Liquidators of Halifax Investment Services find 12,000 active trading accounts as company drawn into Courtenay House Trading probe

As many as 12,000 nest eggs belonging to up to 10,000 active clients in three countries have been frozen in the collapse of a Gold Coast-run stockbroking firm. The full scale of the collapse is being revealed, as well as links to another jaw-dropping case.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

AS many as 12,000 nest eggs belonging to up to 10,000 active clients in three countries have been frozen in the collapse of stockbroking firm Halifax Investment Services.

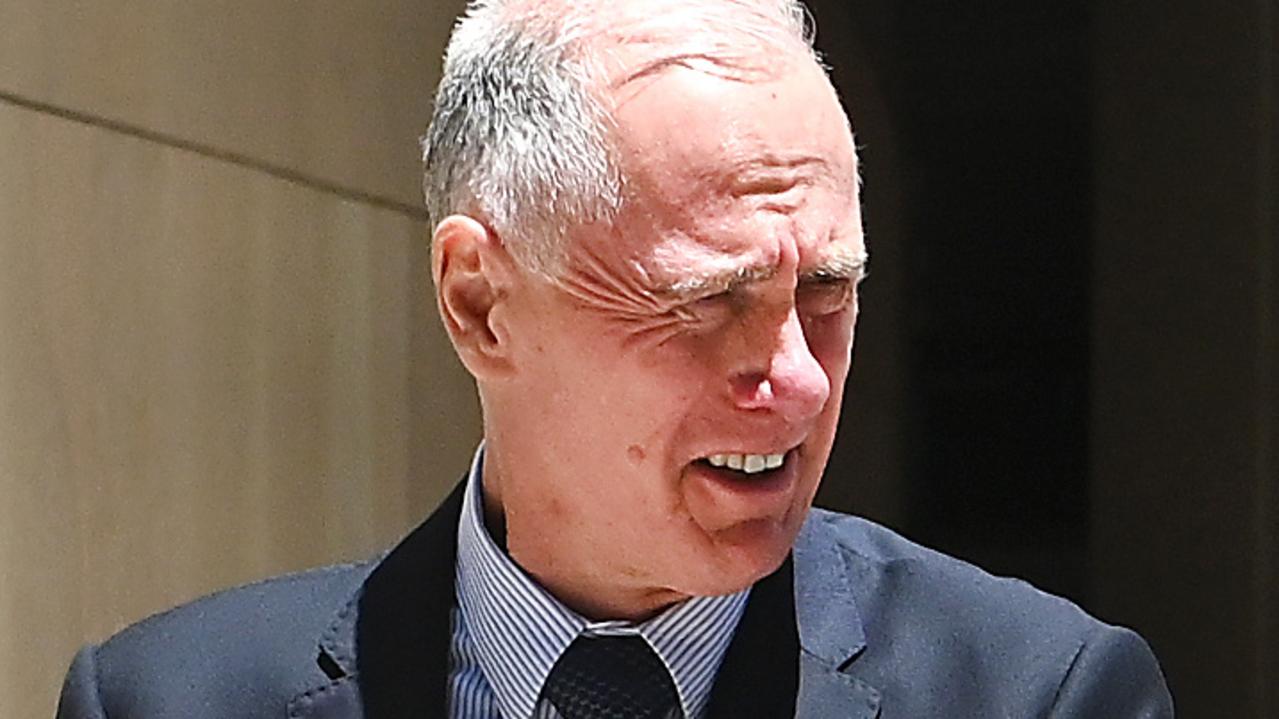

Liquidators are revealing the mammoth scale of the collapse of the firm run by Gold Coaster Jeff Worboys from offices in Sydney and Southport, which had a vast client base in Australia, New Zealand and China.

While the firm claimed to be handling more than $100 million in client funds in 2011, liquidators are expected to have more details on the firm’s current investments at a creditors meeting in Sydney this morning.

It can also be revealed Halifax and another investment company managed and directed by Mr Worboys from the same Sydney address, Australian Mutual Holdings, have been drawn into what has been described as “Australia’s biggest Ponzi scheme”.

OTHER NEWS:

New bakery serves ‘best croissants in world’

Gluten intolerant? Try new Tweed bakery’s bread

Manager left 15 minutes after resident drank poison

Australian Mutual Holdings was formerly the responsible entity for collapsed firm Courtenay House Capital Trading — which took $209 million from 780 investors, including the Mayor of Sydney’s Sutherland Shire.

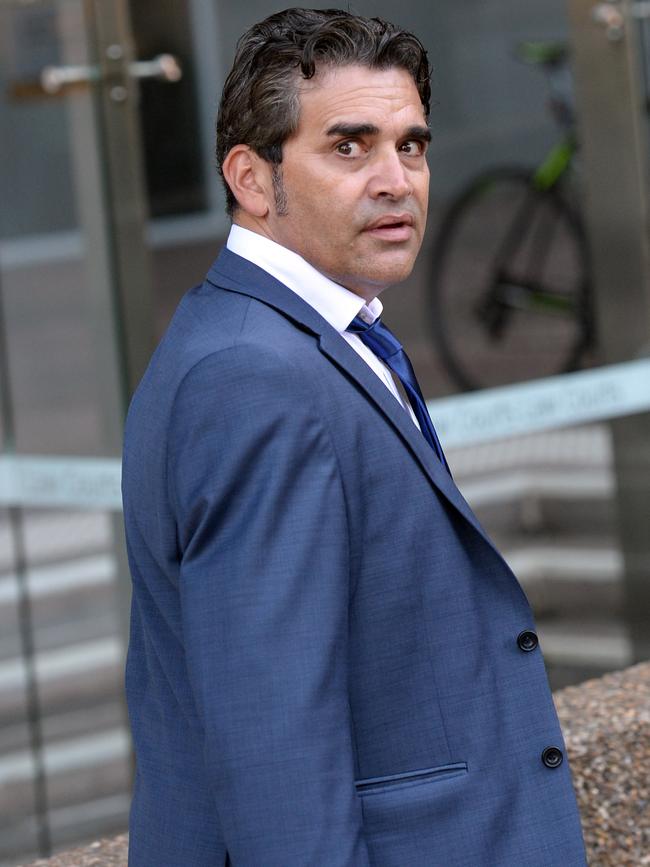

Courtenay House collapsed last year and its colourful mastermind Tony Iervasi could face criminal prosecution.

Documents lodged with the NSW Supreme Court reveal Courtenay House was set up in 2015, with Halifax Investment Services as broker through Australian Mutual Holdings as responsible entity.

Mr Worboys declined to answer the Bulletin’s questions until after this morning’s creditors meeting.

Australian Mutual Holdings was the responsible entity for Courtenay House until April last year and the Courtenay House matter with its liquidators is still before the court.

Courtenay House liquidator Said Jahani, of Grant Thornton, received approval from its creditors in June to set aside funds to “bring an action and/or claim” against eight people and companies, including “Australian Mutual Holdings/Halifax”.

In his reports to creditors, Mr Jahani said he found almost 90 per cent of the $209 million of investors’ money in the Courtenay House companies was used to pay their own monthly interest and capital returns.

Liquidators found that a tiny fraction of the money — just 1 per cent and no more than $50,000 at any time — was invested in foreign currency exchange markets.

Company records show Mr Worboys, who lived at Paradise Waters, held about 40 per cent of Halifax Investment’s shares when it entered administration.

GET FULL DIGITAL ACCESS FOR 50C A DAY

Halifax liquidators Morgan Kelly, Stewart McCallum and Phil Quinlan, of Ferrier Hodgson, have reported finding more than 12,000 active accounts across three trading platforms.

After removing duplications on two platforms they found 6862 unique client email addresses.

The third platform has at least another 4195 active accounts. However, it was unknown how many were duplicates.

ASIC declined to say whether it was examining the operations of Australian Mutual Holdings or Halifax Investment Services.

As well as Mr Worboys, directors of Australian Mutual Holdings include Andrew Gibbs, 41, who is managing director of Halifax Investment’s New Zealand operations.

Other directors listed on the company documents are Broadbeach Waters resident Jason Perkins, Palm Beach resident Susan Yeates and Victorian man Cable Belousoff.

Halifax liquidators found 75 per cent of that company’s clients were located in Australia with the remaining 25 per cent located in China, New Zealand and other countries.

The creditor meeting is to be held in Sydney at 10am Queensland time.