Lunch Wrap: ASX creeps lower as IperionX lands Pentagon payday

The ASX has dipped a tad after inching toward record highs earlier. Lynas is riding a rare earths tailwind, while IperionX has scored a major Pentagon deal.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX creeps lower despite miners lifting

Lynas pops 8pc on China rare earths squeeze

IperionX lands $152m Pentagon titanium deal

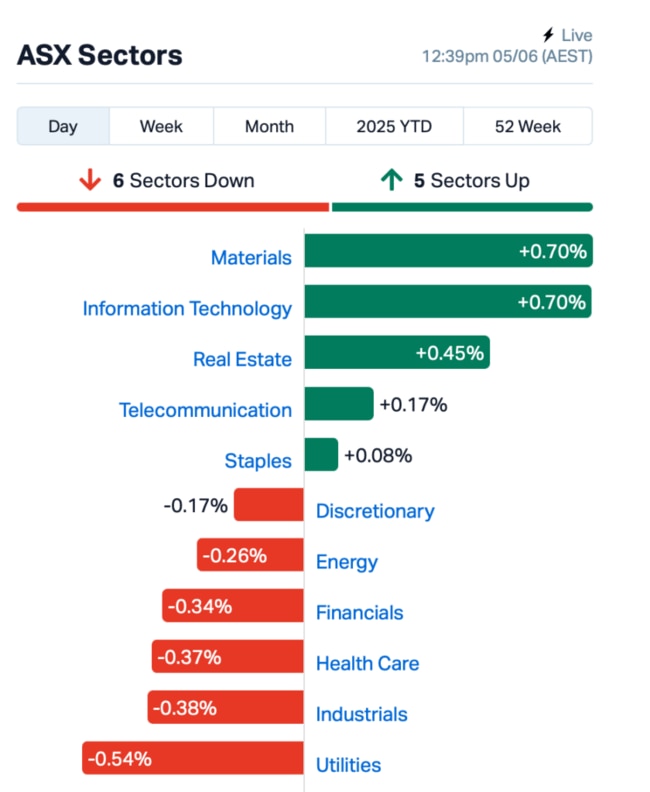

The ASX inched lower by 0.1% at lunch time AEST on Thursday.

Miners such as Fortescue (ASX:FMG), which was up by 1%, did the heavy lifting. And Lynas (ASX:LYC) went ballistic, up 10%, after a bit of good news for the rare earths space.

Turns out some of Europe’s biggest carmakers are starting to feel the pinch from China’s rare earths export controls, and Lynas is quickly shaping up as a reliable alternative in a tightening market.

In the US overnight, bond yields sank as traders piled into bets that the Fed might deliver not just one, but two rate cuts this year.

September is looking like a sure thing now, and you could almost hear the doves cooing from Capitol Hill.

Tech sentiment, meanwhile took a wobble after Apple was downgraded by Needham, who reckons it’s falling behind in the AI race.

Tesla dropped over 3% after Elon Musk went on a full-tilt political offensive, blasting Trump’s new tax plan as a “disgusting abomination” and telling Americans to “kill the bill.”

Back home to the ASX, where just five of 11 sectors were flashing green.

The headline of the morning came from $1.4bn market-capped IperionX (ASX:IPX), the titanium player that just scored a golden ticket from the Pentagon.

Shares in IperionX rocketed 21% after the company locked in a contract worth up to US$99 million with the US Department of Defense.

It’s a Phase III SBIR deal, what it really means is IPX has graduated from R&D to full-blown production. The first orders will focus on titanium fasteners for defence agencies, with all the kit built at its plant in Virginia.

It’s a big nod of confidence for Iperion X, and a win for the US as it tries to wean itself off foreign suppliers.

Meanwhile, Magellan Financial Group (ASX:MFG) kept bleeding, but at least it’s not gushing anymore.

The fundie has just posted $400 million in outflows for May, down from $1 billion the month before. Assets under management inched higher across most of its strategies, with infrastructure holding steady. Total AUM now sits at $39.3 billion.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for June 5 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| EV1 | Evolutionenergy | 0.014 | 75% | 2,147,660 | $2,901,204 |

| ADD | Adavale Resource Ltd | 0.002 | 50% | 400,066 | $2,287,279 |

| AUH | Austchina Holdings | 0.002 | 50% | 27,230 | $3,025,384 |

| AOA | Ausmon Resorces | 0.002 | 33% | 375,000 | $1,966,820 |

| EEL | Enrg Elements Ltd | 0.002 | 33% | 1,000,000 | $4,880,668 |

| ZEU | Zeus Resources Ltd | 0.012 | 33% | 12,469,218 | $5,766,058 |

| GTR | Gti Energy Ltd | 0.005 | 29% | 33,710,486 | $10,496,324 |

| EDE | Eden Inv Ltd | 0.003 | 25% | 2,498,367 | $8,219,762 |

| ENT | Enterprise Metals | 0.003 | 25% | 100,108 | $2,356,635 |

| ENV | Enova Mining Limited | 0.010 | 25% | 44,085,113 | $11,308,006 |

| OLI | Oliver'S Real Food | 0.005 | 25% | 30,000 | $2,162,928 |

| TMX | Terrain Minerals | 0.003 | 25% | 22,788 | $4,497,113 |

| ION | Iondrive Limited | 0.027 | 23% | 5,953,328 | $26,022,399 |

| LAM | Laramide Res Ltd | 0.875 | 22% | 580 | $14,828,157 |

| CDE | Codeifai Limited | 0.017 | 21% | 992,179 | $4,564,445 |

| IRX | Inhalerx Limited | 0.040 | 21% | 1,221,477 | $7,043,791 |

| HWK | Hawk Resources. | 0.018 | 20% | 2,008,040 | $4,063,942 |

| ATX | Amplia Therapeutics | 0.060 | 20% | 5,836,140 | $19,397,633 |

| ALY | Alchemy Resource Ltd | 0.006 | 20% | 871,491 | $5,890,381 |

| OMG | OMG Group Limited | 0.006 | 20% | 966,720 | $3,641,474 |

| PER | Percheron | 0.012 | 20% | 3,787,762 | $10,874,376 |

| TEG | Triangle Energy Ltd | 0.003 | 20% | 2,550,000 | $5,223,085 |

GTI Energy (ASX:GTR) says early numbers from its Lo Herma uranium project in Wyoming look promising, pointing to a potential low-cost in-situ recovery (ISR) operation producing around 800,000 pounds of uranium a year. The scoping study was run by Wyoming-based experts BRS Engineering and outlines a seven-year plan with a total production target of nearly 6 million pounds.

It’s still early days, though – most of the resource is in the lower-confidence “Inferred” category, so there’s no guarantee the uranium’s all there or that it’ll stack up economically just yet.

FireFly Metals (ASX:FFM) has locked in a C$25.8 million (~A$28.8m) funding deal with BMO in Canada and another $46 million from Aussie investors through placements and a share purchase plan.

The funds will go towards advancing its Green Bay copper-gold project in Canada, including underground development, drilling, and pre-construction work. It’s a big step forward as it looks to push Green Bay closer to production.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for June 5 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| OVT | Ovanti Limited | 0.002 | -33% | 3,711,682 | $8,380,545 |

| PIL | Peppermint Inv Ltd | 0.002 | -33% | 2,830,000 | $6,828,269 |

| GMN | Gold Mountain Ltd | 0.002 | -25% | 1,347,106 | $11,239,518 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 655,257 | $15,867,318 |

| MEM | Memphasys Ltd | 0.004 | -20% | 30,805 | $9,917,991 |

| 1AD | Adalta Limited | 0.003 | -17% | 5,146,114 | $3,020,120 |

| AJL | AJ Lucas Group | 0.005 | -17% | 624,546 | $8,254,378 |

| IFG | Infocusgroup Hldltd | 0.005 | -17% | 2,989 | $1,655,771 |

| JAV | Javelin Minerals Ltd | 0.003 | -17% | 537,500 | $18,378,447 |

| RFT | Rectifier Technolog | 0.005 | -17% | 20,000 | $8,291,904 |

| EPM | Eclipse Metals | 0.016 | -16% | 18,423,152 | $54,450,562 |

| QEM | QEM Limited | 0.051 | -15% | 57,568 | $11,450,021 |

| RDN | Raiden Resources Ltd | 0.006 | -14% | 2,515,475 | $24,156,240 |

| SRJ | SRJ Technologies | 0.012 | -14% | 769,489 | $8,478,093 |

| PEB | Pacific Edge | 0.091 | -13% | 2,752 | $85,251,177 |

| OLY | Olympio Metals Ltd | 0.034 | -13% | 579,499 | $3,434,625 |

| AVW | Avira Resources Ltd | 0.007 | -13% | 17,217 | $1,754,286 |

| KLI | Killiresources | 0.028 | -13% | 97,087 | $4,487,160 |

| PNT | Panthermetalsltd | 0.014 | -13% | 798,024 | $4,814,473 |

| WCE | Westcoastsilver Ltd | 0.080 | -11% | 1,807,262 | $23,410,888 |

| WWG | Wisewaygroupltd | 0.160 | -11% | 12,954 | $30,123,575 |

| ANX | Anax Metals Ltd | 0.008 | -11% | 1,596,673 | $7,945,268 |

| LCY | Legacy Iron Ore | 0.008 | -11% | 25,000 | $87,858,383 |

Tyro Payments (ASX:TYR) crashed 11% after announcing that CEO Jon Davey is stepping down. He’s been offered a new private equity gig, based in Melbourne. Davey’s been with Tyro since 2021, arriving via the Medipass acquisition and moving into the top job the following year. He’ll hang around for up to six months to help with the handover.

IN CASE YOU MISSED IT

Two collaborative drilling grants totalling $400,000 have been awarded to Red Metal (ASX:RDM) to test targets across the Gulf and Three Ways copper-gold assets.

Challenger Gold (ASX:CEL) has rolled out a toll treatment PFS that reveals a low-cost, near-term production path at Hualilán in Argentina.

Challenger also raised $34.5 million to advance its Hualilan gold project into production, with first cash flows expected soon.

Nordic Resources (ASX:NNL) has some intriguing projects with close to 1Moz gold in its portfolio after completing its Finnish acquisitions.

Locksley Resources (ASX:LKY) is progressing tenders for upcoming drilling at its El Campo rare earths prospect in California after being awarded drill permits.

Assays from White Cliff Minerals’ (ASX:WCN) maiden RC drilling at the Rae project in Canada have returned 105m at 2.25% copper with higher-grade intervals up to 3.93%.

DY6 Metals (ASX:DY6) has got first boots on the ground at its rutile projects in Cameroon in preparation of a maiden campaign.

Future Battery Minerals (ASX:FBM) is increasing its gold footprint near Coolgardie by applying for seven new contiguous tenement applications at Burbanks East.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX creeps lower as IperionX lands Pentagon payday