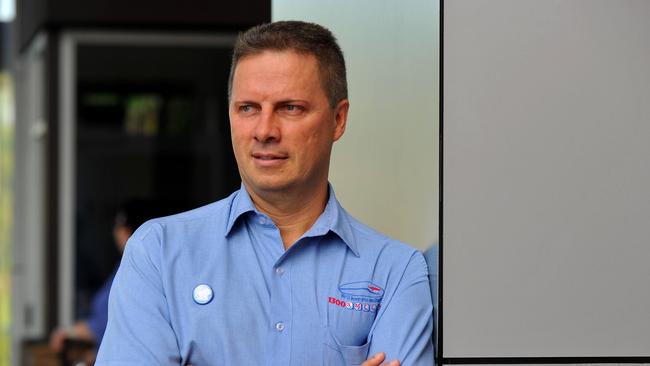

Smiles Inclusive: Dr Daryl Holmes of 1300 Smiles casts doubt on goodwill writedown at Gold Coast dental group

A leading dental industry executive has cast doubt on figures that led to a $31 million loss at Gold Coast dental roll-up Smiles.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

LEADING dental industry executive Dr Daryl Holmes says the slashing of goodwill at embattled Gold Coast company Smiles Inclusive is “extraordinary” and “hard to believe”.

Smiles this month reported a statutory loss of $31 million, largely due to drastic goodwill cuts to the company’s dental practices, and far worse than the previously reported unaudited $18.9 million loss. Goodwill impairment occurs when a company decides to pay more than book value for an asset, and then the value of that asset declines.

The Burleigh Heads-based company listed in April last year after paying $63.3 million for 52 practices. Dentists collectively reinvested $21 million back in the business under a profit-sharing model. Goodwill was listed in October last year at $60.4 million.

Smiles’ annual report released this month shows goodwill cut by $28 million to $34 million, due to lower than expected revenue for FY19.

AMAZING OFFER: GET A SAMSUNG GALAXY TAB A 8.0 WITH THIS BULLETIN SUBSCRIPTION (T & Cs apply)

Dr Holmes is managing director of Townsville-based dental group 1300 Smiles. He also holds 4.96 per cent of shares in Smiles through entity Ashbourne Park Pty Ltd, of which he is a director, making him the company’s fourth-largest shareholder prior to the latest capital raising.

Dr Holmes, while stating he has not read the latest annual report, said the impairment lacked sense on face value.

“I find it hard to believe that over half the value of the dental practices will never be recovered and have been written off by the auditors. That’s what I find extraordinary,” Dr Holmes said.

Dr Holmes said Smiles’ model of profit-sharing had clearly failed.

DISGRUNTLED DENTISTS THREATEN CLASS ACTION OVER SHARE VALUE SLIDE

“In the end maybe they (Smiles) paid them too much upfront but it certainly hasn’t kept them (the dentists) motivated and real partners in the growing and future success of the company, which it is meant to do,” he said.

He said 1300 Smiles owned its clinics and rented the space to the dentists.

“They focus on the dentistry and we do everything else for them,” he said.

He said the Smiles saga had damaged the dental industry.

“It is such a pity and so bad for the dental sector because it has tarnished it horrendously. It really shouldn’t have because there is nothing wrong with it fundamentally, it was poorly managed and it is just another IPO gone wrong.”

ENTREPRENEURS THREATEN SMILES INCLUSIVE WIND UP ACTION

Dr Holmes’ company released a full-year net profit of $7.7 million on the back of a 3.2 per cent increase in revenue to $40.3 million.

He commented, in the company’s preliminary final report, that the company is in an “extremely strong position” to make the most of industry consolidation.

Late last month the company confirmed it was in discussions with Abano Healthcare Group to buy Maven Dental Group.

Smiles’ final audited result of a loss of $31 million for last financial year, undertaken by KPMG, was not included in an investor presentation attached to Smiles’ retail entitlement offer, leading to accusations that the company hid the true state of the loss.

Shares closed yesterday steady at 4.6¢.