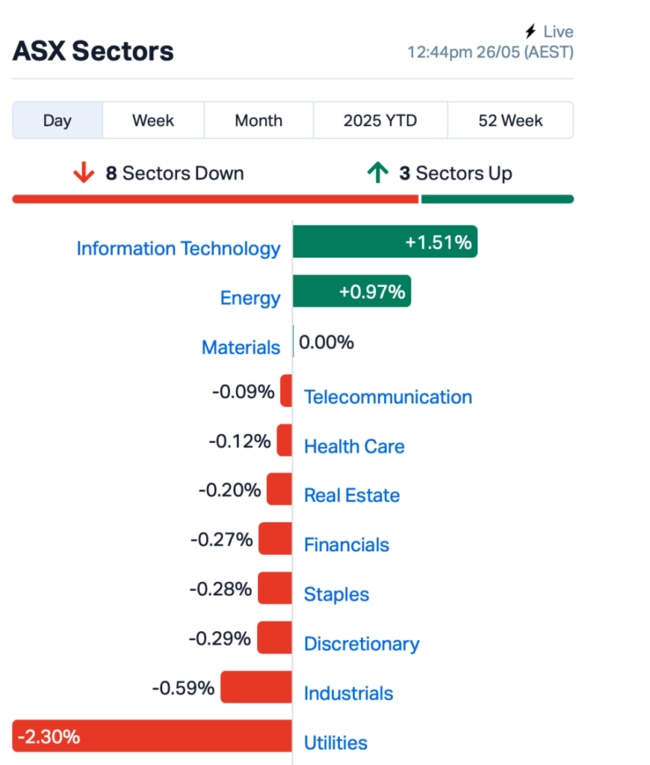

The ASX couldn’t quite decide which way to go on Monday, seesawing through the morning and eventually dipping a modest 0.05% by lunchtime AEST.

Investors watched as Donald Trump swing the tariff hammer, then quietly put it down.

On Friday, Trump threatened to slap 50% duties on all EU imports by June 1st, but then extended the deadline to July 9 in the last few hours after what he called a “friendly call” with EU Commission boss, Ursula von der Leyen.

That was enough to lift Wall Street futures higher this morning, with the Nasdaq and S&P 500 contracts both bouncing around 1%.

Gold took a breather on this latest news, with yellow metal softening and hovering near $US3,346 an ounce as this story goes to press.

But Trump’s tariff tantrums aren’t gone, they’re just on pause.

On Friday, he also rattled markets by threatening Apple with a 25% tax on iPhones not made in the US, dragging down tech stocks and giving Wall Street a sour send-off into the Memorial Day long weekend.

Back in Australia, it was a game of wait-and-see, with most large caps moving in tight ranges.

Except for WiseTech Global (ASX:WTC).

The logistics software giant surged over 6% after announcing its biggest-ever deal, shelling out $3.25 billion to acquire Texas-based e2open. WTC said the deal gets WiseTech closer to being the “operating system” for global trade.

While tech flexed on the back of WTC, uranium stocks lit up again like they did on Friday.

Trump has just signed a string of executive orders on Friday aimed at turbocharging America’s nuclear sector, and Aussie names felt the glow.

Boss Energy (ASX:BOE) jumped another 10.5% this morning, while Deep Yellow (ASX:DYL) and Paladin Energy (ASX:PDN) surged by more than 13%.

Meanwhile, Origin Energy (ASX:ORG) dragged down the utilities sector, falling 4% after telling investors it now expects earnings from UK-based Octopus Energy to swing into lossmaking territory, anywhere up to $100 million.

In other large cap moves, agri firm Elders (ASX:ELD) took a 6% knock despite reporting its half-year profit had more than doubled to nearly $50 million.

Livestock prices, better sentiment, and fatter margins helped, but competition and dry conditions on the retail side clearly spooked some investors.

And, Genesis Minerals (ASX:GMD) climbed 2.5% after locking in a $250 million deal to buy WA’s Laverton Gold Project from Focus Minerals (ASX:FML), which promptly rocketed 107% (see more below).

Genesis says the deal brings serious synergies, with the deposits set to feed its nearby Laverton mill. Genesis will fund the buy with a mix of cash and expanded finance.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 26 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| FML | Focus Minerals Ltd | 0.460 | 100% | 5,937,001 | $65,908,488 |

| LNR | Lanthanein Resources | 0.002 | 100% | 500,000 | $2,443,636 |

| ERA | Energy Resources | 0.003 | 50% | 3,497,471 | $810,792,482 |

| FTC | Fintech Chain Ltd | 0.003 | 50% | 452,029 | $1,301,539 |

| OB1 | Orbminco Limited | 0.002 | 50% | 31,288,136 | $2,397,568 |

| VML | Vital Metals Limited | 0.003 | 50% | 3,834,200 | $11,790,134 |

| GMN | Gold Mountain Ltd | 0.002 | 33% | 251,374 | $7,700,832 |

| MOM | Moab Minerals Ltd | 0.002 | 33% | 250,000 | $2,600,499 |

| TKL | Traka Resources | 0.002 | 33% | 501,227 | $3,188,685 |

| PLN | Pioneer Lithium | 0.120 | 32% | 491,140 | $3,873,113 |

| REZ | Resourc & En Grp Ltd | 0.017 | 31% | 500,000 | $8,731,309 |

| RMX | Red Mount Min Ltd | 0.009 | 29% | 4,779,756 | $3,254,705 |

| W2V | Way2Vatltd | 0.009 | 29% | 50,280,933 | $9,890,007 |

| AOK | Australian Oil. | 0.003 | 25% | 8,591,665 | $2,003,566 |

| AVE | Avecho Biotech Ltd | 0.005 | 25% | 2,651,126 | $12,693,855 |

| BYH | Bryah Resources Ltd | 0.005 | 25% | 4,443,625 | $3,479,814 |

| GTR | Gti Energy Ltd | 0.005 | 25% | 15,557,772 | $11,995,799 |

| HLX | Helix Resources | 0.003 | 25% | 700,000 | $6,728,387 |

| PKO | Peako Limited | 0.003 | 25% | 15,666 | $2,975,484 |

| VRL | Verity Resources | 0.030 | 23% | 9,663,649 | $6,634,243 |

| NNL | Nordicresourcesltd | 0.072 | 22% | 647,657 | $10,662,314 |

| CDEDC | Codeifai Limited | 0.006 | 20% | 250,000 | $1,585,157 |

| CR9 | Corellares | 0.003 | 20% | 334,672 | $2,514,016 |

| NES | Nelson Resources. | 0.003 | 20% | 2,500,000 | $5,429,819 |

As mentioned, Shandong Gold backed Focus Minerals (ASX:FML) has locked in a $250 million deal to sell its Laverton Gold Project to Genesis Minerals (ASX:GMD), with the sale expected to wrap up in early June. It’s a straight cash deal, no conditions attached, and Focus reckons it’s a smart move to cash in while gold prices are high. The payout will bulk up Focus’ balance sheet as it shifts focus to developing the Bonnie Vale underground mine and ramping up mining at Coolgardie.

Lanthanein Resources (ASX:LNR) has pulled the pin on its farm-in deal with Gondwana Resources for the Lady Grey Lithium Project. The agreement would have let it earn up to 70% of the project, but it’s now walking away to focus on other opportunities that better fit its game plan.

Red Mountain Mining (ASX:RMX) has confirmed multiple stibnite veins, key to antimony, at its Armidale Project in NSW, with an inferred strike of over 1km at Oaky Creek North. Coarse mineralisation was also found at Oaky Creek South, suggesting a broader system split by the Namoi Fault. With antimony prices surging past US$60,000 a tonne and global supply tightening, RMX sees strong tailwinds for its timing and ground position.

Fintech firm Way2VAT (ASX:W2V) has signed a major global contract with real estate giant JLL, covering around 25 of JLL’s entities worldwide. The deal includes using Way2VAT’s tech to automate VAT claims on travel, entertainment, and accounts payable invoices, plus its new APAI compliance platform. JLL, which operates in over 80 countries and pulls in more than US$20 billion a year, is expected to become a significant revenue source for Way2VAT.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 26 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AYM | Australia United Min | 0.002 | -33% | 67 | $5,527,732 |

| EDE | Eden Inv Ltd | 0.001 | -33% | 11,000 | $6,164,822 |

| JAY | Jayride Group | 0.001 | -33% | 5,807 | $2,141,834 |

| MRD | Mount Ridley Mines | 0.002 | -33% | 339,129 | $2,335,467 |

| OLI | Oliver'S Real Food | 0.004 | -33% | 141 | $3,244,392 |

| SFG | Seafarms Group Ltd | 0.001 | -33% | 252 | $7,254,899 |

| SKN | Skin Elements Ltd | 0.002 | -33% | 16,356 | $3,225,642 |

| TMX | Terrain Minerals | 0.002 | -33% | 667,500 | $6,745,670 |

| OSL | Oncosil Medical | 0.003 | -29% | 47,708,121 | $16,123,038 |

| CZN | Corazon Ltd | 0.002 | -25% | 120,000 | $2,369,145 |

| QXR | Qx Resources Limited | 0.003 | -25% | 470,480 | $5,241,315 |

| SPX | Spenda Limited | 0.007 | -22% | 1,503,944 | $41,536,939 |

| AMS | Atomos | 0.004 | -20% | 21,926 | $6,075,092 |

| ASR | Asra Minerals Ltd | 0.002 | -20% | 620,000 | $6,916,340 |

| BIT | Biotron Limited | 0.002 | -20% | 45,000 | $3,318,115 |

| ECT | Env Clean Tech Ltd. | 0.002 | -20% | 200,002 | $9,117,026 |

| KPO | Kalina Power Limited | 0.004 | -20% | 272 | $14,664,849 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 194,839 | $23,423,890 |

| AHN | Athena Resources | 0.005 | -17% | 659,278 | $13,595,742 |

| JAV | Javelin Minerals Ltd | 0.003 | -17% | 2,432,945 | $18,138,447 |

| MOH | Moho Resources | 0.005 | -17% | 364,150 | $4,472,484 |

| SRN | Surefire Rescs NL | 0.003 | -17% | 6,743,334 | $7,459,336 |

| GNM | Great Northern | 0.016 | -16% | 1,366 | $2,937,952 |

| BRX | Belararox | 0.097 | -16% | 438,757 | $18,144,559 |

IN CASE YOU MISSED IT

Aldoro Resources (ASX:ARN) said it was kicking off a strategic review after being approached by parties interested in its non-core exploration projects. It’s now weighing up options, including potential sales or other capital moves that could benefit shareholders.

The review won’t include its flagship Kameelburg niobium-REE project in Namibia which remains the main focus. The company believes that asset has the potential to be world class, possibly hosting a global top 3 niobium-REE deposit once a JORC resource is completed.

Projects under review include Niobe, Wyemandoo, Narndee and a majority stake in the EPL 7895 gold project.

No decision has been made yet, and it’s not guaranteed that any deal will happen. Aldoro says it’ll keep the market posted if anything material comes from the review.

Horseshoe Metals (ASX:HOR) is getting close to the start line at its Horseshoe Lights copper-gold project, with camp infrastructure mostly back up and running. It has sorted power, water and Starlink comms.

The site is being prepped to kick off Direct Shipping Ore (DSO) copper operations and sales from existing high-grade stockpiles, with a mining licence expected soon. It's also laying the groundwork for partner Melody Gold to process surface gold material. Exploration and drilling are also on the cards over the next few months.

Zenith Minerals (ASX:ZNC) is shifting gears at its Split Rocks project, pivoting from lithium to gold after spotting regional structures that haven’t been properly tested. Stockhead’s Tylah Tully breaks it all down in a new video now ready to watch.

Meanwhile, Tylah also dives into New Age Exploration (ASX:NAE) ’s Wagyu project, where fresh gold hits are drawing comparisons to De Grey’s monster Hemi find.

At Stockhead, we tell it like it is. While Aldoro Resources, Horseshoe Metals, Zenith Minerals and New Age Exploration are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX seesaws as Wisetech, uranium stocks reel in gains