Closing Bell: WiseTech drags down ASX; DOGE uncovers ‘irregularities’ at US Treasury

ASX drops as WiseTech falls on misconduct claims, and Trump says DOGE has found “irregularities” at the US Treasury.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX drops on Trump’s tariffs, BlueScope rises

Wisetech falls on new misconduct claims of former CEO

Trump says DOGE has found “irregularities” at US Treasury

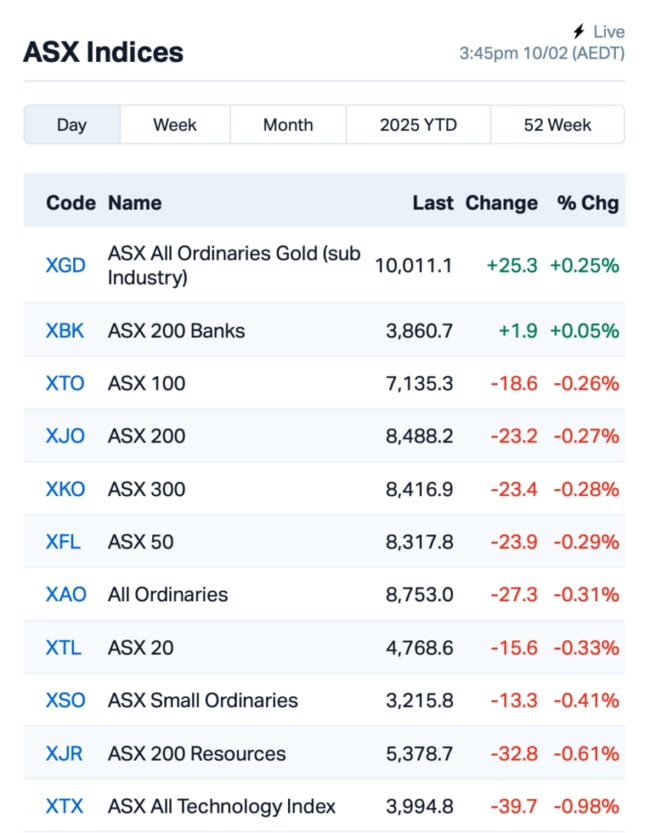

The ASX was down by 0.3% on Monday, tracking the 1% drop in US stocks after President Trump’s announcement that he was slapping a 25% tariff on steel and aluminium imports.

But a bit of relief came through when people realised that China’s steel exports to the US in 2024 were barely a blip on the radar – less than 1%.

As things settled down, shares in Aussie steel giant Bluescope Steel (ASX:BSL) jumped 1.5%, with investors backing it as a potential winner from these new US steel tariff.

Meanwhile, ASX tech wasn’t having the best day, with sector leader WiseTech Global (ASX:WTC) taking a hit after its founder faced new allegations of misconduct.

WTC dropped 4% after two new complaints, one from an employee and another from a supplier, have been made against founder Richard White.

The company’s board said it was looking into it, but for now, both WiseTech and White are sticking to their plan from October 2024, which included him taking on a new consultancy role in the firm.

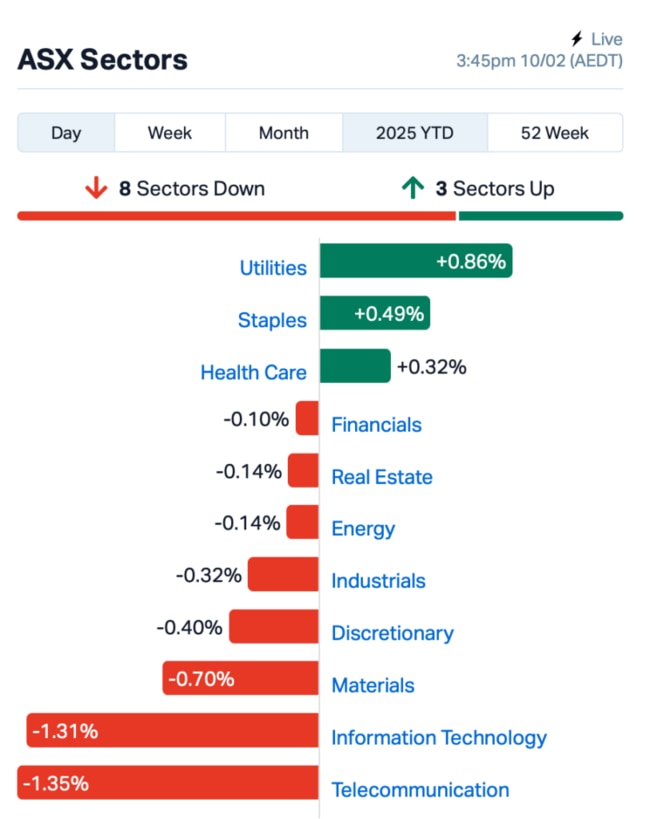

Elsewhere, defensive sectors including utilities, healthcare, and consumer staples were in the green, as traders sought out safer bets.

Gold prices also ticked up by 0.5% as investors, nervous about trade tensions, flocked to the precious metal as a safe haven.

In the large caps space, it was a good day for Star Entertainment Group’s (ASX:SGR), which saw its shares rise by 15% after it rejected takeover offers for its stake in the Queen’s Wharf project in Brisbane.

JB HiFi (ASX:JBH), however, reversed earlier gains, dropping 5% despite the retailer posting impressive sales figures for the first half of the year.

This is where things stood on the ASX leading up to today's close:

In other news, Trump dropped a bombshell, suggesting that Elon Musk’s "Department of Government Efficiency" (aka the DOGE team) might have uncovered some irregularities at the US Treasury.

While Trump didn’t get into the specifics, he hinted that this could lead to a shake-up in how future government payments are handled, possibly even reducing the country’s debt.

“There could be a problem, you’ve been reading about that, with Treasuries,” Trump told reporters Sunday on Air Force One as he headed to the Super Bowl.

Some are speculating it could bring major changes, but for now, it's all a bit murky.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap HYD Hydrix Limited 0.029 93% 10,809,438 $4,091,533 EDE Eden Inv Ltd 0.002 50% 17,494,748 $4,109,881 EMU EMU NL 0.035 35% 1,074,106 $5,001,859 DTR Dateline Resources 0.004 33% 48,420 $7,548,781 JAV Javelin Minerals Ltd 0.004 33% 17,291,773 $18,112,325 OZM Ozaurum Resources 0.165 27% 13,617,030 $25,637,500 PWN Parkway Corp Ltd 0.015 25% 7,306,441 $33,205,366 BNL Blue Star Helium Ltd 0.005 25% 502,265 $10,779,541 ECT Env Clean Tech Ltd. 0.003 25% 3,464 $6,343,621 GRL Godolphin Resources 0.020 25% 56,480,451 $5,745,578 PRX Prodigy Gold NL 0.003 25% 330,767 $6,350,111 MYX Mayne Pharma Ltd 5.820 24% 892,613 $380,230,470 CRS Caprice Resources 0.026 24% 6,123,013 $9,303,773 AEV Avenira Limited 0.009 20% 812,556 $23,832,330 OPL Opyl Limited 0.018 20% 409,082 $2,894,525 FRE Firebrickpharma 0.090 20% 285,318 $15,758,138 C7A Clara Resources 0.006 20% 215,000 $2,383,746 TEM Tempest Minerals 0.006 20% 1,045,847 $3,172,649 WOA Wide Open Agricultur 0.006 20% 126,066 $2,668,433 ENV Enova Mining Limited 0.010 19% 24,247,887 $9,845,149 SGR The Star Ent Grp 0.130 18% 44,955,536 $315,554,896

Hydrix's (ASX:HYD)’s partner Gyder Surgical, has scored FDA 510(k) clearance for its GYDER Hip System, a tech solution for hip surgeries. This clears the way for sales in the US, adding another win after the Australian TGA approval. Hydrix Ventures, which has been backing Gyder, just saw its investment grow to $2.65 million thanks to this milestone.

Javelin Minerals' (ASX:JAV) first drilling at the Coogee Project near Kalgoorlie has hit some sweet high-grade gold and copper. Assays show grades up to 65 g/t gold and 8.5% copper, with new shoots found outside the current resource. The results span over 1km, including a solid 5m at 14.22 g/t gold and 4m at 1.91% copper. The Coogee resource now sits at 126,685 oz of gold and 4,133t of copper, and Javelin is eyeing an upgrade.

Godolphin Resources' (ASX:GRL) Lewis Ponds Gold & Silver Project is looking promising after the first two drill holes of a new program showed good results. Hole GLPDD006 hit 49.6m at 3.53g/t gold equivalent (AuEq) from 210m, with a high-grade core of 28.2m at 5.76g/t AuEq. The drilling has also uncovered more mineralisation in the Torphy’s Lode.

Mayne Pharma (ASX:MYX) was riding high after it forecast a massive 275% jump in earnings, driven by solid growth in its women’s health range. The company’s revenue was also set to soar, with a forecast of double-digit growth.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap LNU Linius Tech Limited 0.001 -50% 92,000 $12,302,431 AOK Australian Oil. 0.002 -33% 350,131 $3,005,349 SKN Skin Elements Ltd 0.002 -33% 56,000 $2,568,458 VML Vital Metals Limited 0.002 -33% 2,300,000 $17,685,201 AOA Ausmon Resorces 0.002 -25% 200,000 $2,179,455 GGE Grand Gulf Energy 0.002 -25% 9,959,334 $4,900,774 MOM Moab Minerals Ltd 0.002 -25% 1,490,723 $3,133,999 NRZ Neurizer Ltd 0.002 -25% 4,817,516 $6,129,741 OB1 Orbminco Limited 0.002 -25% 350,000 $4,333,180 SRN Surefire Rescs NL 0.003 -25% 463,051 $9,665,231 AAU Antilles Gold Ltd 0.004 -20% 3,960,308 $9,289,380 AMS Atomos 0.004 -20% 708,353 $6,075,092 WNX Wellnex Life Ltd 0.730 -20% 144,606 $28,872,873 C1X Cosmosexploration 0.058 -18% 870,539 $5,926,129 ALR Altairminerals 0.003 -17% 945,812 $12,890,233 ASP Aspermont Limited 0.005 -17% 100,000 $14,820,070 BGE Bridgesaaslimited 0.020 -17% 10,003 $4,796,621 CUL Cullen Resources 0.005 -17% 1,648,490 $4,160,411 EPM Eclipse Metals 0.005 -17% 461,324 $17,158,914 ERA Energy Resources 0.003 -17% 355,075 $1,216,188,722 FTC Fintech Chain Ltd 0.005 -17% 9,523 $3,904,618 GES Genesis Resources 0.005 -17% 250,933 $4,697,048

IN CASE YOU MISSED IT

Summit Minerals (ASX:SUM) has appointed Dr Matthew Cobb as CEO to lead the company’s Equador niobium and rare earths project in Northeast Brazil. Cobb is a geologist by trade with 20 years of experience in the mining industry – including in exploration, project development and mines operation.

Cobb has previously worked in senior roles across multiple commodities in Australia, Africa and South America, including positions with Fortuna Mining, Silver Lake Resources, CSA Global and Consolidated Minerals where he has contributed to significant discoveries.

At a time of record gold prices, West Australian explorer Star Minerals (ASX:SMS) has reiterated its commitment to advancing the Tumblegum South gold project. By the end of this year, SMS intends to complete exploration drilling, infill drilling, a feasibility study and engage contractors at Tumblegum. Longer term goals include permitting and environmental and heritage surveying.

Trigg Minerals (ASX:TMG) has appointed Andre Booyzen to its board as a non-executive director. Booyzen previously served as vice president for Mandalay Resources and has already been working with Trigg as a strategic advisor. Booyzen’s work with Mandalay helped lead the Costerfield gold-antimony mine in Victoria – currently Australia’s only producer of antimony concentrate.

Brightstar Resources (ASX:BTR) shared with the market today surface drilling results from its Second Fortune gold mine, south of Laverton in Western Australia. These assays – taken from 23 underground diamond drill holes – were part of an infill and extensional program. Standout hits included 1.16m at 30.36g/t gold from 101.6m and 2.05m at 13.85g/t from 97.75m.

Explorer Riversgold (ASX:RGL) is confident of the gold potential at its Tambourah project in the Pilbara region of Western Australia after turning up rock chip samples grading as high as 101g/t gold. The company says its field works have also validated a highly anomalous gold trend over a roughly 12km strike length.

The recently listed Mount Hope Mining (ASX:MHM) has received soil survey results from a campaign it carried out pre-IPO at its copper, lead, silver and zinc namesake project. The results confirmed historical surface geochemical data at the Black Hill and Mount Hope East prospects – measuring up to 710ppm lead, 680ppm copper and 250ppb silver with anomalous zinc and gold.

Artemis Resources (ASX:ARV) has kicked off a diamond and reverse circulation drilling program in the Pilbara in search of gold. The explorer is testing several gold targets within a 4km long zone centred around its 374,000oz Carlow mineral resource.

Infill drilling at the Sybella rare earths discovery has given Red Metal (ASX:RDM) much to smile about with the campaign confirming the continuity of wide zones of rare earth oxide mineralisation, adding support to a large inferred mineral resource. Top assays from the 19 holes drilled in November include 60m at 336ppm NdPr and 34ppm DyTb from surface and 108m at 349ppm NdPr and 38ppm DyTb from 12m.

Firetail Resources (ASX:FTL) has tagged multiple strong EM conductors at its Skyline copper project in Canada’s Newfoundland. After sharing the news with the market this morning, the explorer entered a trading halt pending an announcement regarding a capital raising.

Mt Malcolm Mines (ASX:M2M) has completed bulk sampling excavation works at its Golden Crown prospect. Throughout January, M2M produced 95.54oz of gold doré from processing 200WMT of ultra high-grade material using a wet gravity recovery method.

Canadian lithium hopeful Lithium Universe (ASX:LU7) today inked a non-binding memorandum of understanding with builder Lafarge Canada to supply the latter with aluminosilicate secondary product (ASCR) from its Bécancour Lithium Refinery. ASCR is a common additive in the cement industry which enhances structural strength and reduced production costs.

North Shore Pediatric Therapy is joining BlinkLab’s (ASX:BB1) US clinical study, which is set to begin patient recruitment and diagnostic testing in the coming weeks. BlinkLab is a digital healthcare company developing AI-powered smartphone technology to service the autism and ADHD diagnostic markets.

At Stockhead, we tell it like it is. While Summit Minerals, Star Minerals, Trigg Minerals, Brightstar Resources, Riversgold, Mount Hope Mining, Artemis Resources, Red Metal, Firetail Resources, Mt Malcolm Mines, Lithium Universe and BlinkLab are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: WiseTech drags down ASX; DOGE uncovers ‘irregularities’ at US Treasury