Huge increase in QLD and NSW insurance claims amid flood crisis

As the wild weather and flooding continues to wreak havoc on the east coast, the cost of the disaster is soaring into the billions.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

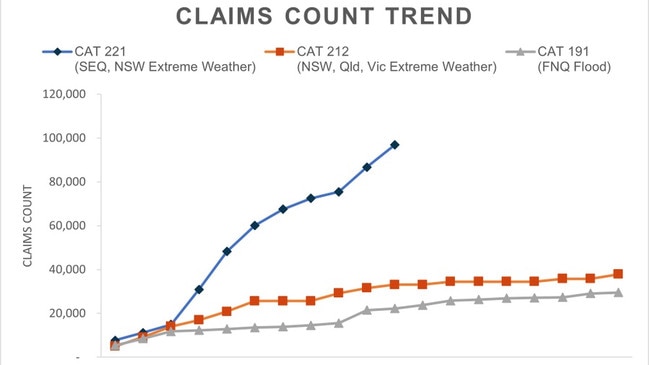

Insurers have received a whopping 96,500 claims related to the catastrophic floods in southeast Queensland and NSW, taking the cost of the disaster up to a predicted $1.45 billion with the figure expected to climb even higher.

The huge amount of claims increased by 12 per cent in just 24 hours, the Insurance Council of Australia (ICA) revealed, driven by the wild weather hitting NSW.

From the claims, 69 per cent were from Queensland and the rest came from NSW with 80 local government areas across both states impacted.

Damage to people’s homes and contents made up 80 per cent of claims, 17 per cent related to motor vehicles, while the remainder were for commercial property.

Andrew Hall, CEO of ICA, said there had been an “influx” of claims from NSW.

“Insurers are prioritising those customers whose situation is the most severe to support them getting back on their feet as soon as possible,” he said.

“This means it may take a few weeks for insurers to start the assessment process for less severe claims.”

State and federal MPs representing flood affected communities from both sides of politics have backed calls for the federal government's cyclone reinsurance scheme, which is due to come into effect in July, to be expanded to cover other natural disasters

The scheme provides a $10 billion government guarantee for 500,000 properties in the path of cyclones and cyclone-related flooding in the country’s north.

It was introduced after sky high premiums in Northern Australia meant many people were going without insurance, almost double the national average.

But experts have warned that communities impacted by the east coast flooding have also been unable to afford insurance.

A federal senate committee was told by insurance experts that there is currently a “market failure” and ICA said the government needed to double its spending on disaster resilience.

“Reducing the cost of reinsurance is only one part of improving the affordability and availability of insurance,” Mathew Jones, the general manager of public affairs at the Insurance Council of Australia told the committee.

“Sustainable reductions in premiums over the long term and better protection for at-risk communities will only be possible with significant investments to make communities more resilient to extreme weather risk.”

Janelle Saffin, the Labor MP for the state seat of Lismore which has been devastated by the flooding, has called for more federal help.

She said there should be government grants to assist in restoring private buildings like doctors surgeries and a Jobkeeper style program to help pay the wages of workers in flood-affected businesses.

Consumer network One Big Switch is also urging the Australian government to radically rethink the flood insurance policy framework in the wake of the latest floods sweeping the east coast.

It said the federal government needed to consider direct subsidies to make flood insurance affordable in flood-prone postcodes, a government funded home insurance comparison website and national flood insurance scheme.

Joel Gibson from One Big Switch, said flood insurance is already unaffordable in areas such as Brisbane, the NSW Northern Rivers and western Sydney.

“After the emergency response, devastated communities will need a bold policy response that gives them hope they won’t be as vulnerable when the next disaster comes, ”he said.

The federal government has paid $282 million in flood disaster payments to 242,000 people, it said on Tuesday.

It comes amid reports that NSW government is considering a plan to offer subsidies such waiving the need to pay stamp duty if people move and buy away from flood plains.

Greens state MP for Ballina, Tamara Smith, said people could now face insurance costs of $1000 a month in her electorate and suggested the government could buy back people’s homes or provide incentives to build outside of flood prone areas.

“That’d be really sensible. There will be people who want to rebuild, people who want to leave,” she told The Guardian.

“It’s cruel to have the conversation now but we have to think about what adaptation to climate change looks like.”

Local councils are also facing staggering multimillion-dollar damage costs from devastating flooding “natural disasters” that have decimated local communities.

The massive bill is just a taste of things to come with experts warning the cost of extreme weather events is expected to be around $25 billion a year by 2100.

More Coverage

Originally published as Huge increase in QLD and NSW insurance claims amid flood crisis