Closing Bell: Gold shines brightly despite minor market dip

Despite a minor dip to the overall ASX, rising gold prices lifted gold stocks, pushing the ASX Gold index up 4.3%.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX Gold Index leads gains, up more than 4pc

Energy sector in the green despite 2pc oil price fall

Tech index bucks Nasdaq's trend to rise 0.8pc

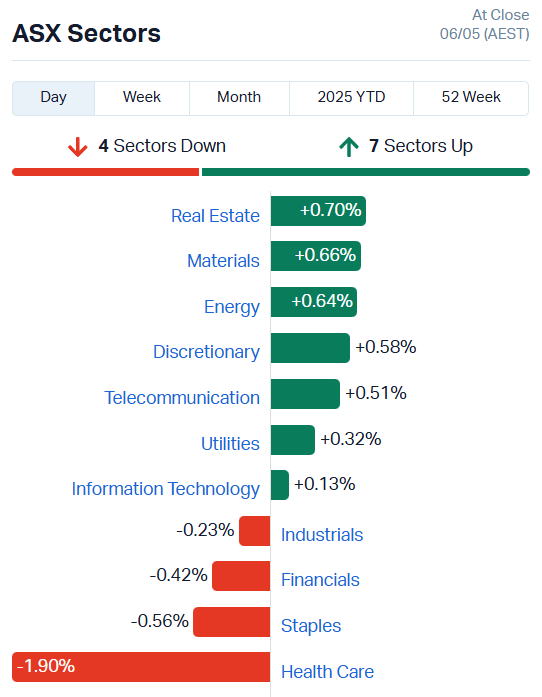

It’s been a rollercoaster of a day on the ASX, with the bourse swinging wildly up and down throughout the day before settling marginally down, dipping 0.08%.

Despite falls in oil and iron ore prices overnight, a 2.5% uptick in the gold price made waves.

Perhaps our market had already priced-in the current oil outlook, because Energy stocks are up today, gaining almost a full percentage point alongside the Materials sector.

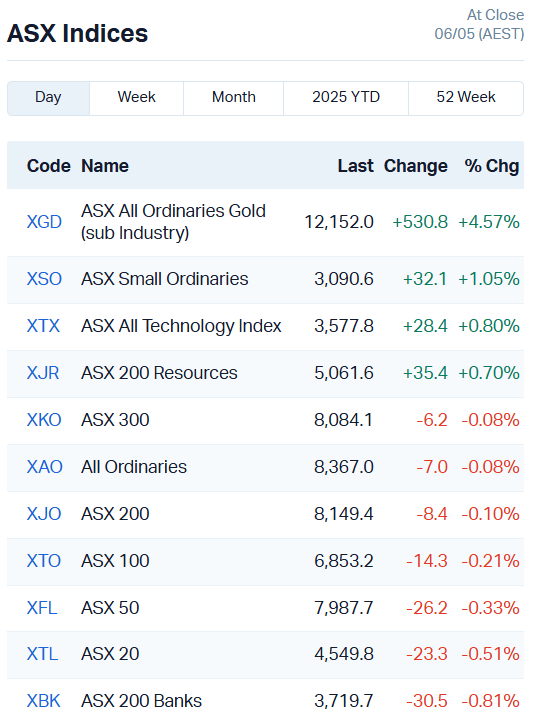

The indices are certainly telling a story – the ASX All Ords Gold index has climbed more than 4.3%, the Small Ords (which is very resources heavy) more than 1% and the ASX200 Resources index tipped up 0.69%.

That’s given plenty of fuel for gold stocks to rise.

Leaving small caps aside for now, Pantoro Gold (ASX:PNR) gained 11.83%, Resolute Mining (ASX:RSG) 10.4%, Larvotto Resources (ASX:LRV) 10.19%, Ora Banda Mining (ASX:OBM) 6.47%, Black Cat Syndicate (ASX:BC8) 7.14% and Ramelius Resources (ASX:RMS) 6.87%.

In fact, the gold miners were so dominant today they didn’t leave a lot of room for other stocks to take the spotlight.

Notable exceptions are immunotherapy biotech Immutep (ASX:IMM) which gained 9%, automotive stock Autosports Group (ASX:ASG) up 9.76%, gambling giant Tabcorp Holdings (ASX:TAH) which lifted 9.2% alongside the Star Group’s (ASX:SGR) 9.52% gain, and technology large cap NextDC (ASX:NXT) up 8.14%.

Overall, the market has taken a minor loss, with seven sectors in the green and four in the red. The Healthcare sector weighed heavily on the bourse, down 1.86%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| DTR | Dateline Resources | 0.035 | 59% | 2.1E+08 | $60,842,510 |

| BP8 | Bph Global Ltd | 0.003 | 50% | 190000 | $2,101,969 |

| AZL | Arizona Lithium Ltd | 0.01 | 43% | 51496080 | $31,932,702 |

| AN1 | Anagenics Limited | 0.008 | 33% | 1449899 | $2,977,922 |

| VEN | Vintage Energy | 0.004 | 33% | 1062981 | $5,697,666 |

| AEV | Avenira Limited | 0.009 | 29% | 7383898 | $22,243,508 |

| BGE | Bridgesaaslimited | 0.019 | 27% | 32000 | $2,997,888 |

| WTM | Waratah Minerals Ltd | 0.295 | 26% | 5747597 | $47,717,729 |

| GCM | Green Critical Min | 0.015 | 25% | 27338485 | $23,540,140 |

| NPM | Newpeak Metals | 0.015 | 25% | 260838 | $3,864,861 |

| GES | Genesis Resources | 0.01 | 25% | 42000 | $6,262,730 |

| IPB | IPB Petroleum Ltd | 0.005 | 25% | 1042715 | $2,825,612 |

| RML | Resolution Minerals | 0.01 | 25% | 2877525 | $4,206,295 |

| WCN | White Cliff Min Ltd | 0.0285 | 24% | 2.79E+08 | $43,595,827 |

| PHO | Phosco Ltd | 0.07 | 23% | 20527 | $16,301,552 |

| GRV | Greenvale Energy Ltd | 0.054 | 23% | 254320 | $23,952,427 |

| PRS | Prospech Limited | 0.027 | 23% | 59377 | $7,234,170 |

| EQX | Equatorial Res Ltd | 0.14 | 22% | 533211 | $15,116,216 |

| LKY | Locksleyresources | 0.028 | 22% | 5761797 | $3,373,333 |

| S66 | Star Combo | 0.14 | 22% | 1500 | $15,534,543 |

| REC | Rechargemetals | 0.017 | 21% | 262117 | $3,597,860 |

| SMM | Somerset Minerals | 0.017 | 21% | 21798832 | $5,918,271 |

| YRL | Yandal Resources | 0.17 | 21% | 410253 | $43,292,897 |

| HIQ | Hitiq Limited | 0.03 | 20% | 1907479 | $9,189,061 |

| 1AI | Algorae Pharma | 0.006 | 20% | 727214 | $8,436,974 |

Making news…

White Cliff Minerals (ASX:WCN) has hit a very promising copper intercept at its Danvers project in Canada, drilling 175m at 2.5% copper from just 7.6m down. The hole ended in even higher grades, still open at depth.

The company says it’s one of the best copper hits globally in decades, and is planning more drilling to chase it further. More assays are on the way, with a maiden JORC resource in the works.

Waratah Minerals (ASX:WTM) fronted the RIU Resources Conference with a cracking pitch on its gold-copper hunt in NSW’s Lachlan Fold Belt, one of Australia’s hottest mineral districts.

It’s sitting on a big district-scale land position at its Spur project, 100% owned, right near majors like Newmont and Gold Fields, with solid hits already in the bag including 11m at 10.8g/t gold and nearly 200m at 0.54% copper equivalent.

Waratah reckons it’s only just getting started in what’s shaping up to be a prime gold-copper postcode.

Somerset Minerals (ASX:SMM) has just wrapped up the acquisition of the high-grade Coppermine Project in Nunavut, right next door to White Cliff’s monster copper hit at Danvers.

It now controls a massive 1,200km² landholding packed with historical copper finds, including grades up to 45.4% copper, and is gearing up to launch its maiden drill campaign in just a couple of weeks.

Early targets at Coronation are looking juicy, the company said, with reprocessed geophysics lighting up multiple anomalies, and old drill holes that ended in mineralisation.

Green Critical Minerals (ASX:GCM) is enjoying increased offtake attention around its very high density graphite technology, including formal requests for product samples from a leading European and UK based thermal management solutions provider.

The company says the uptick in attention is a validation of their product's commercial potential, aligning with market needs in electronics, defence, and high-efficiency manufacturing sectors.

IN CASE YOU MISSED IT

EZZ Life Sciences Holdings (ASX:EZZ) will pay a fully franked share dividend, amounting to $0.020 per share. The ex-dividend date is May 16, 2025 and the payment date June 17, 2025. The genomic life science company says it is investing in the future of consumer health through the development of e-commerce and distribution of high-quality products.

TRADING HALTS

Adelong Gold (ASX:ADG)– cap raise

Echo IQ (ASX:EIQ)– cap raise

At Stockhead, we tell it like it is. While EZZ Life Sciences, Ora Banda Mining, Green Critical Minerals and White Cliff Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: Gold shines brightly despite minor market dip