Overseas holiday soon? Remember these money tips for your trip

As Aussies prepare for their first international holidays since 2019, this guide to travel spending may be a valuable refresher.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

More than two years of sitting at home has left many Australians a little rusty when it comes to overseas holiday spending.

Exchange rates, travel insurance, flights and accommodation now feel foreign to many people, but there are big savings to made for travellers who plan and spend wisely.

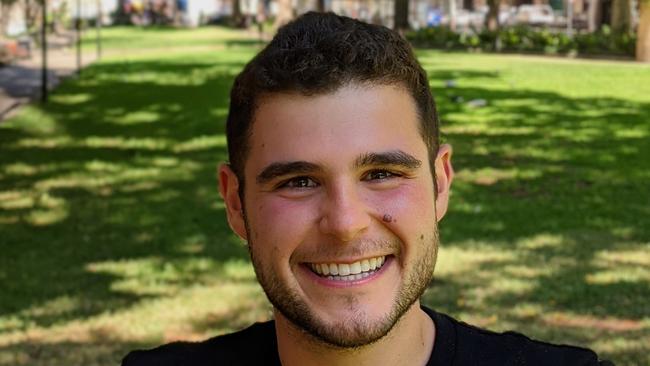

Daniel Wasilewsky, the founder of travel app FreeGuides, says the rising cost of living has made people more budget conscious but many have forgotten where to find travel cost savings.

Online platforms, websites and apps that travellers previously used may have changed over the past two years, Wasilewsky says.

“So getting back up to speed with where to look for the best money-saving deals will be key in nabbing a bargain and cutting holiday costs,” he says.

BOOK EARLY

Wasilewsky recommends booking big-ticket tourist attractions in advance.

“Often you’ll save money by pre-purchasing tickets online and it will most likely allow you to skip the queue – a win-win,” he says.

“Walk whenever possible. It will save you money on ride-shares, rentals, and public transport and you’ll likely find hidden local gems you would’ve otherwise missed.”

And aim to spend your money on experiences rather than accommodation.

“A fancy hotel room is great, but chances are you’re going to spend most of your time out and about on your trip, Wasilewsky says.

PROTECT YOURSELF

Travel insurance left a sour taste in many mouths in 2020 when many people discovered their policies did not pay out on the pandemic.

However, several travel insurers now offer limited Covid cover, but it varies, says consumer group Choice.

“Cancellation policies will also usually cover extra expenses for quarantine costs if you get Covid-19 overseas,” it says.

“But there are several exclusions and limits to look out for in your travel insurance policy’s Covid cover.”

Travel specialist Ivona Siniarska from 1000 Mile Travel says insurance delivers peace of mind and covers other areas including loss or theft and flight delays.

She says people planning multiple trips can consider annual travel insurance policies, which “often end up less than single insurance policies”.

CASH ACCESS

Foreign currency conversions are confusing, with the highest fees and weakest exchange rates usually found at airport kiosks or big banks. Check for better deals online and at local currency exchanges.

“If your bank does have high international transaction fees, speak to them about foreign currency card offers they may have where it permits you to pre-load funds in various currencies,” Siniarska says.

“If you are changing funds, avoid using your hotel or local bank – often destinations will have currency converters that are much more competitive.”

Siniarska also recommends pre-booking transport, accommodation and major tourist attractions, being wary of data costs because “not everywhere has free Wi-Fi”.

“If you are anywhere more than 72 hours it’s always worth picking up a local SIM – usually for anywhere between $5-30 you can get 2 gigabytes of data, if not more,” she says.

Pete and Taygan Bassi will soon head overseas on their Covid-delayed honeymoon, and they always aim to save money on transport and accommodation when they travel.

“You can always fly cheaper than you’d expect,” Pete Bassi says.

“Loyalty programs are a clever way to get perks and save a lot of money, and it’s easier than you think,” he says.

“We are members of nearly every airline you could name. And it pays off every time.

“For example, if you are with Virgin Australia, and they code share with United, chances are that whoever owns the plane will have the cheaper flight, but you’ll get your points from your loyalty program regardless, so make sure you enter your membership number.”

SMART TRAVEL TIPS

• Look for free travel resources before you leave.

• Travel with family members and/or friends to save money on accommodation and activities.

• Avoid buying foreign currencies at airport kiosks – they usually charge the highest fees.

• Eat where the locals do, rather than at tourist hot spots with inflated prices.

• Give yourself a 15 per cent buffer in your travel budget to cover unexpected costs.

• Don’t forget to treat yourself – it’s all about experiences.

Originally published as Overseas holiday soon? Remember these money tips for your trip