Closing Bell: ASX takes breather, goldies shine, Woolies and Coles charged over sneaky discounts

ASX dips, Woolworths and Coles hit with lawsuit over misleading discounts. Gold miners and uranium stocks gain.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX dips amid concerns over delayed RBA rate cuts

Woolworths and Coles hit with lawsuit over misleading discounts

Gold miners and uranium stocks gain

The ASX took a breather from its record highs, down by 0.6% after being rattled by worries that the Reserve Bank might delay the first rate cut until well into 2025.

The cash rate is expected to stay steady at 4.35% for the seventh straight meeting on Tuesday, with the RBA expected to stick to its guns about inflation still being “elevated.”

The ANZ expects the RBA to keep interest rates steady tomorrow, while Commonwealth Bank predicts a 25-point cut before the year ends, potentially pushed back to February 2025.

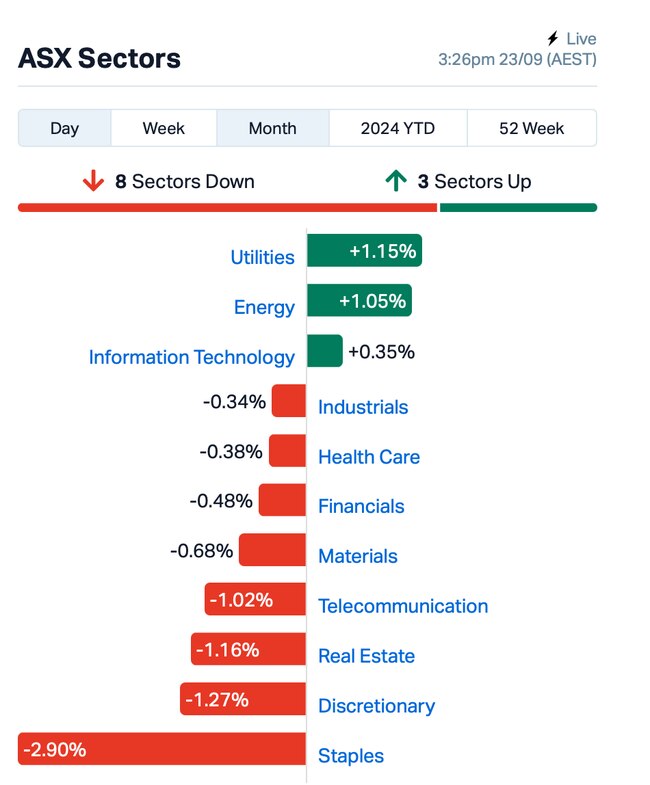

Most ASX sectors were in the red today, with consumer stocks taking the biggest hit.

Supermarket giants Woolworths (ASX:WOW)and Coles (ASX:COL) had a rough day - down 3% each - after the competition regulator, the ACCC, slapped them with a lawsuit.

The ACCC claimed both companies misled consumers with deceptive discount pricing on hundreds of products by inflating prices before marketing them as discounted.

“We're seeking a significant penalty," said ACCC chair, Gina Cass-Gottlieb.

"This is serious conduct that is of great concern to us, that affected many consumers with millions of products sold, subject to this practice."

PM Albenese chimed in, saying the conduct of these supermarkets is “completely unacceptable”.

On a brighter note, gold miners saw gains as gold prices approached an all-time high.

Uranium stocks also surged after Baltimore-based Constellation Energy said it was planning to restart a nuclear reactor at Three Mile Island in Pennsylvania, and sell the power to Microsoft for its data centres, responding to rising energy demands amid the AI boom.

Webjet (ASX:WEB), meanwhile, was down 10% following its demerger into Webjet Group (ASX:WJL)and WEB Travel Group (ASX:WEB) - both now listed separately on the ASX.

What else is happening today?

China's central bank has cut its rates today, lowering the 14-day reverse repurchase rate to 1.85% from 1.95% previously.

The move has pushed the benchmark MSCI Asia Pacific Index higher, with gains in China, Hong Kong, and South Korea, ahead of a key meeting of the People’s Bank of China about the economy.

Over in Sri Lanka, voters elected leftist outsider Anura Kumara Dissanayake as president, rejecting elite leadership that led to bankruptcy of the country. After years of severe economic mismanagement by ex-president Mahinda Rajapaksa – who was in power for 10 years – the Sri Lankan government defaulted on its debt in 2022.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| JPR | Jupiter Energy | 0.025 | 56% | 2,223 | $20,391,768 |

| MTH | Mithril Silver Gold | 0.570 | 54% | 11,669,662 | $38,138,202 |

| EMP | Emperor Energy Ltd | 0.012 | 41% | 16,909,526 | $3,312,575 |

| ODE | Odessa Minerals Ltd | 0.003 | 50% | 180,079 | $2,086,565 |

| MXO | Motio Ltd | 0.025 | 39% | 3,185,037 | $4,827,570 |

| TMX | Terrain Minerals | 0.004 | 33% | 65,000 | $5,298,086 |

| WTM | Waratah Minerals Ltd | 0.470 | 32% | 3,571,602 | $67,035,064 |

| ERW | Errawarra Resources | 0.095 | 32% | 1,126,895 | $6,906,288 |

| NOV | Novatti Group Ltd | 0.080 | 29% | 1,936,088 | $22,056,528 |

| PGO | Pacgold | 0.150 | 25% | 181,599 | $10,097,453 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 12,354,846 | $57,867,624 |

| AVE | Avecho Biotech Ltd | 0.003 | 25% | 500,000 | $6,338,594 |

| CAV | Carnavale Resources | 0.005 | 25% | 110,000 | $16,360,874 |

| CYQ | Cycliq Group Ltd | 0.005 | 25% | 1,172,188 | $1,782,067 |

| NAE | New Age Exploration | 0.005 | 25% | 8,227,416 | $7,175,596 |

| WML | Woomera Mining Ltd | 0.003 | 25% | 599,943 | $3,036,278 |

| PVW | PVW Res Ltd | 0.026 | 24% | 511,115 | $2,654,500 |

| ESR | Estrella Res Ltd | 0.011 | 22% | 20,456,818 | $16,359,347 |

| BPM | BPM Minerals | 0.110 | 22% | 3,182,466 | $6,040,999 |

| PNT | Panthermetalsltd | 0.023 | 21% | 1,058,983 | $1,656,157 |

| ADD | Adavale Resource Ltd | 0.003 | 20% | 203,550 | $3,059,413 |

| ATX | Amplia Therapeutics | 0.160 | 19% | 2,700,802 | $37,097,772 |

| LAM | Laramide Res Ltd | 0.563 | 17% | 10,000 | $9,820,432 |

Media company Motio (ASX:MXO) was up after delivering an investor update to the market, drawing attention to the company’s performance in FY24. Motio says that it has managed to bring in a 27% rise in revenue to $8.367 million on a gross margin of 72%, with the company guidance for FY25 coming in at a 10%-15% increase on pcp, targeting between $9.2 million to $9.6 million.

Mithril Silver and Gold (ASX:MTH) was rising, most likely on the back of Friday’s report that the company has hit a fantastic intercept at its Copalquin project in Mexico. The company says the drill result has come back at a breathtaking 7m grading 144g/t gold and 1162g/t silver, with that intercept from a down-hole depth of just 18m forming part of a broader 33m intersection at 31.8g/t gold and 274g/t silver from surface.

Lachlan Fold Belt explorer, Golden Deeps (ASX:GED), has made another splash after news broke about an 80m-thick high-grade copper intersection from its Havilah project, which sent the share price nuclear.

It dipped on news of a subsequent $1.78m capital raising, yet shares are back up today after announcing a bigger 92m sulphide hit that extends the Hazelbrook copper zone at Havilah. Copper grades of up to 3.6% were discovered using a handheld pXRF reader, and while those visual readings are no substitute for lab analysed confirmation of grades, they bode well for future exploration work. The intersection of another thick zone of sulphide mineralisation in HVD004, including patches of copper sulphides, extends the Hazelbrook mineralised zone 200m to the northeast of the 80m sulphide intersection in HVD003.

Avecho (ASX:AVE) rose after delivering a not-exactly-stellar half-year financial report this morning, showing that the company has experienced a revenue drop of 30% for the period to $312,187, which the company says is “mainly attributable to a decrease in Vital ET sales made to Ashland during the period”. However, Research and development tax incentive and other income increased by 80% to $725,182 – and the company currently has net assets of $4,216,535, including cash and cash equivalents of $4,838,410.

Emperor Energy (ASX:EMP) was up on news that it has received firm commitments to raise $1.25 million in an institutional placement, at an issue price of $0.007 per share with Nero Resources Fund, Perennial Value Management and Regal Funds Management set to become substantial shareholders. The company has also appointed Argonaut as a strategic financial advisor to assist with progressing the Judith Gas Field Project.

New Age Exploration (ASX:NAE)’s early exploration drilling at its Wagyu gold project in WA’s Pilbara is gaining attention as the junior plans to drill ~4300m as part of a Phase 2 program that’s continuing to test high-priority targets, including potential ‘Hemi-style’ intrusive systems just 9km along strike from De Grey Mining (ASX:DEG) ~10.5Moz Hemi gold deposit.

The AC drilling is testing additional gold targets that were identified from geophysics surveys and are following up on Phase 1 geological observations. Phase 1 itself was completed between July and September across gold targets on the eastern side of the project with >7640m drilled across 156 holes, which are currently being assayed for gold and multi-elements, with expected by the end of the month.

Laramide Resources (ASX:LAM) was also rising, but today’s news of a change of Director’s interest most likely wasn’t the cause. Last week, the company revealed first assays from its Long Pocket infill drilling progrem, which returned strong uranium mineralisation at shallow depths. Significant intersections included 10m @ 606ppm U3O8 from 6m depth, including 2m @ 1,726ppm U3O8 from 11m, and 8m @ 1,770ppm U3O8 from 16m depth, including 4m @ 3,128ppm U3O8 from 17m.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BUR | Burley Minerals | 0.049 | -26% | 1,032,400 | $9,924,482 |

| BNL | Blue Star Helium Ltd | 0.003 | -25% | 8,701,321 | $9,724,426 |

| ENT | Enterprise Metals | 0.003 | -25% | 329,096 | $4,413,269 |

| LNU | Linius Tech Limited | 0.002 | -25% | 112,498 | $11,093,481 |

| RNE | Renu Energy Ltd | 0.002 | -25% | 14,503,500 | $1,528,268 |

| VPR | Voltgroupltd | 0.002 | -25% | 504,907 | $21,432,416 |

| QEM | QEM Limited | 0.100 | -23% | 413,191 | $19,680,923 |

| PRS | Prospech Limited | 0.030 | -21% | 2,378,009 | $11,499,855 |

| EXL | Elixinol Wellness | 0.004 | -20% | 413,379 | $6,605,912 |

| TYX | Tyranna Res Ltd | 0.004 | -20% | 519,725 | $16,439,627 |

| AIV | Activex Limited | 0.005 | -17% | 508,010 | $1,293,015 |

| EPM | Eclipse Metals | 0.005 | -17% | 300,000 | $13,505,133 |

| LPD | Lepidico Ltd | 0.003 | -17% | 450,956 | $25,767,375 |

| ZMM | Zimi Ltd | 0.010 | -17% | 175,000 | $1,519,977 |

| SHV | Select Harvests | 3.700 | -17% | 1,491,527 | $536,429,099 |

| LRL | Labyrinth Resources | 0.016 | -16% | 8,072,301 | $25,144,164 |

| MEG | Megado Minerals Ltd | 0.016 | -16% | 417,648 | $4,834,656 |

| COD | Coda Minerals Ltd | 0.084 | -14% | 1,095,940 | $17,178,670 |

| AKN | Auking Mining Ltd | 0.006 | -14% | 300,000 | $2,230,809 |

| PVT | Pivotal Metals Ltd | 0.012 | -14% | 596,737 | $9,857,656 |

| SRN | Surefire Rescs NL | 0.006 | -14% | 1,943,500 | $13,904,155 |

| ZNC | Zenith Minerals Ltd | 0.037 | -14% | 8,000 | $15,152,378 |

IN CASE YOU MISSED IT

Mithril Silver and Gold’s (ASX:MTH)share price continues to surge following a best-ever intersectionof 7m at 144g/t gold and 1162g/t silver at Copalquin. It comes as no surprise that the company seeks to double its current 520,000oz at 6.81g/t gold equivalent resource, with further assays pending.

Following an extensive review of historical exploration, Anax Metals (ASX:ANX) has uncovered several high-potential VMS drill targets at the Evelyn deposit, part of its Whim Creek project in Western Australia. Whim Creek hosts 590,000t at a high-grade 2.54% copper and 3.90% zinc. The review potentially opens the door to adding existing resources with successful exploration and could mean Evelyn is the first of many copper-zinc-lead-silver-gold deposits on the lease.

RC drilling at Brightstar Resources’ (ASX:BTR) Fish deposit at the Jasper Hills project has turned up numerous >20g/t gold hits. A top hit of 45g/t shows the potential for the deposit to deliver high-grade pockets as the growing gold explorer and miner firms up its next stage of growth.

Torque Metals (ASX:TOR)has raised $3.1 million via a placement to drive the next phase of exploration at its Paris gold project in WA’s Goldfields. Just last week, the company announced a maiden MRE for Paris, coming in at 250,000oz gold at 3.1g/t, spanning only 2.5km2 of the company’s 350km2 tenure, signalling plenty of room for growth.

With maiden drilling to commence imminently, Raiden Resources (ASX:RDN) has mapped a new high-priority target zone at its Andover South lithium project in WA’s Pilbara. The company has defined seven target areas with a potential 4.2km strike across the entire Raiden pegmatite field, next door to Azure’s Andover project.

Omega Oil and Gas (ASX:OMA) has spudded the Canyon-1H horizontal well in Southern Queensland. Drilling will take 3 to 4 weeks, with fracture stimulation, flowback, and a well-testing program planned following analysis and integration of the results of the Canyon-1H well.

EZZ Life Science Holdings (ASX:EZZ) has inked a three-year sponsorship deal with the Australian Open starting in 2025, expanding its presence in key markets of China and Southeast Asia and targeting more than 330 million tennis fans. Through the deal, EZZ will be offering a prize package including a trip for two to the Australian Open as well as hosting a series of product giveaways and promotional activities aligned with the Open.

A 730t bulk sample has been shipped to a commercial graphite facility in China, which will produce concentrate using Renascor Resources’ (ASX:RNU) optimised flowsheet. Production is scheduled for Q4 this year, while back home, engineering for the PSG facility and commissioning of the demonstration plant are slated for Q2 next year.

Summit Minerals (ASX:SUM) has acquired a new strategic tenement at the Equador niobium and tantalum project that directly adjoins its existing Equador North mining lease. Rock chips collected as part of due diligence analysis indicated exceptional grades similar to the existing Equador project results, including 42.93% Nb2O5, 11.39% Ta2O5 and 33,310 ppm PREO and 21.21% Nb2O5, 79.49% Ta2O5 and 199,150 ppm PREO.

“This is another exceptional acquisition for the company to add areas of geological significance which has proven results,” managing director Gower He said. “This project just continues to amaze us on its potential and areas of growth. The team has done a wonderful job to make this happen.”

Anson Resources (ASX:ASN) has been granted an additional 21 strategic SITLA blocks that abut its Green River lithium project claims in Utah, USA, which cover a total area of 6,685 acres (27.05 km2) of highly prospective for lithium-rich brines that are the target of planned exploration programs.

The blocks have been granted as 1 large Other Business Administration (OBA) which allows for special consideration to bring significant projects into production.

The company says this approval demonstrates the Government of Utah’s support for the development of the Green River project. This OBA lease also increases the Green River land package abutting the company’s privately owned land parcel and the proposed processing plant location.

New Age Exploration (ASX:NAE) has commenced Phase 2 drilling at its Wagyu gold project in WA with the aim of testing additional gold targets identified from geophysics surveys and to follow up on Phase 1 geological observations (assays pending). NAE plans to drill around 4,300m, continuing to test high priority targets, including potential ‘Hemi-Style’ intrusive systems like De Grey Mining’s (ASX:DEG) adjoining 10.5Moz Hemi gold deposit.

QEM (ASX:QEM) is undertaking a 1 for 3.5 renounceable rights issue at $0.07 per share to raise up to ~$3m to complete current test work program to optimize and lock-down flow sheets for entry into the pre-feasibility study for its Julia Creek vanadium and oil shale project in QLD. The funds will also be used to continue environmental studies, EIS Term of Reference, approvals documentation, and for general working capital.

“This fundraising follows delivery of a positive Scoping Study for QEM’s Julia Creek Project demonstrating a distinctive and commercially attractive project for onsite critical minerals refining in Queensland,” QEM’s Chair Tim Wall said.

TRADING HALTS

Power Minerals (ASX:PNN) – pending an announcement in relation to an expansion of the Nióbio Project in Brazil.

Site Group International (ASX:SIT) – pending an announcement in relation to an equity raising.

Astral Resources (ASX:AAR) – pending the release of an announcement in relation to a capital raising.

West Cobar Metals (ASX:WC1) – pending an announcement of drilling results from the Bulla Park project.

Nordic Nickel (ASX:NNL) – pending an announcement in relation to a proposed capital raising.

Felix Gold (ASX:FXG) – pending an announcement in relation to a potential material capital raising.

Fletcher Building (ASX:FBU) – pending announcement of completion of a placement and institutional offer.

At Stockhead, we tell it like it is. While Summit Minerals, Anson Resources, EZZ Life Science, New Age Exploration, QEM, Mithril Silver and Gold’s,Anax Metals, Brightstar Resources, Torque Metals, Raiden Resources, Omega Oil and Gas, and Renascor Resources are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX takes breather, goldies shine, Woolies and Coles charged over sneaky discounts