ASX Small Caps Lunch Wrap: ASX a sea of red following Wall Street wobble overnight

Local markets have fallen on Tuesday after a wobbly Wall Street session overnight.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Local markets – just like me – started the morning with a thud, some loud groaning and a strong desire to be anywhere but where they were, leaving the benchmark down 0.9 per cent and every sector in the red.

That all followed a mixed result on Wall Street which endured a broad sell-off that saw the Dow and S&P 500 dip.

Let’s just dive right in today… the market’s down across the board, everything’s a bit bleak and I – and everyone else, I suspect – just want to get this over with for the day.

TO MARKETS

The ASX opened lower this morning, after a wonky session on Wall Street delivered mixed results and the market broadly caught a case of the yips.

Falling iron ore prices have again taken wind out of the sails of the big end of the Resources sector, the WiseTech Global (ASX:WTC) sell-off is still going – albeit at a slower pace than the past couple of days – and there’s nary a decent performing clump of the market to find.

The benchmark was down 0.9 per cent at open, and steadily got worse as the morning progressed, heading into lunchtime down around 1.14 per cent and still trending lower beyond a six-day low.

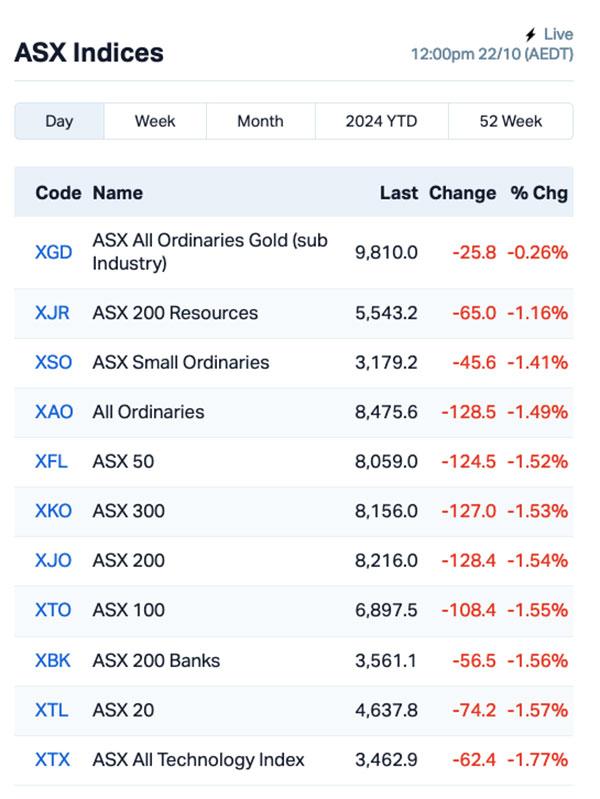

Here’s what the sectors looked like:

And the sub-indices chart isn’t exactly an oil painting, either.

Last time I saw a sea of red like that, an old bloke with a beard was drowning Egyptians in it.

Even the goldies are down today, despite gold prices holding steady above $US2720/oz overnight.

Up the fat end of town, the big losers before lunch included Metcash (ASX:MTS), which has taken a body blow thanks to a downgrade from Goldman Sachs, which says that the company’s “lagging digital transformation and intensifying competition” is having a negative impact on market share.

Mineral sands digger Iluka Resources (ASX:ILU) fell heavily on Tuesday morning, after its disappointing quarterly report showed less-than-stellar revenue that came in well below market expectations.

Audinate (ASX:AD8) delivered bad news of its own, with a 16 per cent sell-off following the company's a profit warning, saying that it doesn’t expect to meet its FY25 gross profit target as 1Q “headwinds” are expected to continue.

And Mineral Resources (ASX:MIN) is having another bad day, following yesterday’s 13 per cent shellacking by investors as allegations of tax evasion by MIN boss Chris Ellison made loads of people mad.

Why’s the market being a mongrel on Tuesday?

Well… the general consensus seems to be that the upcoming US election is starting to make its looming presence felt on global markets, and current projections show that the race for the White House is – worryingly and inexplicably – still very close.

Voters in the US go to the polls on November 5 – the same day Australia will stop to watch tiny men riding horses and gawk at vapid socialites in stupid hats – and I genuinely don’t know which of those events is the bigger gamble.

d

NOT THE ASX

Overnight, US stocks took a breather after their longest weekly rally of the year as traders prepared for crucial earnings reports from companies such as Tesla, Boeing, and UPS.

The S&P 500 fell by 0.18 per cent, the blue chips-focused Dow Jones was down by 0.8 per cent, but the tech-heavy Nasdaq rose by 0.27 per cent.

Before last night, the S&P 500 had managed 30 sessions without back-to-back losses, which is one of the longest streaks since 1928, noted Stockhead earlybird Eddy Sunarto.

In US stock news, Qualcomm Inc. fell 1 per cent despite launching a more advanced processor aimed at giving smartphones laptop-like performance and allowing them to leverage new AI tools.

Microsoft rose slightly after rolling out some new AI tools to help with stuff such as sending emails and keeping records for business workers as part of its push into AI, cranking up the competition with rivals like Salesforce.

Spirit Airlines soared 53 per cent after securing more time from creditors to tackle its debt situation , which has been raising worries about bankruptcy.

Off-market, US 10-year bond yields jumped by by 12 basis points to 4.20 per cent, and analysts from T. Rowe Price believe they could hit 5 per cent in the next six months due to rising inflation and concerns about US government spending.

Oil prices climbed another 1.5 per cent after China implemented new stimulus measures to boost economic growth, including an unexpected cut to benchmark lending rates. This is expected to boost energy demand from China, the world’s largest oil importer.

In Asian market news, Japan’s Nikkei is down 1.2 per cent on Tuesday morning, as the country grapples with the jailing of a 32-year-old Australian man accused of trying to rob an elderly resident of Shinjuku.

The Australian defendant claimed he smelled gas, and climbed up to a second-floor balcony to warn the 70-year-old man inside by shouting “go to the door!”, and asking “Can you walk?”.

Unfortunately for the defendant, those two phrases are phonetically similar to the Japanese phrases “Goto da!” and “Kin wa doko da?”, which translate to “This is a robbery!” and “Where is the money?”.

Also, he cracked the old fella over the head with a shovel, which – as I understand it – means exactly the same thing in English and Japanese, so he’s off to prison for two years, where he will no doubt be learning the phrase “Sekken o otosanaide kudasai”.

In Hong Kong, the Hang Seng is up 0.65 per cent, and in Shanghai the market’s up 0.38 per cent.

Time to see which small caps are caning it today…

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for October 22 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MHC | Manhattan Corp | 0.002 | 100.0 | 6,477,361 | $4,497,970 |

| MTB | Mount Burgess Mining | 0.0015 | 50.0 | 500,000 | $1,298,147 |

| PRX | Prodigy Gold | 0.003 | 50.0 | 93,108,987 | $4,664,912 |

| ALR | Altair Minerals | 0.004 | 33.3 | 45,750 | $12,889,733 |

| AOK | Australian Oil | 0.004 | 33.3 | 350,000 | $2,833,920 |

| ENT | Enterprise Metals | 0.004 | 33.3 | 815,874 | $3,534,952 |

| NVU | Nanoveu | 0.064 | 33.3 | 49,693,882 | $24,236,289 |

| SIS | Simble Solutions | 0.004 | 33.3 | 450,000 | $2,260,352 |

| TX3 | Trinex Minerals | 0.002 | 33.3 | 250,000 | $2,742,978 |

| TMK | TMK Energy | 0.0025 | 25.0 | 858,699 | $15,183,224 |

| NOU | Noumi | 0.295 | 22.9 | 581,427 | $66,506,237 |

| MME | Moneyme | 0.135 | 22.7 | 1,872,659 | $88,008,632 |

| SNG | Siren Gold | 0.135 | 22.7 | 3,338,704 | $22,789,128 |

| TZN | Terramin Australia | 0.099 | 22.2 | 2,024,035 | $171,441,580 |

| IBX | Imagion Biosys | 0.055 | 22.2 | 240,334 | $1,604,095 |

| FHS | Freehill Mining | 0.006 | 20.0 | 1,000,000 | $15,392,639 |

| GTI | Gratifii | 0.006 | 20.0 | 3,251,643 | $10,745,981 |

| PLT | Plenti Group | 0.765 | 17.7 | 157,977 | $113,958,885 |

| BDG | Black Dragon Gold | 0.027 | 17.4 | 775,103 | $6,152,907 |

| MRQ | MRG Metals | 0.0035 | 16.7 | 1,251,714 | $8,134,556 |

Prodigy Gold (ASX:PRX) was up on news that it’s received “excellent” results for the reverse circulation (“RC”) drilling program completed during September at the Hyperion gold deposit, where it has found intercepts such as 25m @ 2.2g/t Au from 66m, 15m @ 3.1g/t Au from 152m and 15m @ 2.1g/t Au from 48m.

Nanoveu (ASX:NVU) was up on news that its current takeover target, EMASS, had completed benchmark testing for its ECS-DOT SoC (System on Chip) chipset, achieving 20x lower energy consumption compared to peers,and “setting a new benchmark for ultra-low power performance in edge AI applications”. Nanoveu is currently in the process of acquiring 100 per cent of EMASS, subject to shareholder approval.

MONEYME (ASX:MME) was up on news it has executed its first asset-backed securities deal in the auto asset class, with the MME Autopay ABS 2024-1 Trust – the second ABS transaction in FY25 and the largest term securitisation deal to date for the company. The Aaa (sf) and AAA (sf) credit ratings for the Class A1 and Commission notes represent 72.4 per cent of the collateralised notes, “reflecting strong credit quality and performance of the Autopay loans,” says MoneyME boss Clayton Howes.

Siren Gold (ASX:SNG) was rising on news that an Ionic Leach soil sampling program at Auld Creek has revealed that the gold and antimony mineralisation previously announced by the company extends for at least 1.5km and is open to the north and south. The ionic leach anomalies are coincident with two parallel conductive anomalies 100m apart that extend for 1.5km and are also open to the north and south.

Gratifii (ASX:GTI) was up after releasing a positive quarterly report on Tuesday morning, showing 1Q FY25 cash receipts of $8.31 million, an increase of 32.7 per cent over previous quarter and 14.4 per cent over previous corresponding quarter. That’s put the company in a cashflow positive position, improving by about $1.1 million from 4Q FY24 supported by the increase in cash receipts and reduced investment in inventory.

Plenti Group (ASX:PLT) climbed after the company announced unaudited 1H25 Cash NPAT of $5.5 million, a massive increase of 260 per cent on PCP. The company says its loan portfolio has increased to $2.28 billion, 14 per cent above PCP and 3 per cent above prior quarter alongside loan originations of $323.3 million, 11 per cent above PCP and 7 per cent above prior quarter.

Black Dragon Gold (ASX:BDG) was rising on no news, and was suspended by the ASX about 10 minutes before 1pm (AEDT). That’s all I know.

MRG Metals (ASX:MRQ) was up on news that Fotinho exploration licence 11000 had been granted over a newly identified, high potential 19,865.18 ha thorium and rare earth element (REE) district in Mozambique, where historical exploration showed the presence of monazite and highly elevated Th and REE grades, with Th assays >1000 ppm in soil and panned heavy mineral concentrate and 559 ppm in rock.

ASX SMALL CAP LOSERS

Here are the worst-performing ASX small cap stocks for 21 October 21 :

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AFA | ASF Group | 0.02 | -33.3 | 35,000 | $23,771,926 |

| NXS | Next Science | 0.135 | -30.8 | 2,540,157 | $56,971,246 |

| NSM | North Stawell | 0.014 | -30.0 | 2,348,314 | $5,453,530 |

| BPM | BPM Minerals | 0.085 | -29.2 | 4,598,132 | $10,064,666 |

| CHM | Chimeric Therapeutic | 0.01 | -28.6 | 16,155,871 | $12,672,098 |

| GMN | Gold Mountain | 0.0015 | -25.0 | 1,295,019 | $7,814,946 |

| DOU | Douugh | 0.01 | -23.1 | 6,154,947 | $14,066,896 |

| DBO | Diablo Resources | 0.02 | -20.0 | 469,999 | $2,576,786 |

| AKN | Auking Mining | 0.004 | -20.0 | 1,545,076 | $1,835,323 |

| AMD | Arrow Minerals | 0.002 | -20.0 | 12,272,010 | $32,559,069 |

| AMM | Armada Metals | 0.009 | -18.2 | 817,374 | $2,288,000 |

| FSG | Field Solu Hldgs | 0.018 | -18.2 | 425,318 | $17,015,780 |

| IS3 | I Synergy Group | 0.005 | -16.7 | 774,335 | $2,137,307 |

| ODE | Odessa Minerals | 0.005 | -16.7 | 5,915,913 | $7,609,695 |

| AUQ | Alara Resources | 0.031 | -16.2 | 767,243 | $26,569,239 |

| AS1 | Asara Resources | 0.023 | -14.8 | 1,768,210 | $26,909,828 |

| ACM | Aus Critical Mineral | 0.082 | -14.6 | 113,193 | $3,391,320 |

| ILA | Island Pharma | 0.15 | -14.3 | 470,378 | $26,994,689 |

| PLG | Pearl Gull Iron | 0.012 | -14.3 | 842,104 | $2,863,585 |

| AAU | Antilles Gold | 0.0035 | -12.5 | 119,272 | $7,422,971 |

ICYMI – AM EDITION

Lithium Energy (ASX:LEL) has extended the timetable for the sale of the company’s 90 per cent interest in the Solaroz lithium brine project in Argentina to CNR Netherlands New Energy Technology (CNNET) B.V.

CNNET is a subsidiary of Chinese listed CNGR Advanced Material Co, one of the world’s largest producers of precursors cathode active materials used by many leading companies in the battery materials supply chain.

Completion of the sale (totalling $97m) was to occur after the satisfaction of several conditions precedent under the Solaroz sale agreement on or before October 25.

CNNET has now requested that the time for completion be extended by a further 60 days to December 24, as permitted under the Solaroz sale agreement.

Sovereign Metals (ASX:SVM) has wrapped up a 281-hole infill drilling program for over 5607m at the Kasiya rutile-graphite project, northwest of Malawi’s capital of Lilongwe.

The program was designed to upgrade Kasiya’s 1.8bn resource at 1 per cent rutile and 1.4 per cent graphite, which is already the world’s largest rutile deposit and second-largest flake graphite deposit.

SVM said the results, expected in early 2025, will feed into the company’s future technical studies as part of ongoing pre-development activities at Kasiya.

Golden Mile Resources (ASX:G88) has received commitments to raise $616,000 from institutional and sophisticated investors alongside a further $234,000 from the board of directors and management of Golden Mile Resources.

The explorer intends to accelerate its maiden drilling program at the Pearl copper project in the San Manuel mining district in Pinal County, Arizona, focusing on the Odyssey prospect.

G88 believes the asset is shaping up as a polymetallic play with recent rock chip assays returning up to 930g/t silver, 10.05 per cent copper and 8.09 per cent zinc during first pass sampling.

Anson Resources (ASX:ASN) has ticked off its second geotechnical engineering survey for the proposed location of a DLE extraction plant or possible site for a stage 2 expansion at the Green River lithium project in southeastern Utah.

This engineering study examined soil and rock types as part of the due diligence process and confirmed subsurface conditions were suitable for the proposed DLE processing plant.

Carried out by a professional engineer and professional geologist, the study consisted of seven boreholes and eight test pits, field resistivity measurements, soil samples, and geophysical surveys to determine dynamic properties of subsurface materials.

The proposed site was selected based on its access to water from the Green River, which is essential for the operation of the direct lithium extraction process.

ADX Energy (ASX:ADX) is progressing drilling of its Lichtenberg-1 (LICHT-1) gas exploration well at its ADX-AT-I licence in Upper Austria.

Previous operations since last report included the logging of the well in 8 ½-inch hole, running and cementing 7 inch casing, setting up for the new 6-inch hole size, drilling out of the casing shoe and drilling ahead in 6 inch hole to the current depth of 2140m.

LICHT-1 targets an Upper Oligocene sandstone reservoir as well as two slightly shallower and geologically similar reservoirs. The first Oligocene reservoirs are expected after around 2000m measured depth, while the main target is expected at about 2500m.

At Stockhead we tell it like it is. While Lithium Energy, Sovereign Metals, Golden Mile Resources, Anson Resources and ADX Energy are Stockhead advertisers, they did not sponsor this article.

Originally published as ASX Small Caps Lunch Wrap: ASX a sea of red following Wall Street wobble overnight