Holiday test looming for Alan Joyce after Qantas turbulence

After taking a reputational beating in recent months, Alan Joyce’s Qantas has a new benchmark for getting the basics right.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The upcoming September school holidays will be the first internal test for Qantas boss Alan Joyce in the airline’s recovery as he works to give passengers a flying experience that is as normal as possible.

October is then firming as the hard target for Qantas to return to an improved operating rhythm – that means shorter queues, easy check-ins, less delays and bags arriving at destinations.

The results from coming months will be used as a platform to make further changes for summer and Christmas, with Joyce under pressure to make it as seamless as possible for travellers, pending external shocks such as bad weather.

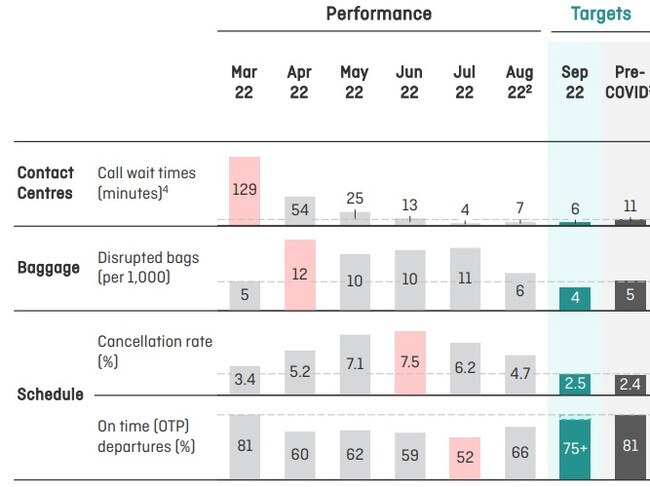

After being caught short earlier this year when the airline experienced a sharp rebound in travel at the time of widespread staff shortages, Qantas is narrowing in on aircraft cancellation rates, call centre experiences, on-time performance and lost bags. With a bigger staffing pool to draw on and demand easing on executives to help on the front line, these crucial operational markers are starting to trend back towards levels seen before Covid-19 hit.

Two-thirds of Qantas’s planes are today taking off on time compared to a little over 50 per cent in July. This is planned to reach 75 per cent next month and then hit a benchmark of 80 per cent in October. On Thursday morning, the first wave of departures was running at 92 per cent.

Call centre wait times have fallen to an average of four minutes – below the levels of Covid-19 – while missing bags are running at four in every 1000, which is also below the pre-pandemic average.

The bad news for travellers is they can expect to pay more for tickets as fuel prices surge, representing an additional $600m cost for Qantas over the past year with more to come.

Qantas is riding the wave of rapid financial recovery, with revenue surging in the past six months, but this is yet to be reflected in its operational performance where Joyce has acknowledged the airline has fallen short.

“It simply wasn’t good enough, and for that, we have apologised,” Joyce says.

The rapid recruitment of more than 1500 employees in recent months is starting to make some difference, although Joyce has pushed back on suggestions he was caught short by letting too many staff go during the pandemic, saying it came down to a matter of survival for the aircraft.

The chaos of the response to Covid-19 meant revenue stopped coming through the door, with international and even domestic borders closed.

“We were staring at 11 weeks of potentially going bankrupt and so we had to make some tough decisions to get the company through that,” he says.

To sweeten the deal to attract staff and hold on to current employees, he is improving access to low-cost staff travel, while another $200m bonus in shares and cash will be delivered to non-executive staffers.

Rather than the massive $1.86bn underlying loss for the year to end-June, it’s worth noting the $526m positive earnings result in the June half. This means the airline is now generating enough surplus cash to pay down its heavy borrowing through the Covid-19 years and deliver a surprise $400m share buyback. This, and a promise to recoup high fuel costs through ticket prices, was behind the 7 per cent surge in Qantas shares on Thursday to $4.86.

This form of investor return is more favourable for big institutional shareholders than small retail shareholders, but there was an acknowledgment from the Richard Goyder-led boardroom that it hasn’t lost sight of investors among its myriad of stakeholders.

But if there was any doubt about how much scar tissue is still left on the Qantas balance sheet from Covid-19, the numbers suggest the airline has work to do on a long recovery. After years of $7bn in accumulated losses, Qantas has fallen to a negative net asset position of $190m – that is, all of its debts and other obligations outweigh all its assets. In the year before Covid hit this number stood at net assets of $3.4bn.

This is a worrying position for a business as complicated as an airline, facing an environment of fast-rising fuel costs and still vulnerable to cascading fallout from the pandemic. Of course, balance sheets represent a moment in time and Qantas has been working to pay down debt. Net debt of $3.9bn is falling and is on track to fall below its normal range in the current financial year.

Qantas insists its $3.3bn cash pile gives it an extra buffer to help it withstand any future shocks.

Joyce says Qantas’s reputation has taken a beating over the past year, but is confident that it will come back quickly. He notes the quick reputational recovery following the 2011 fleetwide grounding, and also 10 years ago, the failure of an engine during a flight from London to Singapore which resulted in the grounding of the entire A380 fleet.

He points out all airlines are in the same place on reputation, calling out rival Virgin’s on-time performance as well as global airports. He also sought to paint a picture of the entire aviation industry under pressure – air traffic controllers being hit with Covid, which reduces runway capacity, or pressures at the airport level including baggage belt breakdowns.

Despite operational issues and higher prices following higher fuel costs, demand has got “stronger and stronger” in recent months for tickets.

However, with the world – particularly aviation – a very different place following the Covid shock, this is not the moment to trade on past performance when it comes to customer goodwill. It all comes down to what you deliver.

Inflation fight

The way Woolworths boss Brad Banducci sees it, we have to make sure inflation complacency doesn’t set in as the economy comes out of the pandemic.

–

Woolies takes on inflation

His supermarket is in a daily arm wrestle with suppliers over keeping prices lower, but the relentless march of inflation means shelf prices rose 3.6 per cent in recent months. This contrasts with the opening of the 2022 financial year when Woolworths prices actually fell by 0.9 per cent.

Woolworths has seen a fivefold increase in requests from suppliers to push through price rises across thousands of products, with some making multiple requests. And with price rises coming from every direction, Banducci says his team needs to be vigilant and to test requests for price rises.

“We’ve got to be very careful we don’t normalise inflation,” Banducci says in an interview.

As Banducci tells his team to focus on price, the next step is to add value for customers.

Customer value has come in different guises through the pandemic, such as availability (think of toilet paper), the convenience of home delivery or new forms of digital payments.

Following the intense logistical challenges of keeping the stores and warehouses fully staffed and stocked, Banducci says his business is running three years behind on productivity improvements. And now that’s where management attention and investment spending will be directed, particularly to combat the rising costs Woolworths is experiencing.

Even as some fresh food prices start to pull back – Banducci is now selling the famous iceberg lettuce at $2.50 each – it’s still too early to call the peak on inflation given there is a lag in the way higher prices flow through.

But Banducci is optimistic the peak could arrive within the next few months and possibly before Christmas. Not only is that good news for shoppers, it could mark an important moment as the Reserve Bank considers further interest rate rises.

About 60 per cent of Woolworths suppliers have been given a material increase. Banducci also points out pricing discussions are held with some of the world’s biggest consumer goods companies, which means Australian supermarkets need to push back on excessive demands for price rises.

Banducci was talking as Woolworths posted a 9.2 per cent jump in group-wide sales in the year to end-June, although Covid-19-related costs, particularly in the first half of the year, saw full-year underlying earnings fall 2.7 per cent to $2.69bn.

Closely watched online sales, which are linked to the home delivery business, are running at 11 per cent of all company wide sales or just over $6bn annually.

Like many companies delivering annual results in the past months, Woolworths saw a sharp turnaround in earnings performance during the second half, helped by tailwinds of a surging economy and a reopening of stores. This momentum is expected to continue into the new financial year while Covid costs ease.

New Zealand remains a soft spot for Woolworths with earnings there under pressure, while its Big W discount department store remains in a rebuilding phase after being hit harder by lockdowns than the supermarkets.

The uncertain inflation environment means Banducci is the latest to hold back on earnings guidance, but he remains committed to spending $2bn on capital investment for the coming year.

johnstone@theaustralian.com.au

Originally published as Holiday test looming for Alan Joyce after Qantas turbulence