More nickel producers likely to leave market, warns Nickel Industries boss Justin Werner

The nickel price rout will claim more victims before prices recover, according to Nickel Industries managing director Justin Werner.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Even Chinese nickel pig iron producers are struggling with low commodity prices, according to Nickel Industries boss Justin Werner, who says more producers are likely to exit the market over the coming months.

ASX-listed Nickel Industries released its June quarter production report on Wednesday, with the company saying it had booked earnings before interest, tax, depreciation and amortisation of $US79.5m for the quarter from its Indonesia nickel operations.

But two of the company’s nickel plants, Hengjaya Nickel (HNI) and Ranger Nickel (RNI), booked a modest loss in the period, with the bulk of the company’s earnings coming from its Angel nickel plant and its Hengjaya mine.

Mr Werner told analysts dire conditions in the nickel market could push as much as 450,000 tonnes of nickel production out of the market – including BHP’s Nickel West operations in WA – with further cutbacks likely to come.

“We believe that these production cuts and closures will continue. We think that we may see higher cost nickel pig iron producers coming out of the market, and additional global producers,” he said.

“The current number of at-risk or closed nickel production currently sits at about 450,000 tonnes per annum.”

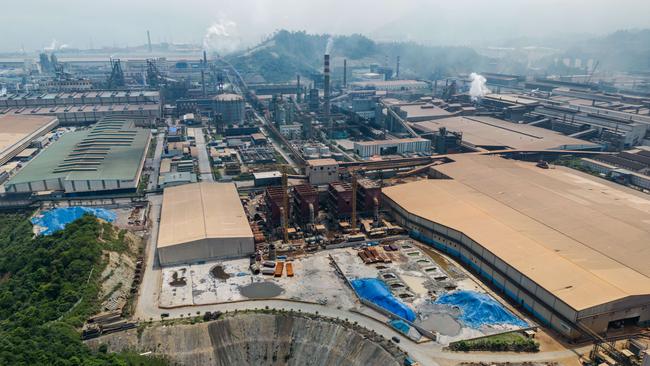

Even the Indonesian nickel industry – blamed by other producers for the flood of production hitting global markets – was struggling with low nickel prices, Mr Werner said, pointing to the June decision of BASF and Eramet to cancel the construction of a $US2.6bn nickel-cobalt refinery in Indonesia’s Weda Bay Industrial Park.

“If you look at actual new class one projects in Indonesia, there’s currently only three projects that are actually funded and under construction. And that only amounts to about 300,000 tonnes. We think in Indonesia, potential further growth is probably limited,” he said.

Nickel traded on the London Metal Exchange is sitting at about $US15,675 a tonne this week, but dipped below $US15,500 last week.

Mr Werner said nickel pig iron had traded at an average $11,787 a tonne in the June quarter, up from lows of $US11,688 in the March period.

The Nickel Industries boss told The Australian the nickel price was not likely to see a recovery just based on production cuts, but would need to see demand recovery – particularly in China – to push up to higher levels.

“Electric vehicle penetration rates have been sluggish this year. They’re still quite reasonable, but nowhere near where they were the previous two years,” he said.

“But I think we will continue to see higher cost nickel pig iron producers come out of the market, and higher cost class one producers as well.”

But Mr Werner said the Indonesia nickel sector could also be lifted by demand for nickel pig iron from outside of China.

He said major Indian steelmakers were looking closely at sourcing nickel pig iron – used to make both carbon and stainless steel – from the country, which could improve demand for the company’s products.

“We’re well positioned when there’s a turnaround in the nickel price, to really take advantage of it. But even where we are today, when the nickel market is pretty sluggish, we’re still making good money,” he said.

Nickel Industries shares closed up 5c to 85.5c on Wednesday.

Originally published as More nickel producers likely to leave market, warns Nickel Industries boss Justin Werner