High Voltage: Trump’s 721pc tariffs could see price spike for graphite

Argonaut research says US graphite tariffs will lift prices as near-term projects rush to get up and producing.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

US announces 721% tariff on Chinese natural and synthetic graphite

Argonaut Research says prices could lift to US$36/kg

Renascor Resources says near-term producers set to benefit

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, and vanadium.

The US/China tariff trade war has highlighted the need for Western countries to shore up domestic supply chains, particularly around minerals critical to defence and tech applications like graphite.

Graphite is crucial in lithium-ion batteries, acting as the anode material. In fact, there’s more graphite in a lithium-ion battery than there is lithium.

China has a stranglehold on global graphite supply, with 98% of graphite anode material (both natural and synthetic) coming from China.

And the US Department of Commerce (DoC) has recently decided to impose countervailing duty (CVD) tariffs of up to 721% on synthetic and natural graphite anode material imported from China.

It’s a preliminary determination, with the final determinations and potential implementation not expected until December this year, but Argonaut Research analyst Jon Scholtz said in a recent note that we could see a jump in prices as a result.

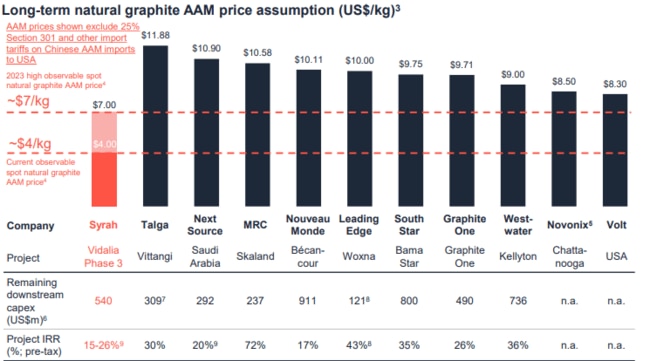

“ anode material price US$4-7/kg,” he said.

“So, at US$5/kg and 50kg of graphite anode, this is US$250 worth of graphite in each EV (0.5% of average EV selling price).

“The tariff could lift prices to ~US$36/kg which is ~US$1800 per EV (3.6% of average EV selling price).”

Quickest project to production wins

It’s not all doom and gloom, however. The tariff/trade war could present opportunities for ASX stocks with a near-term development projects.

Scholtz pointed to Syrah Resources' (ASX:SYR) 11,250tpa Vidalia active anode materials plant, which is ramping up in the US and has the potential for expansion to 45,000tpa (targeted by 2028) and long term aspirations of >100ktpa. Syrah investors breathed a sigh of relief this week, when the firm allayed concerns an as yet unmet deadline for qualification by key customer Tesla had been put back from May 31 this year to February 9, 2026.

There’s also Novonix (ASX:NVX) with its Riverside facility in Chattanooga, Tennessee, which is poised to become the first large-scale production site dedicated to high-performance synthetic graphite for the battery sector in North America. The project is targeting a 3000tpa start-up this year, growing to to 15-20,000tpa by 2030, with long term aspirations of capacity around 150,000tpa.

NVX CEO Michael O’Kronley welcomed the DoC decision. “This decision is an important step in supporting the United States’ goal of developing critical mineral supply domestically for increased energy independence,” he said in recent statement.

Renascor Resources (ASX:RNU) is another player with a stake in the game, with MD David Christensen noting there are opportunities in the sector if a project can get into production quickly.

While not based in the United States itself, the potential tariffs against Chinese exporters could open a window of opportunity to access the US market from its Siviour project in South Australia, the most advanced graphite development in Oz.

“This threatens to change the status quo in the graphite and anode sectors, which have seen China achieve market dominance over the last several years,” he said.

“In particular, it favours the most competitive ex-China projects and those that can quickly move into production.”

Sivious is expected to be one of the world’s lowest cost projects, with costs of US$405/t of graphite concentrate in the first 10 years.

Currently, RNU is advancing optimisation studies and is also looking to commission a purified spherical graphite (PSG) demonstration plant later this year.

“From a practical perspective, we expect the impact on the anode market to be a greater advantage for established suppliers who have either underutilised capacity or can quickly bring new capacity online,” Christensen said.

“These groups have already made large capital commitments, so have greater ability to fill ex-China demand.

“We’ve already seen some significant announcements out of South Korea and Japan from incumbent anode producers.

“We are also seeing tier 1 Chinese anode producers establish production ex-China.”

Other Aussie graphite companies could be poised to benefit if demand from American and European customers who want to excise their operations from Chinese supply chains – subject to dumping accusations – spurs interest in developing new projects in the West.

Kingsland Minerals (ASX:KNG) is among those with its Leliyn project in the Northern Territory, which with an inferred resource of 180.2Mt at 7.2% total graphitic content and indicated resource of 12.3Mt at 7.9% TGC, holds the largest in situ graphite resource in Australia.

An even larger exploration target extends beyond that of 700-1.1Bt at 7-8% TGC, with a recently commissioned scoping study led by GR Engineering Services (ASX:GNG) to focus on just a fraction of the project's massive 12km strike zone.

"This is a crucial step in the development of the Leliyn Graphite Project," Kingsland MD Richard Maddocks said on the commissioning of the study earlier this month.

"We are very pleased to be working with GR Engineering Services to assess the potential of this project. GRES has considerable global experience in the delivery of scoping and feasibility studies and the design and construction of processing facilities.

"They also have particular expertise in the design of graphite processing infrastructure."

Other Aussie graphite proponents include iTech Minerals (ASX:ITM), which boasts the Lacroma, Sugarloaf and Campoona deposits north of Siviour on South Australia's Eyre Peninsula.

It boasts a global mineral resource of 35.2Mt at 6% TGC, with test work already showing the project can produce a 94% graphite concentrate with material suitable for the key battery market.

Over in WA a number of players are looking to potentially commercialise graphite resources including Buxton Resources (ASX:BUX), which owns the 20.7Mt at 10.8% TGC Graphite Bull project, International Graphite (ASX:IG6), which owns the Springdale deposit and proposed Collie plant, and Green Critical Minerals (ASX:GCM), which last year said it had completed a stage 3 earn in that would give the firm 80% of the 1.1Mt McIntosh project.

GCM has caught market interest this year thanks to its acquisition of the breakthrough very high density graphite block tech.

Battery Metals Winners and Losers

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese and vanadium is performing >>>

Code Company Price % Week % Month % Six Month % Year Market Cap NWC New World Resources 0.047 68% 88% 135% 18% $166,440,241 YAR Yari Minerals Ltd 0.01 67% 150% 233% 150% $4,437,692 RIL Redivium Limited 0.004 60% 0% 0% 33% $13,609,422 CTN Catalina Resources 0.003 50% 50% 7% 7% $7,278,057 OB1 Orbminco Limited 0.0015 50% 50% -10% -55% $3,596,352 LLI Loyal Lithium Ltd 0.13 48% 88% 18% -46% $13,095,298 TKL Traka Resources 0.002 33% 0% 33% 33% $4,251,580 OM1 Omnia Metals Group 0.013 30% 30% -83% -83% $3,039,284 SLM Solismineralsltd 0.1 30% 19% 11% -5% $12,980,463 COB Cobalt Blue Ltd 0.07 27% 11% 3% -24% $24,688,556 HRE Heavy Rare Earths 0.038 27% 90% 0% 10% $7,489,220 STK Strickland Metals 0.1325 26% 38% 74% 20% $294,106,774 CNB Carnaby Resource Ltd 0.35 25% 27% -13% -54% $84,503,878 FRS Forrestaniaresources 0.085 23% 107% 507% 85% $26,392,489 BCA Black Canyon Limited 0.061 22% 2% 5% -49% $7,908,692 KM1 Kalimetalslimited 0.1 22% 11% -17% -75% $7,696,094 OD6 Od6Metalsltd 0.034 21% 48% 10% -46% $5,455,910 ODE Odessa Minerals Ltd 0.006 20% 0% -14% 50% $11,196,728 EV1 Evolutionenergy 0.012 20% 0% -57% -81% $3,989,155 DEV Devex Resources Ltd 0.095 19% 10% -17% -78% $41,518,923 MTM MTM Critical Metals 0.34 17% 51% 400% 656% $160,537,274 LSR Lodestar Minerals 0.007 17% -59% -65% -78% $1,910,543 EFE Eastern Resources 0.029 16% 12% -9% -52% $3,404,429 FG1 Flynngold 0.029 16% 32% 0% -3% $12,130,811 GW1 Greenwing Resources 0.03 15% 0% -27% -58% $8,234,997 GCM Green Critical Min 0.015 15% 36% 150% 400% $29,447,674 BKT Black Rock Mining 0.031 15% 55% -21% -50% $47,022,076 PVT Pivotal Metals Ltd 0.008 14% 14% 0% -64% $7,257,807 TKM Trek Metals Ltd 0.065 14% 3% 225% 55% $38,723,709 LOT Lotus Resources Ltd 0.1875 14% 14% -20% -58% $485,793,226 REC Rechargemetals 0.017 13% 21% -37% -56% $4,368,829 AXN Alliance Nickel Ltd 0.035 13% 0% -17% -27% $25,404,387 IMI Infinitymining 0.009 13% -25% -36% -80% $3,384,126 TAR Taruga Minerals 0.009 13% -10% -10% 13% $6,423,787 QPM QPM Energy Limited 0.038 12% 0% -10% -3% $98,486,311 A8G Australasian Metals 0.077 12% 10% 0% -21% $4,457,509 AZI Altamin Limited 0.029 12% 21% 4% -18% $15,511,578 GRL Godolphin Resources 0.01 11% 0% -29% -64% $4,488,733 MEI Meteoric Resources 0.11 11% 5% 18% -44% $245,370,592 AXE Archer Materials 0.31 11% 22% 2% -26% $75,179,869 AQD Ausquest Limited 0.054 10% 8% 391% 249% $77,723,998 ASO Aston Minerals Ltd 0.022 10% 16% 144% 38% $29,786,478 THR Thor Energy PLC 0.011 10% 0% -15% -35% $7,818,688 PBL Parabellumresources 0.045 10% -10% -10% 5% $2,803,500 VMC Venus Metals Cor Ltd 0.115 10% 5% 64% 25% $23,045,120 QEM QEM Limited 0.059 9% 20% 48% -60% $10,305,019 NWM Norwest Minerals 0.012 9% 0% -26% -62% $9,952,225 AR3 Austrare 0.062 9% -44% -34% -43% $13,567,191 WA1 Wa1Resourcesltd 13.275 8% 10% -16% -34% $897,234,032 JMS Jupiter Mines. 0.2 8% 33% 38% -39% $372,597,935 ZNC Zenith Minerals Ltd 0.043 8% -10% 2% -38% $17,519,981 OCN Oceanalithiumlimited 0.058 7% 115% 123% 43% $7,974,790 SRL Sunrise 0.445 7% -25% 85% -20% $40,602,374 STM Sunstone Metals Ltd 0.015 7% 25% 114% 25% $93,576,601 CY5 Cygnus Metals Ltd 0.075 7% -21% -40% -1% $63,834,875 GBR Greatbould Resources 0.066 6% -12% 57% 10% $50,955,703 LIN Lindian Resources 0.13 6% 18% 33% 8% $155,678,252 FBM Future Battery 0.0175 6% -3% -8% -56% $12,038,507 A11 Atlantic Lithium 0.1375 6% -2% -38% -69% $95,307,756 GED Golden Deeps 0.019 6% 0% -30% -54% $3,365,388 LIT Livium Ltd 0.0095 6% 19% -47% -63% $16,905,071 BOA BOA Resources Ltd 0.019 6% 6% -14% -17% $2,220,351 CTM Centaurus Metals Ltd 0.385 5% -1% -10% -25% $181,295,943 PLL Piedmont Lithium Inc 0.1 5% -20% -44% -53% $60,320,207 DM1 Desert Metals 0.02 5% 5% -17% -9% $8,403,445 NVX Novonix Limited 0.4525 5% 3% -34% -39% $289,418,875 PGM Platina Resources 0.021 5% 0% 11% -25% $12,463,607 BUX Buxton Resources Ltd 0.044 5% 38% -10% -56% $12,010,916 ICL Iceni Gold 0.066 5% 0% 22% 0% $20,386,442 LPM Lithium Plus 0.068 5% 10% -32% -30% $9,033,120 GT1 Greentechnology 0.024 4% -17% -61% -75% $11,404,081 TOR Torque Met 0.12 4% 26% 173% -43% $32,359,671 HAW Hawthorn Resources 0.05 4% 14% 4% -29% $16,750,781 ARR American Rare Earths 0.26 4% -5% -2% -4% $134,467,174 NIC Nickel Industries 0.685 4% 32% -23% -29% $2,907,757,036 PSC Prospect Res Ltd 0.14 4% -5% 40% -32% $94,975,325 MEK Meeka Metals Limited 0.14 4% -3% 94% 289% $352,163,724 RVT Richmond Vanadium 0.14 4% -13% -46% -49% $29,573,789 ADV Ardiden Ltd 0.15 3% 3% 15% 0% $9,377,626 WR1 Winsome Resources 0.15 3% -17% -66% -88% $36,584,018 PTR Petratherm Ltd 0.31 3% 29% 88% 1309% $93,315,988 S2R S2 Resources 0.094 3% -15% 34% -22% $43,474,367 SYA Sayona Mining Ltd 0.0165 3% -18% -48% -62% $184,692,736 ASM Ausstratmaterials 0.515 3% -28% 4% -48% $94,297,155 LYC Lynas Rare Earths 7.815 3% -9% 15% 16% $7,436,802,632 PUR Pursuit Minerals 0.041 3% -5% -67% -82% $4,089,092 WIN WIN Metals 0.0205 3% 3% -2% -43% $11,001,162 CHN Chalice Mining Ltd 1.1475 2% 7% -14% -36% $441,545,404 PMT Patriotbatterymetals 0.24 2% -8% -4% -73% $127,464,747 DVP Develop Global Ltd 3.78 2% 39% 96% 61% $1,023,459,567 IGO IGO Limited 4.145 2% 13% -14% -43% $3,104,798,033 FTL Firetail Resources 0.06 2% 0% -26% 31% $22,801,679 PAT Patriot Resourcesltd 0.065 2% -3% 48% -19% $8,090,750 CXO Core Lithium 0.091 1% 30% 1% -35% $192,871,399 ASL Andean Silver 0.935 1% -8% -6% 15% $146,865,723 HAS Hastings Tech Met 0.3175 1% -15% 2% 30% $61,853,659 IPX Iperionx Limited 3.58 0% 10% -18% 48% $1,222,386,668 LPD Lepidico Ltd 0.002 0% 0% 0% -33% $17,178,371 MRD Mount Ridley Mines 0.002 0% -20% -80% -87% $1,556,978 INR Ioneer Ltd 0.125 0% -7% -39% -40% $306,237,427 MAN Mandrake Res Ltd 0.018 0% -14% -25% -47% $11,290,679 RLC Reedy Lagoon Corp. 0.0015 0% -25% -25% -63% $1,165,060 CLA Celsius Resource Ltd 0.007 0% 0% -36% -22% $21,948,419 MNS Magnis Energy Tech 0.042 0% 0% 0% 0% $50,378,922 SBR Sabre Resources 0.008 0% 0% -27% -56% $3,550,157 SRI Sipa Resources Ltd 0.013 0% 8% 0% -19% $5,413,178 NTU Northern Min Ltd 0.027 0% -27% 35% -23% $225,643,207 CWX Carawine Resources 0.096 0% 2% -13% -4% $22,668,043 ARN Aldoro Resources 0.315 0% -39% 254% 314% $55,168,277 JRV Jervois Global Ltd 0.011 0% 0% 0% -27% $29,730,402 ADD Adavale Resource Ltd 0.002 0% 0% -20% -60% $4,574,558 ALY Alchemy Resource Ltd 0.006 0% 20% -14% -14% $7,068,458 LEL Lithenergy 0.37 0% 0% 0% -9% $41,440,581 RMX Red Mount Min Ltd 0.008 0% 0% -20% -20% $3,952,141 LML Lincoln Minerals 0.005 0% 0% -17% -29% $10,512,849 MRC Mineral Commodities 0.026 0% 0% 0% 0% $25,596,288 BMM Bayanminingandmin 0.029 0% -9% -42% -48% $2,985,707 LEG Legend Mining 0.008 0% 0% -27% -47% $23,291,817 G88 Golden Mile Res Ltd 0.014 0% 40% 40% 8% $7,619,470 WKT Walkabout Resources 0.095 0% 0% 0% -24% $63,769,838 CNJ Conico Ltd 0.007 0% 0% -30% -30% $1,662,411 VR8 Vanadium Resources 0.014 0% -18% -46% -76% $7,617,940 SLZ Sultan Resources Ltd 0.006 0% -14% -14% -45% $1,388,819 MLS Metals Australia 0.018 0% -14% -28% -18% $13,845,671 MQR Marquee Resource Ltd 0.008 0% -27% -38% -47% $4,466,420 EVR Ev Resources Ltd 0.005 0% 25% 67% -32% $9,929,183 AS2 Askarimetalslimited 0.008 0% -11% -38% -86% $3,233,365 EMS Eastern Metals 0.01 0% 0% -23% -73% $1,394,262 RAG Ragnar Metals Ltd 0.018 0% -10% -14% 13% $8,531,748 TEM Tempest Minerals 0.004 0% 0% -20% -53% $2,203,590 KOR Korab Resources 0.008 0% 0% 0% 14% $2,936,400 CMX Chemxmaterials 0.026 0% 0% -26% -46% $3,354,580 NC1 Nicoresourceslimited 0.073 0% -3% -25% -51% $8,008,142 CMO Cosmometalslimited 0.016 0% -14% 2% -51% $5,476,306 CRR Critical Resources 0.003 0% 0% -40% -73% $7,842,664 ENT Enterprise Metals 0.002 0% 0% -50% -60% $2,356,635 ENV Enova Mining Limited 0.008 0% 14% 23% -64% $12,014,757 RBX Resource B 0.028 0% -20% -33% -26% $3,225,166 AKN Auking Mining Ltd 0.007 0% -13% 40% -67% $3,448,673 EMT Emetals Limited 0.003 0% -25% -40% -40% $2,975,000 PNT Panthermetalsltd 0.013 0% 0% -24% -69% $3,911,759 RAS Ragusa Minerals Ltd 0.015 0% -29% 15% -21% $2,138,982 RGL Riversgold 0.004 0% 0% 33% -47% $6,734,850 CLZ Classic Min Ltd 0.001 0% 0% 0% -80% $1,544,026 XTC XTC Lithium Limited 0.2 0% 19900% 0% 19900% $17,528,272 M2R Miramar 0.003 0% -25% -40% -71% $2,990,470 KTA Krakatoa Resources 0.01 0% 11% 0% -41% $6,821,474 DLI Delta Lithium 0.185 0% 6% 0% -37% $136,142,940 KNI Kunikolimited 0.13 0% -24% -38% -42% $10,865,534 BUR Burleyminerals 0.046 0% -8% -19% -65% $8,333,696 L1M Lightning Minerals 0.06 0% 2% -22% -29% $6,199,699 1AE Auroraenergymetals 0.069 0% 50% 23% -22% $12,713,525 LLL Leolithiumlimited 0.332997 0% 0% 0% 0% $401,204,047 LU7 Lithium Universe Ltd 0.005 0% -17% -38% -70% $4,715,878 DYM Dynamicmetalslimited 0.3 0% -17% 50% 76% $13,743,615 TMX Terrain Minerals 0.003 0% 50% 0% 0% $6,745,670 ANX Anax Metals Ltd 0.008 0% 60% -20% -81% $7,062,461 FIN FIN Resources Ltd 0.006 0% 0% 20% -54% $4,169,331 LCY Legacy Iron Ore 0.009 0% 0% -18% -38% $87,858,383 ASR Asra Minerals Ltd 0.002 0% 0% -33% -71% $5,533,072 PFE Pantera Lithium 0.014 0% -13% -30% -70% $6,632,972 KNG Kingsland Minerals 0.105 0% -16% -36% -49% $7,618,896 ILU Iluka Resources 3.81 -1% -5% -31% -47% $1,628,419,181 BHP BHP Group Limited 38.29 -1% 2% -4% -15% $195,171,901,436 S32 South32 Limited 3.05 -1% 13% -18% -22% $13,841,052,714 CDT Castle Minerals 0.095 -1% 70% 27% -47% $10,788,890 E25 Element 25 Ltd 0.2225 -1% -3% -18% -16% $53,723,914 KZR Kalamazoo Resources 0.086 -1% 2% 4% -18% $18,867,842 ARL Ardea Resources Ltd 0.4 -1% -4% 14% -34% $84,165,166 BSX Blackstone Ltd 0.07 -1% 4% 150% 24% $48,040,053 ARU Arafura Rare Earths 0.1625 -2% -21% 35% -14% $406,614,234 LKE Lake Resources 0.0315 -2% -7% -28% -49% $55,897,643 PNN Power Minerals Ltd 0.059 -2% -18% -36% -58% $7,641,764 CHR Charger Metals 0.045 -2% 5% -37% -51% $3,096,810 WMG Western Mines 0.195 -3% 56% 3% -50% $18,070,669 SUM Summitminerals 0.039 -3% -17% -79% -81% $3,454,467 IDA Indiana Resources 0.077 -3% 1% 28% 81% $51,418,597 FLG Flagship Min Ltd 0.07 -3% 4% 13% -56% $14,251,595 PEK Peak Rare Earths Ltd 0.2575 -3% 96% 145% 13% $89,789,736 PEK Peak Rare Earths Ltd 0.2575 -3% 96% 145% 13% $89,789,736 NVA Nova Minerals Ltd 0.315 -3% -3% 37% 37% $103,359,173 MHK Metalhawk. 0.45 -3% 14% 55% 650% $56,563,792 EMC Everest Metals Corp 0.145 -3% -3% 16% 16% $32,499,032 TLG Talga Group Ltd 0.4 -4% -10% -15% -43% $178,408,813 MIN Mineral Resources. 22.66 -4% 25% -32% -70% $4,411,842,660 KAI Kairos Minerals Ltd 0.026 -4% 30% 73% 136% $71,034,629 LTR Liontown Resources 0.63 -4% 17% -15% -54% $1,468,618,583 ESR Estrella Res Ltd 0.0355 -4% 18% 122% 689% $67,714,577 NH3 Nh3Cleanenergyltd 0.023 -4% -8% 10% 21% $13,550,515 KFM Kingfisher Mining 0.046 -4% -4% -16% -28% $2,470,890 RXL Rox Resources 0.2825 -4% -17% 88% 77% $212,426,063 RNU Renascor Res Ltd 0.064 -4% -6% -2% -42% $165,302,508 LMG Latrobe Magnesium 0.0105 -5% -5% -58% -81% $27,579,195 PLS Pilbara Min Ltd 1.3025 -5% -10% -46% -67% $4,247,667,608 VUL Vulcan Energy 4.03 -5% -15% -43% -16% $900,759,755 TVN Tivan Limited 0.1 -5% -13% 92% 96% $211,951,587 INF Infinity Lithium 0.019 -5% -24% -34% -65% $9,451,842 AUZ Australian Mines Ltd 0.009 -5% -25% -18% 0% $13,285,865 1MC Morella Corporation 0.018 -5% -5% -38% -76% $6,897,131 REE Rarex Limited 0.018 -5% -40% 80% -10% $16,562,952 NMT Neometals Ltd 0.088 -5% 44% 0% -19% $67,709,407 MLX Metals X Limited 0.525 -5% -3% 31% 11% $474,219,473 AGY Argosy Minerals Ltd 0.017 -6% -6% -45% -87% $24,750,656 LRV Larvottoresources 0.6275 -6% -29% 14% 534% $252,905,917 FGR First Graphene Ltd 0.032 -6% -20% 10% -44% $21,715,593 EUR European Lithium Ltd 0.048 -6% -9% 45% -4% $72,259,073 GL1 Globallith 0.16 -6% -9% -20% -57% $43,185,800 SRZ Stellar Resources 0.016 -6% -6% -16% -27% $35,355,760 WC1 Westcobarmetals 0.016 -6% 23% 0% -70% $3,110,692 EMH European Metals Hldg 0.1975 -6% -12% 36% -49% $41,488,941 OMH OM Holdings Limited 0.31 -6% -6% -7% -38% $237,539,608 GRE Greentechmetals 0.046 -6% -6% -46% -79% $5,158,554 AX8 Accelerate Resources 0.0075 -6% 7% -17% -86% $4,783,132 VHM Vhmlimited 0.225 -6% -32% -42% -52% $56,733,739 WC8 Wildcat Resources 0.145 -6% -26% -40% -70% $194,962,424 BC8 Black Cat Syndicate 0.785 -7% -19% 9% 131% $572,963,607 ASN Anson Resources Ltd 0.0495 -7% -7% -23% -62% $69,336,827 M24 Mamba Exploration 0.014 -7% 8% 27% -33% $4,132,319 ABX ABX Group Limited 0.041 -7% -2% 3% -18% $10,288,257 GLN Galan Lithium Ltd 0.093 -7% -11% -26% -58% $88,808,766 KOB Kobaresourceslimited 0.039 -7% -9% -51% -76% $6,183,903 ETM Energy Transition 0.0455 -7% -34% 82% 38% $71,364,799 PGD Peregrine Gold 0.125 -7% -22% -14% -57% $11,030,206 AZL Arizona Lithium Ltd 0.006 -8% 0% -54% -74% $31,621,887 DRE Dreadnought Resources Ltd 0.012 -8% -20% -20% -29% $60,954,000 BM8 Battery Age Minerals 0.047 -8% -20% -48% -71% $5,972,699 ATM Aneka Tambang 0.9 -8% -5% 0% -17% $1,173,284 PVW PVW Res Ltd 0.011 -8% -21% -31% -59% $2,187,953 IPT Impact Minerals 0.0055 -8% 10% -47% -69% $23,731,980 GAL Galileo Mining Ltd 0.11 -8% -4% -4% -58% $20,750,617 MHC Manhattan Corp Ltd 0.022 -8% 29% -45% -34% $5,167,776 FRB Firebird Metals 0.073 -9% -18% -27% -59% $10,392,382 SYR Syrah Resources 0.305 -9% 24% 39% -36% $323,095,892 SYR Syrah Resources 0.305 -9% 24% 39% -36% $323,095,892 AAJ Aruma Resources Ltd 0.01 -9% 5% -33% -47% $2,775,727 AVL Aust Vanadium Ltd 0.01 -9% -9% -29% -38% $86,346,581 MRR Minrex Resources Ltd 0.01 -9% 25% 25% -9% $10,848,675 RR1 Reach Resources Ltd 0.01 -9% 11% 18% -23% $7,869,882 RR1 Reach Resources Ltd 0.01 -9% 11% 18% -23% $7,869,882 EG1 Evergreenlithium 0.03 -9% -33% -63% -67% $6,587,349 LM1 Leeuwin Metals Ltd 0.135 -10% -31% 85% 80% $13,608,862 VTM Victory Metals Ltd 0.92 -10% 90% 142% 268% $98,552,443 EVG Evion Group NL 0.017 -11% -6% -45% -29% $7,393,640 SGQ St George Min Ltd 0.024 -11% -4% -4% 20% $64,147,738 GSM Golden State Mining 0.008 -11% -11% 0% -27% $2,234,965 WSR Westar Resources 0.004 -11% -20% -50% -60% $1,594,899 ITM Itech Minerals Ltd 0.03 -12% -35% -55% -61% $5,295,897 QXR Qx Resources Limited 0.0035 -13% 17% -13% -68% $5,241,315 IXR Ionic Rare Earths 0.007 -13% -13% 0% -46% $36,871,980 AVW Avira Resources Ltd 0.007 -13% -13% -65% -65% $1,535,000 EGR Ecograf Limited 0.32 -14% 8% 300% 121% $145,322,182 JLL Jindalee Lithium Ltd 0.42 -14% 24% 83% -20% $33,046,086 SMX Strata Minerals 0.012 -14% -60% -43% -43% $2,938,226 IG6 Internationalgraphit 0.048 -14% 2% 0% -58% $9,484,358 AM7 Arcadia Minerals 0.017 -15% 6% -26% -76% $1,995,518 SCN Scorpion Minerals 0.017 -15% 0% 55% -15% $8,908,955 TMB Tambourahmetals 0.021 -16% -34% -25% -73% $2,586,981 CAE Cannindah Resources 0.031 -16% -47% -38% -43% $22,570,479 TON Triton Min Ltd 0.005 -17% -29% -38% -64% $7,841,944 WCN White Cliff Min Ltd 0.025 -17% 32% 56% 56% $58,084,654 RON Roninresourcesltd 0.165 -18% -8% -3% 27% $6,661,877 KGD Kula Gold Limited 0.0065 -19% -7% -2% -31% $5,988,149 BNR Bulletin Res Ltd 0.055 -19% -20% 38% 15% $18,204,026 VRC Volt Resources Ltd 0.004 -20% -11% 33% -20% $18,739,112 BYH Bryah Resources Ltd 0.004 -20% -20% 0% -50% $4,349,768 SRN Surefire Rescs NL 0.002 -20% -40% -20% -75% $4,972,891 EMN Euromanganese 0.17 -23% -32% -23% -58% $11,999,560 CRI Criticalim 0.013 -24% -19% 18% -52% $37,638,280 CZN Corazon Ltd 0.0015 -25% -25% -25% -83% $1,776,858 DTM Dart Mining NL 0.003 -25% -25% -73% -87% $4,792,222 VML Vital Metals Limited 0.002 -33% -33% -33% -50% $11,790,134 MOH Moho Resources 0.004 -33% 33% -20% 0% $2,981,656 LNR Lanthanein Resources 0.001 -33% -50% -67% -80% $2,443,636 LNR Lanthanein Resources 0.001 -33% -50% -67% -80% $2,443,636 AOA Ausmon Resorces 0.001 -50% -50% -50% -60% $1,311,213 PRL Province Resources 0 -100% -100% -100% -100% $0 POS Poseidon Nick Ltd 0 -100% -100% -100% -100% $23,380,727 AML Aeon Metals Ltd. 0 -100% -100% -100% -100% $5,482,003 LRS Latin Resources Ltd 0 -100% -100% -100% -100% $477,661,711 CAI Calidus Resources 0 -100% -100% -100% -100% $93,678,206 LTM Arcadium Lithium PLC 0 -100% -100% -100% -100% $1,994,929,982

Weekly Small Cap Standouts

Cobalt Blue Holdings (ASX:COB)

COB has announced a contract for Glencore to provide cobalt hydroxide feedstock from its Kamoto Copper Company SA (KCC) and Mutanda Mining SARL (Mutanda) operations in the Democratic Republic of Congo (DRC) to the company’s Kwinana Cobalt Refinery (KCR).

The contract guarantees supply of a minimum of 3750 tonnes of cobalt hydroxide (750t in year one, 1500t in years two and three), representing 50% of KCR’s initial feedstock requirements.

"We are thrilled to formalise a relationship with Glencore,” COB CEO Andrew Tong said.

“Locking in at least 50% of KCR’s feedstock requirements is a significant step in derisking the project that brings us closer to FID.

“Developing a commercial partnership with one of the world’s largest diversified miners helps solidify COB’s position as a participant in the global cobalt industry.

“This relationship will also enable COB to play a strategically important role in building new battery and critical minerals supply chains among like-minded countries.”

The company’s call option granted to NIO Inc subsidiary Blue Northstar to acquire a significant stake in Andes Litio SA has lapsed.

Andes Litio SA holds rights to the San Jorge lithium brine project in Argentina, which covers 36,000ha in one of world’s premier lithium jurisdictions.

Initial drilling last year resulted in a resource estimate of 1.07Mt of lithium carbonate equivalent (LCE) with 670,000t indicated (62.7% of resource) and 400,000t inferred.

Greenwing is now looking to a cap raise to review exploration data and optimise future drilling, and funding options to advance the project.

Tanzanian graphite developer Black Rock Mining and its 84%-owned Tanzanian subsidiary, Faru Graphite Corporation (Faru) have secured credit approval for a US$25m increase in available funding under the Facilities Agreement signed last year with the Development Bank of Southern Africa (DBSA), the Industrial Development Corporation of South Africa (IDC), and Tanzanian lender CRDB Bank (CRDB).

The additional funding will be provided by CRDB in the construction term loan, and this increases the total facilities available to US$204m to develop the Mahenge graphite project.

CEO John de Vries said it brings the company one step closer to developing the construction-ready project.

“The additional commitment should give all investors great confidence in Mahenge’s development and outlook as an operating entity within the global supply chain,” he said.

At Stockhead, we tell it like it is. While Renascor Resources, iTech Minerals, Buxton Resources, Kingsland Minerals and Green Critical Metals are Stockhead advertisers, they did not sponsor this article.

Originally published as High Voltage: Trump’s 721pc tariffs could see price spike for graphite