Closing Bell: Star Casino ruled unfit to reclaim licence; Cassius jumps 40pc as AustChina exits lithium deal

ASX 200 up on Friday boosted by strong US GDP and Wall Street gains. But… The Star cops scathing remarks from regulator.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX 200 up on Friday boosted by strong US GDP and Wall Street gains

Star Entertainment gets scathing remarks from regulator

Downer EDI and TPG Telecom among the stocks to surge today

The ASX closed 0.58% higher on Friday as investors digested a flurry of company earnings reports on the last day of the earnings season.

For the week, the benchmark ASX 200 index was up around 0.8%.

Local markets tracked a rather firm lead from Wall Street where the Dow Jones rose by 0.6%. Despite a slight drop in the Nasdaq, about 75% of S&P 500’s stocks posted gains overnight.

US traders came back to risk assets as GDP data showed the US economy grew 3% annually in Q2, up from 2.8% the month before.

“There was nothing here to make the Fed rethink its plan to cut rates next month,” said Chris Larkin at E*Trade.

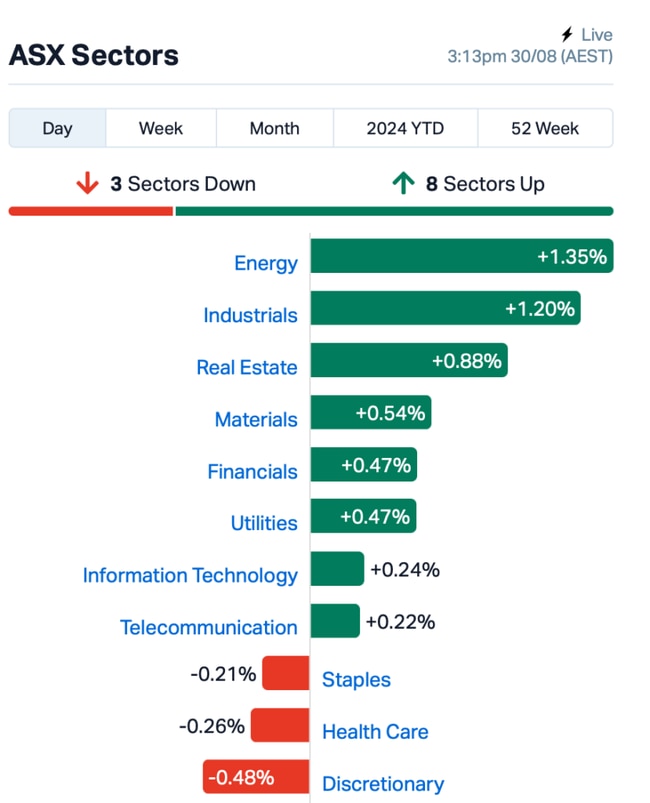

On the ASX today, Energy, Industrials and Tech led the ASX today, while Discretionary lagged.

Star Casino grabbed headlines today as shares of Star Entertainment Group (ASX:SGR) remain suspended following the release of the final report from the 2024 Independent Inquiry.

The NSW casino regulator's report, authored by Adam Bell SC, revealed that Star Entertainment’s executives, including former CEO Robbie Cooke, "failed to provide the necessary leadership and oversight".

The report highlighted that Star had breached compliance rules four times. Despite this, Bell expressed optimism about the company's future under new leadership, including CEO Steve McCann and COO Jeannie Mok.

Star had earlier announced plans to write down $1.4 billion of its casino assets.

Energy stocks caught bids after crude prices swung ~1.5% to ~2.0% higher last night. Mining stocks also got a boost after spot silver rebounded from Wednesday's drop.

The Aussie dollar, meanwhile, burst through the $US68c level.

Today’s earnings season highlights

TPG Telecom (ASX:TPM) rose 7% despite net profit falling nearly 40% to $29 million due to higher depreciation, amortisation expenses, and financing costs.

TPG said it was laying off 120 employees to save $20 million after the profit drop.

Harvey Norman Holdings (ASX:HVN)dropped 5% after reporting a 3.9% decrease in revenue to $4.11 billion and a 30.2% drop in profit before tax for the full year.

The company announced a final dividend of 12 cents per share, maintaining the yield at 4.7%.

Contractor Downer EDI (ASX:DOW) surged 18% after reporting an $82 million annual profit, reversing last year's $386 million net loss on the back of writedowns.

Ramsay Health Care (ASX:RHC)slipped 7% after the private hospital chain announced that patient growth would slow this year and that rising costs are impacting its ability to improve margins.

What else is happening?

Asian stocks rose and have clocked up a fourth consecutive month of gains.

Shares in China led the rally, fuelled by strong earnings and a rebound in electric vehicle stocks.

Markets in Hong Kong and Japan also saw increases, alongside US futures, as investors awaited the Fed Reserve's inflation report tonight.

Gold remains near record highs, and there's news about Nvidia joining a funding round for OpenAI, potentially valuing the AI company at more than $100 billion.

Sources say Nvidia might contribute around $100 million, with Apple and Microsoft also exploring investment opportunities in this round.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MCM | Mc Mining Ltd | 0.215 | 72% | 3,768,942 | $51,751,669 |

| CMD | Cassius Mining Ltd | 0.007 | 40% | 5,623,549 | $2,710,022 |

| ATP | Atlas Pearls Ltd | 0.150 | 36% | 5,524,399 | $48,044,328 |

| EDE | Eden Inv Ltd | 0.002 | 33% | 288,063 | $6,162,314 |

| MCT | Metalicity Limited | 0.002 | 33% | 1,200,000 | $7,044,099 |

| VPR | Voltgroupltd | 0.002 | 33% | 7,152,945 | $16,074,312 |

| DEL | Delorean Corporation | 0.110 | 29% | 1,958,375 | $18,336,278 |

| AFL | Af Legal Group Ltd | 0.165 | 27% | 132,159 | $11,868,897 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 14,946,945 | $57,867,624 |

| AYT | Austin Metals Ltd | 0.005 | 25% | 200,237 | $5,296,765 |

| JAV | Javelin Minerals Ltd | 0.003 | 25% | 3,051,005 | $8,553,692 |

| LML | Lincoln Minerals | 0.005 | 25% | 1,215,410 | $8,225,038 |

| RHT | Resonance Health | 0.065 | 25% | 922,361 | $23,238,432 |

| VFX | Visionflex Group Ltd | 0.005 | 25% | 223,000 | $11,671,298 |

| NIM | Nimyresourceslimited | 0.081 | 25% | 1,076,046 | $10,826,635 |

| ICI | Icandy Interactive | 0.027 | 23% | 897,089 | $29,586,501 |

| PHO | Phosco Ltd | 0.036 | 20% | 220,000 | $8,392,445 |

| CUL | Cullen Resources | 0.006 | 20% | 132,000 | $3,467,009 |

| LNR | Lanthanein Resources | 0.003 | 20% | 590,996 | $6,109,090 |

| NKL | Nickelxltd | 0.024 | 20% | 9,968,661 | $2,045,379 |

| XPN | Xpon Technologies | 0.012 | 20% | 518,075 | $3,624,415 |

| RLF | Rlfagtechltd | 0.056 | 19% | 98,927 | $10,978,085 |

| TGH | Terragen | 0.044 | 19% | 101,427 | $13,656,002 |

| ID8 | Identitii Limited | 0.013 | 18% | 708,444 | $6,615,758 |

| MDI | Middle Island Res | 0.013 | 18% | 1,029,542 | $2,402,408 |

It looks like minnow Cassius Mining (ASX:CMD) will keep its Chenene lithium project in Tanzania after AustChina (ASX:AUH) pulled out of a deal to acquire the project after its option period expired two days ago.

AUH cited that while drilling had completed, there were outstanding analytical results and had not hit one of the key criteria that required results show at least one 10m interval of 1% Li2O within the Dulu 1 pegmatite target. It asked for a 14-day extension to to allow for final assays to be received but was denied by the vendor and has subsequently pulled out of the deal.

AUH decided that it will not exercise its option to acquire the shares in Cassius Mining Limited (CMD’s subsidiary that owns Chenene) and has advised Cassius the the transaction agreements are terminated. CMD will keep the initial $100,000 upfront payment that was made when the binding agreement was made earlier this year.

Formerly Coal of Africa Limited, MC Mining (ASX:MCM), is a coal exploration, development and mining company operating in South Africa. Yesterday, MCM exited a trading halt after securing a US$90m deal for Chinese coal miner Kinetic Development Group Limited to take a 51% stake via a two tranche subscription agreement, which will back the development of its Makhado steelmaking coal project. That compares to an ASX market cap of just $84.87m currently, and MCM is up ~200% in just two trading days

Eden Innovations (ASX:EDE) says sales of its OptiBlend concrete products in the US have been growing, amounting to about $168,585. EdenCrete Pz7 is also now being used in several projects. For example, EdenCrete continues to be used in concrete repairs at Denver International Airport and other locations.

OptiBlend is known for its efficiency in replacing diesel with natural gas, lowering fuel costs and emissions. EdenCrete enhances concrete with carbon nanotubes, making it stronger and more durable.

Energy tech company Volt Power Group (ASX:VPR) has reported significant growth, with revenue increasing by 23% to $2.81 million and adjusted EBITDA rising by 30% to $0.90 million. Both Wescone and EcoQuip, subsidiaries of Volt, achieved record revenues and profits.

Resonance Health (ASX:RHT)has reported a full-year revenue of $8.6 million, which is a 95% increase from the previous year. Normalised EBITDA rose by 183% to $0.69 million, and its normalised operating EBITDA grew by 234% to $1.12 million, with a margin of 13%. The company also saw a significant boost in operating cash flow, which increased nearly tenfold to $1.39 million. Earnings per share improved to 0.04 cents.

Junior NickelX (ASX:NKL) has just bought the Penny Gold South project off Aurum Resources (ASX:AUE) for $120,000 in cash and shares plus extras, right next door to one of the highest-grade gold mines in production in WA. Spectrum Metals, which owned the Penny West project prior to being taken over by Ramelius Resources (ASX:RMS) in 2020 for ~$215m, reported outstanding exploration success at Penny North and at the southern end of the Penny West pit within deeper drill holes beneath cover. The explorer intends to utilise a similar exploration strategy to reinterpret all available data and to test targets at depth.

Nimy Resources (ASX:NIM) meanwhile was up on recent news.

Two more holes drilled by NIM in WA – beneath an initial RC hole that intersected 10m of massive sulphides at its Mons nickel project at the northern end of the Forrestania nickel belt – have revealed increasing widths of mineralisation.

Diamond drilling of the Masson prospect has extended the mineralisation downhole from 102m to 274.5m and remains open, where previous drilling established a mineralised north-south strike length of 160m, open in both directions. A final, deeper diamond hole of the program is expected to be completed early next week , designed to further test dip and depth of the sulphide and disseminated mineralisation.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ZMM | Zimi Ltd | 0.009 | -31% | 631,343 | $1,646,641 |

| AUR | Auris Minerals Ltd | 0.005 | -29% | 4,290,631 | $3,336,382 |

| MOZ | Mosaic Brands Ltd | 0.033 | -28% | 2,167,249 | $8,211,296 |

| IVX | Invion Ltd | 0.003 | -25% | 191,771 | $26,551,462 |

| YAR | Yari Minerals Ltd | 0.003 | -25% | 75,816 | $1,929,431 |

| AAU | Antilles Gold Ltd | 0.004 | -20% | 521,900 | $7,307,139 |

| BLZ | Blaze Minerals Ltd | 0.004 | -20% | 1,043,351 | $3,142,791 |

| GGE | Grand Gulf Energy | 0.004 | -20% | 630,005 | $10,476,235 |

| IBG | Ironbark Zinc Ltd | 0.002 | -20% | 183,333 | $4,584,120 |

| RGL | Riversgold | 0.004 | -20% | 3,545,470 | $6,637,313 |

| RIL | Redivium Limited | 0.004 | -20% | 258,609 | $13,654,274 |

| TYX | Tyranna Res Ltd | 0.004 | -20% | 50,000 | $16,439,627 |

| WEL | Winchester Energy | 0.002 | -20% | 13,682,000 | $3,407,547 |

| HPR | High Peak Royalties | 0.060 | -19% | 25,015 | $15,396,419 |

| BCC | Beam Communications | 0.140 | -18% | 2,000 | $14,691,727 |

| MKT | The Market Limited | 0.150 | -17% | 419,222 | $57,775,065 |

| MXO | Motio Ltd | 0.015 | -17% | 597,648 | $4,827,570 |

| PNT | Panthermetalsltd | 0.025 | -17% | 176,936 | $2,614,985 |

| STM | Sunstone Metals Ltd | 0.008 | -17% | 4,711,282 | $34,667,133 |

| AUH | Austchina Holdings | 0.003 | -17% | 8,175,966 | $6,301,151 |

| CZN | Corazon Ltd | 0.005 | -17% | 2,866,904 | $4,007,434 |

| GCM | Green Critical Min | 0.003 | -17% | 2,720 | $4,405,628 |

| PUR | Pursuit Minerals | 0.003 | -17% | 4,305,975 | $10,906,200 |

IN CASE YOU MISSED IT

Chariot Corporation’s (ASX:CC9) exposure to the Horizon and Halo lithium projects in Nevada’s Big Smoky Valley is poised to increase after Mustang Lithium moved to regain full control over the two projects. Chariot has a 24.1% ownership interest in Mustang.

EBR Systems (ASX:EBR) has submitted the final premarket approval (PMA) application module to the US Food and Drug Administration (FDA) for its WiSE CRT System, bringing the world’s first leadless pacemaker for the heart’s left ventricle closer towards commercialisation in the US.

Neurotech International (ASX:NTI) has submitted a request with the US Food and Drug Administration for orphan drug designation (ODD) for use of its broad-spectrum cannabinoid drug NTI164 in children and adults diagnosed with Rett Syndrome.

NickelX (ASX:NKL) is acquiring the Penny South project that is just 550m south of Ramelius Resources’ (ASX:RMS) Penny West/North, one of Australia’s highest grade gold mines. It includes a 2.5km strike extension of the Penny West Shear that hosts the Penny deposits.

Scorpion Minerals (ASX:SCN) has continued its focus on advancing several gold targets within its Pharos project in WA’s Murchison region with a strategic review involving analysing historic data to refine drilling targets.

High-grade gold potential has been confirmed by historic reverse circulation (RC) drilling that returned 12m at 7.40 g/t gold from 44m, including 2m at 42.4 g/t gold and 16m at 3.09 g/t gold from surface, including 2m at 16.8 g/t gold at the Lantern prospect.

SCN’s CEO Michael Fotios says the company is working quickly to complete this data review ahead of a planned drilling program later this year to tap into Pharos gold potential.

Raiden Resources (ASX:RDN) has completed a heritage survey covering new gold targets at the Arrow project, 35km on strike from De Grey’s (ASX:DEG) Hemi gold deposit.

The company is now preparing to begin aircore drilling as soon possible, once the final heritage survey report is finalised and a program of work (PoW) has been issued. RDN managing director Dusko Ljubojevic says the company is hopeful the survey will indicate the program may proceed as planned, which sets Raiden up for a third drilling campaign across its projects this year.

iCandy International (ASX:ICI) has seen a big 1,364% jump in EBITDA to $2.7m for the first half of 2024 from the previous corresponding quarter. Revenue for the period also increased by 9.9% to ~$13.2m due to the gaming market returning to its normal performance levels.

Net cash generated by operating activities also turned positive, with $3.17m recorded, up from the negative cash flow of $6.4m in 1H 2023.

“The sustained improvement of our EBITDA margin, coupled with strong positive operating cash flow underscores the company’s focus on value creation,” chairman Kin Wai Lau said.

At Stockhead, we tell it like it is. While Chariot Corporation, EBR Systems, iCandy Interactive, Neurotech International and NickelX are Stockhead advertisers, they did not sponsor this article.

Originally published as Closing Bell: Star Casino ruled unfit to reclaim licence; Cassius jumps 40pc as AustChina exits lithium deal