ASX Small Caps Lunch Wrap: Tech on top as ASX bags another PB amid fresh US economy optimism

The ASX hit another all-time high on Friday morning following good Wall Street results overnight. The tech sector is leading the charge.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX 200 hits ANOTHER personal best before dipping a tad

Renewed optimism for the US economy having positive ripple effect

Locally, the Information Technology sector is leading the charge

Well then, with another personal best for the ASX on Friday morning dominating headlines early doors, there are no real complaints about the action so far.

Unless you're department store Myer (ASX:MYR), that is. The retail giant has seen its shares slide -9.71% after reporting a full-year profit decline and slashed dividend.

Also, some less-than opitmal news for Macquarie Group (ASX:MQG) is turning heads – which centres around the financial institution forking out US$80m (around $117m) to settle claims by the US SEC that it inflated the value of 4,900 mortgage-backed securities and overstated their performance between 2017 and 2021.

But re the health of the ASX on the whole, things are in good shape as we round out another week. I suppose Jerome Powell and mates want some thanks for that.

With the dust settling on the Fed's announcement of its first interest rate cut in more than four years, optimism for what many feared was unlikely – a soft landing – seems to be winning. For the moment.

At the time of writing, the ASX 200 is up 0.28%.

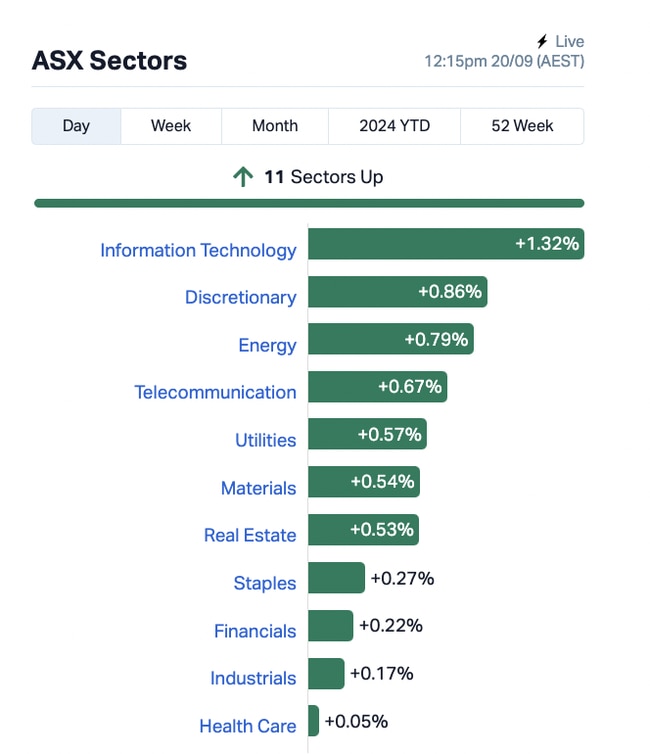

And here's the sector overview at about 12.15pm AEST.

Local tech stocks are on something of a tear, which also reflects the tech-heavy and highly influential Nasdaq 100 – the latter having surged by more than 2.25% over the past handful of days led by a rebounding Nvidia (NVDA).

Have a read of Eddy's Nasdaq Wrap from earlier in the week for more details on leading US tech stocks, and watch out for it again on Tuesday for a full overview of the week currently in play.

Meanwhile, the ASX and Nasdaq-listed $8-billion market capped Life360 (ASX:360) is a standout performer so far today with a 5% rise. The family connection and safety company (it uses mobile-tracking app technology) announced a couple of days ago that it will be joining the Russell 2000 and the Russell 3000 indexes as part of the quarterly Russell US Index initial public offering (IPO) additions, effective after the US market opens on September 23.

Recession avoidance hopes boosted, but expect volatility

Some further US markets and tech-stocks nuance from Eddy's Market Highlights, published earlier in the day:

US stocks rallied as the Fed’s 50 bp rate cut yesterday boosted hopes of the US avoiding a recession.

Overnight, the S&P 500 jumped 1.7% to 5,713 points, marking its 39th record this year and bringing its total rise to around 20%.

Solita Marcelli from UBS believes the S&P 500 could hit 5,900 by year-end and reach 6,200 by mid-2025.

“And within tech, we expect AI to be a key driver of equity market returns over the coming years and recommend strategic exposure to this theme,” she said.

“Investors may use tech sector volatility, which could rise in the months ahead on cyclical and geopolitical risks, to build up long-term exposure to AI at more favourable prices.”

Tech stocks led the way last night, with the Nasdaq surging by 2.5%, and small-cap stocks on the Russell 2000 were up by 2%.

Traders were also gearing up for the “triple witching” event later tonight, when a significant amount of stock options and futures expire simultaneously—about US$5.1 trillion worth. This can sometimes lead to increased market volatility.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for September 20 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MTH | Mithril Silver Gold | 0.31 | 51% | 11,750,086 | $21,130,626 |

| BGE | Bridgesaaslimited | 0.014 | 40% | 250,000 | $1,227,304 |

| ATX | Amplia Therapeutics | 0.1325 | 34% | 665,773 | $27,205,033 |

| MEL | Metgasco Ltd | 0.004 | 33% | 250,491 | $4,342,760 |

| ESR | Estrella Res Ltd | 0.009 | 29% | 1,720,027 | $12,723,936 |

| PIM | Pinnacleminerals | 0.055 | 28% | 237,072 | $1,954,923 |

| RFA | Rare Foods Australia | 0.015 | 25% | 943,975 | $3,263,799 |

| TMG | Trigg Minerals Ltd | 0.025 | 25% | 26,295,274 | $9,360,026 |

| 88E | 88 Energy Ltd | 0.0025 | 25% | 3,394,334 | $57,867,624 |

| EEL | Enrg Elements Ltd | 0.0025 | 25% | 1,592,003 | $2,090,032 |

| PUR | Pursuit Minerals | 0.0025 | 25% | 3,616 | $7,270,800 |

| BDG | Black Dragon Gold | 0.017 | 21% | 371,921 | $3,745,247 |

| MCTDB | Metalicity Limited | 0.023 | 21% | 4,016,457 | $8,922,525 |

| AD1 | AD1 Holdings Limited | 0.006 | 20% | 255,657 | $5,486,742 |

| GCM | Green Critical Min | 0.003 | 20% | 95,000 | $3,671,357 |

| SUH | Southern Hem Min | 0.019 | 19% | 589,145 | $11,779,841 |

| IPD | Impedimed Limited | 0.059 | 18% | 2,555,805 | $101,154,696 |

| ALY | Alchemy Resource Ltd | 0.007 | 17% | 2,302,947 | $7,068,458 |

| AOK | Australian Oil. | 0.0035 | 17% | 504,596 | $2,833,920 |

| CDT | Castle Minerals | 0.0035 | 17% | 3,741,667 | $4,118,442 |

| POS | Poseidon Nick Ltd | 0.0035 | 17% | 3,946,555 | $12,611,626 |

| KLI | Killiresources | 0.185 | 16% | 1,209,650 | $22,435,799 |

| PPG | Pro-Pac Packaging | 0.06 | 15% | 5,488 | $9,447,761 |

| MAT | Matsa Resources | 0.038 | 15% | 994,270 | $21,452,888 |

| AGD | Austral Gold | 0.023 | 15% | 1,553 | $12,246,227 |

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for September 20 :

| OVT | Ovanti Limited | 0.003 | -25% | 6,427,422 | $6,225,393 |

|---|---|---|---|---|---|

| RBR | RBR Group Ltd | 0.0015 | -25% | 8,250,000 | $3,268,809 |

| SI6 | SI6 Metals Limited | 0.0015 | -25% | 328,987 | $4,737,719 |

| EXL | Elixinol Wellness | 0.004 | -20% | 500 | $6,605,912 |

| GTR | Gti Energy Ltd | 0.004 | -20% | 1,948,293 | $12,749,735 |

| KNB | Koonenberrygold | 0.008 | -20% | 958,340 | $2,877,875 |

| ODE | Odessa Minerals Ltd | 0.002 | -20% | 41,833 | $2,608,206 |

| RIL | Redivium Limited | 0.004 | -20% | 125,000 | $13,734,274 |

| SFG | Seafarms Group Ltd | 0.002 | -20% | 165,558 | $12,091,498 |

| BLG | Bluglass Limited | 0.024 | -17% | 2,017,278 | $53,262,660 |

| OVT | Ovanti Limited | 0.003 | -25% | 6,427,422 | $6,225,393 |

ICYMI – AM EDITION

Renegade Exploration (ASX:RNX)

Renegade Exploration is set to drill into new Greater Mongoose targets in mid-October in its search for the next large iron-oxide copper-gold discovery in Queensland at its Cloncurry project.

The explorer, which shares the broader Carpentaria JV with Glencore, is chasing an iron-oxide copper-gold discovery in the vein of Evolution Mining’s (ASX:EVN) 50,000tpa copper, 80,000ozpa gold Ernest Henry mine.

“The new drone data will be incorporated with our magnetic remnants data, and Mongoose Deeps drill hole data to provide a higher confidence 3D model for drill targeting but is already offering an impressive picture of widespread mineralisation and robust new targets,” RNX MD Rob Kirtlan said.

Trigg Minerals has picked up a string of historic antimony mines that include some of the highest grades of the critical mineral ever recorded in Australia.

The Taylors Arm portfolio and Spartan antimony project have history on their side in the form of previous production and proximity to Australia’s largest antimony resource.

Taylors Arm contains no less than 71 historical mines on granted exploration licence areas, including the Testers mine which featured massive stibnite veins grading up to 63% Sb, the highest recorded in Oz.

Notably, Spartan is next to Larvotto Resources (ASX:LRV) and its mothballed Hillgrove mine on the same rocks.

Raiden has secured two diamond drill rigs from Western Australian drilling contractor, Topdrill, and earthmoving contractor JB Contracting, for its upcoming maiden diamond drilling program at the Andover South lithium project.

“Both have extensive experience working within the Andover Complex, including at Azure’s Andover lithium project,” MD Dusko Ljubojevic said.

“Along with the expertise of our technical team, this positions Raiden for a smooth and successful campaign, maximising the potential for discovery success for our shareholders.”

The 5,000m drilling program (up to 10,000m if RDN elects to extend) is expected to commence next week with a single diamond drill rig, as soon as initial access has been completed, with a second rig mobilising shortly after.

At Stockhead, we tell it like it is. While Renegade Exploration, Trigg Minerals and Raiden Resources are Stockhead advertisers, they did not sponsor this article.

Originally published as ASX Small Caps Lunch Wrap: Tech on top as ASX bags another PB amid fresh US economy optimism