Bailador’s investment in fintech DASH paying off as growth accelerates

Bailador Technology Investments is reaping the early rewards of its investment in fintech platform DASH Technology Group, which has reported strong H2 FY25 growth.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Bailador’s investment in fintech platform DASH paying off with business delivering strong growth

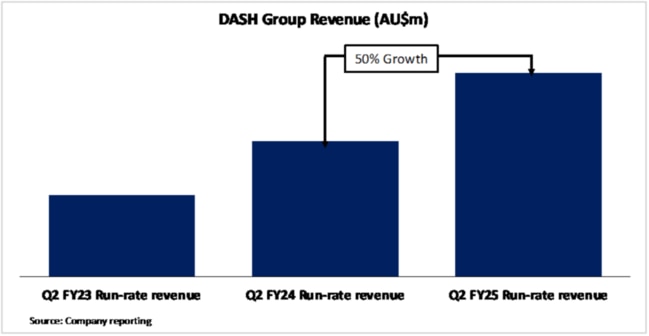

For H2 FY25 DASH has reported 50% revenue growth compared to prior corresponding period

DASH has completed a key acquisition, expanded its executive team and signed new high-profile partnerships

Special Report: Tech-centric capital fund Bailador Technology Investments is reaping early rewards from its investment in fintech platform DASH Technology Group, with the business delivering strong growth just 10 months after Bailador’s initial backing.

Bailador Technology Investments (ASX:BTI) has invested $30 million (including $5 million in debt), in DASH since June 2024 and has watched the company power ahead.

DASH has acquired Integrated Portfolio Solutions (IPS), expanded its executive team, and signed new high-profile partnerships with all the activity translating into strong financial performance.

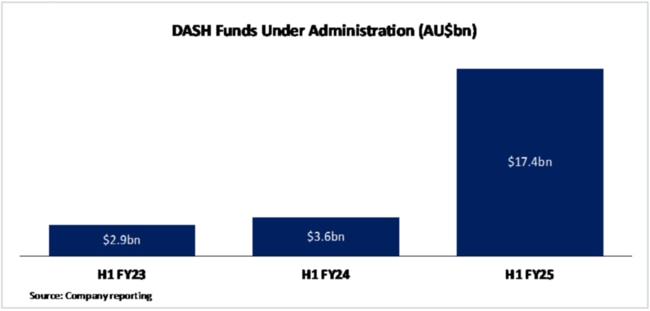

For H2 FY25, DASH reported 50% revenue growth compared to the prior corresponding period (pcp), a result underpinned by a jump in funds under administration (FUA) from ~$4 billion to more than $17bn.

The jump in revenue growth has been attributed to the IPS acquisition and integration into the DASH platform and continued organic FUA inflows.

Source: Bailador

DASH is a cloud-based financial advice and investment management software platform used by independent financial advisers (IFAs) and financial institutions.

The company operates in the large and fast-growing investment platform and financial advice software market.

Its recent strong increase in FUA has driven a 50% increase in run-rate revenue which now positions DASH as one of the fastest growing digital advice technology firms in Australia.

Source: Bailador

‘Very active 10 months’ for DASH

BTI co-Founder and managing partner David Kirk is one of three BTI representatives on the DASH board.

“It’s been a very active 10 months since we first invested,” Kirk said.

We are pleased with the progress the business has made and remain optimistic we will see continued strong growth and new business opportunities ahead.

In October DASH completed its acquisition of IPS, which provides portfolio management solutions to ultra-high-net-worth investors and family offices.

“IPS fits neatly with DASH’s platform and software which caters to the emerging affluent investor,” Kirk said.

“The acquisition of IPS enables DASH to serve all financial advisors irrespective of the type of client they manage.”

He said the integration of IPS into DASH had progressed well with the two teams now highly aligned and working together as a single team from a new DASH office location.

“The integration of IPS has resulted in valuable cost savings with additional cost savings to follow as the technology integration is completed,” Kirk said.

“IPS has grown well since being acquired by DASH and has won a number of large new customer accounts.”

New execs drive growth plans

Kirk said DASH had added important new executives to its management team to drive the organisation’s growth plans.

IPS founders Darryl Johnson and Mark Papendieck have taken on the roles of chief platform officer and chief commercial officer respectively.

Jim Lim has joined the business as chief technology officer to lead the execution of DASH’s exciting tech roadmap, while Adrian Bell has been appointed chief financial officer.

“Bailador knows Jim well, having worked with him previously at DocsCorp,” Kirk said.

“These strong additions have built out DASH’s executive team, and the business is well prepared to execute its growth plan.”

Extensive product development

Along with the IPS acquisition, Kirk said the DASH team had embarked upon an exciting and aggressive product development roadmap that would see a raft of new features added to the DASH platform.

“A small sample of these features include a customisable reporting suite, an expanded securities universe, additional data feeds and an enhanced client portal,” he said.

“DASH’s product leadership is being recognised by industry participants, with DASH securing three new distribution partnerships since June last year. “

Kirk said DASH’s innovative technology stack was powering the new superannuation funds of millennial-focused Fintechs Stockspot and Pearler.

“DASH has also secured a distribution partnership with an ASX 50 financial services business with very significant funds under administration,” he said.

“These partnerships are a strong endorsement of DASH’s product capabilities and an ‘always-on’ distribution channel for FUA growth and revenue expansion.”

Bailador said it would revisit DASH again when it’s up for its annual valuation review in October 2025.

This article was developed in collaboration with Bailador Technology Investments, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Bailador’s investment in fintech DASH paying off as growth accelerates