ASX Small Caps Lunch Wrap: ASX recovers well from Fed hangover; mining stocks surge

The ASX reached a new record high this morning following the first rate cut from the US Fed in more than four years. It has since fallen back again, but the day is still young-ish yet…

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX hits record high before dipping

Jobs report shows tight labour market, making rate cuts less likely for RBA

Oil stocks slump as crude prices fall amid concerns over China's economy

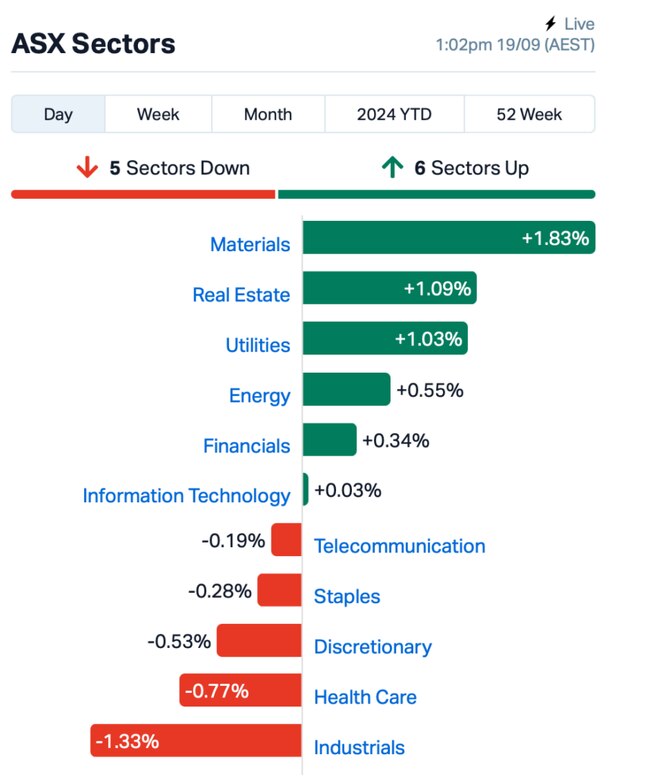

The ASX touched a fresh record high this morning before taking a dip, thanks to the first interest rate cut from the US Fed Reserve in over four years.

At midday today, the S&P/ASX 200 was 0.2% higher.

The initial morning rally came from gains in mining stocks when Singapore opened and iron ore futures jumped by 1.5%, pushing iron ore stocks higher.

Overnight, Wall Street had a bit of a wild ride after the Federal Reserve announced a 0.50% interest rate cut. The US market started off strong but then reversed direction, ending lower for the day.

Traders got jittery after Fed chairman Powell said not to expect this rate cut as a new trend.

The statements from the meeting also showed that only 10 out of 19 Fed officials supported another 50 basis point cut in their upcoming meetings, which added to the uncertainty.

Locally today, the August jobs report showed a tight employment market, with the unemployment rate staying at 4.2%.

ABS data showed that the economy gained 47,500 jobs last month, significantly surpassing economists' prediction of 25,000.

For the RBA, this latest job figures could indicate that an interest rate cut is less likely in the near future.

“As it stands there's really nothing in this report that shows that we're going to have an interest rate cut in the next couple of meetings here in Australia,” said 9 News’ Chris Kohler.

Meanwhile, oil-related stocks were under pressure as crude prices dropped on concerns about China's economic slowdown and global oversupply.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for September 19 :

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap CNJ Conico Ltd 0.002 100% 3,412,996 $2,201,528 ICU Investor Centre Ltd 0.006 100% 170,447 $913,534 RNE Renu Energy Ltd 0.002 100% 1,019,161 $764,134 IBG Ironbark Zinc Ltd 0.003 50% 1,000,000 $3,667,296 M2R Miramar 0.010 43% 7,515,597 $2,763,457 EDE Eden Inv Ltd 0.002 33% 2,562,842 $6,162,314 CUS Coppersearchlimited 0.045 29% 201,432 $3,975,489 GRE Greentechmetals 0.120 28% 1,987,184 $7,809,518 BIM Bindimetalslimited 0.099 27% 1,321,796 $2,515,500 88E 88 Energy Ltd 0.003 25% 6,669,453 $57,867,624 GTI Gratifii 0.005 25% 31,401 $8,596,785 VML Vital Metals Limited 0.003 25% 632,411 $11,790,134 NGS NGS Ltd 0.030 20% 77,900 $2,780,821 JAV Javelin Minerals Ltd 0.003 20% 3,586,144 $10,692,115 ROG Red Sky Energy. 0.006 20% 4,958,392 $27,111,136 WMG Western Mines 0.255 19% 66,565 $18,307,482 RRR Revolverresources 0.058 18% 36,600 $13,383,089 PV1 Provaris Energy Ltd 0.021 17% 251,580 $11,357,412 AAU Antilles Gold Ltd 0.004 17% 16,804,826 $5,567,228 DOU Douugh Limited 0.004 17% 378,598 $3,246,207 LNR Lanthanein Resources 0.004 17% 500,000 $7,330,908 NRZ Neurizer Ltd 0.004 17% 594,603 $6,543,358 POS Poseidon Nick Ltd 0.004 17% 1,092,046 $12,545,926 SRN Surefire Rescs NL 0.007 17% 574,984 $11,917,847

Recent drilling at GreenTech Metals' (ASX:GRE) Whundo Copper Project has revealed strong potential for resource expansion, with high-grade copper results reaching up to 4.6% Cu. A 1,710-metre drilling program confirmed continuity of copper and zinc mineralisation at two sites, Austin and Ayshia, with significant intersections of 16 metres at 1.2% Cu and previous high-grade results of up to 5.4% Cu. GreenTech says it plans to advance its drilling efforts to target these high-grade areas and expand the current copper-zinc resource, which stands at 6.2 million tonnes.

Bindi Metals (ASX:BIM) has acquired two promising antimony projects in Serbia, located in the renowned Tethyan Magmatic Belt. The Mutnica Antimony-Copper Project has shown historical antimony grades of up to 4.5%, while the Lisa Antimony-Gold Project features high-grade antimony mines with grades between 5% and 20%, from which around 60,000 tonnes of ore were extracted between 1932 and 1951. These projects are well-positioned near major European markets and benefit from modern infrastructure, especially important given China’s recent export ban on antimony, which raises supply chain concerns for Europe. To support these initiatives, Bindi Metals has raised $2 million from investors for further exploration and development.

Javelin Minerals (ASX:JAV) is set to begin drilling at the Coogee Gold-Copper Project in Western Australia during the December quarter. The initial program will involve about 2,500 metres of drilling aimed at extending known mineralisation and exploring new targets around the Coogee Pit, which is located near the St Ives goldfield. Despite its promising resource of 126,685 ounces of gold, Coogee hasn’t seen a systematic drilling campaign since 2014. The company is finalising a drilling-for-equity agreement with a Kalgoorlie contractor and said it was excited about the potential for significant discoveries in the area.

And, Cann Group (ASX:CAN) says it expects to return to underlying earnings profitability this year, having posted a $13.2 million loss in the 2023-24 stanza. The company also expects to be cash-flow positive in 2025-26. In a presentation to the Pitt Street Research life sciences conference in Sydney today, the company has outlined a plan to increase capacity at its flagship Mildura facility to the maximum 10,000 tonnes per annum, by 2026-27.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for September 19 :

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap EEL Enrg Elements Ltd 0.002 -33% 5,935,913 $3,135,048 FGH Foresta Group 0.003 -25% 19,079,360 $9,421,516 PKO Peako Limited 0.003 -25% 10,000 $3,513,899 BUY Bounty Oil & Gas NL 0.004 -22% 6,940,004 $6,743,254 OVT Ovanti Limited 0.004 -22% 792,396 $6,851,725 CTQ Careteq Limited 0.011 -21% 1,796,811 $3,319,662 NAE New Age Exploration 0.004 -20% 627,500 $8,969,495 PUR Pursuit Minerals 0.002 -20% 3,062 $9,088,500 SKN Skin Elements Ltd 0.004 -20% 385,891 $2,947,430 AUK Aumake Limited 0.005 -17% 23,988,296 $11,569,446 HT8 Harris Technology Gl 0.010 -17% 47,667 $3,589,626 IPB IPB Petroleum Ltd 0.005 -17% 2,900 $4,238,418 TFL Tasfoods Ltd 0.010 -17% 8,500 $5,245,146 LOM Lucapa Diamond Ltd 0.036 -16% 300,000 $12,475,246 TGM Theta Gold Mines Ltd 0.145 -15% 115,865 $120,961,772 CDT Castle Minerals 0.003 -14% 101,813 $4,804,849 PAB Patrys Limited 0.006 -14% 677,576 $14,402,131 QXR Qx Resources Limited 0.006 -14% 1,663,784 $7,770,545 SPA Spacetalk Ltd 0.024 -14% 1,801,703 $13,356,680 SVG Savannah Goldfields 0.025 -14% 262,264 $8,151,463 IPC Imperial Pacific Ltd 1.350 -13% 5,000 $8,242,137 AOK Australian Oil. 0.004 -13% 16,666 $3,778,561 GGE Grand Gulf Energy 0.004 -13% 5,099,626 $9,380,988 LIO Lion Energy Limited 0.021 -13% 41,700 $10,487,466 AI1 Adisyn Ltd 0.031 -11% 290,909 $8,089,620

ICYMI – AM EDITION

Portable x-ray fluorescence (P-XRF) has recorded heavy rare earth yttrium in clay regolith 2.6km south of the existing resource estimate at its North Stanmore project.

While not a substitute for lab analysis, the company says the results are a useful HREE vector that shows the potential extension of rare earth mineralisation defined in the resource.

“Drilling has now commenced 9km north of the current MRE,” CEO and executive director Brendan Clarks said.

“Shallow saprolitic clay horizons similar to those observed in previous drilling campaigns have been identified, supporting the prospect of further rare earth element (REE) mineralisation.”

To date, over 2,239m have been successfully completed in the current aircore drill program.

The company has appointed a new managing director in Glenn Poole, with Brett Grosvenor to transition to non-executive chairman.

Poole’s promotion is expected to facilitate exploration and development of Firetail’s portfolio of copper-focused assets, with his combination of advanced technical and corporate experience specifically expected to expedite the exploration and development of the York Harbour copper-zinc-silver project in Newfoundland.

“It is clear to us from the early works completed, that the York Harbour project will be transformational for Firetail and these changes ensure that we have the right team to develop the asset,” Grosvenor said.

In Newfoundland, the team is assembled and the company is eagerly awaiting the commencement of drilling and geophysics activities in the coming weeks.

“Work is ongoing reassessing the historic core, so we can further understand and demonstrate the unrealised potential of this project,” Poole said.

In Peru, the focus is on modification of the approved work area to encompass the highly prospective Ichucollo target in preparation for drilling, planned for mid 2025.

At Stockhead, we tell it like it is. While GreenTech Metals, Victory Metals and Firetail Resources are Stockhead advertisers, they did not sponsor this article.

Originally published as ASX Small Caps Lunch Wrap: ASX recovers well from Fed hangover; mining stocks surge