Closing Bell: Tech, Miners fuel ASX winning run; but Yancoal sinks 14pc after dividend halt

Coal miner Yancoal surprised investors after announcing it won’t pay dividends soon, despite a strong half-year profit.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX 200 nears 8,000 points, boosted by mining stocks

Monadelphous and Baby Bunting rose; Yancoal and Dexus fell

RBA considered lifting rates in August, minutes revealed

The S&P/ASX 200 index rose by 0.2% to finish near 8,000 points on Tuesday, buoyed by overnight gains in US stocks.

This is the first time the benchmark has exceeded 8,000 points since it dropped sharply in early August.

The recent rally in the ASX has mirrored that on Wall Street, where the S&P 500 climbed 1% overnight, marking its eighth consecutive gain and the longest winning streak of 2024.

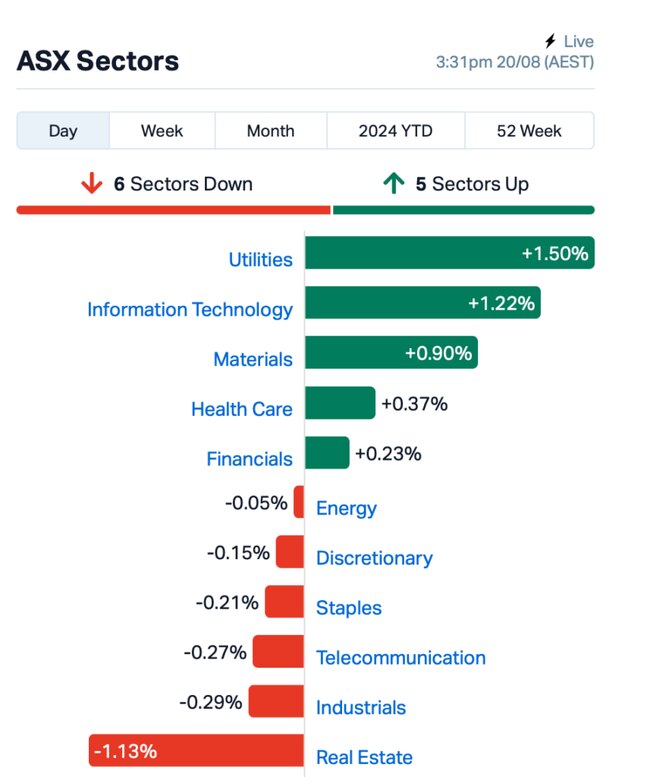

Gains were being driven today by a rebound in tech and mining, with a recent uptick in iron ore prices helping to lift related stocks.

The biggest large cap gainer was Monadelphous (ASX:MND), an engineering outfit providing construction and maintenance services.

MND rose 9% after reporting an 11% increase in full year revenue to $2.03 billion. The company said it has a significant pipeline of opportunities in the resources and energy sectors.

More earnings highlights below.

Meanwhile, investors are parsing through the hawkish minutes from the RBA’s July meeting.

In the minutes, the RBA said it was closely monitoring the risk of a sudden increase in unemployment, particularly if businesses have been retaining more workers than needed.

In terms of interest rates, the minutes revealed that the Board had deliberated the possibility of increasing the cash rate on August 6th, but ultimately decided to keep it at 4.3% for the sixth consecutive meeting.

“Raising the cash rate target at this meeting could be appropriate if members judged that the risk that inflation would not return to target in a reasonable timeframe had materially increased, either because of economic developments or because financial conditions were insufficiently tight,” said the minutes.

Today’s earnings season highlights

Rip Curl and Kathmandu owner, KMD Brands (ASX:KMD), jumped 5% after reporting a rebound in trading in FY24.

“Kathmandu sales trends, relative to fiscal year 2023, continued to improve in a challenging consumer environment, with enhanced in-store execution and new products,” said the company’s release.

Maternity and baby goods retailer, Baby Bunting (ASX:BBN), was up 8% despite sales dropping by 3.4% in FY24 due to tough trading conditions.

The company predicts modest sales growth and stable profit margins for FY25, with net profit projected between $9.5 million and $12.5 million, assuming stable economic condition.

Coal miner, Yancoal (ASX:YAL) dropped 16% after the company stated it will not be paying dividends in the immediate future, despite a strong half-year profit boosting its cash balance to $1.55 billion with no debt. Yancoal said it will the use the cash for potential met coal deals.

Property investor Dexus (ASX:DXS) fell 7% after reporting a statutory loss of $1.58 billion for FY24, driven by substantial devaluations across its portfolio. The loss is 110% worse compared to the previous year's loss of $752.7 million.

Judo Capital (ASX:JDO) was one of the best performers today, up 10% after reporting a 20% rise in gross loans to $10.7 billion, which contributed to a 2% increase in underlying profit before tax of $110.1 million.

But it was the company’s prediction for FY25 that was driving all the excitement, with a forecast of 15% growth in profit before tax.

What else happened today?

Across the region, Asian stock markets mostly rose today, driven by Wall Street’s rally and growing expectations that the Federal Reserve will soon start lowering rates.

The MSCI ACWI Index is on track for its longest winning streak since December, with gains in Japan, South Korea, and Australia, though Chinese stocks fell.

Investor optimism was boosted by the S&P 500's eighth consecutive day of gains and news of a cease-fire proposal in Gaza, which also contributed to a drop in oil prices overnight.

And tonight in the US, two Federal Reserve officials are set to speak publicly.

Meanwhile, attention will be on inflation and monetary policy as Canada and the Euro zone provides their final July CPI readings.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| JAV | Javelin Minerals Ltd | 0.002 | 100% | 2,689,334 | $4,276,846 |

| GCR | Golden Cross | 0.003 | 50% | 106,330 | $2,194,512 |

| ICU | Investor Centre Ltd | 0.003 | 50% | 555,440 | $609,023 |

| M2R | Miramar | 0.010 | 43% | 44,720,459 | $2,763,457 |

| CR9 | Corellares | 0.007 | 40% | 8,699,303 | $2,325,462 |

| GT1 | Greentechnology | 0.086 | 34% | 1,718,189 | $20,592,134 |

| POS | Poseidon Nick Ltd | 0.004 | 33% | 475,357 | $11,140,604 |

| VRC | Volt Resources Ltd | 0.004 | 33% | 103,390 | $12,476,034 |

| YAR | Yari Minerals Ltd | 0.004 | 33% | 19,628 | $1,447,073 |

| FFG | Fatfish Group | 0.012 | 33% | 3,671,794 | $12,659,157 |

| BSX | Blackstone Ltd | 0.033 | 32% | 521,350 | $13,159,070 |

| HCT | Holista CollTech Ltd | 0.014 | 27% | 470,400 | $3,066,801 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 2,431,365 | $57,867,624 |

| AX8 | Accelerate Resources | 0.010 | 25% | 956,019 | $4,974,031 |

| ION | Iondrive Limited | 0.010 | 25% | 4,665,322 | $5,668,060 |

| LV1 | Live Verdure Ltd | 0.530 | 20% | 448,037 | $55,333,430 |

| BDG | Black Dragon Gold | 0.018 | 20% | 812,500 | $4,012,765 |

| ADD | Adavale Resource Ltd | 0.003 | 20% | 363,333 | $3,028,580 |

| BP8 | Bph Global Ltd | 0.003 | 20% | 260,333 | $991,604 |

| TEG | Triangle Energy Ltd | 0.006 | 20% | 4,958,992 | $10,400,670 |

| UNT | Unith Ltd | 0.019 | 19% | 1,898,710 | $19,641,666 |

| LEX | Lefroy Exploration | 0.091 | 18% | 875,196 | $15,435,303 |

| ASM | Ausstratmaterials | 0.555 | 18% | 658,176 | $85,192,837 |

Corella Resources (ASX:CR9) was up on news that it has been granted government funding to fast track an R&D program to investigate a new and alternative HPA Flowsheet for its Tampu kaolin deposit in Western Australia, in conjunction with an industry partner and the Chemical Engineering division of the University of Queensland.

Green Technology Metals (ASX:GT1) was climbing on news of the execution of a Framework Agreement and corporate Subscription Agreement with leading South Korean EV battery metals producer EcoPro Innovation Co, which will bring in $8 million via a two-tranche placement at a premium of 40% over the company’s 90-day VWAP, as part of GT1’s strategy to become the first integrated lithium producer in Ontario.

Also in Canada, Koba Resources (ASX:KOB) gained after announcing “exceptionally high-grade rock chip assays” from its inaugural sampling and prospecting program at the Harrier Uranium Project, including samples as high as 74,800ppm (7.48%) U3O8, and 72,000ppm (7.20%) U3O8, with a further 5 samples assaying >30,000ppm (3.0%) U3O8.

Celsius Resources (ASX:CLA) was up on recent news. CLA has obtained a mineral production sharing agreement with the Philippines government for its flagship Maalinao-Caigutan-Biyon (MCB) copper project which gives the company a 25-year lease for exploration and development.MCB contains a 338Mt at 0.47% copper and 0.12 g/t gold resource for a contained 1.6Mt copper and 1.3Moz of gold.

A 2021 study highlighted a post-tax NPV8 of US$464m and an IRR of 31% at an assumed copper price of US$4/lb and gold price of US$1695/oz, both below current spot prices, with gold recently cresting record highs of US$2500/oz. It’s a key step for Celsius in its planned transition from explorer to developer

Javelin Minerals (ASX:JAV) was up on yesterday’s news. Compelling gold-copper targets were announced yesterday at JAV’s Coogee deposit, which is right next door to the world-class St Ives gold field in WA.

Run throughs of historical data from previous exploration work has cropped up numerous targets for the explorer to sink its teeth into, including a large, untested magnetic anomaly 300m from the Coogee pit.

Little to no previous drilling has been conducted and JAV reckons it’s on track to start drilling the new targets next quarter and is cashed up to do so after a raising $1.25m last month.

Inoviq (ASX:IIQ) lifted nicely after announcing that its NEURO-NET technology has been further validated for isolating brain-derived exosomes in Parkinson’s disease (PD).

Earlier this year, Inoviq demonstrated that NEURO-NET could successfully isolate brain-derived exosomes from blood and identify a distinct protein fingerprint that differentiates Alzheimer’s disease (AD) from healthy samples.

Now, NEURO-NET has also proven effective in isolating exosomes from the blood of Parkinson’s disease patients, revealing a unique protein profile that contrasts with healthy individuals.

Initial studies show that NEURO-NET enhances the detection of known neurodegenerative disease biomarkers by 5-8 times compared to direct blood measurement, potentially allowing for earlier detection of Parkinson’s disease.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RNE | Renu Energy Ltd | 0.002 | -33% | 2,346,448 | $2,178,402 |

| KBC | Keybridge Capital | 0.047 | -28% | 64,502 | $13,476,959 |

| 1TT | Thrive Tribe Tech | 0.002 | -25% | 15,746,388 | $1,223,243 |

| BCT | Bluechiip Limited | 0.003 | -25% | 245,000 | $4,728,158 |

| MEL | Metgasco Ltd | 0.003 | -25% | 32,963,784 | $5,790,347 |

| MBK | Metal Bank Ltd | 0.013 | -24% | 994,146 | $6,637,808 |

| ZMM | Zimi Ltd | 0.015 | -21% | 45,000 | $2,406,630 |

| WMG | Western Mines | 0.250 | -21% | 292,078 | $25,483,839 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 3,132 | $2,516,434 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 35,000 | $5,294,436 |

| RGL | Riversgold | 0.004 | -20% | 1,780,512 | $6,637,313 |

| RON | Roninresourcesltd | 0.095 | -17% | 165,000 | $4,234,876 |

| A8G | Australasian Metals | 0.100 | -17% | 175,554 | $6,254,459 |

| AUA | Audeara | 0.025 | -17% | 471,538 | $4,356,724 |

| NVO | Novo Resources Corp | 0.100 | -17% | 15,230 | $10,734,985 |

| AVE | Avecho Biotech Ltd | 0.003 | -17% | 65,500 | $9,507,891 |

| GTI | Gratifii | 0.005 | -17% | 595,160 | $10,536,286 |

| LML | Lincoln Minerals | 0.005 | -17% | 1,920,099 | $12,337,557 |

| PRM | Prominence Energy | 0.005 | -17% | 152,846 | $1,868,258 |

| ROG | Red Sky Energy. | 0.005 | -17% | 3,727,250 | $32,533,363 |

| WML | Woomera Mining Ltd | 0.003 | -17% | 8,000,000 | $4,554,417 |

| MOZ | Mosaic Brands Ltd | 0.042 | -16% | 76,481 | $8,925,322 |

| MCM | Mc Mining Ltd | 0.076 | -16% | 15,000 | $37,261,201 |

IN CASE YOU MISSED IT

Anson Resources (ASX:ASN) has discovered additional high-grade critical minerals such as gallium, germanium, barium and indium at its Ajana project in WA after reviewing historical reports.

Aroa Biosurgery (ASX:ARX) is continuing to advance clinical evidence supporting efficacy of its extracellular matrix (ECM) products, recently achieving two clinical milestones as it continues to invest in R&D.

Corella Resources (ASX:CR9) has secured funding from the Australian Federal Government’s Trailblazer program to fast-track HPA flowsheet R&D, which will lower the environmental impact and improve economic metrics.

Green Technology Metals (ASX:GT1) has attracted a significant $8m investment from South Korean electric vehicle battery metals producer EcoPro Innovations. EcoPro will also partner with GT1 across its projects.

Koba Resources (ASX:KOB) has reported exceptionally high-grade rock chip assays from the inaugural sampling program at its 489km2 Harrier uranium project in Canada. A follow-up program is planned to further advance the highest priority prospects.

Lithium Universe (ASX:LU7) has formed a joint committee to collaborate with the Tribal Council representing the Abenaki Council of Odanak and the Abenaki Council of Wôlinak to progress development of its 16,000tpa Bécancour lithium refinery in Canada.

Many Peaks Minerals’ (ASX:MPK) auger sampling and diamond drilling program has delineated priority targets at its Odienné South permit, which covers a 30km extent of the Sassandra Fault that also hosts Predictive Discovery’s 5.4Moz Bankan gold deposit. Additional new targets have also been identified within the high strain Archean margin

St George Mining (ASX:SGQ) has appointed former CBMM executives and niobium experts Thiago Amaral and Adriano Rios to help drive its Araxá project in Brazil. CBMM produces ~90% of the world’s niobium.

Trinex Minerals’ (ASX:TX3) first phase of field work at its Halo-Yuri project in Canada has identified multiple areas with high-grade lithium in spodumene bearing pegmatite outcrops and boulders, with the highest assay returning 5.1% Li2O.

Chariot Corporation’s (ASX:CC9) K-feldspar testing program carried out at the Black Mountain hard rock lithium project has confirmed the moderately to high-fractionated state of outcropping LCT pegmatites. A pXRF (portable X-ray fluorescence) device was used on 218 potassium-feldspar samples, with many of these displaying anomalous caesium-tantalum values, supporting the existence of LCT pegmatites in the area.

D3 Energy (ASX:D3E) has received notice from the Petroleum Agency of South Africa (PASA) of the renewal of its flagship methane and helium exploration asset, ER315 in the country’s Free State. The renewal marks the second renewal period and means the exploration right is valid for a further two years from the renewal date.

Venture Minerals (ASX:VMS) is conducting a series of reviews on mineralogical data as follow up work from the initial resource drill-out at the 40km2 Jupiter rare earth discovery. This metallurgical program is designed to follow in stages and will be conducted across several independent laboratories to deliver results as efficiently and effectively as possible.

TRADING HALTS

Panther Metals (ASX:PNT) – pending the release of an announcement to the market regarding a capital raising.

Unico Silver (ASX:USL) – for the purpose of executing a proposed capital raising and a material acquisition.

Arrow Minerals (ASX:AMD) – requested in respect of a proposed capital raising.

SRG Global (ASX:SRG) – pending an announcement in relation to a corporate acquisition and an associated equity raising.

At Stockhead we tell it like it is. While Chariot Corporation, D3 Energy, Venture Minerals, Anson Resources, Aroa Biosurgery, Corella Resources, Green Technology Metals, Koba Resources, Lithium Universe, Many Peaks Minerals, St George Mining and Trinex Minerals are Stockhead advertisers, they did not sponsor this article.

Originally published as Closing Bell: Tech, Miners fuel ASX winning run; but Yancoal sinks 14pc after dividend halt