Lunch Wrap: ASX climbs again, Burry shorts Nvidia, Appen roars back

The ASX is flying on rate-cut buzz, Appen’s made a surprise comeback, but Burry’s turned bearish, shorting Nvidia.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX eyes eight-day winning streak as rate-cut buzz builds

Appen rockets 22pc on profit guidance

Burry dumps stocks, bets against Nvidia and China tech

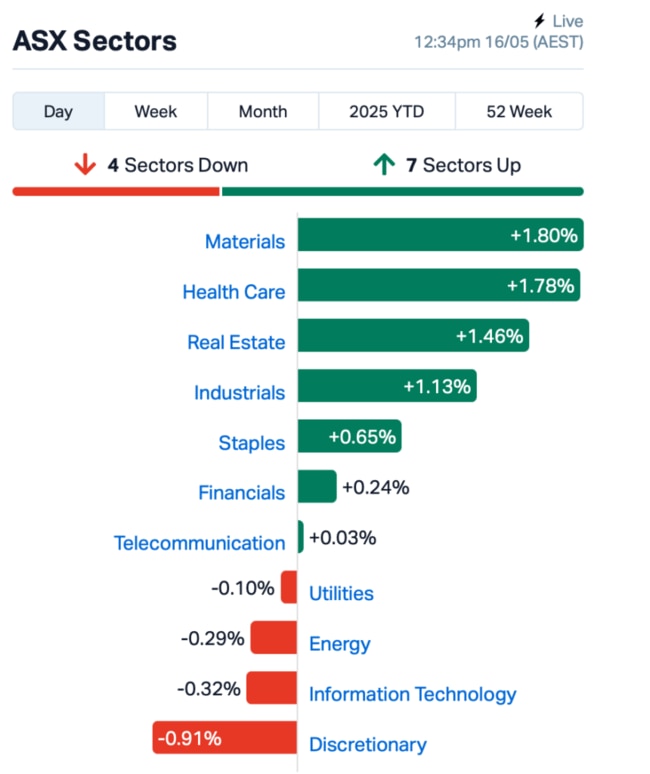

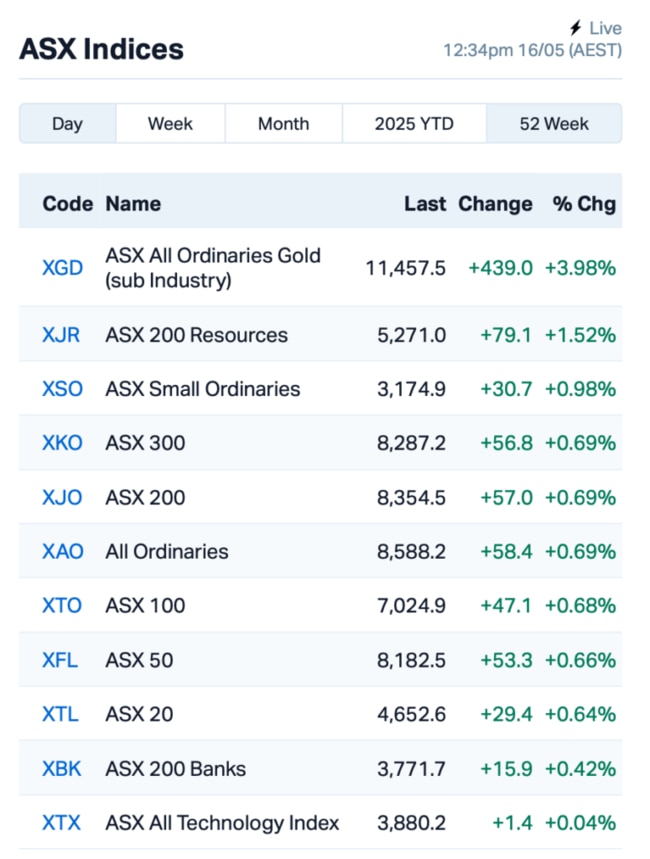

The ASX is having a ripper run.

Eight straight days of gains, and on Friday morning it came close to a three-month high, up 0.7% at lunch time, AEST.

The spark this morning was a mix of wobbly economic data out of the US, and growing bets that central banks – both here and in the States – are getting itchy fingers on the interest rate trigger.

Over in America, producer prices dropped harder than expected (biggest fall in five years), and retail sales came in soft.

That had markets whispering about rate cuts, two, in fact, now fully priced in for the US this year.

US 10-year bond yields tumbled on the news, gold rallied, and the S&P 500 gained 0.4%.

Amazon fell over 2% after more job cuts hit its Alexa division. That’s 27,000 layoffs since 2022, even Alexa didn’t see that one coming.

Elsewhere, oil prices slipped another 2% as Iran nuclear deal talk stirred fears of even more crude in an already soggy market.

Meanwhile, Michael Burry (of The Big Short film fame) is back in the headlines.

According to fresh filings, Burry has hit the sell button on just about everything in his fund, Scion Asset Management.

He’s now betting against Nvidia with a stack of put options, and has turned cold on Chinese tech giants like Alibaba, Baidu and JD.com, which he used to hold long.

Burry could be ahead of the curve again here… or way off it. Only time will tell.

Back home on the ASX, banks were off to the races.

Commonwealth Bank (ASX:CBA) surged to a new all-time high of $172.92 before retreating to around $170.

Iron ore, gold miners also rallied, and healthcare joined the fun, with CSL (ASX:CSL) up almost 2% on no news.

The real screamer of the morning, however, was AI data firm Appen (ASX:APX) , which just skyrocketed 23% on the back of some long-overdue good news.

At its AGM, the once market darling said it’s targeting full-year revenue between $235m and $260m, and reckons it’ll actually turn a profit this year. Investors clearly liked what they heard.

Elsewhere, property stock Dexus (ASX:DXS) was licking its wounds.

It dipped nearly 2% after being accused of breaking confidentiality rules while trying to offload its 27% stake in APAC, the outfit behind Melbourne and Launceston Airports.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 16 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ERA | Energy Resources | 0.002 | 100% | 7,081,387 | $405,396,241 |

| NPM | Newpeak Metals | 0.018 | 100% | 2,594,516 | $2,898,646 |

| VPR | Voltgroupltd | 0.002 | 50% | 300,282 | $10,716,208 |

| AMN | Agrimin Ltd | 0.076 | 38% | 61,341 | $18,879,453 |

| ZMM | Zimi Ltd | 0.011 | 38% | 127,741 | $3,420,351 |

| M2R | Miramar | 0.004 | 33% | 120,000 | $2,990,470 |

| OSL | Oncosil Medical | 0.004 | 33% | 170,022 | $13,819,747 |

| OVT | Ovanti Limited | 0.004 | 33% | 1,000,000 | $8,380,545 |

| RMI | Resource Mining Corp | 0.017 | 31% | 12,378,672 | $8,650,275 |

| XPN | Xpon Technologies | 0.015 | 25% | 5,617,186 | $4,971,039 |

| EAT | Entertainment | 0.005 | 25% | 1,000 | $5,235,144 |

| HCF | Hghighconviction | 0.041 | 24% | 174,958 | $640,414 |

| APX | Appen Limited | 1.515 | 23% | 20,257,756 | $325,028,699 |

| AM5 | Antares Metals | 0.011 | 22% | 8,000,147 | $4,633,676 |

| ECS | ECS Botanics Holding | 0.011 | 22% | 7,439,000 | $11,664,446 |

| BRX | Belararoxlimited | 0.120 | 20% | 271,235 | $15,652,235 |

| MOH | Moho Resources | 0.006 | 20% | 190,112 | $3,654,373 |

| SPX | Spenda Limited | 0.006 | 20% | 7,296,597 | $23,076,077 |

| TMK | TMK Energy Limited | 0.003 | 20% | 325,705 | $25,555,958 |

| DTR | Dateline Resources | 0.038 | 19% | 57,718,087 | $88,498,196 |

| FBM | Future Battery | 0.020 | 18% | 296,046 | $11,369,701 |

| PFT | Pure Foods Tas Ltd | 0.020 | 18% | 1,863 | $2,302,236 |

| ESK | Etherstack PLC | 0.340 | 17% | 696,864 | $38,329,881 |

ECS Botanics (ASX:ECS) is set for a record cannabis harvest, with most of its 6-tonne outdoor crop now high-value A-grade flower. The company said it’s cutting costs, boosting margins, and launching four new premium strains in June. With strong demand and upgrades underway, ECS says it’s still on track for positive cash flow this year.

Moho Resources (ASX:MOH) has uncovered a 4km-long gold anomaly at its Silver Swan North project near Kalgoorlie, the first real gold sniff at a site once chased for nickel. The hotspot includes a higher-grade 1.4km core and sits just 2km from Horizon’s Black Swan plant, smack in the middle of WA’s gold-rich Eastern Goldfields. Moho reckons it’s a promising sign of what’s sitting beneath.

TMK Energy (ASX:TMK) has offloaded its 20% stake in the Talisman Deeps Project, clearing the decks to focus fully on its Mongolian coal seam gas play. TMK will pocket a deferred $1 million if production ever kicks off at Talisman, but for now, the sale means no more risk or spend on the offshore WA project. TMK says it’s all about Mongolia from here.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 16 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.001 | -33% | 1,110,000 | 6,164,822 |

| MEL | Metgasco Ltd | 0.002 | -33% | 48,000 | 4,372,760 |

| AOA | Ausmon Resorces | 0.002 | -25% | 192,534 | 2,622,427 |

| SFG | Seafarms Group Ltd | 0.002 | -25% | 89,018 | 9,673,198 |

| DSK | Dusk Group | 0.920 | -21% | 981,347 | 72,853,402 |

| CP8 | Canphosphateltd | 0.020 | -20% | 21,771 | 7,669,013 |

| ASR | Asra Minerals Ltd | 0.002 | -20% | 976,495 | 6,765,117 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 366,132 | 15,867,318 |

| C7A | Clara Resources | 0.004 | -20% | 3,116 | 2,558,021 |

| CTN | Catalina Resources | 0.002 | -20% | 2,700,278 | 6,065,048 |

| PPG | Pro-Pac Packaging | 0.016 | -20% | 93,472 | 3,633,754 |

| OD6 | Od6Metalsltd | 0.025 | -17% | 183,765 | 4,814,039 |

| SCN | Scorpion Minerals | 0.015 | -17% | 391,601 | 9,433,011 |

| DTI | DTI Group Ltd | 0.005 | -17% | 2,663,510 | 2,691,308 |

| FBR | FBR Ltd | 0.005 | -17% | 10,476,321 | 34,136,713 |

| MBK | Metal Bank Ltd | 0.010 | -17% | 754 | 5,969,508 |

| NOR | Norwood Systems Ltd. | 0.020 | -17% | 1,284,180 | 11,750,684 |

| TEG | Triangle Energy Ltd | 0.003 | -17% | 508,122 | 6,267,702 |

| WBE | Whitebark Energy | 0.005 | -17% | 819,370 | 3,454,733 |

| QEM | QEM Limited | 0.045 | -15% | 78,578 | 10,114,185 |

| EEG | Empire Energy Ltd | 0.175 | -15% | 1,407,508 | 208,547,160 |

| X2M | X2M Connect Limited | 0.018 | -14% | 105,295 | 8,151,819 |

| AN1 | Anagenics Limited | 0.006 | -14% | 1,086,148 | 3,474,243 |

| CLA | Celsius Resource Ltd | 0.006 | -14% | 1,758,694 | 20,352,998 |

IN CASE YOU MISSED IT

Hillgrove Resources (ASX:HGO) has selected industrial minerals and logistics expert Luke Anderson as its new chief financial officer, effective June 2.

Anderson has more than 30 years’ executive leadership experience, having held senior positions with One Rail Australia, OZ Minerals, Unimin Corporation and most recently as CEO of Andromeda Metals (ASX:ADN).

He will lead finance, governance, reporting and planning functions and play a key role in supporting Hillgrove’s long-term growth strategy.

At Stockhead, we tell it like it is. While Hillgrove Resources and Andromeda Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX climbs again, Burry shorts Nvidia, Appen roars back