Capital raisings have these explorers cashed and ready to drill for precious metals

Asra Minerals, Errawarra Resources and Trek Metals have all raised funds recently to support drill programs that could power a rerate.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Capital raisings are the primary method for funding resource exploration programs

Asra Minerals, Errawarra Resources and Trek Metals have all raised funds for exploration

These drill programs could be the catalyst for a discovery that has the potential to transform the respective companies

To make a discovery you need to drill and in order to drill you need to be able to secure funding.

So if a junior explorer is running on empty, it's hard to envisage them pulling out that big, company-making find.

While the mileage from such programs might vary widely, success can be game changing if the results are impressive enough.

One notable example is Spartan Resources (ASX:SPR) which raised $19 million in early 2022 before drilling to test a westerly extension at Gilbey’s North and uncovered the Never Never deposit.

Then known as Gascoyne Resources, it went on to shut the Dalgaranga mine and raise another $50m in a recapitalisation which delivered the powder to drill out the new orebody fully. It now hosts ~1.5Moz at over 8g/t, with the nearby Pepper find taking its high grade underground inventory to over 2.3Moz at more than 9g/t.

Without supportive shareholders that success, a ~1500% share price gain and $2.4bn takeover offer from Ramelius Resources (ASX:RMS), would never have come to fruition.

So it pays to look out for companies which have tapped the market for fresh equity and have drilling programs on the horizon.

You never know which could turn up trumps. Here a few who could be on the right path.

Asra Minerals (ASX:ASR)

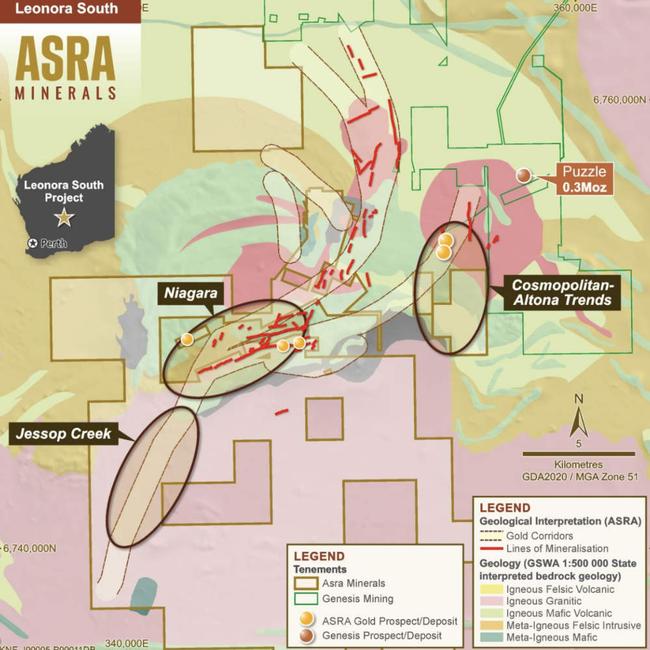

In mid-April, Asra Minerals raised $3m through a two-tranche share placement priced at 0.2c per share to key new and existing institutional and sophisticated investors to fund an aggressive exploration campaign with a focus on its gold assets in WA’s Leonora region.

The company holds more than 725km2 of highly prospective tenure in this region with its Leonora North-Mt Stirling asset sitting close to Vault Minerals' (ASX:VAU) 4Moz King of the Hills mine.

It is also located close to Genesis Minerals' (ASX:GMD) Leonora and Kookynie operations.

Chief executive officer Paul Stephen told Stockhead that Leonora was really interesting as it was originally opened up by old timers from 1880-90 through to the beginning of World War One, which essentially ended their activity.

However, they left behind a rich legacy that include an enormous amount of evidence of high-grade gold.

“I think we've got 155 individual shafts, and these were where the old-timers were working down on fairly narrow quartz veins, hoping to reach the source of that high-grade gold,” Stephen said.

“A lot of the time that was pretty hard going, a lot of the time they didn't get there.”

He adds that Leonora is home to some “absolutely wonderful and profitable” gold mines and that the best place to make a new discovery is next to existing gold mines.

“We know we're in the right location. We know we've got the right rocks that are hosting the high-grade gold and that's really a starting point.”

Stephen noted the company’s exploration strategy has two prongs, the first of which is aimed at methodically increasing its existing 200,000oz of established JORC resources that’s spread across four areas.

“That's what I'd call the fairly high confidence drilling into something that you really know you know where it's at and you're drilling to expand an existing resource” he said.

“In parallel to that, we also did a lot of regional work last year where we used aeromagnetic to prove that areas previously mapped as being granites were in fact mafic rocks that are known to host gold deposits in this area.”

This aeromagnetic survey data has been combined with mapping to identify new target areas that have never been drilled before.

Stephen said the company was going to stage operations to ensure it was busy for the next six months.

“We've got one operational team that will methodically work through the reverse circulation drilling, then the diamond drilling, and then we're going to do a lot of regional aircore drill,” he added.

“Because at this gold price, we feel that as much as it's obviously very good to improve your existing resources, we think we have the right ground to make a new discovery and I think in this market that's exactly what the market wants to see.”

Drilling is expected to start imminently thanks to the ready availability of rigs in the Leonora region and will carry on for up to three months as the company works through various different phases and targets.

“I think we'll start to see results mid to late June just with assays and the time it takes you to get stuff done,” Stephen said.

“Logically I think this will be a good program and it'll lead to the need to do more follow-up.”

Errawarra Resources (ASX:ERW)

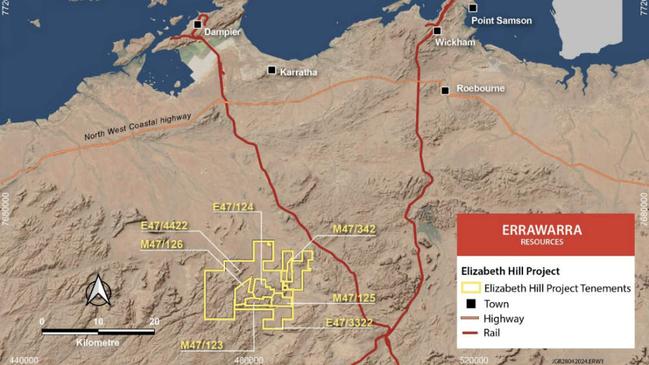

Another company that has seen $3m flood into its coffers for exploration is Errawarra Resources which wrapped up a placement priced at 2.7c to advance the Elizabeth Hill project in WA’s Pilbara region that it had acquired in March 2025.

Elizabeth Hill is a historical producer from which some 1.2Moz of silver was extracted from just 17,000t of ore at an eye-popping head head grade of ~2200g/t.

Operations at the mine ceased in 2000 because silver price dropped, but current silver prices – close to 7x higher than the US$5/oz seen when Elizabeth Hill closed – could inspire a revival.

Historical drilling has returned bonanza grade intercepts including 11.7m at 5371g/t silver from 13m while various explorers over the years have identified anomalous silver soil results across land package, which has been consolidated for the first time by ERW.

Speaking to Stockhead columnist Barry FitzGerald in early April, executive director Bruce Garlick said having the sole right to explore for silver at Elizabeth Hill was a game changer.

“We have an existing deposit there and we have to now expand our thinking. We also have the added advantage of a 180km2 tenement that has never really been in existence before,” he said.

Having already done soil sampling and geochemical surveying, the company plans to identify drill targets in the coming weeks before launching drilling that will initially focused on near mine areas.

“What we are trying to do is identify the target areas, then hone in on those targets areas with ERM and decide which to put drilling into,” Garlick added.

ERW, soon to be renamed West Coast Silver, will also follow up on the Munni Munni fault, which is considered to be prospective for repetitive deposits.

“Once we have got some good assays hopefully coming out of these drill holes, we will understand the future a lot better than we do right now,” he concluded.

Trek Metals (ASX:TKM)

Late in April, Trek Metals saw such strong demand from new and existing sophisticated investors for a $3.5m placement priced at 5c per share that it had to implement scale-backs.

This placement included a cornerstone investment of $500,000 from Patronus Resources (ASX:PTN).

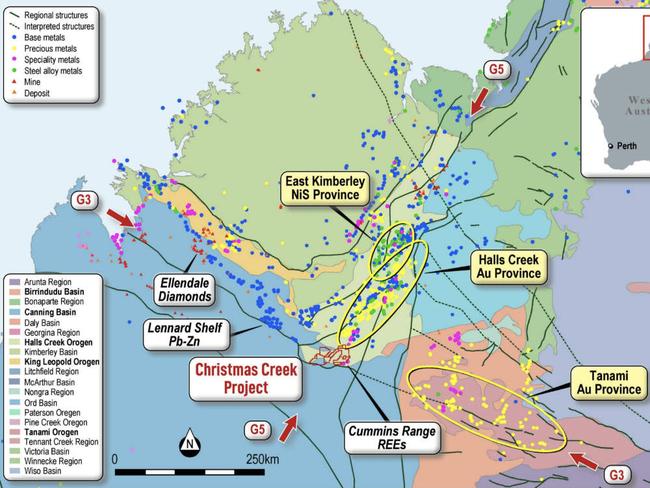

Proceeds from the placement will be used to fast-track the next phase of drilling at its Christmas Creek gold project in WA’s Kimberley region.

The 1183km2 Christmas Creek project to the southwest of Halls Creek is a previously unexplored, largely concealed district-scale gold and rare earths exploration opportunity.

Previous exploration to test if the area is an extension of the prolific Granites-Tanami Orogen had demonstrated a correlation to the sequences that host Newmont Mining’s Tanami gold mine in the Northern Territory.

Drilling carried out by TKM in late 2024 returned thick, high-grade intercepts such as 10m at 12.66g/t gold from 59m and 10m at 7.34g/t gold from 94m.

Visible gold has been noted in these high-grade intersections and the Martin prospect was interpreted to be an orogenic gold system, with similar characteristics to the large Tanami deposits over the border.

Reverse circulation drilling scheduled to commence in May with an initial focus on expanding the high-grade gold hits at the Martin prospect.

Drilling will also test other priority targets at Christmas Creek including Zahn and Coogan.

“In our view, the Christmas Creek project represents a major discovery opportunity as part of the upcoming drill season, with the potential to confirm a large-scale orogenic gold find of considerable scale that we believe could quickly re-rate the company as we drill test below and immediately along strike from the thick, high-grade intercepts reported late last year,” chief executive officer Derek Marshall said in the placement announcement on April 24.

At Stockhead we tell it like it is. While Asra Minerals, Errawarra Resources, Spartan Resources and Trek Metals are Stockhead advertisers, they did not sponsor this article.

Originally published as Capital raisings have these explorers cashed and ready to drill for precious metals